Last Updated: 2023.07.13

Results Summary for FY2023 Third Quarter (Nine Months to May 2023)

FAST RETAILING CO., LTD.![]() (172KB)

(172KB)

to Japanese page

to Chinese page

FY2023 3Q Highlights

■Fast Retailing's significant increases in revenue and profit exceed plan to generate a record high performance

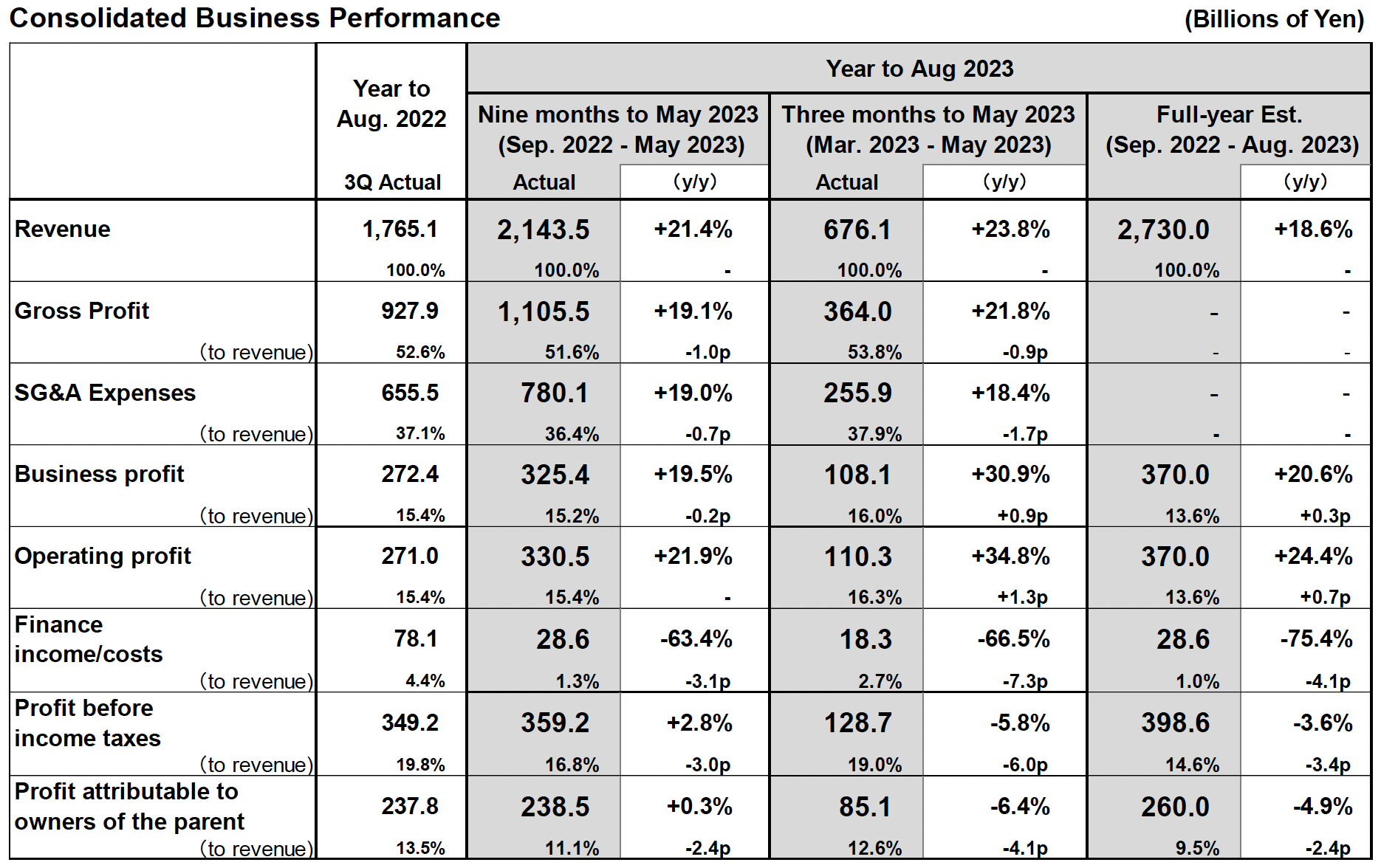

- In the nine months to 31 May 2023, consolidated revenue totaled 2.1435 trillion yen (+21.4% year-on-year) and operating profit rose to 330.5 billion yen (+21.9%). Profit attributable to owners of the parent increased to 238.5 billion yen (+0.3%) on the recording of 28.6 billion yen under finance income net of costs due primarily to higher interest income.

- Fast Retailing reported large revenue and profit increases in the third quarter from March to May 2023. UNIQLO operations in the Southeast Asia, North America, and Europe regions, along with the GU operation, continued to report strong results and UNIQLO performance in the Greater China region also recovered to generate large increases in both revenue and profit, resulting in a further diversification of our global earnings pillars.

■UNIQLO Japan:Higher revenue but lower profit in the March-May quarter (3Q)

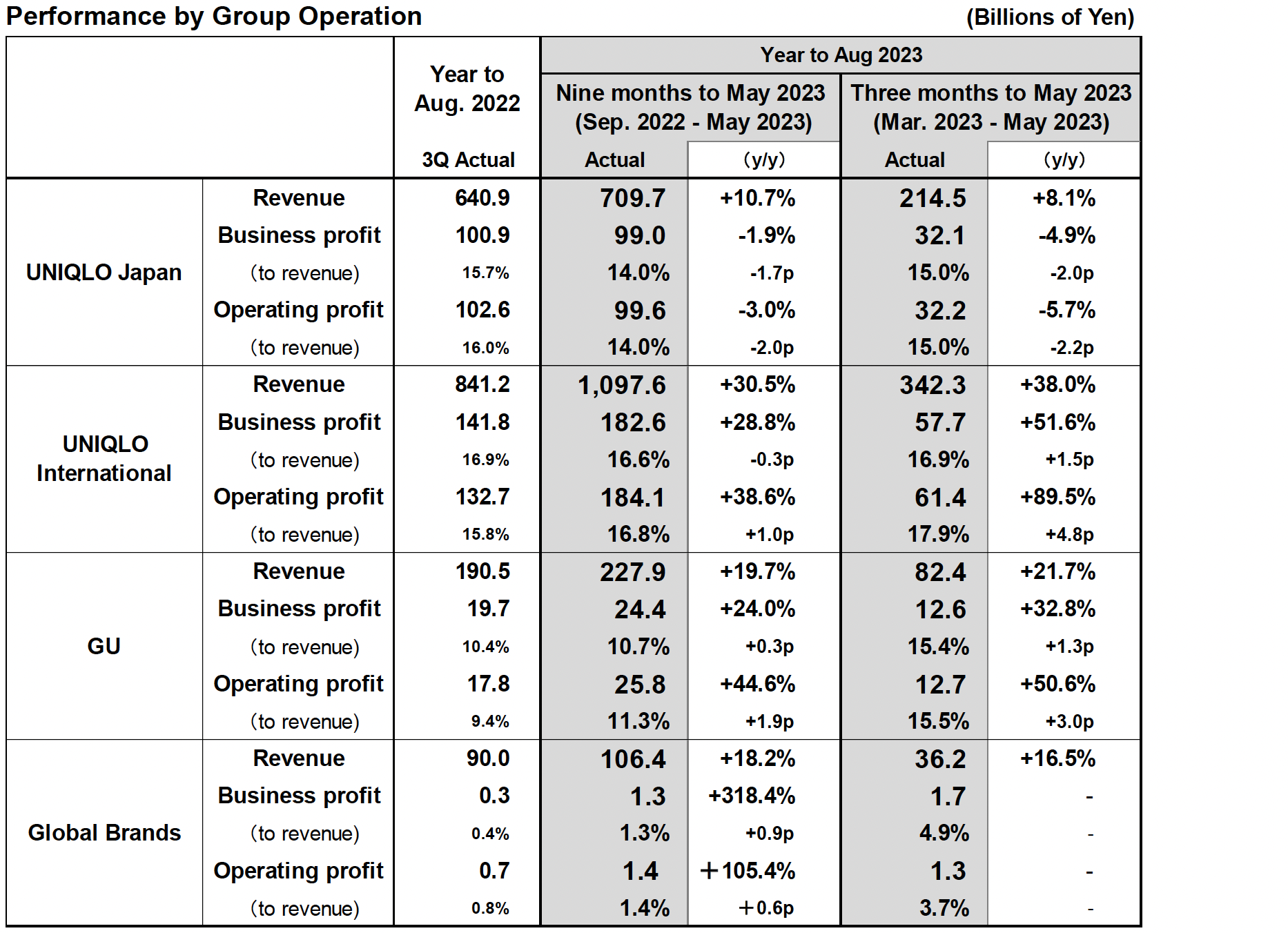

- Three months through May 2023: Revenue rose to 214.5 billion yen (+8.1%) but operating profit contracted to 32.2 billion yen (−5.7%).

- Gross profit margin declined by 1.7 points after yen weakness inflated the cost of sales, and we sought to normalize inventory left over from the previous business year.

- The selling, general and administrative expense ratio increased 0.3 point primarily on our decision to raise wages. However, sales per employee improved favorably.

- Nine months through May 2023: Revenue rose 10.7% to 709.7 billion yen, while operating profit contracted by 3.0% to 99.6 billion yen.

■UNIQLO International:Reports large 3Q revenue and profit gains as earnings pillars continue to diversify

- Three months through May 2023: Revenue rose to 342.3 billion yen (+38.0%), operating profit increased to 61.4 billion yen (+89.5%).

- Greater China region reported considerable increases in revenue and profit. Performance from the Mainland China market in particular exceeded expectations after generating a year-on-year rise in same-store sales of over 40%.

- The Southeast Asia, India & Australia region reported a significant rise in revenue and an increase in profits, while both North America and Europe continued their strong performances by reporting considerably higher revenue and profit levels.

- Nine months through May 2023: Revenue totaled 1.0976 trillion yen (+30.5%) and operating profit totaled 184.1 billion yen (+38.6%).

■GU:Large 3Q revenue and profits gains as GU starts to fuel a sustainable expansion

- Three months through May 2023: Revenue rose to 82.4 billion yen (+21.7%), operating profit increased to 12.7 billion yen (+50.6%).

- Strong sales buoyed by the emergence of new hit products. With organizational reforms on product development systems and other areas progressing, the GU operation is starting to get a feel for how to steer a sustainable expansion in performance.

- Nine months through May 2023: Revenue totaled 227.9 billion yen (+19.7%) and operating profit totaled 25.8 billion yen (+44.6%).

■Global Brands:3Q revenue rises sharply and operating profit moves into the black

- Three months through May 2023: Revenue rose to 36.2 billion yen (+16.5%) and the operation moved back into the black with the recording of an operating profit of 1.3 billion yen for the quarter.

- The Theory operation reported significant increases in revenue and profit driven primarily by strong sales from Theory Asia.

- Nine months through May 2023: Revenue totaled 106.4 billion yen (+18.2%) and operating profit totaled 1.4 billion yen (+105.4%).

■FY2023 consolidated estimates:Revised upwards. Expect to increase FY2023 dividend by 73.3 yen

- We have revised up our latest estimates for FY2023 consolidated performance and now expect full-year consolidated revenue to total 2.7300 trillion yen (+18.6%), operating profit to rise to 370.0 billion yen (+24.4%), and profit attributable to owners of the parent to total 260.0 billion yen (−4.9%).

- We forecast an annual dividend per share in FY2023 of 280 yen, split into an interim dividend of 125 yen and a year-end dividend of 155 yen. This represents an increase of 73.3 yen in the annual dividend for FY2023 compared to FY2022.

Fiscal 2023 3Q Performance in Focus

■UNIQLO Japan:Higher revenue but lower profit in March-May quarter (3Q)

UNIQLO Japan reported a considerable increase in revenue in the first nine months of fiscal 2023. However, profits declined as the depreciation in the Japanese yen resulted in higher cost of sales. As a result, revenue totaled 709.7 billion yen (+10.7% year-on-year) and operating profit totaled 99.6 billion yen (−3.0% year-on-year).

The same performance pattern was recorded for the third quarter from March to May 2023, with revenue increasing and operating profit declining. While third quarter same-store sales increased by 5.5% year-on-year thanks to strong sales of Summer items, haori-style jackets, and bottoms that captured the latest trends, operating profit declined on the back of a 1.7 point decline in the gross profit margin and a 0.3 point rise in the selling, general and administrative expense ratio. The gross profit margin declined as the cost of sales on additional product orders rose after the yen spot exchange rates used for those orders weakened more than we had expected over the period. We also pressed ahead with efforts to normalize inventory by more vigorously offloading excess Spring inventory left over from that past financial year. The increase in the selling, general and administrative expense ratio was caused primarily by a rise in personnel costs following our decision to increase in wages from March. However, we also observed a rise in productivity in the third quarter, and an increase in sales per employee. We plan to swiftly improve the personnel cost ratio by encouraging further efficiencies in inventory management and store operations.

■UNIQLO International:Reports large 3Q revenue and profit gains as earnings pillars continue to diversify

UNIQLO International reported a significant increase in both revenue and profit in the first nine months of fiscal 2023, with revenue rising to 1.0976 trillion yen (+30.5% year-on-year) and operating profit expanding to 184.1 billion yen (+38.6% year-on-year). All markets within the segment generated large increases in both revenue and profit, generating yet another advance in the drive to diversify our earnings pillars.

Breaking down the third quarter performance from March to May 2023 by geographical region and in local currency terms, the Greater China region achieved considerable rises in revenue and profit. Performance recovered across the board, with the Mainland China market, the Hong Kong market, and the Taiwan market all reporting large revenue and profit increases. The Mainland China market, in particular, generated higher-than-expected sales, with same-store sales rising over 40% year on year. In the Southeast Asia, India & Australia region, revenue increase significantly and operating profit also expanded. Within those regions, UNIQLO operations in Singapore, Thailand, India, and Australia all performed strongly. UNIQLO North America reported significant increases in revenue and profit, with sales of core products proving strong and sales of products developed specifically to meet the needs of US consumers also contributing greatly to the higher revenue figure. UNIQLO Europe generated large rises in revenue and profit on the back of strong sales of core products, such as bottoms and linen shirts. Furthermore, efforts to convey more determined news about our Round Mini Shoulder Bag and BRATOP products sparked considerable interest on social media and helped expand our customer base among women and younger consumers.

■GU:Large 3Q revenue and profits gains as GU starts to fuel a sustainable expansion

The GU business segment reported large increases in both revenue and profit in the first nine months of fiscal 2023, with revenue rising to 227.9 billion yen (+19.7% year-on-year) and operating profit totaling 25.8 billion yen (+44.6% year-on-year). GU was able to generate a strong performance and create multiple hit products by successfully narrowing down the number of product items on offer, ensuring a sufficient supply of mass-trend products, and strengthening the marketing of those products. The segment also made progress on building a strong business platform for creating highly finished, on-trend products by pressing ahead with organizational reforms and strengthening product development frameworks.

In the third quarter from March to May 2023, GU generated large increases in revenue and profit. Sales of super wide cargo pants, pull-on pants, and sweatshirt-style T-shirts proved especially strong. The operating profit margin improved by 3.0 points year-on-year thanks to the large increase in sales, stricter cost controls, and an improvement in the selling, general and administrative expense ratio generated primarily by lower store rent and distribution ratios.

■Global Brands:3Q revenue rises sharply and operating profit moves into the black

The Global Brands segment reported a large rise in revenue and profit in the first nine months of fiscal 2023, with revenue rising to 106.4 billion yen (+18.2% year-on-year) and an operating profit rising to 1.4 billion yen (+105.4% year-on-year).

In the third quarter from March to May 2023, the Theory brand reported considerable increases in revenue and profit. The Theory label generated a particularly good performance, and significantly higher revenue and profit in the Asian region as restrictions eased once COVID-19 was brought under control and the operation strengthened the release of core products. The PLST operation reported higher revenue in the third quarter. However, operating profit declined slightly following the recording of an impairment loss as the label presses ahead with the closure of loss-making stores and other operational reforms. Finally, revenue from Comptoir de Cotonniers declined and the label's operating loss expanded slightly.

■FY2023 consolidated estimates:Revised upwards. Expect to increase FY2023 dividend by 73.3 yen

We decided to revise up our consolidated forecasts for the year ending 31 August 2023 to reflect the higher-than-expected performance in the three months from March to May 2023, particularly from the UNIQLO operation in the Mainland China market. We decided on an upward revision of 50.0 billion yen for revenue and 10.0 billion yen for operating profit compared to the business estimates announced in April. We now expect consolidated revenue of 2.7300 trillion yen (+18.6% year-on-year) and operating profit of 370.0 billion yen (+24.4% year-on-year) in fiscal 2023. In addition, we expect profit attributable to owners of the parent to reach 260.0 billion yen (−4.9% year-on-year) after incorporating the 28.6 billion yen in finance income net of costs resulting primarily from foreign exchange gains and interest income. If we strip out the boost to corporate performance resulting from the depreciation in the Japanese yen, full-year revenue is expected to increase by approximately 14% year-on-year, operating profit by approximately 20% year-on-year, and profit attributable to owners of the parent by approximately 22% year-on-year.

Looking at each business segment in turn, we predict UNIQLO International will achieve significantly higher revenue and profit in the second half of fiscal 2023 and the full business year. In view of the ongoing favorable recovery in performance in the Mainland China market, we expect the Greater China region to generate considerable increases revenue and profit in the second half and a rise in revenue and a sharp increase in profits for the full business year. UNIQLO South Korea is predicted to report higher revenue and profit in the second half and full fiscal year. The Southeast Asia, India & Australia region, along with the North America and Europe regions, are expected to generate considerable increases in full-year revenue and profit and to continue to expand operations. While UNIQLO Japan reported a contraction in profit in the nine months to 31 May 2023, that segment is expected to report higher revenue and a steady business profit in the second half and for the full fiscal year by spurring a more vigorous recovery in the fourth quarter from June through August 2023. UNIQLO Japan recorded an impairment loss on stores in the fourth quarter of fiscal 2022, but no impairment losses are set to be recorded in the fourth quarter of fiscal 2023, so the operation should be able to achieve a modest year-on-year expansion in operating profit. Our GU business segment is expected to generate significant increases in second-half and full-year revenue and profit on the back of continued strong sales. Meanwhile, the Global Brands segment is predicted to achieve a rise in revenue in the second half and full fiscal year and to see business profit move back into the black. However, operating losses are expected to expand in view of the expected recording of impairment and store losses associated with store closures at the Comptoir des Cotonniers label.

In terms of store numbers, we predict our store network will total 3,594 stores by the end of August 2023, comprising 802 UNIQLO Japan stores (including franchise stores), 1,642 UNIQLO International stores, 467 GU stores, and 683 Global Brands stores.

Finally, we are now predicting an annual dividend of 280 yen, split into an interim dividend of 125 yen and a year-end dividend of 155 yen. This represents an increase of 73.3 yen in the annual dividend for fiscal 2023 compared to fiscal 2022.

Fast Retailing Co., Ltd. discloses business results data and offers a variety of press releases on its IR website https://www.fastretailing.com/eng/ir/.