Last Updated: 2008.01.10

Results summary for the three months to November 2007

FAST RETAILING CO., LTD.![]() ( 25KB )

( 25KB )

to Japanese page

Consolidated Results

【Summary】 Both revenue and profit up in three months to November 07

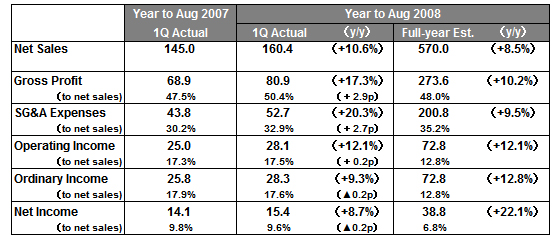

FAST RETAILING CO., LTD. enjoyed a rise in both revenue and profit during the first quarter, or the three months from September to November 2007. Net sales rose 10.6% year on year to ¥ 160.4bln, operating income rose 12.1% to ¥ 28.1bln, and net income rose 8.7% year on year to ¥ 15.4bln.

We generated in increase in both revenue and profit at our mainstay UNIQLO Japan operation with both net sales and operating income coming in above expectations. Factors at play here were the strong sales performance of core winter products such as HEAT TECH INNER wear, cashmere sweaters and down jackets. The need to discount surplus stock was also reduced. We turned our first profit at our UNIQLO International operation during the quarter thanks to a strong performance at our New York global flagship store, and continued favorable results in China, Hong Kong and South Korea. Performance at our Japan Apparel and Global Brands sections was within expectations.

Capturing strong sales at UNIQLO Japan over the peak demand month of December has meant that the overall business is performing well. However, we do not intend to revise our half-year or full business year forecasts given our cautious outlook for sales in January and February with shortages in some winter goods already emerging. For that reason, our consolidated business forecasts for the full year to August 2008 remain unchanged with net sales expected to rise 8.5% year on year to ¥ 570.0bln, operating income seen rising 12.1% to ¥ 72.8bln, and a predicted profit per share of 380.95 yen. Our annual dividend per share remains as initially predicted at 130 yen.

■ UNIQLO Japan

Our mainstay UNIQLO Japan operation accounts for 81% of consolidated net sales. In the three months to November 2007, UNIQLO Japan generated a 6.4% year-on-year increase in net sales, and a 10.3% rise in operating income. First quarter results exceeded our expectations thanks to this strong sales performance and also an improvement in gross margin.

Net sales were flat on an existing store basis, but an increase of 25 direct-run stores compared to August 2007 helped generate the greater revenue. Total direct-run stores as of end November 2007 stood at 739 stores, or 758 including franchises. Looking back on monthly performance, revenue fell in September as the warm weather delayed sales of autumn garments. However, when the cold spell set in mid October, sales of winter cashmere sweaters, fleeces, and HEAT TECH INNER wear perked up. Our HEAT TECH INNER wear and down jacket campaign products attracted more customers and boosted revenue in November. Thus we were more than able to regain the slip in sales suffered in September, and sales for the September to November quarter overall ended up exceeding our initial forecast. We believe this proves that UNIQLO's unique "functional materials" such as HEAT TECH INNER wear for the autumn/winter season matched customer needs well, further boosted by our timely promotion campaigns.

We also performed well on the profit front boosting the gross margin on sales ratio by 2.4 points. This reflected the strong sales of core winter garments, and our resulting ability to reduce discounting, and keep limited-period promotional sales to a minimum, etc. On the cost front, the SG&A to sales ratio increased 1.7 points. This was due to higher personnel costs on the back of increased hires, higher advertising and promotional costs, and rise in store rents as we aggressively moved ahead on store openings in shopping centers and prominent city center retail facilities.

We are moving ahead with our scrap and build policy for the full business year at UNIQLO Japan as part of our decision to position large scale 1600sqm stores as the key growth driver. We opened 9 large-scale stores in the first quarter as planned. However, we have revised our initial forecast for 40 large-scale store openings down to 25 for the full year to August 2008 following the delay in opening of new shopping centers scheduled to open in Spring 2008, but now pushed back due to revisions to the building standards law.

The business trend continues to be favorable for UNIQLO Japan. The operation managed to boost existing store revenue by 6.4% year on year even in the peak year-end period of December. However, we are already noting some shortages in certain winter garments in early January and therefore we are viewing January and February sales cautiously and do not intend to revise up our half-year or full business year forecasts. We are predicting net sales for the year to August 2008 of ¥ 448.0bln (up 5.5% year on year), and operating income of ¥ 71.0bln (up 10.9% year on year).

■ UNIQLO International

Performance at our UNIQLO International operation roughly doubled in the first quarter compared to the previous year. And we achieved our first profit in this business operation. Several factors contributed to this positive result including a strong performance at our New York global flagship store that was opened in November 2006, and continued favorable expansion in our operations in China, Hong Kong and South Korea.

Our business strategy at UNIQLO International is to increasingly use flagship stores to boost our brand visibility and strength around the world. To that aim, following on from the opening of our New York global flagship store, we opened another global flagship store in London's Oxford Street in November 2007. In addition, we opened our first store in La Defense in suburban Paris, France in December, and we have begun preparations to open a global flagship store in Paris. For the full business year to August 2008, we are predicting net sales of ¥ 30.0bln at UNIQLO International and a reduction in operating losses to ¥ 0.4bln.

■ Japan Apparel

Performance at our Japan Apparel operation was in line with expectations in the three months to November 2007. Although women's fashion retailer CABIN was weak on its September sales push, the elegance-style "ZAZIE"line performed well boosting overall sales and operating income back up to forecast for the full quarter. Our low-cost brand developer G.U. CO., LTD. also performed roughly as expected. Here, sales of women's fashion items were favorable and we are making progress in our efforts to boost profitability. Footwear retailer ONEZONE CORPORATION also performed as expected in a very competitive retail environment, and we continue our efforts to standardize store operations and strengthen original product lines.

We estimate net sales of ¥ 47.0bln and a reduced operating loss for our Japan Apparel operation for the full year to August 2008. We are aiming to turn a profit at CABIN this business year as we complete our transformation of the business to focus on four main brands. We plan to halve operating losses at G.U. and ONEZONE by improving sales per store, and reducing costs by streamlining head office operations.

■ Global Brands

Performance at our Global Brands operation was in line with expectations over the three months to November 2007. Customer numbers for the French-based casual wear fashion brand COMPTOIR DES COTONNIERS were dampened by the strikes in Paris. However sales of the brand in other European countries such as Spain and Italy were strong. Another favorable performance was also registered by our French lingerie brand PRINCESSE TAM.TAM.

Over the full business year to August 2008, we are planning to aggressively open new COMPTOIR DES COTONNIERS stores across Europe, while we consolidate a firmer base for PRINCESSE TAM.TAM in the French market. Our full-year forecasts for the Global Brands operation are for net sales of ¥ 43.0bln, and operating income of ¥ 7.4bln.

■ Forecasts for Year to August 2008

There is no change in our consolidated forecasts for the full business year to August 2008. We are forecasting net sales to rise 8.5% year on year to ¥ 570.0bln, operating income to increase 12.1% to ¥ 72.8bln, and a predicted profit per share of 380.95 yen. Our annual dividend per share remains as initially predicted at 130 yen.

Note: FAST RETAILING CO., LTD. discloses data on its business results and offers a variety of press releases on its IR website https://www.fastretailing.com/eng/ir/.