Last Updated: 2024.01.11

Results Summary for FY2024 1Q (Three Months to November 2023)

FAST RETAILING CO., LTD.![]() (170KB)

(170KB)

to Japanese page

to Chinese page

【Highlights】

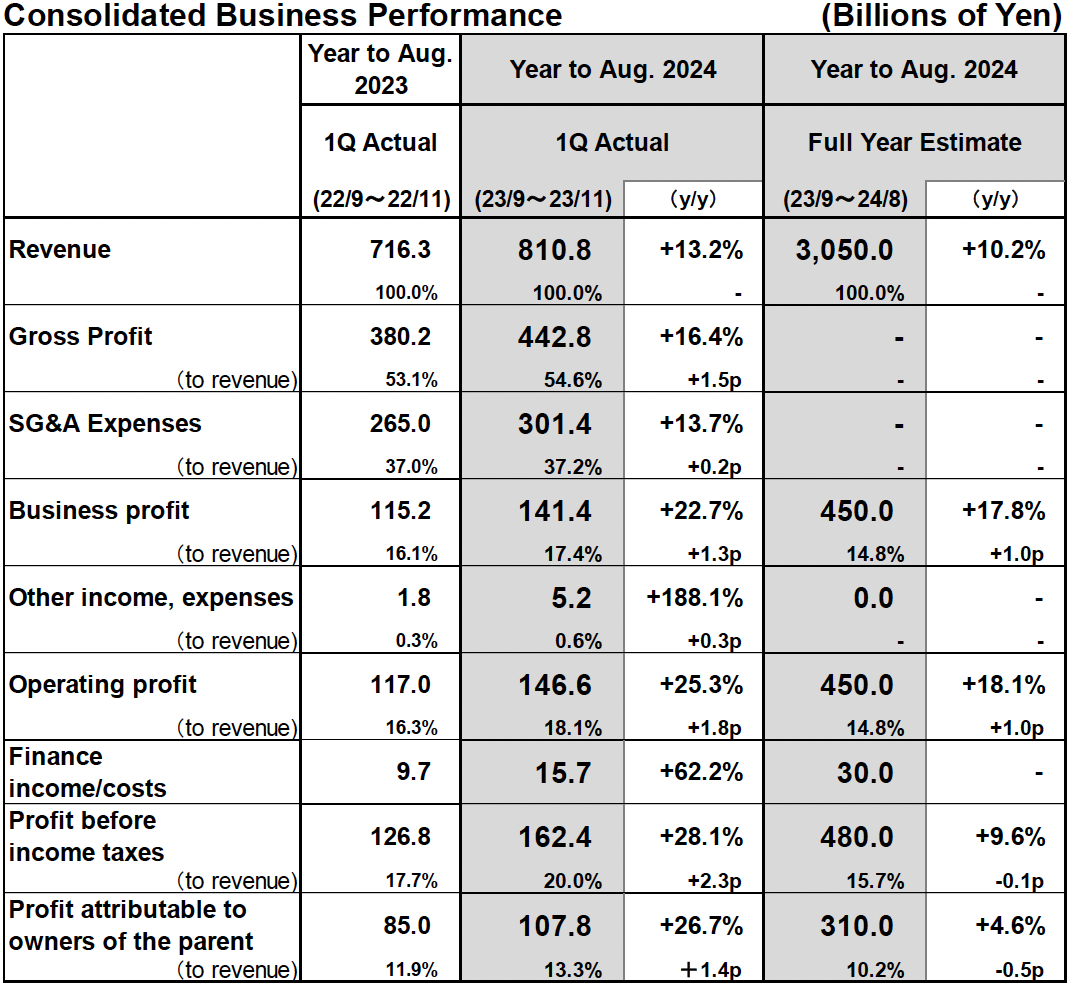

■FY2024 1Q consolidated results: Fast Retailing reports significant revenue and profit gains

- In the first quarter of FY2024, consolidated revenue rose to 810.8 billion yen (+13.2% year-on-year) and operating profit increased to 146.6 billion yen (+25.3%).

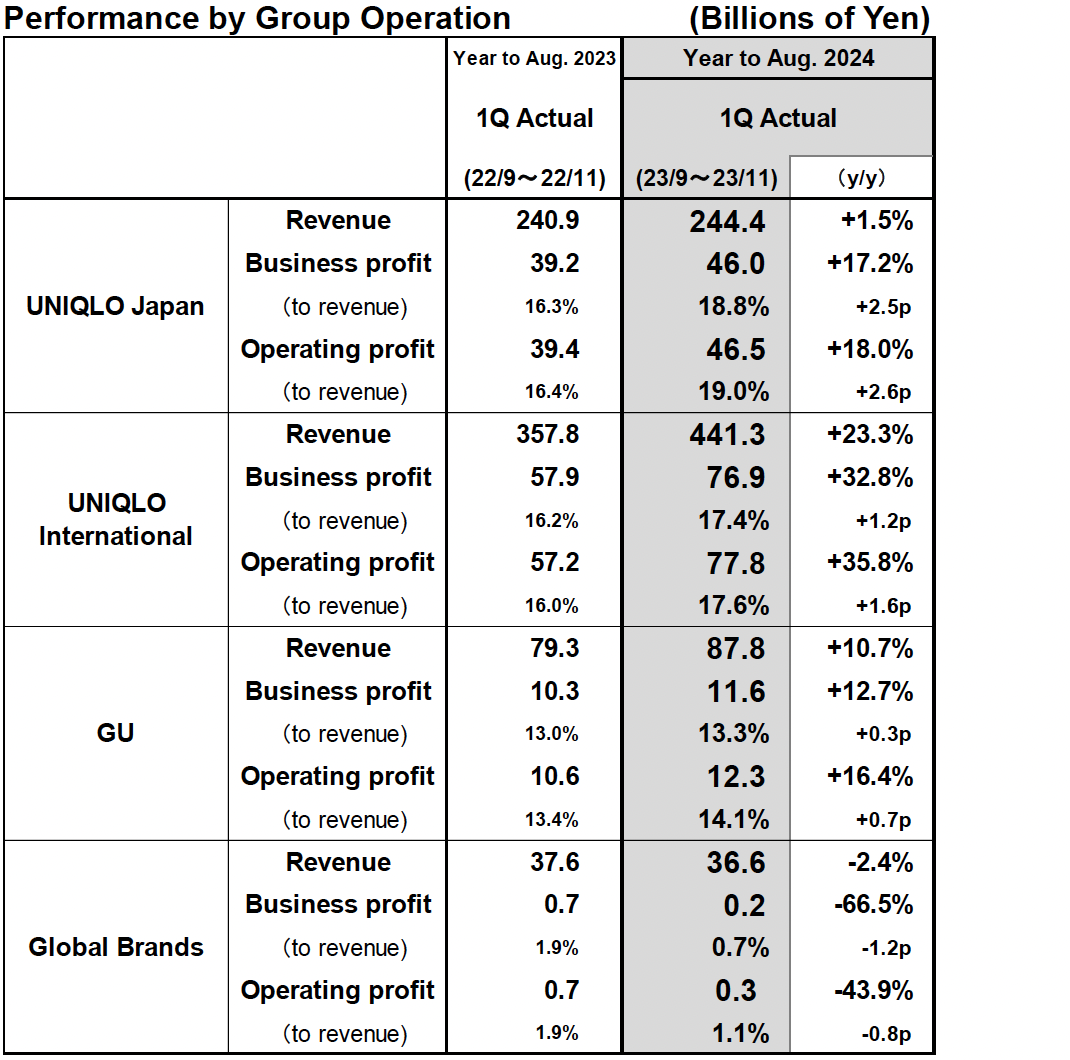

- All UNIQLO International operations generated significant increases in both revenue and profit. UNIQLO Japan reported higher revenue and a considerable rise in profit. GU generated considerably higher revenue and profit.

- First-half performance is performing almost exactly to plan, so we expect to be able to achieve our business estimates.

■UNIQLO Japan: Large expansion in profits on higher revenue and improved gross profit margin

- Revenue: 244.4 billion yen (+1.5%), operating profit: 46.5 billion yen (+18.0%).

- Sales struggled during unusually warm September and October weather. Achieved large revenue gain in November on strong sales of thermal winter clothing and a buoyant UNIQLO anniversary sale.

- Gross profit margin improved 2.7 points. Impact of yen spot rates used for additional production orders eased and cost of sales improved following stricter control of orders.

■UNIQLO International: Large revenue and profit gains. North America, Europe especially strong

- Revenue: 441.3 billion yen (+23.3%), operating profit: 77.8 billion yen (+35.8%).

- Greater China, North America and Europe regions all reported significant increases in revenue and profit.

- Southeast Asia, India & Australia fell slightly short of our business estimates despite generating significant revenue and profit gains. Going forward, we plan to further strengthen our business platforms by learning how to compile better product mixes that match eternal summer climates and clarifying local human resource training issues.

■GU: Large revenue and profit gains.

- Revenue: 87.8 billion yen (+10.7%), operating profit: 12.3 billion yen (+16.4%).

- Sales struggled in September and October but picked up strongly in November as we ensured ample stock of strong-selling Winter items.

■Global Brands: Revenue and profit decline

- Revenue: 36.6 billion yen (−2.4%), operating profit: 0.3 billion yen (−43.9%).

- Revenue from the Theory operation held steady year on year and operating profit declined. PLST reported lower revenue and a slight operating loss. Comptoir des Cotonniers reported a decline in revenue but a contraction in operating losses.

■FY2024 consolidated business forecasts: Unchanged from initial estimates

- We have maintained our initial estimates for FY2024 consolidated revenue of 3.0500 trillion yen (+10.2%), consolidated operating profit of 450.0 billion yen (+18.1%), and profit attributable to owners of the Parent of 310.0 billion yen (+4.6%).

- We forecast an annual dividend per share in FY2024 of 330 yen, split equally between interim and year-end dividends of 165 yen each.

FY2024 1Q Performance in Focus

■UNIQLO Japan:Higher revenue and a significant increase in profit

UNIQLO Japan reported higher revenue and a significant increase in profit in the first quarter of fiscal 2024, with revenue totaling 244.4 billion yen (+1.5% year-on-year) and operating profit totaling 46.5 billion yen (+18.0% year-on-year). First-quarter same-store sales increased by 0.2% year-on-year. Warmer-than-usual temperatures in September and October stifled demand for Fall Winter ranges, resulting in a decline in revenue for those two months. However, sales picked up considerably in November thanks to strong sales of HEATTECH innerwear, fleece and other thermal winter clothing once the temperature dropped, strong sales of collaboration products and a buoyant UNIQLO anniversary sale. The gross profit margin improved by 2.7 points year-on-year thanks to an improvement in cost of sales. In the first quarter of fiscal 2023, cost of sales deteriorated considerably following the sharp weakening in yen spot rates used for additional production orders. However, greater control over orders reduced the amount of additional production in the first quarter of fiscal 2024, lessening the impact of spot exchange rates and greatly improving first-quarter cost of sales. The selling, general and administrative expense ratio increased by 0.2 point year-on-year due to higher depreciation and amortization and personnel cost ratios. The personnel cost ratio increased as a result of the change in the practice of recording year-end bonuses. However, this factor is excluded, the personnel cost ratio improved slightly by 0.1 point year-on-year in the first quarter of fiscal 2024.

■UNIQLO International: Large revenue and profit gains. North America, Europe especially strong

UNIQLO International reported significant increases in revenue and profit in the first quarter of fiscal 2024, with revenue rising to 441.3 billion yen (+23.3% year-on-year) and operating profit expanding to 77.8 billion yen (+35.8% year-on-year). All markets reported significantly higher revenue and profit in the first quarter, with North America and Europe achieving particularly strong results as those regions further expanded their customer bases by developing products that reflected global customer needs. While demand for Winter products was stifled by the warm winter weather, the gross profit margin and the selling, general and administrative expense ratio both improved on the back of flexible ordering and firm cost controls.

Breaking down the UNIQLO International performance into individual regions and markets, the Mainland China market reported significantly higher revenue and profit in the first quarter. While the launch of Fall Winter ranges was somewhat impacted by the warm weather, the weather did turn colder in November and, in the end, sales proved extremely buoyant thanks to stronger marketing of core Winter items. Revenue and profits also rose strongly in the Hong Kong market and the Taiwan market. UNIQLO South Korea reported higher revenue and profit in the first quarter thanks to particularly strong sales in the month of November. Revenue and profit rose considerably in the Southeast Asia, India & Australia region. In addition to strong sales of core Winter products and collaboration ranges such as KAWS, the expansion of the region's network by 45 stores year-on-year also contributed to the significantly higher revenue figures. However, those results fell slightly short of our business estimates. Going forward, we intend to strengthen business management platforms now that we have clarified some particular issues facing our business in the region, such as how to best compile product mixes for a perpetual summer climate and how to enhance human resources. Meanwhile, UNIQLO North America and UNIQLO Europe both reported significant increases in first-quarter revenue and profit thanks to an expanding new customer base and strong sales of cashmere sweaters, HEATTECH innerwear and other core Winter items.

■GU:Large revenue and profit gains

The GU business segment reported large increases in both revenue and profit in the first quarter of fiscal 2024, with revenue rising to 87.8 billion yen (+10.7% year-on-year) and operating profit totaling 12.3 billion yen (+16.4% year-on-year). Warm weather in September and October resulted in sluggish sales of Fall and Winter products, but sales proved strong in November once the weather turned colder and thanks to our efforts to successfully prepare sufficient stock of top-selling Winter items. Sales of Heavy Weight Sweat items, Heat Padded outerwear, Parachute Cargo Pants and other products that captured mass fashion trends proved especially strong. Furthermore, GU's operating profit margin also improved by 0.7point year-on-year as improvements in production efficiency also helped improve cost of sales and the gross profit margin.

■Global Brands:Revenue and profit decline

The Global Brands segment reported a decline in revenue and profit in the first quarter of fiscal 2024, with revenue contracting to 36.6 billion (−2.4% year-on-year) and operating profit contracting to 0.3 billion yen (−43.9% year-on-year). While our Theory brand generated a similar level of revenue to the previous year, it also reported a decline in profits. Theory profits declined after warm winter weather stifled sales, and higher personnel costs primarily at Theory USA led to a deterioration in the selling, general and administrative expense ratio. Meanwhile, our PLST brand reported a decline in revenue due to a reduction in the network of 35 stores compared to the previous year, and a slight operating loss. Finally, our France-based Comptoir des Cotonniers brand reported a decline in revenue on the back of sluggish consumer sentiment in the European market and warmer winter weather, but losses narrowed thanks to improvements in the gross profit margin and selling, general and administrative expense ratio.

■FY2024 consolidated business forecasts: Unchanged from initial estimates

We have made no change to the initial forecasts for fiscal 2024 consolidated performance announced in October 2023. We still expect to achieve consolidated revenue of 3.0500 trillion yen (+10.2% year-on-year), operating profit of 450.0 billion yen (+18.1% year-on-year), and profit attributable to owners of the Parent of 310.0 billion yen (+4.6% year-on-year). While first-quarter performance exceeded expectations, but sales slowed in December due to the warm winter weather. However, we expect to be able to achieve our business estimates for the first half of FY2024 overall.

We predict UNIQLO International will achieve significantly higher revenue and profit in the first half of fiscal 2024. Breaking those forecasts down by geographical location, we predict North America and Europe will generate higher-than-expected significant increases in first-half revenue and profit. The Greater China region and South Korea are expected to perform as planned by generating higher revenue and profit. UNIQLO Southeast Asia, India & Australia is expected to report significantly higher revenue and profit. However, first-half performance is predicted to come in below plan following the lower-than-planned performance in the first quarter. UNIQLO Japan is expected to fall slightly short of plan on the revenue front by reporting a slight decline in first-half revenue after warm winter weather in December dampened sales of Winter products. However, first-half operating profit from UNIQLO Japan will likely come in roughly on plan as more accurate ordering improves cost of sales and greatly improves the gross profit margin, and we increase our efforts to cut costs. The GU segment will meet expectations by reporting higher first-half revenue and a considerable increase in first-half profit, while our Global Brands segment will likely fall short of expectations by reporting an increase in first-half revenue but a similar marginal operating profit as in the previous year.

Our dividend forecasts remain unchanged from our initial estimate. We forecast an annual dividend per share in FY2024 of 330 yen, split equally between interim and year-end dividends of 165 yen each.

Fast Retailing Co., Ltd. discloses business results data and offers a variety of press releases on its IR website https://www.fastretailing.com/eng/ir/.