Last Updated: 2022.10.13

Results Summary for Fiscal 2022 (Year to August 31, 2022)

FAST RETAILING CO., LTD.![]() (208KB)

(208KB)

to Japanese page

to Chinese page

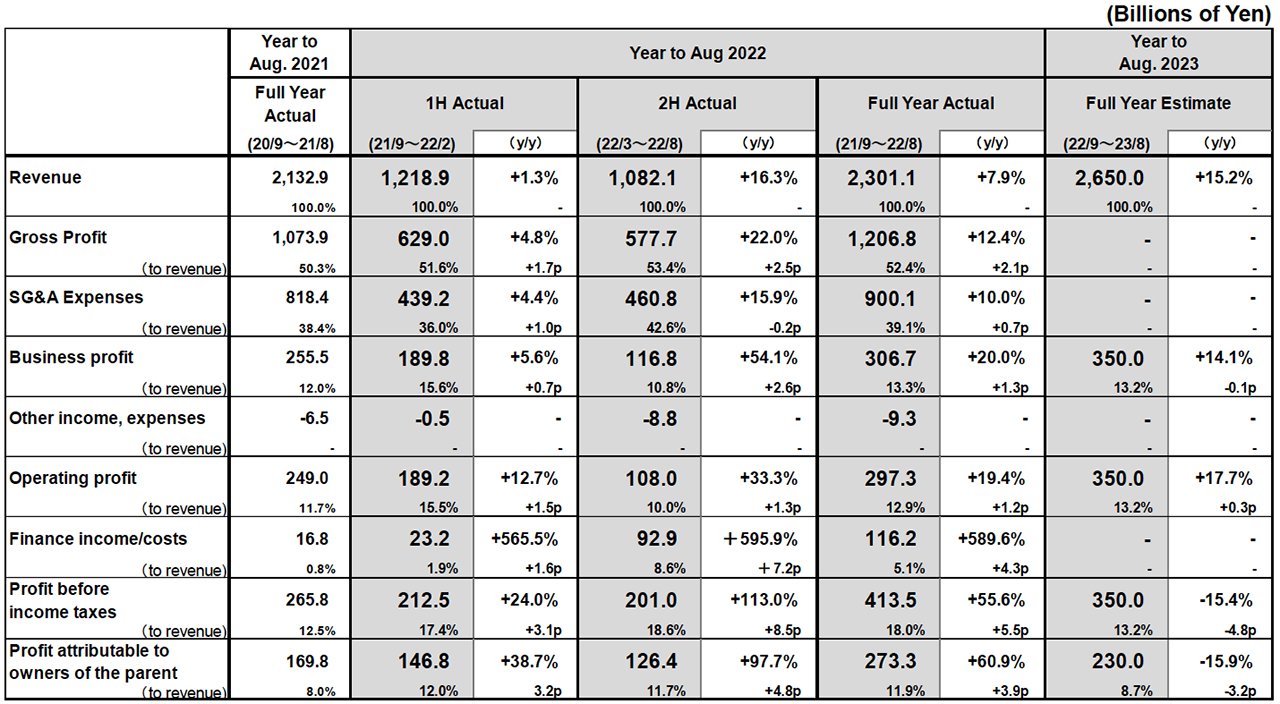

Consolidated Business Performance

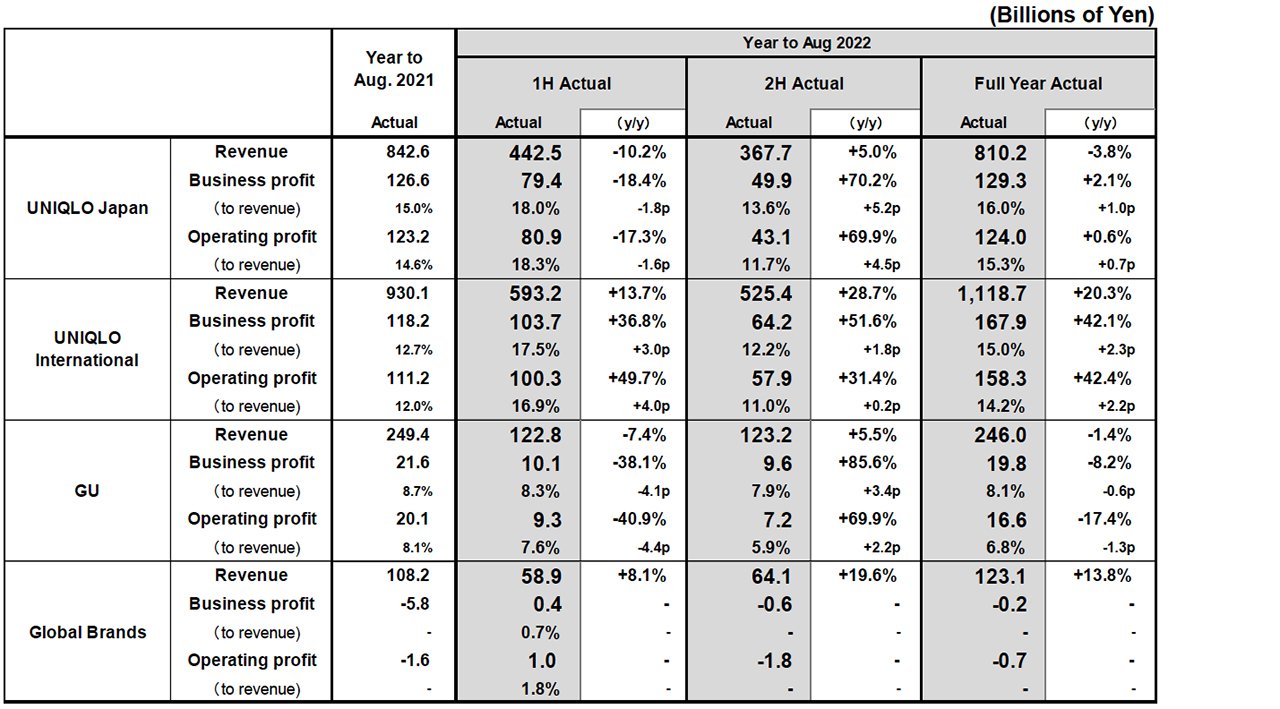

Performance by Group Operation

【FY2022 Highlights】

■FY2022 consolidated results: Fast Retailing achieves another record performance on higher revenue and a sharp increase in profit

- Achieved a record result. Full-year consolidated revenue: 2.3011 trillion yen (+7.9% year-on-year), operating profit: 297.3 billion yen (+19.4%), and profit attributable to owners of the parent: 273.3 billion yen (+60.9%). If we strip out the impact of the weaker yen, which inflated performance, operating profit increased by approximately 14% and profit attributable to owners of the parent increased by approximately 16% year-on-year.

- Sales recovered steadily in all markets as demand for clothing picked up globally, and we consistently strengthened the branding of our LifeWear (ultimate everyday clothing) and responded flexibly to changes in production and distribution environments.

- Scheduled to offer a year-end dividend of 340 yen per share. When added to the 280 yen interim dividend, that would generate a scheduled annual dividend of 620 yen for FY2022, an increase of 140 yen compared to the previous year.

■UNIQLO Japan: FY2022 revenue down, profit up. Performance recovers in 2H with revenue rise and sharp profit gain

- FY2022 same-store sales declined 3.3%. First-half same-stores sales declined 9.0%, but second-half same-store sales rose 4.7% on strong sales of Kando jackets and pants, shirts and other products that satisfied renewed going-out needs as well as strong sales of Summer ranges.

- The gross profit margin improved 2.5 points on controlled discount sales. The selling, general and administrative expense ratio increased by 1.5 points.

■UNIQLO International: Large full-year revenue and profit gains. Large profit improvement in Europe and the United States

- Large rises in FY2022 revenue and profit. Revenue: 1.1187 trillion yen (+20.3%), operating profit: 158.3 billion yen (+42.4%). Revenue increased and profits rose sharply even in local currency terms.

- Greater China region reported a significant contraction in profit due to COVID-related restrictions on movement. However, sales recovered and resulted in higher revenue and a large increase in profit in the fourth quarter from June to August 2022.

- South Asia, Southeast Asia & Oceania region reported an impressive increase in revenue of approximately 60% year-on-year and a large increase in profit with operating profit more than tripling.

- The North America and Europe regions achieved a large increase in revenue, a move into the black, and an operating profit margin of approximately 10%. UNIQLO is gradually establishing a firm presence for itself in those regions, resulting in increased new customer visits.

■GU: Full-year revenue declines, profit dips sharply

- FY2022 revenue: 246.0 billion yen (−1.4%), operating profit: 16.6 billion yen (−17.4%).

- First half: Revenue declined and profits fell sharply as the label's inability to introduce strong-selling items in a timely manner due to production and distribution delays resulted in product shortages.

- Second half: Revenue rose and profit increased considerably on improved product lineups and stronger marketing, which resulted in higher sales of items that successfully captured mass fashion trends.

■Global Brands:Full-year revenue rises sharply and operating loss shrinks

- FY2022 revenue: 123.1 billion yen (+13.8%), operating loss: 0.7 billion yen.

- Theory: Large increases in revenue and profit thanks to a recovery in performance primarily in the United States and Japan.

- Comptoir des Cotonniers: Revenue increased year-on-year. Operating loss shrank considerably as we closed unprofitable stores and proceeded with structural reforms.

■FY2023 consolidated estimates: Expect significant rises in revenue and operating profit

- FY2023 consolidated revenue:2.6500 trillion yen (+15.2%), consolidated operating profit: 350.0 billion yen (+17.7%)

- We estimate FY2023 profit attributable to owners of the parent of 230.0 billion yen, down 15.9% compared to FY2022 when we recorded a 114.3 billion yen foreign exchange gain on foreign-currency denominated assets. Expected to increase year-on-year excluding foreign exchange impact.

- We forecast an annual dividend per share in FY2023 of 680 yen, split equally between interim and year-end dividends of 340 yen each.

- We plan to open 310 stores across the Group in FY2023, accelerating new store openings primarily at UNIQLO International.

FY2022 Performance in Focus

■UNIQLO Japan: FY2022 revenue down, profit up. Performance recovers in 2H with revenue rise and sharp profit gain

UNIQLO Japan reported a decline in revenue but an increase in profit in fiscal 2022, with revenue totaling 810.2 billion yen (−3.8% year-on-year) and operating profit totaling 124.0 billion yen (+0.6% year-on-year). Full-year same-store sales (including e-commerce) contracted by 3.3% year-on-year. In the first half from 1 September 2021 through 28 February 2022, same-store sales declined by 9.0% year-on-year because we were unable to fully satisfy customer demand due to shortages in some strong-selling Winter items. However, same-store sales increased by 4.7% year-on-year in the second half from 1 March through 31 August 2022 on strong sales of Kando Jackets and Kando Pants as well as regular shirts that met customers' renewed going-out needs and strong sales of Summer ranges once the temperature rose from July onwards. Meanwhile, full-year e-commerce sales expanded by 3.1% year-on-year in fiscal 2022 to 130.9 billion yen, constituting 16.2% of total revenue. The UNIQLO Japan gross profit margin improved 2.5 points year-on-year in fiscal 2022. While the cost of sales worsened in the wake of sharp rises in raw materials and transportation costs, the discounting rate improved markedly thanks to our fundamental drive to control retail prices. The selling, general and administrative expense ratio increased by 1.5 points year-on-year because we have been increasing advertising spend to strengthen branding from a medium- to long-term perspective, and pursuing strategic investments in automated warehousing.

■UNIQLO International: Large full-year revenue and profit gains. Large profit improvement in Europe and the United States

UNIQLO International recorded significant increases in both revenue and profit in fiscal 2022, with revenue rising to 1.1187 trillion yen (+20.3% year-on-year) and operating profit expanding to 158.3 billion yen (+42.4% year-on-year). Those revenue and profit figures were boosted by the progressive weakening of the yen over the year, but the segment also managed to generate stronger revenue and significantly higher profits in local currency terms.

Breaking down the UNIQLO International performance into individual regions and markets, with the exception of the Greater China region, which was heavily impacted by COVID-19 restrictions on movement, all operations achieved significant increases in both revenue and profit for the year. The Greater China region reported revenue of 538.5 billion yen (+1.2% year-on-year) and operating profit of 83.4 billion yen (−16.8% year-on-year). However, sales recovered once the restrictions on movement were eased, resulting in higher revenue and a large increase in profit in the fourth quarter from June to August 2022. UNIQLO South Korea reported increases in full-year revenue and profit. UNIQLO S/SE Asia & Oceania reported large increases in both revenue and profit, with revenue rising by approximately 60% year-on-year to approximately 240.0 billion yen, the operating profit margin improving sharply to approximately 19%, and operating income more than tripling. A recovery in customers' going-out needs plus some proactive marketing on our part helped further boost support among for the UNIQLO brand among local customers and increase the number of new customers. UNIQLO North America achieved a large increase in revenue, a move into the black, and an operating profit margin just below 10% for fiscal 2022. We were able to gradually establish a firmer UNIQLO presence and greatly extend sales thanks to better conveyance of information about core products and stronger branding. UNIQLO Europe (excluding Russia) achieved a large increase in revenue, a move into the black, and an operating profit margin of approximately 12% in fiscal 2022. The region is enjoying greater support for UNIQLO's LifeWear concept and a rise in the number of new customers, and sales are proving strong especially in the regional flagship stores that we are opening in major European cities. Our operation in Russia remains closed, resulting in a large decline in revenue and an operating loss for the year following the recording of impairment losses. However, the impact of this operation on consolidated results is limited.

■GU: Full-year revenue declines, profit dips sharply

Our GU segment reported a decline in revenue and a sharp dip in profits in fiscal 2022, with revenue totaling 246.0 billion yen (−1.4% year-on-year) and operating profit totaling 16.6 billion yen (−17.4% year-on-year). In the first half, we were not able to sufficiently tighten the number of product types offered and we suffered some shortages in strong-selling items caused by delays in production and distribution. As a result, first-half sales struggled, revenue dipped, and profit declined considerably. By contrast, revenue increased in the second half thanks to a tighter range of product types, stronger marketing, and strong sales of products that successfully captured mass fashion trends, such as color slacks and sweatshirt-style T-shirts. Furthermore, GU's gross profit margin improved on tighter discounting and the general and administrative expense ratio also improved, resulting in a large increase in operating profit in the second half of fiscal 2022.

■Global Brands:Full-year revenue rises sharply and operating loss shrinks

In fiscal 2022, the Global Brands segment reported an increase in revenue to 123.1 billion yen (+13.8% year-on-year) and an operating loss of 0.7 billion yen (compared to an operating loss of 1.6 billion yen in the previous fiscal year). Our Theory operation reported significant increases in revenue and profit thanks to a recovery in performance in both the United States and Japan. The label was able to successfully expand its customer base by offering comfortable, highly finished lightweight clothing and strategically expanding products with revised price lines. Our PLST label reported a decline in revenue and a wider operating loss in fiscal 2022. Finally, our Comptoir des Cotonniers label reported an increase in revenue and a much smaller operating loss in fiscal 2022. The brand's selling, general and administrative expense ratio also improved significantly following the closure of unprofitable stores and some determined structural business reforms.

■FY2023 consolidated estimates: Expect significant rises in revenue and operating profit

In fiscal 2023, the Fast Retailing Group expects to achieve consolidated revenue of 2.6500 trillion yen (+15.2% year-on-year), operating profit of 350.0 billion yen (+17.7% year-on-year), profit before income taxes of 350.0 billion (−15.4% year-on-year) and profit attributable to owners of the Parent of ¥230.0 billion (−15.9% year-on-year). We have used the period-start exchange rates of 1USD=138.7JPY and 1CNY=20.0JPY to calculate business estimates for international operations. We also used the period-start exchange rate of 1USD=138.7JPY for calculating finance income net of costs, which does not incorporate any foreign exchange gains or losses. We are predicting a year-on-year decline in profit attributable to owners of the Parent in fiscal 2023 compared to fiscal 2022 when we recorded a 114.3 billion yen foreign exchange gain on foreign-currency denominated assets. However, that profit measure is expected to increase year-on-year if we strip out the foreign exchange impact.

The year ending 31 August 2023 will be the year in which we aim to aggressively transform our business structure and create a solid foundation as a global No.1 brand. While the business environment continues to be severe in light of progressive inflation and the rapid depreciation of the yen, we are determined to accelerate our efforts to address the following four priority areas and produce steady results.

- Realize business that meets customer needs and encourage empathy towards the value we value

- Promote the globalization of our headquarters so we can earn profitrepos worldwide

- Accelerate sustainability initiatives in tandem with our business development

- Emphasize productivity and firmly implement low-cost management in an inflationary environment

Looking now at the future outlook for our individual business segments, we expect UNIQLO Japan will generate higher revenue and profit in both the first and second halves of fiscal 2023. While we expect cost of sales to continue to broadly worsen, we plan to improve discounting rates and contain any decline in the gross profit margin within a minimal level. We expect UNIQLO International will generate large increases in revenue and profit in fiscal 2023. We also expect our GU segment to produce significantly higher revenue and profit, while the Global Brand segments is reporting a large increase in full-year revenue and a move into the black.

We plan to accelerate new store openings in fiscal 2023, especially at UNIQLO International. We forecast the Fast Retailing Group network will boast a total of 3,747 stores by the end of August 2023: 809 stores (including franchise stores) at UNIQLO Japan, 1,740 stores at UNIQLO International, 469 stores at GU, and 729 stores at Global Brands(including franchise stores).

Finally, we are forecasting an annual dividend per share for fiscal 2023 of 680 yen, split equally between interim and year-end dividends of 340 yen each.

Fast Retailing Co., Ltd. discloses business results data and offers a variety of press releases on its IR website https://www.fastretailing.com/eng/ir/.