Last Updated: 2019.07.11

Results Summary for the Nine Months to May 31, 2019

FAST RETAILING CO., LTD.![]() (271KB)

(271KB)

to Japanese page

to Chinese page

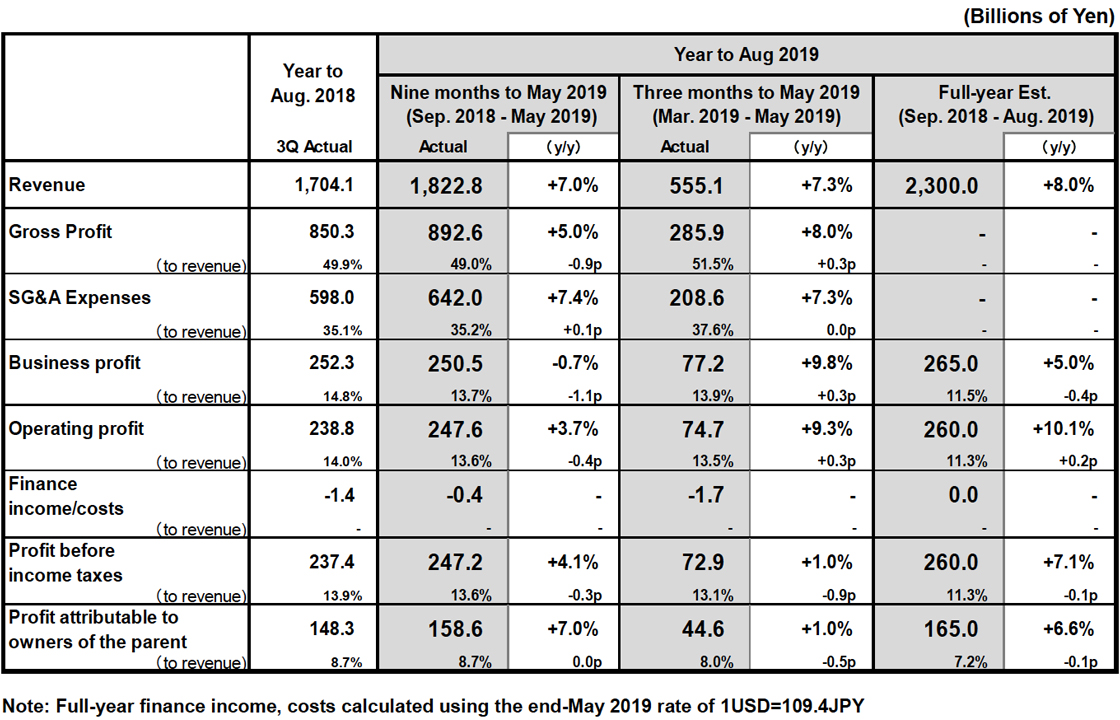

Consolidated Business Performance

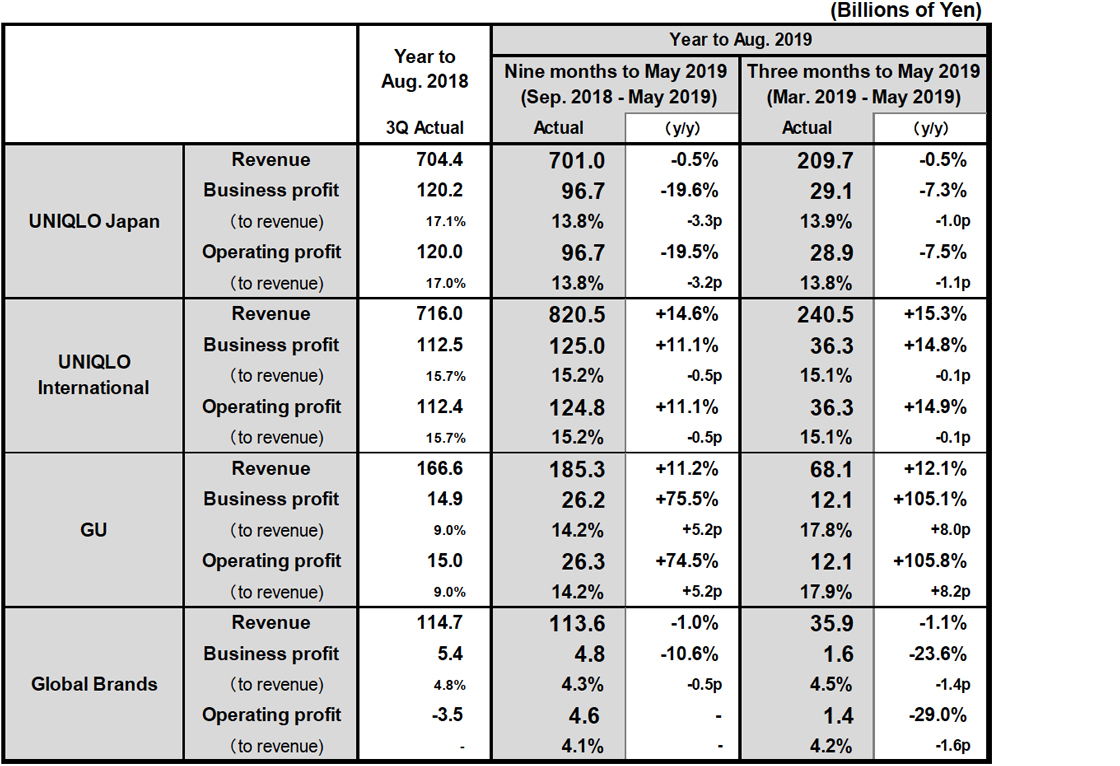

Performance by Group Operation

FY2019 3Q Main Points

■Consolidated results: Fast Retailing third-quarter revenue and profit gains generate a new record performance for the financial year to date.

・The Fast Retailing Group recorded another record performance in the first nine months of FY2019 from September 2018 through May 2019. Consolidated 1Q-3Q revenue: 1.8228 trillion yen (+7.0% year on year), operating profit: 247.6 billion yen (+3.7%).

・The Group also reported revenue and profit gains for the third quarter from March to May 2019, with the UNIQLO International and GU segments producing further strong performances.

■UNIQLO Japan: Third-quarter revenue and profit down as anniversary sale shifted to June

・In the March-to-May quarter, UNIQLO Japan reported falls in both revenue and profit that were roughly in line with expectations. Third-quarter revenue declined 0.5% to 209.7 billion yen, and operating profit contracted 7.5% to 28.9 billion yen.

・The decline in third-quarter revenue and profit was caused primarily by a 0.1% year-on-year contraction in same-store sales after we decided to defer the holding of our UNIQLO anniversary sale until June. In addition, the third-quarter gross profit margin contracted 0.3 point following our decision to start running down excess inventory earlier than usual.

・Operating profit for the nine months through end May 2019 declined by 19.5% to 96.7 billion. This figure incorporates the considerable contraction in first-half operating profit.

■UNIQLO International: Third-quarter revenue and profit rise, performance continues strong

・UNIQLO International generated the expected gains in both revenue and profit in the March-to-May quarter, with revenue expanding 15.3% to 240.5 billion yen and operating profit rising 14.9% to 36.3 billion yen.

・In terms of individual markets, Greater China and Southeast Asia & Oceania both reported further strong performances in the third quarter that fueled double-digit growth in both revenue and profit. UNIQLO South Korea profit dipped slightly. UNIQLO USA reduced losses further in the third quarter, but overall performance was weaker than expected. UNIQLO Europe profit declined.

・In the nine months through May 2019, profits continued to expand consistently, with operating profit increasing 11.1% over that period to 124.8 billion yen.

■GU: Operating profit improves markedly, performance continues on recovery trend

・GU generated a significant rise in profit that outstripped expectations in the third quarter. Third-quarter revenue expanded 12.1% to 68.1 billion yen, while operating profit expanded by an impressive 105.8% to 12.1 billion yen.

・The gross profit margin improved considerably on the back of strong sales, significantly improved cost of sales, and lower discounting rates.

・In the nine months through May 2019, GU enjoyed a marked profit recovery, with operating profit expanding 74.5% to 26.3 billion yen.

■Global Brands: Third-quarter revenue and profit contract

・The Global Brands segment fell short of expectations by reporting declines in revenue and profit for the March-to-May quarter. Revenue fell 1.1% to 35.9 billion yen, while operating profit declined 29.0% to 1.4 billion yen.

・The Theory operation generated a flat year-on-year performance in the third quarter. PLST profit rose slightly, while losses expanded at Comptoir des Cotonniers and Princesse tam.tam.

・Over the nine months through May 2019, Global Brands operating profit increased to 4.6 billion yen. That is a 8.1 billion yen increase compared to the previous year when impairment losses were recorded.

■FY2019 consolidated estimates: Continue to expect a record full-year performance

・Our FY2019 business estimates remain unchanged from our most recent forecasts announced in April. Consolidated revenue: 2.3000 trillion yen (+8.0%), business profit: 265.0 billion yen (+5.0%), operating profit: 260.0 billion yen (+10.1%), and profit attributable to owners of the parent: 165.0 billion yen (+6.6%).

・We forecast an annual dividend per share in FY2019 of 480 yen, which includes an interim dividend of 240 yen.

Fiscal 2019 3Q Performance in Focus

■UNIQLO Japan: Third-quarter revenue and profit down as anniversary sale shifted to June

UNIQLO Japan reported declines in both revenue and profit in the first nine months of fiscal 2019, with revenue totaling 701.0 billion yen (-0.5% year-on-year) and operating profit totaling 96.7 billion yen (-19.5% year-on-year). The gross profit margin declined 2.4 points year-on-year as a result of stronger discounting of Winter items following the warm winter weather in the first half, and an early rundown of Spring Summer inventory in the third quarter. Meanwhile, the selling, general and administrative expense ratio increased by 0.9 points year-on-year. While new IC tags (radio frequency identification) helped increase cash-register and store-operation efficiencies and reduce the personnel-to-net-sales ratio, the distribution-to-net-sales ratio rose on the back of expanding online sales and higher inventory levels, and we also recorded higher depreciation expenses on investment linked to the automation of our Ariake warehouse.

For the three months through 31 May 2019, UNIQLO Japan same-store sales, including online sales, declined 0.1% year-on-year, resulting in a 0.5% year-on-year decline in revenue. While sweat wear, UV-cut items, leggings, T-shirts and other ranges sold well throughout the quarter, the deferral of our hallmark UNIQLO anniversary sale until June meant that same-store sales in the traditionally bumper month of May actually declined year-on-year, and that was what generated the slight contraction in revenue for the three-month period as a whole. Meanwhile, online sales expanded by 16.1% year-on-year in the three months to 31 May 2019 to 19.0 billion yen, increasing their proportion of total sales from 7.8% to 9.1% of total sales. On the profit front, operating profit declined by 7.5% year-on-year on the back of a higher selling, general and administrative expense ratio, and a lower gross profit margin, which was dampened by our decision to bring forward discounting of leftover Spring Summer inventory.

■UNIQLO International: Third-quarter revenue and profit rise, performance continues strong

UNIQLO International revenue and profit rose in the first nine months of fiscal 2019, with revenue rising to 820.5 billion yen (+14.6% year-on-year) and operating profit expanding to 124.8 billion yen (+11.1% year-on-year).

For the three months from March to May 2019, the segment also reported strong results, with revenue expanding 15.3% year-on-year and operating profit expanding 14.9% year-on-year over that period. In terms of individual markets, within the UNIQLO Greater China region, the Mainland China operation continued to achieve significant year-on-year growth in both revenue and profit. UNIQLO Southeast Asia & Oceania achieved double-digit growth in both revenue and profit on the back of strong sales of Summer ranges. UNIQLO South Korea reported a fall in same-store sales and a slight decline in profit. While the loss generated by UNIQLO USA shrank year-on-year, overall performance was lower than expected after unseasonal weather dampened sales of Spring Summer ranges. UNIQLO Europe reported a decline in profit caused by unseasonal weather patterns and political uncertainty. However, within that region, Russia continued to perform strongly and report expanding revenue and profit.

In terms of new-store activity, UNIQLO International opened its first store in the Netherlands in Amsterdam in September 2018, as well as its biggest Southeast Asian global flagship store in Manila, the Philippines in October 2018, and its first store in Denmark in Copenhagen in April 2019.

■GU: Operating profit improves markedly, performance continues on recovery trend

The GU business segment reported a large recovery in profits over the first nine months of fiscal 2019, with revenue expanding 11.2% year-on-year to 185.3 billion yen and operating profit expanding 74.5% year-on-year to 26.3 billion yen.

Over the three-month period from March to May 2019, that profit recovery was even more marked, as revenue expanded by 12.1% year-on-year and operating profit increased by 105.8% year-on-year. GU generated further strong sales over the Spring Summer period thanks to its persistent drive to concentrate the number of product items, and developing product mixes that focus on mass fashion trends. Furthermore, the GU operating profit margin improved by an impressive 8.2 points year-on-year on reduced discounting, and a lower cost of sales resulting from early submission of orders and aggregate purchasing of raw materials.

■Global Brands: Third-quarter revenue and profit contract

Global Brands reported a decline in revenue but a rise in profit over the first nine months of fiscal 2019, with revenue totaling 113.6 billion yen (-1.0% year-on-year) and operating profit standing at 4.6 billion yen (compared to a 3.5 billion yen loss in the previous year following the recording of 8.9 billion yen in impairment losses).

For the three months from March to May 2019, Global Brands reported a 1.1% year-on-year decline in revenue and a 29.0% decline in operating profit. Breaking down that performance into individual brands, our Theory operation reported a steady operating profit and our PLST brand achieved a slight rise in profit. Meanwhile, our France-based Comptoir des Cotonniers and Princesse tam.tam brands reported increasing losses, while our US-based J Brand premium denim label generated a similar loss to the previous year.

■FY2019 consolidated estimates: Continue to expect a record full-year performance

As we announced in our most recent business estimates in April, we expect to attain a new record full-year performance in FY2019 for the third year in a row. Consolidated revenue is forecast to reach 2.3000 trillion yen (+8.0%), business profit 265.0 billion yen (+5.0%), operating profit 260.0 billion yen (+10.1%), profit before income taxes 260.0 billion yen (+7.1%), and profit attributable to owners of the parent 165.0 billion yen (+6.6%).

In light of the fact that UNIQLO Japan suffered a significant decline in profit in the first half of the financial year, we expect that segment will generate a full-year rise in revenue but a decline in profit. For the fourth quarter from June through August 2019, we predict UNIQLO Japan will attain considerably higher revenue and profit thanks to rising sales and profits generated from UNIQLO's hallmark anniversary sale, which was deferred this year until June, and to anticipated improvements in the gross profit margin and SG&A ratio. We expect UNIQLO International will generate strong gains in both revenue and profit in FY2019. We predict that strong performances from Greater China and Southeast Asia & Oceania will continue to drive growth in the fourth quarter. UNIQLO USA is expected to report a slight full-year loss. We expect GU sales will continue on a strong rising trend and profit will improve sharply in the fourth quarter, leading to significant gains in both revenue and profit for the full business year. Global Brands is expected to achieve flat full-year sales, and higher operating profit when compared to the previous year's recording of substantial impairment losses. At the end of August 2019, we expect to have a total number of 3,614 stores, made up of 820 UNIQLO Japan stores (including franchise outlets), 1,392 UNIQLO International stores, 420 GU stores, and 982 Global Brands stores.

Finally, we maintain our most recent forecast for a FY2019 annual dividend per share of 480 yen. This will be split evenly into interim and year-end dividends of 240 yen each, and represents a 40 yen increase in the annual dividend compared to the previous year.

Fast Retailing Co., Ltd. discloses business results data and offers a variety of press releases on its IR website https://www.fastretailing.com/eng/ir/.