Last Updated: 2009.10.08

Results Summary for Year to August 2009

FAST RETAILING CO., LTD.![]() ( 137KB )

( 137KB )

to Japanese page

Consolidated results

【Summary】 FR achieves a record operating profit in Year to August 2009

FAST RETAILING CO., LTD. achieved a significant increase in both revenue and income in the year to August 2009, boosting its operating income for the year to a new record, the first time in eight years. The main reasons behind this strong performance were the significant increase in both revenue and income at our mainstay UNIQLO Japan operation, expanded profits from our UNIQLO International segment, and reduced losses at our Japan Apparel operation.

Existing store sales at UNIQLO Japan continued their strong upward trend, rising 11.3% year on year. Important factors at play here included the strengthening of our advertising and promotion activities, our popular products such as HEAT TECH, BRATOP and washable sweaters caught people's attention and attracted more customers to our stores, and the increase of more new products for women such as skirts and jackets.

Operating income at UNIQLO International rose from ¥ 0.3bln in the year to August 2008 to ¥ 1.6bln in the year to August 2009 as losses were reduced at our UK and US operations and business expanded smoothly in the Asian region.

The operating loss at our Japan Apparel segment improved significantly on the back of improved profitability at our low-price g.u. casual brand following the launch of popular lines such as the ¥ 990 Jeans.

Profits shrank considerably at our Global Brands operation due to the worsening consumer environment in both Europe and the US. In the Global Brand segment, LINK THEORY HOLDINGS CO., LTD. was incorporated as a consolidated subsidiary from the second half.

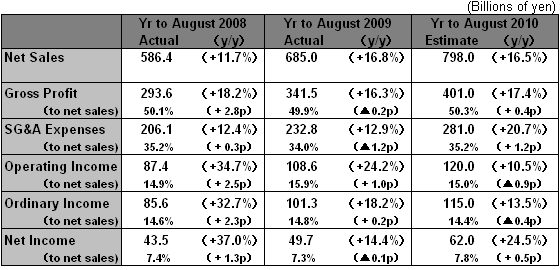

As a result, our consolidated business results for the full year to August 2009 stood as follows: Overall net sales ¥ 685.0bln (up 16.8% y/y), operating income ¥ 108.6bln (up 24.2% y/y), and net income ¥ 49.7bln (up 14.4% y/y). We are scheduled to pay a year-end dividend of 85 yen per share. Adding this to the 75-yen interim dividend payout generates a scheduled annual dividend of 160 yen per share.

Our consolidated business estimates for the year to August 2010 are as follows: Overall net sales ¥ 798.0bln (up 16.5% y/y), operating income ¥ 120.0bln (up 10.5% y/y), net income ¥ 62.0bln (up 24.5% y/y) and a profit per share of 609.13 yen. We plan to increase the annual dividend per share by 40 yen to 200 yen per share. This breaks down into an interim dividend of 100 yen and a year-end dividend also of 100 yen.

■ UNIQLO Japan

UNIQLO Japan makes up 78% of all FR consolidated sales. UNIQLO Japan generated a significant increase in both revenue and income in the year to August 2009 with net sales increasing 16.4% year on year to ¥ 538.1bln and operating income rising 28.2% to ¥ 110.7bln. Underlying this strong performance was a range of factors: aggressive advertising activities focused on product campaigns, popular products such as HEAT TECH, BRATOP and washable knitwear caught people's attention and attracted more customers to our stores, the increase of more new products for women such as skirts and jackets, and the fact that we were able to minimize lost sales opportunities by increasing in-store inventory of core basic products such as T-shirts and polo shirts.

New store openings proceeded to plan generating a net increase of 10 stores over the year bringing the total number of direct-run stores to 750 by the end of August 2009 (770 including franchises). Our more aggressive approach to the opening of large-format stores boosted the number of such stores to 71 by the end of August 2009.

We were able to improve our gross profit to net sales ratio by 0.9 points in the first half through February 2009. However, a 1.8 point fall in the margin in the second half through August meant that our gross margin for the business year as a whole fell 0.4 points. Our gross profit margin in the second half was influenced by the increased number of campaign products as the focus of more advertising campaigns. Moreover, we began discounting summer items earlier than usual in order to sell out the summer inventories to the fourth quarter period June through August 2009. Our SG&A cost ratio for the full business year improved as strong sales boosted efficiency across the board for personnel, advertising and promotion and store rents.

For the full year to August 2010, our business estimates for UNIQLO Japan are for a 10.6% increase in overall net sales to ¥ 595.0bln, and an 8.3% increase in operating income to ¥ 120.0bln. The launch of our autumn/winter ranges proceeded well boosting existing store sales in September by 31.6% year on year. Given this strong performance, we have factored in a 3.0% increase in existing store sales for the full year to August 2010. Our new store opening strategy for the coming business year will continue along the same lines with the planned opening of 25 large-format stores over the year. We are planning to positively focus on opening new large-format stores in prime urban areas as illustrated by the opening of our bigger, better Ginza store (2300sqm) and a new large-format store in Sakae, Nagoya this autumn and the planned opening of the Shibuya Prime (temporary name) and a large-format store in Osaka's Shinsaibashi in autumn 2010.

On product development, we will continue to perfect UNIQLO products by pressing ahead with the development of new women's products and more unique products with high functionality and high value-added to follow our HEATTECH range. One example of such efforts was the launch in October of our +J Collection created along Ms. Jil Sander.

■ UNIQLO International

Our UNIQLO International operation boosted profits considerably in the year to August 2009 with overall net sales rising 28.8% year on year to ¥ 37.7bln and operating income well surpassing last year's level of ¥ 0.3bln to reach ¥ 1.6bln. Profitability improved at UNIQLO UK with sales favorable at our Oxford Street global flagship store and other existing stores there. UNIQLO USA was able to generate an operating profit thanks to strong sales at our New York global flagship store. Business expanded favorably in China, Hong Kong and South Korea with the number of stores in that region approximately double that of the previous year. Sales outstripped our initial estimate at our first Singapore store opened in April.

For the coming year to August 2010, we are forecasting a major increase in both revenue and income at UNIQLO International. We estimate net sales will increase 72.0% year on year to ¥ 65.0bln and operating income will nearly treble year on year to ¥ 4.5bln. We view our expansion in China, Hong Kong, South Korea and Singapore as the engine for growth at UNIQLO International, and therefore, we plan to increase the number of stores in the Asian region considerably from the current 76 stores to 132 by the end of August 2010. We plan to open our largest global flagship store yet in Shanghai, China in spring 2010. And next spring, we also plan to open our first store in a new market - Moscow, Russia.

■ Japan Apparel

Overall net sales at our Japan Apparel operation held flat at ¥ 51.5bln over the year to August 2009. But the operating loss improved considerably from ¥ 2.8bln to ¥ 0.5bln. GOV RETAILING posted an operating profit as profitability improved at g.u. after the launch of its ¥ 990 Jeans in March nudged overall sales onto a strong upward trend. CABIN generated an operating loss as the depressed consumer sentiment in the fashion apparel industry knocked existing store sales below the previous year's level.

Over the year to August 2010, we forecast profitability at the Japan Apparel segment will improve as g.u. continues to expand business and CABIN improves its own profitability. At g.u., we plan to launch more and more new low-priced products to follow the ¥ 990 Jeans and ¥ 490 T-shirts. We are also planning to open 50 new stores. As for our footwear operation, we will continue with the closure of FOOTPARK stores, while on the other hand building up our new footwear business. We launched UNIQLO SHOES in September. We plan to continue our efforts to boost profitability at CABIN through efficiency gains from focusing on mainstay brands, and consolidating its procurement of materials.

■ Global Brands

Profits shrank considerably at our Global Brands operation over the year to August 2009 as sales at our French brands COMPTOIR DES COTONNIERS and PRINCESSE TAM.TAM were dampened by the worsening consumer environment in Europe. LINK THEORY HOLDINGS CO., LTD. has contributed as a consolidated subsidiary from the second half.

We are forecasting an increase in both revenue and income for Global Brands in the year to August 2010. Given that we expect the consumer downturn to continue in Europe and the US, we aim to make gains through improved management efficiency at the Global Brands operation, and from the consolidated contribution generated by LTH. We plan to increase operational efficiency at our Global Brands operation by generating additional group synergies through the strengthening of links between Tokyo, New York and Paris.

■ Estimates for Year to August 2010

Our consolidated business estimates for the year to August 2010 are as follows: Overall net sales ¥ 798.0bln (up 16.5% y/y), operating income ¥ 120.0bln (up 10.5% y/y), net income ¥ 62.0bln (up 24.5% y/y) or a profit per share of 609.13 yen. We plan to increase the annual dividend per share by 40 yen to 200 yen per share - split as 100 yen for both the interim and year-end dividends.