Last Updated: 2012.04.12

Results Summary for the Six Months to February 2012

FAST RETAILING CO., LTD.![]() ( 180KB )

( 180KB )

to Japanese page

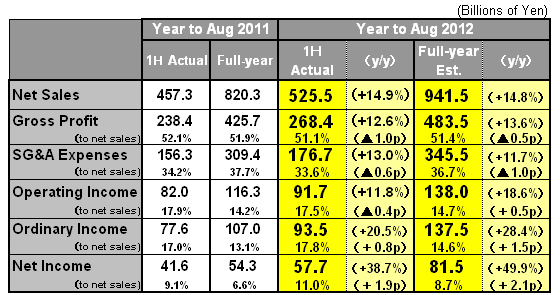

Consolidated Business Performance

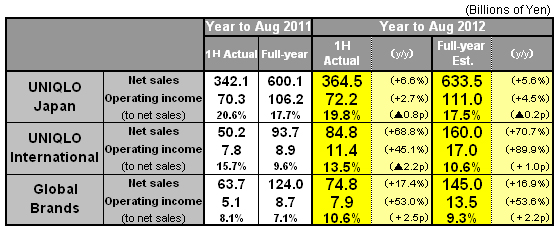

Performance by Group Operation

FY2012 First Half Highlights

■Group Performance:The Fast Retailing Group achieved impressive gains in both sales and income with consolidated sales rising 14.9% year on year to ¥ 525.5bln, operating income increasing11.8% to ¥91.7bln and net income expanding 38.7% to ¥ 57.7bln.

■UNIQLO Japan: Sales of core winter items proved strong since the weather turned cold in December. Same-store sales increased 2.3% in the first half, or the six months from September 2011 through February 2012. A recovery in sales along with strictly controlled discounting and effective cost-cutting measures helped reverse the downward trend in profit in the first quarter (September to November 2011) into a profit gain in the second quarter (December 2011 to February 2012). As a result, operating income expanded 2.7% year on year in the first half.

■UNIQLO International: Store numbers increased especially strongly in China, Hong Kong, Taiwan and also South Korea. Same-store sales also continued to show robust growth. The UNIQLO operation in the United States posted a loss following slower than expected sales at the New York 34th Street megastore and higher costs relating to the opening of global flagship store. However, for the operation as a whole, UNIQLO International generated an impressive profit gain.

■Global Flagship Stores: The opening of global flagship stores in fall 2011 on New York Fifth Avenue and in Seoul and Taipei has greatly extended the visibility of the UNIQLO brand across world markets. Subsequently, a new global flagship store was opened in Tokyo's Ginza in March 2012.

■Theory: The brand continues to perform strongly in both Japan and the United States.

■g.u.: The g.u. operation generated significant gains in both sales and income in the first half with same-store sales growth exceeding 20% year on year. The low-priced casualwear brand continued its blazing run with the opening of a flagship store in Ginza in March 2012. Annual sales are now expected to break above ¥ 50.0bln in fiscal 2012.

■Fiscal 2012 Consolidated Estimates:Consolidated income is expected to reach a new record high in fiscal 2012 with consolidated sales forecast to expand 14.8% year on year to ¥ 941.5bln, operating income to rise 18.6% to ¥ 138.0bln and net income to rise an impressive 49.9% to ¥ 81.5bln. That would generate earnings per share of 800.25 yen.

■Dividend Payment:Following the upward revision to net income forecasts for fiscal 2012, the company has decided to increase the interim dividend per share to 130 yen and expects to pay an annual dividend of 260 yen.

■ UNIQLO Japan

The UNIQLO Japan operation, which constitutes 69.4% of consolidated sales, generated gains in both sales and income in the first half with sales expanding 6.6% year on year to ¥ 364.5bln and operating income rising 2.7% year on year to ¥ 72.2bln. Compared to our latest business estimates announced on January 12, sales outperformed by ¥ 4.5bln and operating income by ¥ 4.2bln. Reviewing the first-half performance at UNIQLO Japan, sales of fall items were stifled by hot weather in the September to November quarter. However, after the weather turned cold in December, sales of core winter items such as HEATTECH, Ultra Light Down and warm pants proved strong, leading to an overall rise in same-store sales of 2.3% in the first half. The net addition of 24 directly run stores also helped boost revenue in the first half. The total number of UNIQLO Japan stores including franchise stores expanded to 849 by the end of February 2012.

The gross profit margin contracted 1.3 points to 48.2% in the first half as stricter controls over discounting failed to offset the rise in cost of sales resulting from the increase in the prices of cotton and other raw materials prices and the rising costs of manufacturing in China. On the other hand, the SG&A to net sales ratio improved 0.6 point thanks to persistent cost-cutting efforts.

On product development, UNIQLO is strengthening its cooperative development system with materials manufacturers in its ongoing quest to fulfill customer needs. Ultra Light Down, created jointly by UNIQLO and Toray Industries, is a revolutionary new material which is both warm and lightweight. For the 2011 fall/winter season, we increased production volumes of Ultra Light Down 2.5 times compared to the previous year and this contributed considerably to sales growth in the first half. We also increased production of HEATTECH functional innerwear from 80 million units in 2010 fall/winter to 100 million units in the 2011 fall/winter, all of which was sold successfully in Japan and other international markets.

Full-year forecasts for UNIQLO Japan have been revised upwards to reflect the strong upturn in the first half. Forecasts for sales and operating income have both been revised up by ¥ 4.5bln, generating new estimates for a 5.6% year-on-year increase in sales to ¥ 633.5bln and a 4.5% increase in operating income to ¥ 111.0bln.

The UNIQLO Ginza global flagship store was opened in March 2012 with shop floor space of 5,000 square meters spanning 12 floors. Customers have been delighted with the new store and its many exciting features such as collaborative design products with the cult-hit Undercover fashion label, and a dazzling variety of contents to mark the 10th anniversary of the UNIQLO UT print T-shirt brand including Snoopy and other animation characters and original designers such as Laura Ashley and Orla Kiely. In its drive to revitalize the Japanese market, UNIQLO plans to open another Japanese global flagship store in fall 2012 in Tokyo's Shinjuku. Subsequent openings of global flagship stores in major Japanese commercial districts such as Harajuku, Shibuya, Ikebukuro, Ueno, Osaka, Nagoya, Sapporo, Fukuoka and Sendai should each serve to refresh and renew the UNIQLO brand in Japan.

■ UNIQLO International

UNIQLO International generated significant gains in both sales and income in the first half with sales expanding an impressive 68.8% year on year to ¥ 84.8bln and operating income rising 45.1% to ¥ 11.4bln. Performance was particularly strong in the Asian region of China and Hong Kong, Taiwan and South Korea. Over the six months from September 2011 through February 2012, 55 stores were opened predominately in these Asian nations and two stores were closed, bringing the total number of UNIQLO International stores to 234 by the end of February 2012. In addition, the successive opening of global flagship stores on New York Fifth Avenue, in Myeongdong, Seoul and Taipei, Taiwan in the first half dramatically enhanced the visibility of the UNIQLO brand worldwide.

UNIQLO operations in Asia performed especially well in the first half with the China, Hong Kong and Taiwan region generating sales and income growth significantly above target. The UNIQLO operation in South Korea also exceeded expectations as the new global flagship boosted recognition of the UNIQLO brand, and TV commercials featuring Ultra Light Down and HEATTECH products also fuelled further double-digit gains in same-store sales. UNIQLO operations in Singapore and Malaysia performed favorably and to plan. Following the opening of its first store in September 2011, UNIQLO Thailand had expanded to three stores by the end of February 2012, and the operation was generating strong sales.

UNIQLO International plans to swiftly accelerate the pace of new store openings in Greater China from 32 stores in fiscal 2011 to 80 stores in fiscal 2012. The first UNIQLO store is scheduled to open in the Philippines in June 2012. UNIQLO International is also investigating the possibility of opening stores in other new markets starting with Indonesia, Australia and Vietnam.

Conversely, despite favorable sales at its New York Fifth Avenue Store, UNIQLO America reported a loss in the first half as sales at the New York 34th Street Store fell short of target and the operation had to absorb costs related to the opening of new flagship store. UNIQLO France performed to plan with sales at the Paris Opera Store continuing to rise. The U.K. UNIQLO operation reported falling profits as both sales and income fell below target. UNIQLO Russia turned a profit in the first half thanks to improvements in the operation's profitability.

Regarding future expansion plans in the United States and Europe, we will seek to establish a presence on the U.S. West Coast by opening a flagship store in San Francisco, California in fall 2012. At the same time, we plan to open a store in shopping mall in New Jersey. In the mid-term, we will be looking to open between 20 and 30 stores in central and suburban New York and between 20 and 30 stores on the West Coast in and around the cities of San Francisco and Los Angeles. In Europe, in addition to London and Paris, we are also looking to open new stores in other major cities such as Berlin, Milan and Barcelona.

In fiscal 2012, UNIQLO International is expected to generate full-year sales of ¥ 160.0bln (up 70.7% year on year) and operating income of ¥ 17.0bln (up 89.9%).

■ Global Brands

The Global Brands segment achieved growth in both sales and income in the first half with sales expanding 17.4% year on year to ¥ 74.8bln and operating income expanding an impressive 53.0% to ¥ 7.9bln. Same-store sales for the theory label continued to expand in both Japan and the United States. Meanwhile, same-store sales growth for the g.u. brand topped 20% and operating income came in considerably above target. Elsewhere, profits from our French-based Comptoir des Cotonniers and Princesse tam.tam lines dipped as operating income fell below target.

The opening of the g.u. flagship store in Ginza in March 2012 attracted a stream of customers from the first day onwards and that has had a positive impact on all g.u. stores across Japan. As a brand offering fashionable apparel at amazingly low prices, g.u. is successfully expanding its operations, and annual sales are now expected to top ¥ 50.0bln in fiscal 2012.

For the full year to end August 2012, the Global Brands segment is predicted to generate sales of ¥ 145.0bln (up 16.9% year on year) and operating income of ¥ 13.5bln (up 53.6%).

■ Income expected to reach a new record high in fiscal 2012: Fast Retailing forecasts earnings per share of 800.25 yen, and an annual dividend payment of 260 yen

In terms of our consolidated business estimates for the year to the end of August 2012, consolidated sales are forecast to rise 14.8% year on year to ¥ 941.5bln, operating income is seen increasing 18.6% to ¥ 138.0bln, ordinary income rising 28.4% to ¥ 137.5bln and net income expanding 49.9% to ¥ 81.5bln.

Income generated by the Fast Retailing Group is expected to hit a new record in fiscal 2012 for the first time in two years boosting earnings per share to 800.25 yen. In line with the upward revision to our net income forecast, the Fast Retailing executive board decided today to increase the interim dividend for fiscal 2012 to 130 yen per share. Including the year-end dividend of 130 yen, that would generate an anticipated annual dividend payment of 260 yen.