Last Updated: 2009.07.09

Results summary for third quarter to May 2009

FAST RETAILING CO., LTD.![]() ( 28KB )

( 28KB )

to Japanese page

Consolidated results

【Summary】 FR operating income up 28.3% over the 9 months to May 2009

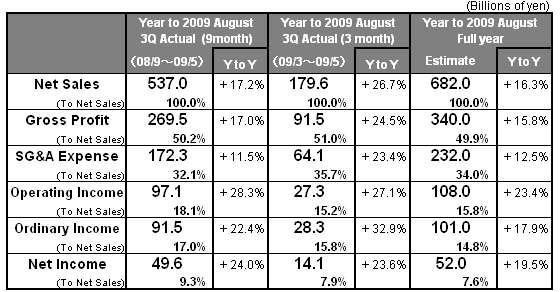

FAST RETAILING recorded a significant increase in both revenue and income over the nine months to May 2009 with net sales rising 17.2% year on year to ¥ 537.0bln and operating income rising 28.3% year on year to ¥ 97.1bln.

Our mainstay UNIQLO Japan operation exceeded our plan in the three months to May 2009 achieving a strong 15.4% rise in same store sales over the period. A strong sales performance at our Shinjuku West Exit Store also contributed to the operation's significant rise in both revenue and income. We achieved a profit at our UNIQLO International operation as sales expanded favorably in the Asian region including Mainland China and South Korea, and losses at our UK operation shrank considerably. Sales at our first store opened recently in Singapore have proved very successful outstripping all expectations.

Profitability improved at our Japan Apparel segment with g.u. sales expanding significantly on the back of the launch of our ¥ 990 jeans series. At the same time however, we have decided to vastly reduce our FOOTPARK footwear retailing operation, closing approximately 200 stores to leave 10 stores by the end of January 2010. In view of these store closures, we have accounted a special loss of approximately ¥ 2.5bln in the third quarter to May. We are in the process of building our new footwear business going forward as the FAST RETAILING group including our existing VIEW footwear operation. We have revised up our business forecasts for the Japan Apparel segment for the full business year to reflect the recent strength in our low-cost g.u. brand. We are expecting the segment's loss to be significantly reduced compared to the previous year.

At our Global brands operation, business at our French-based subsidiaries COMPTOIR DES COTONNIERS and PRINCESSE TAM.TAM proceeding according to plan. Our former equity method affiliate LINK THEORY HOLDINGS was fully consolidated from this third quarter.

We have revised up our consolidated business forecasts for the full year to end August 2009 with net sales now seen rising 16.3% year on year to ¥ 682.0bln, operating income now seen increasing by 23.4% year on year to ¥ 108.0bln, net income seen up 19.5% at ¥ 52.0bln and our profit per share rising to 510.55 yen.

We have also increased our estimated 75 yen year-end dividend by 10 yen to 85 yen. Adding this to the 75 yen per share interim dividend payout generates an annual estimated dividend per share of 160 yen.

■ UNIQLO Japan

Our mainstay UNIQLO Japan operation, which constitutes approximately 80% of total consolidated sales, outstripped its targets in the three months from March to May to achieve significant increases in both revenue and income. Same stores sales leapt 15.4% year on year, and sales from new stores such as our Shinjuku West Exit store contributed considerably to the 22.8% year-on-year increase in overall UNIQLO Japan net sales. Our store opening and closure plans proceeded as expected generating a total number of 757 direct-run stores (777 including franchises) at the end of May 2009. That is a net increase of 16 stores.

UNIQLO Japan saw the number of customers to its stores leap in the third quarter through May with two extra advertising campaigns during the quarter. The successive campaign program featured our PARKA, Polo Shirts, BRATOP and UT (Print T-Shirt) products. We were also able to minimize potential lost sales by increasing store inventory of core basic items such as our fraise stitch T-shirts and polo shirts. We successfully boosted sales of our popular BRATOP products by trebling last year's production levels and maintaining solid in-store inventory. At the same time, we have continued to strengthen our women's wear ranges. The launch of our soft tailored jacket at the Tokyo Girls Collection in March captured a great deal of attention, and other fashion items such as our blouses, tunics and skirts have also sold well.

Our gross margin in the three months to May 2009 fell 1.5 points year on year; the quarter's gross margin level was on plan, however. While keeping discounting under control, we strengthened our sales promotion activities in a tough consumer environment. The fall in gross profit was due to the increased number of limited sales of popular core products, and also the wider range of products incorporated within the limited sales framework given the larger number of advertising campaigns during the quarter. The SG&A ratio improved 2.7 points year on year. Efficiency across all areas from personnel costs, advertising & promotion costs to store rents improved thanks to the segment's strong sales performance.

In light of the upturn in performance during the third quarter from March to May and the continued strength in sales through June, we have revised up our full-year estimates for UNIQLO Japan through August 2009 as follows: The forecast for net sales has been increased by a further ¥ 17.0bln compared to the most recent revision announced on April 9. The net sales forecast now sits up 16.4% year on year at ¥ 538.0bln. The April estimate for operating income has been revised up a further ¥ 7.0bln to ¥ 112.0bln, a year-on-year increase of 29.6%.

■ UNIQLO International

We were able to expand operating profit at UNIQLO International in the three months from March to May 2009 to ¥ 0.2bln (compared to ¥ 0.0bln in the previous year). This was due in part to a favorable expansion in sales in the Asian region including China and South Korea, and also to a significant reduction in losses at our UK operation. Sales at our first Singapore store, opened in April, have outstripped our plan. And this success has encouraged us to begin considering advances into neighboring South East Asian nations such as Thailand, Indonesia, Malaysia, Philippines and also India, Vietnam and Australia. Our full-year forecasts for UNIQLO International remain unchanged with net sales expected to rise 26.1% year on year to ¥ 37.0bln, and operating income seen creeping up from the previous year's level of ¥ 0.3bln to a more solid ¥ 1.5bln.

■ Japan Apparel

We were able to reduce losses at our Japan Apparel segment in the third quarter to May 2009 thanks to improved profitability at our g.u. apparel brand. Profitability has been improving at g.u. with sales expanding significantly since the launch of our ¥ 990 jeans in March. And now it is not just our jeans that are keeping g.u. sales so buoyant but also our ¥ 990 polo shirts, our ¥ 490 T-shirts and a successive line of new low-priced products. Although our footwear operation (FOOTPARK & VIEW) continues to underperform, third quarter performance for GOV RETAILING as a whole was in line with expectations. Existing store sales at women's fashion retailer CABIN continue to fall year on year but this was also in line with the plan.

Regarding our FOOTPARK footwear operation, we have decided to make a sweeping reduction in the number of stores, closing approximately 200 stores to leave about 10 stores by the end of January 2010. We have accounted a special loss of ¥ 2.5bln in the third quarter to May in relation to these store closures. However, we do not expect to generate another material store-closure related loss in the coming business year through August 2010. As the FAST RETAILING group, we are currently in the process of building our new footwear operation including VIEW should take.

We have revised our full business year estimates for the Japan Apparel segment to reflect the strong performance by g.u. Net sales have been revised up a further ¥ 3.0bln from to the April estimate to ¥ 51.0bln (+3.1% year on year). The segment's operating loss is now seen improving a further ¥ 0.5bln compared to the most recent forecast. That would equate to an operating loss of¥ 1.5bln for the year to end August 2009 compared to an operating loss of ¥ 2.8bln last year.

■ Global Brands

Business performance at our Global Brands operation proceeded as planned in the three months to May 2009. LINK THEORY HOLDINGS became a consolidated subsidiary from this third quarter. Our French-based COMPTOIR DES COTONNIERS and PRINCESSE TAM.TAM operations saw revenue drop 20% and income drop 80% in yen terms. However, we had expected and prepared for this drop. Full business year forecasts for our Global Brands segment reflect revisions to performance at LINK, etc. We now expect the operation to generate a 21.1% year-on-year increase in net sales to ¥ 53.0bln, while we foresee a 66.5% fall in operating income to ¥ 2.6bln.

■ Consolidated estimates for the business year to end August 2009

We have made further upward revisions to our recent estimates for consolidated business performance over the year to August 2009. We now see net sales increasing 16.3% year on year to ¥ 682.0bln, and operating income rising 23.4% year on year to ¥ 108.0bln. In addition, we expect ordinary income to rise 17.9% year on year to ¥ 101.0bln and net income to rise 19.5% year on year to ¥ 52.0bln. We are now predicting profit per share to reach 510.55 yen.

We have also increased our estimated 75 yen year-end dividend by 10 yen to 85 yen. Adding this to the 75 yen per share interim dividend payout generates an annual estimated dividend per share of 160 yen.