Last Updated: 2008.07.10

Results summary for three months to May, 2008

FAST RETAILING CO., LTD.![]() ( 24KB )

( 24KB )

to Japanese page

Consolidated results

【Summary】 Profits continue to rise significantly during 3 months to May

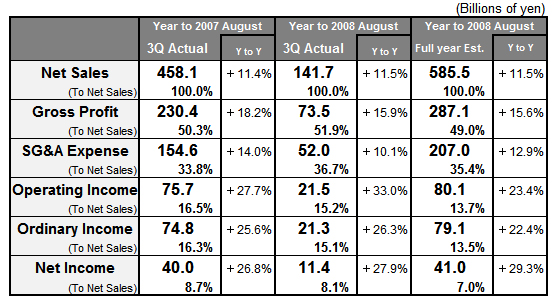

FAST RETAILING generated another significant rise in both revenue and profit in the third quarter from March to May 2008 following on from the strong first half performance. Sales promotions at our mainstay UNIQLO Japan operation met with considerable success helping to boost existing store sales by 4.2% year on year. In addition, UNIQLO Japan was able to improve our gross profit margins and cost ratios, generating a higher than expected level of operating income.

UNIQLO International posted a cumulative profit in the first nine months to May 2008. UNIQLO operations in China, Hong Kong and South Korea continued to expand favorably, and performance at our New York global flagship store was also favorable. Our Japan Apparel segment posted a small profit in the March to May period thanks to improved profitability at both our women's fashion retailer CABIN and footwear retailer ONEZONE CORPORATION subsidiaries. On the other hand, profits from our Global Brands segment were flat in the third quarter due to the deterioration in the European consumption environment.

Our consolidated business forecasts for the full year to August 2008 remain unchanged from the estimates announced along with our interim results on April 10. We estimate overall net sales will rise 11.5% year on year to ¥ 585.5bln and operating income will rise 23.4% to ¥ 80.1bln, generating a profit per share of 403.33 yen. We are forecasting an annual dividend per share of 130 yen, including the interim dividend payment of 65 yen already distributed.

Finally, we took the decision today to go ahead with a business merger between three of our Japan Apparel subsidiaries (low cost casual wear brand developer G.U. CO., LTD., and footwear retailers ONEZONE CORPORATION and VIEWCOMPANY CO., LTD.) effective September 1, 2008. The newly merged company will strive to create a new style of shoe business within the footwear industry, and the cheapest quality clothes in the low-cost clothing market. We are expecting to account a special loss of ¥ 1.8bln in the year to August 31, 2008 in relation to this three-company merger.

■ UNIQLO Japan

Our UNIQLO Japan operation accounts for roughly 80% of FAST RETAILING consolidated net sales. In the three months to May, UNIQLO Japan enjoyed an increase in revenue, and, thanks to improvements in both our gross profit to net sales and cost to net sales ratios, UNIQLO Japan operating income exceeded target. Existing store net sales increased a favorable 4.2% year on year in the third quarter from March to May. Factors underlying this strong performance include: a) the stronger appreciation of UNIQLO's high quality, functional material garments, b) our success in creating clearer standout displays for easy purchase by increasing store inventory of mainstay garments such as our cotton T-shirts, denim, etc., and, c) our successful promotion campaigns. The campaigns conducted in the third quarter were designed to boost the image of our women's wear such as our New Shapely Leg Bottoms Campaign by Japanese beauty queen Norika Fujiwara and our Bra Top Campaign by Japanese actress Kazue Fukiishi. These were the first for UNIQLO to appeal only to female customers through TV commercials and helped attract customers. Our store openings & closures were conducted roughly to plan with a net increase of 11 stores boosting our total number to 741 direct-run stores at end May 2008 (759 including franchise stores).

Our gross profit to net sales ratio outstripped target in the third quarter from March to May, improving by 2.4 points compared to the previous year as we exercised stronger control over discounting. Our SG&A cost ratio improved 1.4 points year on year as the advent of our regional employee system helped reduce time spent hiring and training new personnel, and our efforts to improve operational store efficiency led to a rise in productivity.

Our forecasts for the full year to August 2008 for UNIQLO Japan remain unchanged with net sales expected to rise 8.1% year on year to ¥ 459.2bln, and operating income expected to rise 23.9% to ¥ 79.2bln.

■ UNIQLO International

UNIQLO International again managed to turn a slight profit in the third quarter from March to May with net sales rising 71.8% year on year. Within the segment, business in the Asian region of China, Hong Kong and South Korea continues to expand favorably, and the financial balance at our US operation has also improved since the opening of our global flagship store in New York in November 2006. Our full-year forecasts through end August 2008 for UNIQLO International remain unchanged with net sales predicted to rise 76.5% to ¥ 30.0bln and the operating loss expected to shrink from the previous year's ¥ 1.1bln to ¥ 0.4bln.

■ Japan Apparel

Our Japan Apparel segment posted a slight profit in the third quarter (March to May). The impact of cost cuts at CABIN generated a higher than expected profit there, and profitability at ONEZONE improved during this quarter of traditionally buoyant demand. Our forecasts for the Japan Apparel operation for the full year through August 2008 remain unchanged with net sales expected to rise 10.4% year on year to ¥ 50.8bln, and the operating loss to shrink from the previous year's ¥ 3.5bln to ¥ 2.7bln. Profit and loss figures for women's footwear subsidiary VIEWCOMPANY CO. LTD are included in the consolidated profit and loss statement from this third quarter.

Having considered the matter since April this year, we have now taken the decision to merge three of our Japan Apparel subsidiaries (low-cost casual wear brand developer G.U. CO., LTD., and footwear retailers ONEZONE CORPORATION, and VIEWCOMPANY CO., LTD.) effective September 1, 2008. The newly merged company will strive to create a new style of shoe business within the footwear industry, and the cheapest quality clothes in the low-cost clothing market. We are looking to further improve profitability by boosting the new company's operational efficiency through the merger of production, product, marketing, supervision and management planning functions. We are expecting to account a special loss of ¥ 1.8bln in the year to August 31, 2008 as the three-company merger results in inevitable store closures and office transfers.

■ Global Brands

Our Global Brands operation did not meet its targets for the third quarter from March to May. When the data are viewed on a real basis adjusted for differing business periods, revenue actually rose 8% year on year and operating income was roughly flat. The developer of the casual wear Comptoir des Cotonniers brand in France and other parts of Europe failed to reach its sales target owing to the deteriorating consumption environment in Europe. However, it still managed to generate a rise in both revenue and profit. Our full year business forecasts for the Global Brands segment remain unchanged with net sales expected to rise 17.0% year on year to ¥ 43.0bln and operating income expected to rise ¥ 3.2% year on year to ¥ 7.4bln.

■ Business forecasts for the full year to August 2008

While our UNIQLO Japan operation outperformed on the profit front in the third quarter, forecasts for the full year remain unchanged. As a result, our consolidated business estimates for the year to end August 2008 indicate an 11.5% year-on-year increase in overall net sales to ¥ 585.5bln and a 23.4% rise in operating income to ¥ 80.1bln generating a profit per share of 403.33 yen. We are forecasting an annual dividend per share of 130 yen, including the interim dividend payment of 65 yen already distributed.