FAST RETAILING CO., LTD. conducts its investor relations based on the fundamental direction outlined below, in order to aid a clear understanding and just evaluation of our company by various stakeholders including shareholders and investors.

1. Fundamental stance on IR activities

FAST RETAILING CO., LTD.'s fundamental approach to IR activities is the timely and appropriate disclosure of important facts concerning the company to the various stakeholders including shareholders and investors, in an accurate and clear, impartial and swift manner. We always aim to be a company that evokes trust and empathy among shareholders and investors. We undertake to continually enhance our internal system on information disclosure, and, in line with the accepted open procedure, to disclose information based on statute and various regulations, information related to our business performance, financial strength, management strategy, and information on compliance and corporate governance in order to fulfill our social responsibility.

2. Criteria for information disclosure

The corporate information classified as important information requiring disclosure is as follows:

- 1)

- Information that is required to be disclosed by the timely disclosure rules determined by the Tokyo Stock Exchange and Hong Kong Stock Exchange.

- 2)

- Corporate information that we decide to disclose voluntarily because it may be considered to have a potential influence on investors' investment decisions, even though disclosure of that information is not required by statute or the timely disclosure rules.

However, we may decide not to disclose certain information that could potentially produce a notable adverse effect on FAST RETAILING's interests.

3. Method of information disclosure

FAST RETAILING information disclosure is conducted through a variety of media in order to ensure an accurate, clear, impartial and swift disclosure of information to as many investors as possible. We use the TDnet (Timely Disclosure network: information communication system provided by the Tokyo Stock Exchange), news releases, our company home page, meetings for securities analysts, and inclusion in various accounting statements such as our annual financial statements. We also disclose information on the progress of our business activities and our sustainability initiatives through the publication of Business Reports (Business Review), and Integrated Reports.

4. Internal system for information disclosure

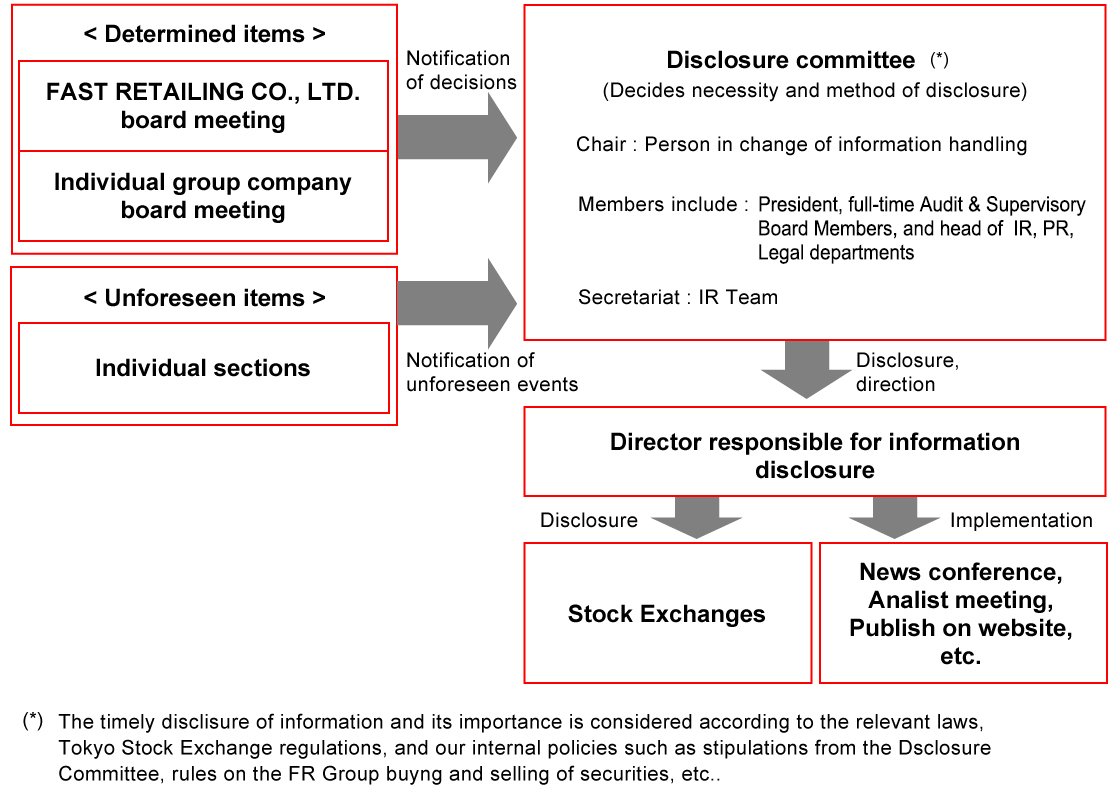

As regards decisions, unforeseen items, items for timely disclosure and items for voluntary disclosure at FAST RETAILING and other group companies which might have a significant influence on investment decisions by shareholders and other investors, the need to disclose such items is determined in the Disclosure Committee and any necessary disclosure is then made via person in change of information handling to the Tokyo Stock Exchange and Hong Kong Stock Exchange.

The Disclosure Committee is chaired by the person in change of information handling. Other committee members include the company president, a full-time Audit & Supervisory Board Members and the heads of the IR, PR and Legal departments.

We also publish the items for timely and voluntary disclosure to the Tokyo Stock Exchange and Hong Kong Stock Exchange in both Japanese and English on our company website.

The following flow diagram illustrates our internal system for the disclosure of timely and voluntary information.

5. Disclosure method on future prospects

Information disclosed by the company sometimes includes statements regarding the future outlook. However, these statements may differ substantially from our actual operational business and performance due to changes in economic conditions and market environment. When we announce our "future outlook", we also disclose concrete details of the various possible risk factors that could influence the actual outcome. Please bear this in mind when considering FAST RETAILING's business performance, competitiveness and corporate value.

In addition, announcements relating to business forecasts and revisions stipulated by the Tokyo Stock Exchange are disclosed according to Exchange regulations. We also strive to disclose speedily, fairly and extensively any other information that could be considered to influence shareholders' or investors' investment decisions.

6. Analyst reports

FAST RETAILING will not evaluate or comment on any analyst reports. However, if a report is considered to contain factual errors then those errors may be pointed out.

7. Market rumors

FAST RETAILING will not debate or comment on any market rumors and will not respond to any questions regarding such rumors. However, we will take an appropriate action according to the stipulated procedures in the case of any market rumor exerting a significant influence on the capital markets, or if requested to offer an explanation by the Stock Exchanges.

8. Quiet Period

The company has a quiet period which extends from the day after a business period ends to the day of the announcement of full year, interim or quarterly financial results. During this period we refrain from IR activities in order to avoid leaks of information that might affect the share price while financial statements are being prepared. Please understand that the company cannot comment on business performance or respond to related questions during this period.