Last Updated: 2010.07.08

Results summary for the nine months to May 2010

FAST RETAILING CO., LTD.![]() ( 26KB )

( 26KB )

to Japanese page

Consolidated results

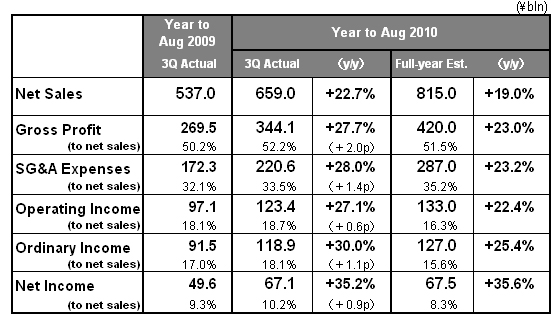

【Summary】Nine months to May 2010 : Net sales rise 22.7%, operating income up 27.1%

FAST RETAILING CO., LTD achieved significant gains in both revenue and profit through the third quarter, the nine months to May 2010. Net sales rose 22.7% year on year to ¥ 659.0bln, operating income rose 27.1% year on year to ¥ 123.4bln and net income increased by 35.2% year on year to ¥ 67.1bln.

UNIQLO Japan did experience a contraction in profit in the third quarter (March-May 2010) as unseasonably cold weather hindered customer traffic and same-store sales fell. While we have revised downward our second half estimates for UNIQLO Japan, we are still predicting the operation will generate increased sales and profit for the full business year through August 2010. We now estimate full-year net sales at UNIQLO Japan will rise 13.0% year on year to ¥ 608.0bln and operating income will rise 17.4% year on year to ¥ 130.0bln. Sales of SILKY DRY and SARAFINE innerwear made from functional materials proved strong during the spring/summer season. Our plan to open 31 large-format stores this business year is on track, and we expect to achieve our aggregate 808-store, including 20 franchise stores and 102 large-format stores, by the end of the business year,

UNIQLO International is enjoying a favorable expansion particularly in the Asian region. UNIQLO brand awareness is also increasing in the US and Europe generating improvements in sales and profit per store. We opened our first store in Russia in April of this year, while the May 15 opening of our fourth global flagship store, the Shanghai West Nanjing Road Store, met with phenomenal success. We estimate UNIQLO International net sales for the full business year through August 2010 will rise 93.2% to ¥ 73.0bln and that operating income will rise 301.2% to ¥ 6.5bln.

Within the Japan Apparel segment, our low-priced fashion operation g.u. continues its strong performance. Our Global Brands segment is producing considerable gains in both revenue and income following the incorporation of the Theory operation onto consolidated accounts from the third quarter 2009.

For the full business year through August 2010, we now estimate consolidated net sales will rise 19.0% year on year to ¥ 815.0bln and consolidated operating income will increase 22.4% year on year to ¥ 133.0bln. This represents a downward revision to our previous estimate announced April 8 of ¥ 19.0bln in net sales and ¥ 7.5bln in operating income. These estimates translate into profit per share of 663.16 yen. We predict an annual dividend per share of 230 yen: a 115 yen as interim dividend and a 115 yen as year-end dividend. This would represent a 70-yen rise in the dividend per share over last year.

■ UNIQLO Japan

UNIQLO Japan, which accounts for 75% of consolidated net sales, generated significant gains in both revenue and income in the nine months to May 2010. Net sales rose 15.0% year on year to ¥ 497.5bln and operating income rose 21.4% year on year to ¥ 117.1bln.

In the three months to May 2010, UNIQLO Japan saw sales rise but profits contract. Net sales for the three-month period rose 0.7% year on year to ¥ 137.3bln but operating income shrank 15.6% year on year to ¥ 23.3bln. The primary cause was unseasonably cold weather in March and April which reduced customer traffic, and led in turn to a 7.9% contraction in same-store sales for the quarter. The persistently cold weather dampened sales of our staple spring/summer cut & sew garments. Conversely, sales of SARAFINE and SILKY DRY innerwear made from functional materials were strong. Although same-store sales fell in the third quarter, we did not conduct any unreasonable discounting and this enabled us to maintain a gross profit margin in line with the previous year's level. UNIQLO Japan inventory stood at ¥ 50.0bln at the end of May, up ¥ 8.4bln year on year. This rise in inventory was due to both the increased number and larger size of UNIQLO Japan stores. Inventory of regular, staple products such as denim and cut & sew garments also increased after net sales fell below our targets in March through April. We have already taken the March-April sales trend into account and are controlling production of fall staple products accordingly.

For the full business year to August 2010, we estimate UNIQLO Japan will generate a 13.0% rise in net sales to ¥ 608.0bln and a 17.4% rise in operating income to ¥ 130.0bln. Taking into account the recent data for same-store sales, we predict a 6.3% contraction in net sales for the six months to August. We have revised downward our previous April estimate for second half net sales by ¥ 16.0bln, and operating income by ¥ 7.5bln. New store openings are proceeding as planned and we estimate total store numbers will reach 808 stores (including 20 franchise and 102 large-format stores) by end August 2010, a year-on-year increase of 38 stores.

■ UNIQLO International

UNIQLO International performance over the nine months to May 2010 shows the segment's strong growth continuing. UNIQLO International generated considerable gains in both revenue and income with net sales roughly doubling to ¥ 58.6bln and operating income increasing 3.5 times year on year to ¥ 6.5bln.

We opened our fourth global flagship store, the Shanghai West Nanjing Road Store, in May. The success of the Shanghai global flagship store helped secure further double-digit gains for same-store sales in China and Hong Kong. Our operations in South Korea continue favorably with business developing as planned. We opened our first store in Russia in April. Sales continue to be solid at our New York global flagship store. Our UK and French operations continue to enjoy rising sales and both operations are performing to target.

For the full business year through August 2010, we estimate net sales at UNIQLO International will rise 93.2% year on year to ¥ 73.0bln and operating income will rise 301.2% to ¥ 6.5bln. We have however revised our April estimate downward marginally in light of recent factors such as the generation of new rent obligations in the second half for the property on Fifth Avenue New York leased in May, and also the impact of exchange rate volatility.

■ Japan Apparel

Our Japan Apparel segment performed to plan in the nine months to May 2010. Net sales shrank 7.8% year on year to ¥ 35.8bln and the segment posted an operating loss of ¥ 0.5bln. Our low-price clothing brand g.u. performed to target. New g.u. store openings are also proceeding in line with our full-year plan with the first large-format g.u. store, g.u. Kawasaki Dice Store, opened in April. Our footwear operation was merged with UNIQLO CO., LTD. on April 1 this year. We plan to use UNIQLO's business foundation to heighten the efficiency of and transform the UNIQLO SHOES operation into a specialty retailer of private label footwear. Same-store sales at our women's fashion developer CABIN continue to fall below previous year levels. However, this result was expected. Our full-year business forecasts for the Japan Apparel segment remain unchanged. We predict full-year net sales will shrink 8.8% to ¥ 47.0bln and we estimate an operating loss of ¥ 0.7bln.

■ Global Brands

Our Global Brands segment generated significant gains in both revenue and income in the nine months to May 2010. Net sales rose 86.6% year on year to ¥ 66.3bln, and operating income rose 108.2% year on year to ¥ 6.6bln. This was due to the new incorporation of the Theory operation from the third quarter 2009, and Theory's subsequent strong performance.

Same-store sales expanded strongly and profitability improved at the US Theory operation. Same-store sales have also continued to expand at Theory Japan. The additional benefit of a stronger yen in the form of reduced procurement costs also helped boost profitability considerably at Theory Japan. Same-store sales continue to expand at our France-based fashion brand COMPTOIR DES COTONNIERS with business performing as planned in local currency terms. Our French lingerie brand PRINCESSE TAM.TAM is also performing to plan in local currency terms. We continue to seek further gains in management efficiency by reducing the scale of its wholesale business.

We have made some revisions to our full-year estimates for the Global Brands segment to reflect factors such as the stronger-than-expected operating income figures generated by our Theory operations, and the recent impact of foreign exchange volatility. We now estimate full-year net sales will rise 51.1% year on year to ¥ 84.0bln and operating income will rise 77.3% to ¥ 6.5bln.

■ Revisions to consolidated business estimates for the full year to August 2010

We estimate that consolidated net sales for the full year through August 2010 will rise 19.0% year on year to ¥ 815.0bln, operating income will rise 22.4% year on year to ¥ 133.0bln, and ordinary income will rise 25.4% year on year to ¥ 127.0bln. Compared to our April 8 estimate, this represents a downward revision of ¥ 19.0bln for net sales and ¥ 7.5bln for operating income. Our current estimates would generate profit per share of 663.16 yen. We predict an annual dividend per share of 230 yen: a 115 yen as interim dividend and a 115 yen as year-end dividend. This would represent a 70-yen rise in the dividend per share over the previous year.