Last Updated: 2025.10.09

Results Summary for Fiscal 2025 (Year to August 31, 2025)

FAST RETAILING CO., LTD.![]() (193KB)

(193KB)

to Japanese page

to Chinese page

FY2025 Highlights

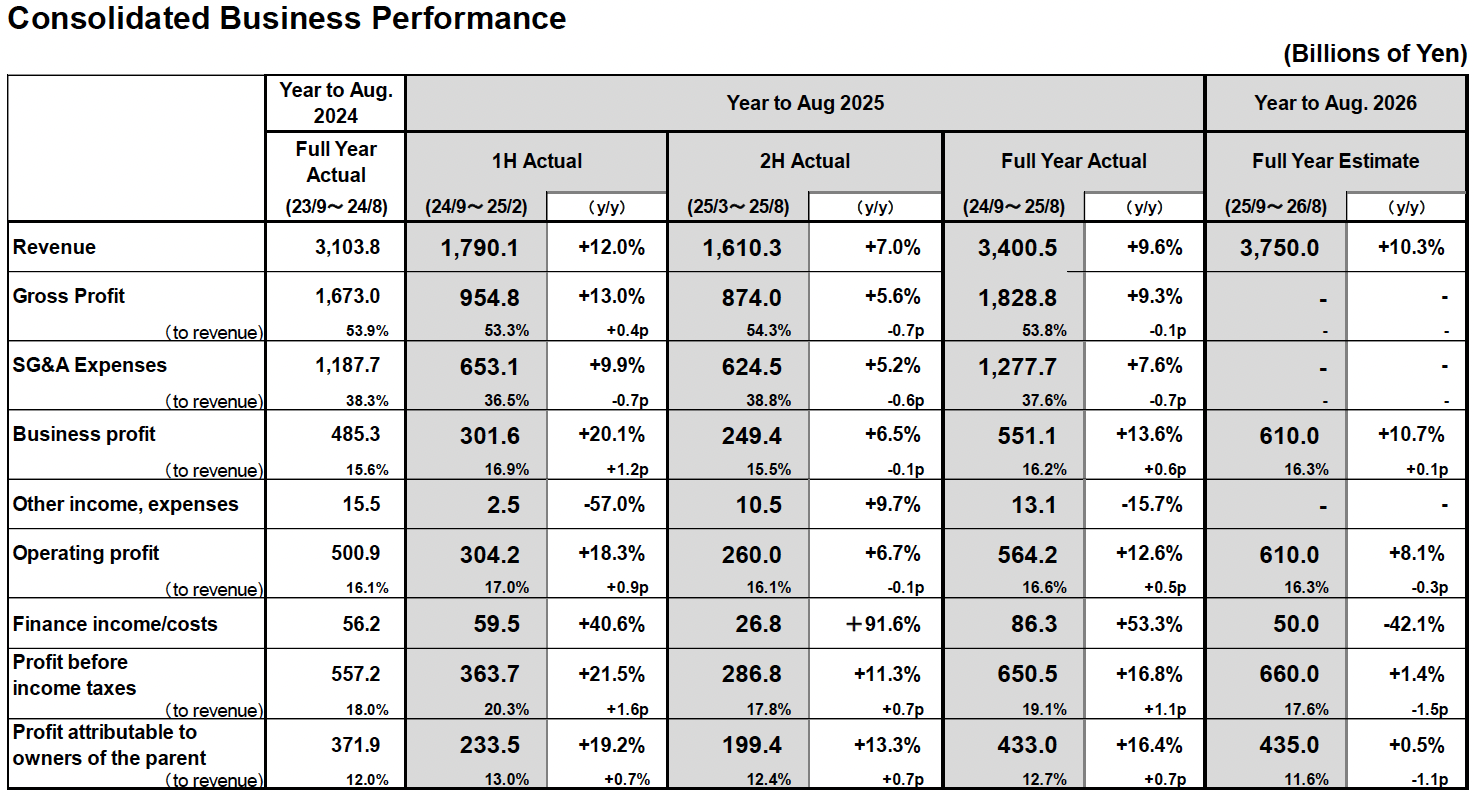

■Consolidated Results: Fast Retailing achieves record performance for fourth consecutive year

- FY2025 revenue: 3.4005 trillion yen (+9.6% year on year), business profit: 551.1 billion yen (+13.6%), and profit attributable to owners of the Parent: 433.0 billion yen (+16.4%).

- Continued to open quality stores. New stores proved a huge success. UNIQLO's popularity is rising worldwide as customer support for LifeWear grows and local media pick up the brand's activities and achievements.

- We plan to offer a year-end dividend of 260 yen per share. When added to the 240 yen interim dividend, that would generate a scheduled annual dividend of 500 yen for FY2025, an increase of 100 yen compared to the previous year.

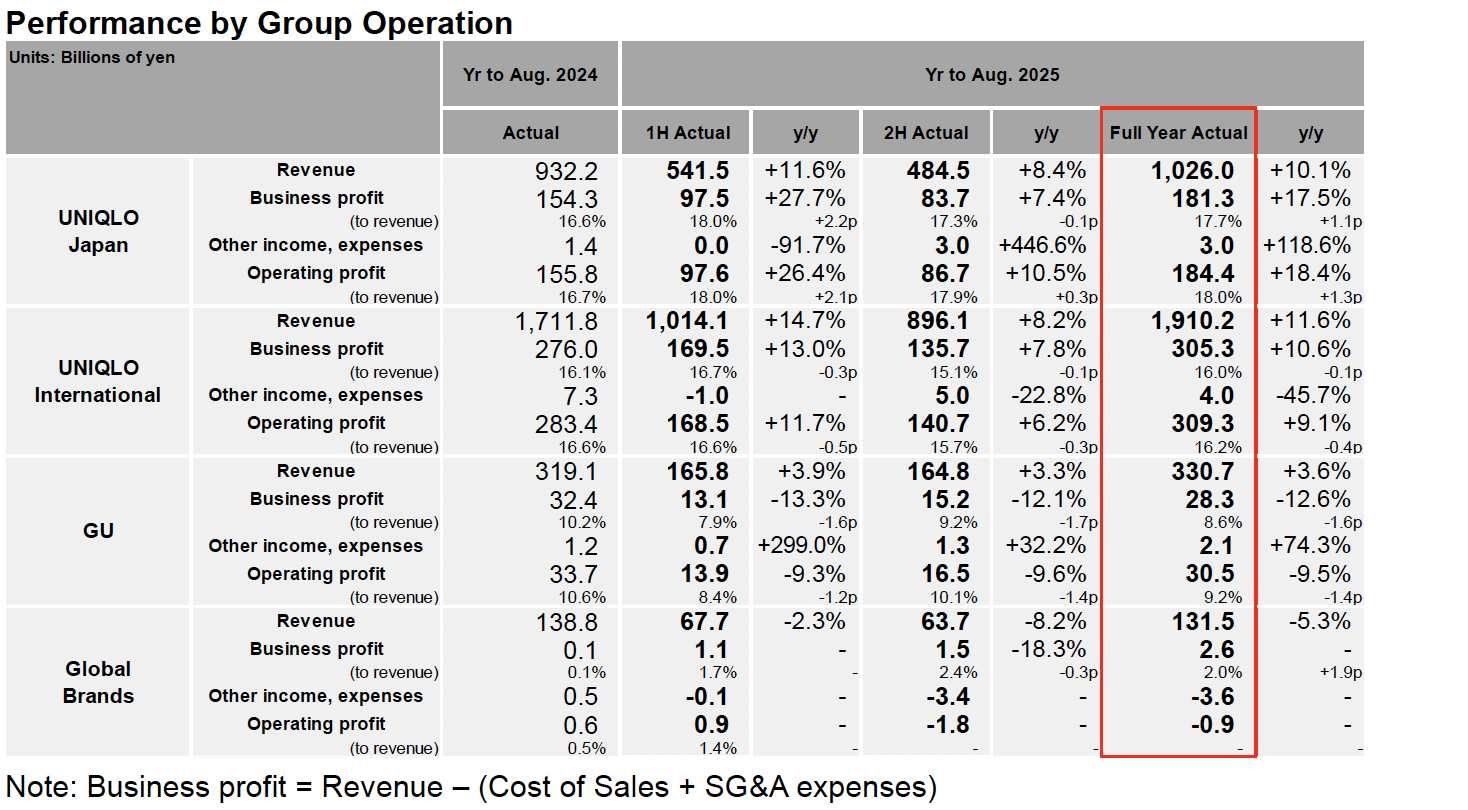

■UNIQLO Japan: Reports large full-year revenue and profit gains. Revenue tops 1 trillion yen

- FY2025 revenue: 1.0260 trillion yen (+10.1%), business profit: 181.3 billion yen (+17.5%).

- FY2025 same-store sales increased 8.1% year on year (1H: +9.8%, 2H: +6.2%) thanks to strong sales throughout the period.

- The full-year gross profit margin came in roughly flat year on year, contracting by just 0.1 point, while the selling, general and administrative expense ratio improved by 1.2 points.

■UNIQLO International: Achieves large full-year rises in revenue and profit and a new record performance

- FY2025 revenue: 1.9102 trillion yen (+11.6%), business profit: 305.3 billion yen (+10.6%).

- Greater China markets reported a decline in revenue and a sharp contraction in profits in FY2025, but sales have slightly increased in August and September.

- UNIQLO South Korea, UNIQLO operations in Southeast Asia, India & Australia, UNIQLO North America, and UNIQLO Europe all reported significant revenue and profit gains thanks to growing customer support for core products, as well as effective marketing and the successful opening of high-quality stores.

■GU: Full-year revenue rises, but profit contracts sharply

- FY2025 revenue: 330.7 billion yen (+3.6%), business profit: 28.3 billion yen (−12.6%).

- Unable to maximize sales due to insufficient creation of hit products that captured mass fashion trends and shortages of strong-selling items.

- The selling, general and administrative expense ratio increased on the back of higher personnel costs associated with wage increases and higher costs associated with the opening of the GU store in the United States. That resulted in a large contraction in full-year profits.

■Global Brands: Full-year revenue declines, but business profit improves

- While Global Brands revenue decreased to 131.5 billion yen (−5.3%) in FY2025, the segment generated a business profit of 2.6 billion yen (compared to a profit of 0.1 billion yen in FY2024) after losses from the Comptoir des Cotonniers operation were halved. The segment reported an operating loss of 0.9 billion yen (compared to a 0.6 billion yen operating profit in FY2024) due to the recording of impairment and other losses of 3.9 billion yen associated with structural reforms at our Comptoir des Cotonniers label.

- Theory reported declines in both revenue and profit. PLST generated significantly higher revenue and profit. While revenue from Comptoir des Cotonniers declined, improvements in both the gross profit margin and the selling, general and administrative expense ratio resulted in a halving of losses under the business loss category.

■FY2026 consolidated estimates: Anticipate another record performance

- FY2026 consolidated revenue: 3.7500 trillion yen (+10.3%), consolidated business profit: 610.0 billion yen (+10.7%), profit attributable to owners of the Parent: 435.0 billion yen (+0.5%).

- We forecast an annual dividend per share in FY2026 of 520 yen, split equally between interim and year-end dividends of 260 yen each. That represents an increase in the full-year dividend of 20 yen per share.

Fiscal 2025 Performance in Focus

■UNIQLO Japan: Reports large full-year revenue and profit gains. Revenue tops 1 trillion yen

UNIQLO Japan reported a considerable increase in revenue and profit in fiscal 2025, which resulted in a record annual performance for the business segment, with revenue topping one trillion yen for the first time. UNIQLO Japan revenue totaled 1.0260 trillion yen (+10.1%) and business profit expanded to 181.3 billion yen (+17.5%). Operating profit increased to 184.4 billion yen (+18.4%) due to a reversal of store-related impairment losses under other income net of costs. Full-year same-store sales (including e-commerce) expanded by 8.1% year on year. Sales remained strong throughout the year, with same-store sales expanding by 9.8% year on year in the first half from 1 September 2024 through 28 February 2025 and 6.2% year on year in the second half from March 1 2025 through August 31 2025. In addition to capturing actual demand by strategically preparing products designed to suit prevailing temperatures and dovetailing those products with marketing launches, we also generated new demand by reflecting on-trend silhouettes and designs in core products such as sweatshirts and jeans. The gross profit margin was largely similar to the previous year, contracting by just 0.1 point year on year. The selling, general and administrative expense ratio improved by 1.2 points as strong sales helped improve the store rent and personnel component ratios.

■UNIQLO International: Achieves large full-year rises in revenue and profit and a new record performance

UNIQLO International reported a record high performance in fiscal 2025 on the back of significant increases in both revenue and profit, with revenue rising to 1.9102 trillion yen (+11.6%) and business profit expanding to 305.3 billion yen (+10.6%).

Breaking down the UNIQLO International performance into individual regions and markets, the Greater China markets reported a decline in revenue and a large contraction in profit in fiscal 2025, with revenue totaling 650.2 billion yen (−4.0%) and business profit totaling 89.9 billion yen (−12.5%). In local currency terms, full-year revenue from the Mainland China market declined by approximately 4% year on year and business profit declined by roughly 10% year on year. On the other hand, business profit increased in the fourth quarter, rising by approximately 11% year on year thanks to improvements in the gross profit margin and the selling, general and administrative expense ratio. The Hong Kong market reported a decline in revenue and a large contraction in profits in fiscal 2025 as a result of product lineup issues and a decline in consumer appetite for apparel. The Taiwan market reported a rise in full-year revenue but a decline in profit. However, profit from that market increased slightly if we exclude the impact of higher royalty expenses. UNIQLO South Korea and UNIQLO operations in Southeast Asia, India & Australia reported significantly higher full-year revenue and profits, with combined revenue from those markets rising to 619.4 billion yen (+14.6%) and business profit totaling 116.9 billion yen (+20.5%). South Korea reported a large increase in both revenue and profit on the back of successful weather-sensitive business development and marketing strategies. Strong sales primarily of core products generated significant increases in both revenue and profit in Southeast Asia, India & Australia. Meanwhile, UNIQLO North America and UNIQLO Europe both achieved significant increases in revenue and profit in fiscal 2025, with revenue in North America totaling 271.1 billion yen (+24.5%) and business profit rising 44.2 billion yen (+35.1%), and revenue in Europe totaling 369.5 billion yen (+33.6%) and business profit expanding to 54.2 billion yen (+23.7%). Newly opened stores in both regions proved once again extremely successful, and a virtuous cycle has started to emerge in both markets in which those successful new stores serve as media beacons that boost brand awareness and consequently e-commerce sales. Revenue and profit from the United States even increased significantly in the fourth quarter, despite the impact of additional tariffs imposed by the U.S. government starting to appear. We managed to absorb the costs incurred as a result of the additional tariffs, and improve the business profit margin by reviewing product prices, reducing discounting, and implementing stronger cost controls.

■GU: Full-year revenue rises, but profit contracts sharply

GU reported an increase in revenue but a large contraction in profits in fiscal 2025, with revenue reaching 330.7 billion yen (+3.6%) and business profit declining to 28.3 billion yen (-12.6%). GU same-store sales came in at the same level as in the previous year. We were unable to maximize sales due to a lack of hit products that captured mass fashion trends and some shortages of strong-selling items. In terms of profits, the selling, general and administrative expense ratio increased, and overall profits declined significantly due to rising personnel costs caused by wage hikes and increased costs pertaining to the opening of the GU store in the United States.

■Global Brands: Full-year revenue declines, but business profit improves

In fiscal 2025, the Global Brands segment reported a decline in revenue but an increase in profit, with revenue falling to 131.5 billion yen (−5.3%) while business profit expanded to 2.6 billion yen (compared to a 0.1 billion yen profit in fiscal 2024). The segment recorded an operating loss of 0.9 billion yen (compared to an operating profit of 0.6 billion yen in fiscal 2024) but that was due to the recording of 3.9 billion yen in impairment losses and other costs associated with the restructuring of Comptoir des Cotonniers operations. The Theory label reported year on year declines in full-year revenue and profits, after sales of core products struggled to gain momentum and Theory sales in the Mainland China market were adversely impacted by declining consumer appetite. The PLST brand generated significant increases in both revenue and profit due to strong sales of wide pants and sheer sweaters. Meanwhile, revenue from the Comptoir des Cotonniers label contracted, but the loss recorded under business loss halved following improvements in both the gross profit margin and selling, general and the administrative expense ratio.

■FY2026 consolidated estimates: Anticipate another record performance

In fiscal 2026, the Fast Retailing Group expects to achieve consolidated revenue of 3.7500 trillion yen (+10.3% year on year), business profit of 610.0 billion yen (+10.7%), profit before income taxes of 660.0 billion (+1.4%), and profit attributable to owners of the Parent of 435.0 billion yen (+0.5%).

In terms of individual business segments, we expect UNIQLO Japan will generate slightly higher revenue and a steady level of business profit in fiscal 2026. While costs are expected to rise due to higher procurements costs associated with a weaker yen, as well as increases in personnel and distribution expenses, we anticipate being able to continue to achieve a business profit margin of 15% or more by creating products that earn customer support, enhancing our marketing, setting appropriate pricing, improving productivity, controlling discounting rates, and pursuing low-cost management. UNIQLO International is forecast to generate large increases in revenue and profit in fiscal 2026. The Greater China markets are expected to report year on year increases in revenue and profit, while UNIQLO operations in South Korea, the Southeast Asia, India & Australia region, North America, and Europe are all expected to generate significantly higher revenue and profit, and our global operations continue to expand. We expect to achieve a business profit margin of approximately 15% in North America by strengthening our branding, revising the prices of some products, improving discounting rates, and cutting costs in order to offset the impact of additional tariffs imposed by the US government. Our GU segment is expected to generate higher revenue and profit in fiscal 2026, while the Global Brands segment is forecast to report higher revenue and a significant increase in profit.

We plan to continue to strengthen the opening of high-quality stores around the world in fiscal 2026. In terms of store numbers, we predict our network will total 3,594 stores at the end of August 2026, comprising 794 UNIQLO Japan stores (including franchise stores), 1,765 UNIQLO International stores, 489 GU stores, and 546 Global Brands stores.

We forecast an annual dividend per share in fiscal 2026 of 520 yen (interim and year-end dividends of 260 yen each). That would represent an increase in the full-year dividend of 20 yen per share compared to the previous year.

Fast Retailing Co., Ltd. discloses business results data and offers a variety of press releases on its IR website https://www.fastretailing.com/eng/ir/.