Last Updated: 2013.07.11

Results Summary for the Nine Months to May 2013

FAST RETAILING CO., LTD.![]() ( 292KB )

( 292KB )

to Japanese page

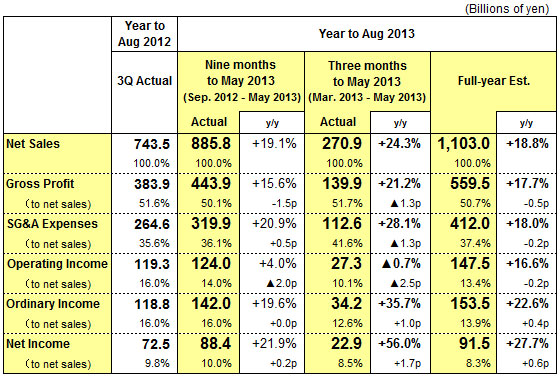

Consolidated Business Performance

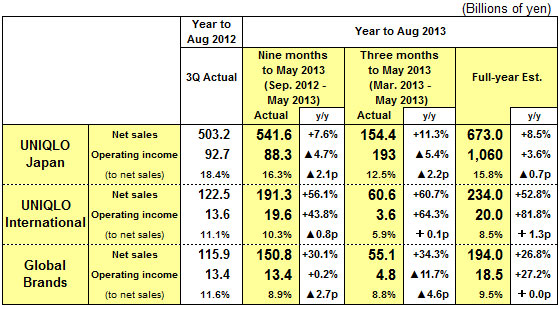

Performance by Group Operation

Highlights: Strength at UNIQLO International Boosts Group Sales and Income

■Group Performance (3Q cumulative):

The Fast Retailing Group reported cumulative gains in both sales and income for the third quarter of fiscal 2013, or the nine months from September 2012 through May 2013. Consolidated sales totaled ¥ 885.8bln (+19.1% y/y), operating income totaled ¥ 124.0bln (+4.0%), ordinary income stood at ¥ 142.0bln (+19.6%) and net income totaled ¥ 88.4bln (+21.9%). Breaking this performance down into Group segments, UNIQLO International generated significant growth in both sales and income, while our other two segments, UNIQLO Japan and Global Brands, reported a fall in profits. In terms of non-operating income, we reported a large foreign exchange gain of ¥ 17.8bln generated by the comparative depreciation in the yen exchange rate at the end of May 2013.

■UNIQLO Japan:

Sales increased but income fell in the third quarter from March to May 2013. While same-store sales growth proved strong at 9.3% year on year, a contraction in the gross profit margin knocked operating income lower. UNIQLO Japan sales and operating income both came in ¥ 3.0bln below our most recent estimates for the third quarter, but the subsequent sales data for June proved strong and so we have not made any changes to our full-year estimates. We expect operating income at UNIQLO Japan to rise 3.6% year on year in fiscal 2013 to ¥ 106.0bln.

■UNIQLO International:

This segment continued to generate considerable growth in both sales and income in the third quarter from March to May 2013. The significant gain in profits can be attributed to our commitment to open large numbers of new stores, primarily in the Asian region, and also to consistent strong growth in same-store sales in Asia. One market in Asia that fell short of target was South Korea after unseasonal weather dampened sales of spring garments. We had expected to be able to generate an earnings recovery at UNIQLO USA in the second half from March through August 2013. However, losses continue to hover stubbornly at previous year levels.

■Global Brands:

Sales rose but income fell in the third quarter from March to May 2013. Despite another strong result from GU, a contraction in profits at Comptoir des Cotonniers and Princesse tam.tam knocked income lower for the segment as a whole.

■Fiscal 2013 Consolidated Estimates:

Group sales are forecast to top ¥ 1 trillion for the first time. Estimated consolidated sales: ¥ 1.103trln (+18.8% y/y), operating income: ¥ 147.5bln (+16.6%), ordinary income: ¥ 153.5bln (+22.6%), net income: ¥ 91.5bln (+27.7%), earnings per share: ¥ 898.09. Annual dividend forecast for the year ending August 31, 2013: ¥ 280 per share (including interim dividend of ¥ 140).

■ UNIQLO Japan: Same-store Sales Expand but Income Falls in the Third Quarter

UNIQLO Japan constitutes 61.1% of consolidated sales and 71.2% of Group income. In the nine months through May 2013, UNIQLO Japan generated a 7.6% year-on-year gain in sales to ¥ 541.6bln. However, operating income contracted 4.7% over the same period to ¥ 88.3bln. We boosted our advertising campaigns for core lines including Ultra Light Down, HEATTECH, and danpan warm pants in the 2012 fall/winter season and AIRism, Leggings Pants, Steteco and Relaco ("Relax and Comfort") in the 2013 spring/summer season. This additional advertising greatly boosted the number of customers visiting our stores, and helped generate impressive growth in same-store sales of 5.2% year on year for September 2012 through May 2013 and 9.3% for the March to May quarter. However, the contraction in operating income during the same period was due primarily to a year-on-year contraction in the gross profit margin of 1.4 points and a 0.7-point increase in the SG&A ratio. Indeed, our more vigorous promotional advertising encouraged customers to focus their attention and their wallets on discounted items, and the gross profit margin suffered as a result.

As regards our fiscal 2013 estimates for UNIQLO Japan, while sales and operating income both fell ¥ 3.0bln short of our most recent estimates in the third quarter, subsequent sales data for June showed a healthy 20.5% year-on-year gain in same-store sales and so we have not made any changes to our full-year estimates for UNIQLO Japan. We expect fiscal 2013 sales to increase by 8.5% year on year to ¥ 673.0bln and operating income to rise 3.6% to ¥ 106.0bln. The total number of UNIQLO stores increased by 5 stores to 833 stores (excluding 19 franchise stores) at the end of May 2013, and we expect this to grow to 834 by August 2013.

■ UNIQLO International: Asian Strength Fuels Further Large Gains in Sales and Income

UNIQLO International generated significant gains in both sales and income in the nine months to May 2013, with sales rising 56.1% year on year to ¥ 191.3bln and operating income expanding by an equally impressive 43.8% to ¥ 19.6bln. The segment also reported considerable growth in sales and income for the third quarter from March to May 2013. UNIQLO's Asian operations exceeded our forecasts to generate large gains in both sales and income, particularly in China, Hong Kong and Taiwan where we have accelerated the pace of new store openings. However, cool spring temperatures chilled sales in South Korea, resulting in a slight contraction in profit for that operation in the March-to-May quarter.

Across the Pacific, we had expected to reduce the operating loss at UNIQLO USA during the second half of fiscal 2013 from March through August 2013. However, earnings in the third quarter hovered stubbornly at previous-year levels. This was due in part to unfavorable weather which dampened sales of spring garments, and also to a weaker-than-expected recovery in earnings at our three flagship stores in New York. Meanwhile, the UNIQLO Westfield Garden State Plaza Store and the UNIQLO San Francisco Union Square Store, both opened in fall 2012, continue to generate favorable sales, as do the two new stores opened in malls in spring 2013. Looking ahead, we plan to open a total of 10 new stores in the United States in fall 2013 (six on the East Coast and four on the West Coast).

The total UNIQLO International network expanded by 135 stores year on year to 410 stores at the end of May 2013 and we plan to expand the network to 446 stores (+154 stores year on year) by the end of August. Of those 446 new stores, 243 stores will be located in China and Hong Kong, 105 stores in South Korea, 37 stores in Taiwan, 39 stores elsewhere in Asia, 7 stores in the United States and 15 stores in Europe. Our first UNIQLO store in Indonesia, opened in Jakarta on June 22, is already off to a solid start. As regards our full-year estimates for UNIQLO International, we expect sales to rise 52.8% year on year to ¥ 234.0bln in fiscal 2013 and operating income to expand by 81.8% to ¥ 20.0bln.

■ Global Brands: Low-priced GU Casualwear Brand Continues to Perform Strongly

Our Global Brands segment reported a rise in sales and income in the nine months to May 2013, with sales expanding by 30.1% year on year to ¥ 150.8bln and operating income increasing by 0.2% to ¥ 13.4bln. However, the segment reported a fall in profit in the third quarter from March to May 2013. While our low-priced GU casualwear brand continued to generate strong results, the extremely poor weather in Europe this spring pushed performance at France-based Comptoir des Cotonniers (women's fashion) and Princesse tam.tam (corsetry, lounge wear and swimwear) below target and the two brands reported a dip in profits. Regarding our full-year estimates for Global Brands, we forecast sales will increase by 26.8% year on year to ¥ 194.0bln and operating income will expand by 27.2% to ¥ 18.5bln.

■ Fiscal 2013 Consolidated Forecasts: Sales Forecast to Top ¥ 1 Trillion

We estimate Group sales will top ¥ 1 trillion for the first time. Our consolidated forecasts for fiscal 2013 are as follows: sales ¥ 1.103trln (+18.8% y/y), operating income ¥ 147.5bln (+16.6%), ordinary income ¥ 153.5bln (+22.6%) and net income ¥ 91.5bln (+27.7%). This translates into earnings per share of ¥ 898.09. We forecast an annual dividend of ¥ 280 per share for the year ending August 31, 2013. This includes an interim dividend of ¥ 140 which has already been paid out.