Last Updated: 2014.01.09

Results Summary for the Three Months to November 2014

FAST RETAILING CO., LTD.![]() ( 230KB )

( 230KB )

to Japanese page

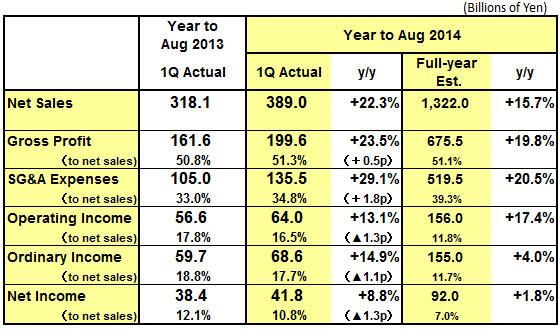

Consolidated Business Performance

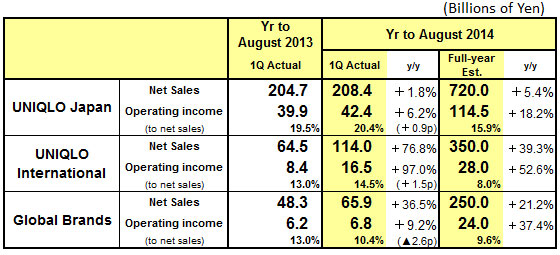

Performance by Group Operation

FY2014 First Quarter Highlights: All Business Segments Report Gains in Sales and Income

■Group Performance:

The Fast Retailing Group generated significant gains in both sales and income in the first quarter of fiscal 2014. Consolidated net sales increased by 22.3% year on year to ¥ 389.0bln, operating income expanded by 13.1% to ¥ 64.0bln, ordinary income rose 14.9% to ¥ 68.6bln and net income expanded by 8.8% to ¥ 41.8bln.

■UNIQLO Japan:

Sales and income both rose in the first quarter, with sales reaching ¥ 208.4bln (+1.8% year on year) and operating income expanding to ¥ 42.4bln (+6.2%). Same-store sales contracted 0.3% over the three months to November 2013, but UNIQLO Japan was still able to report a gain in net sales as the total number of stores increased by five stores over the previous year, and our "scrap and build" policy of replacing smaller stores with larger ones continued to boost the average size of our sales floor. UNIQLO Japan also reported a profit gain in the first quarter. The operation improved its gross profit margin, by maintaining firm control over the range of discounted items and the magnitude of the discounts. Business expenses were also kept in check, with the 1.1 point rise in the SG&A ratio well within expectations.

■UNIQLO International:

Significant year-on-year gains in both sales and income, with sales reaching ¥ 114.0bln (+76.8% year on year) and operating income rising to ¥ 16.5bln (+97.0%). Performance far outstripped our expectations in China, Hong Kong, Taiwan, South Korea, the United States, and Europe. UNIQLO operations in Southeast Asia also performed strongly as expected. UNIQLO International opened 68 new stores and closed two stores in the first quarter, bringing the total number of stores to 512 at the end of November 2013.

■Global Brands:

This segment also generated gains in both sales and income, with sales expanding to ¥ 65.9bln (+36.5% year on year) and operating income rising to ¥ 6.8bln (+9.2%). GU achieved double-digit growth in both sales and income. GU opened 39 new stores (including its first store outside Japan) and closed three stores, bringing the total number of GU stores to 250 at the end of November 2013.

■Fiscal 2014 Consolidated Estimates:

Group sales: ¥ 1.322trln (+15.7% year on year), operating income: ¥ 156.0bln (+17.4%), ordinary income: ¥ 155.0bln (+4.0%), net income: ¥ 92.0bln (+1.8%), earnings per share: ¥ 902.85, annual dividend forecast: ¥ 300 per share (interim dividend: ¥ 150, year-end dividend: ¥ 150).

■ UNIQLO Japan

Our UNIQLO Japan operation currently accounts for 53.6% of consolidated net sales and 66.3% of consolidated operating income within the Fast Retailing Group. In the first quarter of fiscal 2014, or the three months from September through November 2013, UNIQLO Japan generated gains in both sales and income, with sales expanding 1.8% year on year to ¥ 208.4bln and operating income rising 6.2% to ¥ 42.4bln. Compared to our initial estimates announced on October 10, 2013, sales fell approximately ¥ 9.0bln short of target in the first quarter, while operating income came in approximately ¥ 1.0bln above target. Looking at each individual month in more detail, revenue increased in September thanks to the strong launch of our autumn ranges. Revenue contracted in October, as persistent warm weather and a strong typhoon season kept many customers away. Revenue then rebounded in November, with the colder weather boosting sales of HEATTECH, Ultra Light Down, Fleece, cashmere and other core winter items. Same-store sales contracted 0.3% year on year in the first quarter, but overall net sales expanded by 1.8%, as the total number of UNIQLO Japan stores increased by five stores year on year. This was linked to our decision to open some new large-format stores, and also to our continued efforts to boost the average size of our sales floor by replacing small and regular-sized stores with larger ones through our "scrap and build" policy. UNIQLO Japan had a total of 837 stores (excluding 19 franchise stores) at the end of November 2013.

Operating income also expanded at UNQILO Japan in the first quarter. The gross profit margin improved 1.8 points year on year, with strict control being maintained over the range of discounted items, and the magnitude of discounts and of any permanent price cutting. Even when we exclude the impact generated by the removal of some internal transactions from UNIQLO Japan's sales total, the gross profit margin still improved 0.6 point year on year. The SG&A to net sales ratio rose 1.1 points, but this increase was still well within the expected range.

During the 2013 fall/winter season, we conducted advertising campaigns for several core ranges, including Legging Pants, Ultra Stretch Jeans, cashmere, Ultra Light Down, HEATTECH and Warm Easy Pants. We have set a fiscal 2014 sales target for cashmere items of approximately 5.9 million units (100% cashmere: 2.9 million, cashmere blends: 3.0 million). We reintroduced 100% cashmere items at all UNIQLO stores in Japan this year for the first time in four years, and our cashmere ranges are currently selling well.

Our estimates for UNIQLO Japan performance during the year ending August 31, 2014 include a 5.4% rise in net sales to ¥ 720.0bln and an 18.2% increase in operating income to ¥ 114.5bln. The fiscal 2014 sales forecast has been adjusted from the initial estimate announced on October 10, 2013 to reflect the subtraction of ¥ 8.0bln in internal transactions from the UNIQLO Japan sales forecast.

■ UNIQLO International:

UNIQLO International reported significant year-on-year gains in both sales and income in the September to November quarter, with sales expanding 76.8% year on year to ¥ 114.0bln and operating income increasing an impressive 97.0% to ¥ 16.5bln. We added a further 66 stores in the first quarter, located mainly in Asia and the United States. That boosted the total UNIQLO International network to 512 stores at the end of November 2013.

Looking at individual regions, performance far outstripped our expectations in China, Hong Kong, Taiwan, South Korea, the United States, and Europe. UNIQLO operations in Southeast Asia also performed strongly and roughly to plan. The UNIQLO brand is becoming increasingly well known in the Chinese market, thanks to the success of the UNIQLO Shanghai Store, our global flagship store opened in Shanghai on September 30, 2013. UNIQLO USA also generated higher than expected gains in sales and profit, with our three New York high-street stores reporting double-digit gains in sales and the 10 new stores opened in fall 2013 also performing well.

Our estimates for UNIQLO International performance during the year ending August 31, 2014 remain the same as expected at the start of the fiscal year. We predict net sales will rise 39.3% to ¥ 350.0bln and operating income will expand by 52.6% to ¥ 28.0bln.

■ Global Brands

The Global Brands segment performed in line with expectations in the first quarter, reporting gains in both sales and income. Sales expanded by 36.5% year on year to ¥ 65.9bln and operating income rose 9.2% to ¥ 6.8bln. Our low-priced GU casualwear brand performed to plan, generating double-digit growth in both sales and income in the September to November quarter. GU opened 39 stores (including its first ever store located outside of Japan) and closed 3 stores, bringing the total number of GU stores to 250 at the end of November 2013. Our affordable luxury Theory fashion brand also reported a gain in sales, but the operation fell slightly short of target, reporting a contraction in operating income. Our French women's fashion label, Comptoir des Cotonniers, outperformed slightly, to report a gain in both sales and income, while our French corsetry, homewear, and swimwear brand, Princesse tam.tam, reported a flat performance, as expected. Our J Brand premium denim label also generated the expected level of sales and profit in the first quarter.

Our estimates for Global Brands segment during the year ending August 31, 2014 remain the same as expected at the start of the fiscal year, and include a 21.2% rise in net sales to ¥ 250.0bln and a 37.4% increase in operating income to ¥ 24.0bln.

■ Fiscal 2014 Consolidated Forecasts

Regarding our consolidated business estimates for fiscal 2014, or the year ending August 31, 2014, we have recently subtracted ¥ 8.0bln in internal transactions from the UNIQLO Japan sales forecast. As a result, we now estimate Group sales will expand by 15.7% year on year to ¥ 1.322trln in fiscal 2014. We forecast operating income will expand by 17.4% to ¥ 156.0bln, ordinary income will increase by 4.0% to ¥ 155.0bln and net income will rise 1.8% to ¥ 92.0bln in the same period. This translates into expected earnings per share of ¥ 902.88. In addition, we forecast an annual dividend per share for fiscal 2014 of ¥ 300, split equally between an interim dividend of ¥ 150 and a year-end dividend of ¥ 150.