Last Updated: 2012.01.12

Results Summary for the Three Months to November 2011

FAST RETAILING CO., LTD.![]() ( 170KB )

( 170KB )

to Japanese page

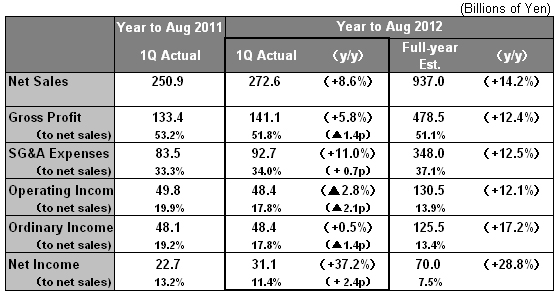

Consolidated Business Performance

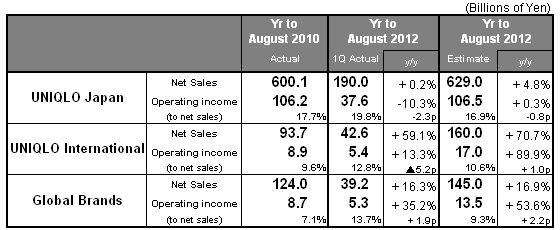

Fiscal 2012 Business Estimates by Group Operation

【Summary】 UNIQLO International and Global Brands Contribute Strongly in the Three Months to November 2011

In the first quarter of fiscal 2012, or the three months to November 2011, Fast Retailing generated consolidated sales of ¥ 272.6bln (up 8.6% year on year), operating income of ¥ 48.4bln (down 2.8%), ordinary income of ¥ 48.4bln (up 0.5%) and net income of ¥ 31.1bln (up 37.2%). Breaking the income figures down into operational segments, operating income at UNIQLO Japan contracted 10.3% year on year in the first quarter, while UNIQLO International and Global Brands both generated year-on-year gains in operating income of 13.3% and 35.2% respectively. A respite in the strengthening of the yen reduced our foreign exchange losses considerably compared to the previous year and this, in turn, helped generate a year-on-year gain in consolidated ordinary income. In addition, net income rose significantly compared to the previous year when we accounted extra-ordinary losses of ¥ 9.6bln related to changes in accounting practices.

At UNIQLO Japan, operating income levels fell year on year as the gross profit margin dipped lower and same-store sales contracted 4.0% due to the September heat wave and persistent warm temperatures in October through November. On the other hand, performance continued to expand favorably at UNIQLO International. UNIQLO International has successfully strengthened its operational base by expanding store networks particularly in the Asian nations of China, Hong Kong, South Korea, Singapore, Taiwan, Malaysia, and Thailand, and also through the opening of successful global flagship stores on New York Fifth Avenue, in Taipei and in Seoul. Within our Global Brands segment, the Theory women's fashion label maintained a strong performance in both the U.S. and Japan. In addition, our low-priced g.u. casualwear brand generated significant gains in profit on the back of multiple new store openings and a rise in same-store sales in excess of 20% year on year.

In terms of our consolidated forecasts for the full business year to end August 2012, a downward revision to our estimates for performance at UNIQLO Japan means that we are now forecasting consolidated sales will rise 14.2% year on year to ¥ 937.0bln, operating income will rise 12.1% to ¥ 130.5bln, ordinary income will rise 17.2% to ¥ 125.5bln and net income will rise 28.8% to ¥ 70.0bln. Thanks to the lull in the strengthening of the yen, we have revised down our initial estimated foreign exchange loss for fiscal 2012 by ¥ 3.0bln. For the fiscal year 2012, we expect earnings per share of 687.49 yen, and so we are planning to pay an annual dividend per share of 230 yen, including an interim dividend of 115 yen.

■ UNIQLO Japan

Our mainstay UNIQLO Japan operation constitutes 69.7% of total consolidated sales. In the three months to November 2011, the UNIQLO Japan segment generated a gain in sales but a fall in income. Sales rose 0.2% year on year to ¥ 190.0bln and operating income contracted 10.3% to ¥ 37.6bln. Both these figures fell short our or initial estimate with sales underperforming by ¥ 17.9bln and operating income by ¥ 5.3bln. The weather was unseasonably hot in the first quarter. The heat wave in September and the persistent warm temperatures in October and November stifled sales of fall/winter items and this led to a contraction of 4.0% year on year in same-store sales over the quarter as a whole. However, our total number of stores had expanded by 28 year on year to 853 stores, including 22 franchise stores, by the end of November 2011.

The gross profit margin at UNIQLO Japan dipped 2.4 points year on year in the September to November quarter. However, the margin came in 0.3 point higher than we had initially forecast thanks to our decision to focus on sales of core items which facilitated a more efficient control over discounting, and to offer only marginal discounts on our strong-selling Ultra Light Down garments. The year-on-year fall in the gross profit margin was due to an increase in the cost of sales as the price of cotton fiber and other raw materials prices rose and the cost of manufacturing goods in China also nudged higher. Our decision to attract customers with more limited-period sales on our HEATTECH functional innerwear also dampened the gross profit margin in the first quarter. However, UNIQLO Japan did manage to cut SG&A expenses by ¥ 2.7bln more than initially expected.

We are working to strengthen our product development system with materials manufacturers in order to ensure we can closely respond to and fulfill our customers' needs. Our Ultra Light Down range, developed jointly between UNIQLO and Toray Industries, has been selling extremely well as a revolutionary product that is light in weight but very warm. In this fall/winter season we have expanded the amount of Ultra Light Down garments produced 2.5 times compared to the last year. We have also expanded production of our HEATTECH functional innerwear from last year's 80 million units to 100 million units for retail in UNIQLO Japan and UNIQLO International stores.

We have revised our business estimates for UNIQLO Japan for the first half of fiscal 2012, or the six months from September 2010 through February 2012. We now expect sales of ¥ 360.0bln (up 5.2% year on year) and operating income of ¥ 68.0bln (down 3.4%). We have also revised down our forecast for same-store sales growth from 5.0% to 1.3% year on year for the second half from March through August 2012. As a result, we have revised down some of our initial estimates for the full business year through end August 2012. We now expect sales to come in ¥ 28.0bln lower than initially forecast at ¥ 629.0bln (up 4.8% year on year), SG&A expenses ¥ 8.5bln lower, and operating income ¥ 5.0bln lower at ¥ 106.5bln (up 0.3%).

■ UNIQLO International

UNIQLO International generated significant gains, as forecast, in both sales and income in the first quarter with sales expanding an impressive 59.1% year on year to ¥ 42.6bln and operating income rising 13.3% to ¥ 5.4bln. The pace of new store openings was particularly strong in the Asian region with 37 new stores coming on line in the first quarter, boosting the total number of UNIQLO International stores to 223 at the end of November 2011.

Our UNIQLO operations in China and Hong Kong exceeded our forecasts in the first quarter. The operations generated significant increases in both sales and income as 25 new stores came on line and same-store sales continued to enjoy double-digit gains. Our Taiwan operation performed well too with six new stores coming on line in the first quarter and continued strong sales from our global flagship store which opened in Taipei's Mingyao department store in September 2011. Our operation in South Korea continued to generate double-digit growth in same-store sales and overall performance exceeded our initial plan there. Sales are proving strong at our Myeongdong Central global flagship store which was opened in November 2011. UNIQLO operations in Singapore and Malaysia are proceeding well and to plan. We also achieved a great success with the opening of our first store in Thailand in September 2011.

The visibility of the UNIQLO brand improved dramatically with the opening of our New York Fifth Avenue global flagship store and New York 34th Street megastore in October 2011. The New York Fifth Avenue store has become a UNIQLO showcase to the world and sales there have been favorable. Sales at the New York 34th Street megastore are currently slightly below target. In France, we reopened the bigger, better La Defense store and the overall operation is proceeding as planned. In the U.K., income contracted as both sales and profit fell short of target. In Russia, profitability is improving with both sales and income slightly exceeding our target.

Our full-year estimates for UNIQLO International remain unchanged with sales expected to increase by an impressive 70.7% year on year to ¥ 160.0bln and operating income to expand 89.9% to ¥ 17.0bln. We had initially expected our UNIQLO operation in the U.S. to turn a profit in fiscal 2012 but, with the New York 34th Street store currently underperforming on sales, we now predict the operation will post a small loss. On the other hand, operations are exceeding expectations in the Asian nations of China, Hong Kong, South Korea and Taiwan. However, we have decided not to revise our full-year forecasts for the UNIQLO International segment overall.

■ Global Brands

Our Global Brands segment fulfilled expectations to generate gains in both sales and income in the first quarter from September to November 2011. Sales rose 16.3% year on year to ¥ 39.2bln and operating income expanded 35.2% to ¥ 5.3bln. Our Theory women's fashion label exceeded our expectations by generating a significant profit gain as same-store sales growth continued to rise in the U.S. and Japan too. Profit also increased considerably at our low-priced g.u. casualwear brand. The g.u. brand generated same-store sales growth in excess of 20%, and measures to improve management efficiency helped boost the operating income margin. Our French women's fashion label, Comptoir des Cotonniers and our French lingerie brand, Princesse tam.tam, both produced a flat performance as expected.

We have made no revisions to our initial estimates for the Global Brands segment for fiscal 2012. We still expect sales to increase 16.9% year on year to ¥ 145.0bln and operating income to rise 53.6% to ¥ 13.5bln.

■ Fiscal 2012 Consolidated Estimates: Increased Downward Revisions for UNIQLO Japan

In terms of our consolidated business forecasts for the year to end August 2012, a further downward revision to our estimates for performance at UNIQLO Japan means that we are now forecasting consolidated sales will rise 14.2% year on year to ¥ 937.0bln, operating income will rise 12.1% to ¥ 130.5bln, ordinary income will rise 17.2% to ¥ 125.5bln and net income will rise 28.8% to ¥ 70.0bln. Thanks to the lull in the strengthening of the yen, we have revised down our initial estimated foreign exchange loss for fiscal 2012 by ¥ 3.0bln. In addition, net income is expected to rise significantly compared to last year when we accounted a special loss of ¥ 9.6bln relating to changes in accounting practices. For the fiscal year 2012, we expect earnings per share of 687.49 yen, and so we are planning an annual dividend per share of 230 yen, including an interim dividend of 115 yen.