Last Updated: 2019.04.11

Results Summary for FY2019 First Half (Six Months to February 2019)

FAST RETAILING CO., LTD.![]() (219KB)

(219KB)

to Japanese page

to Chinese page

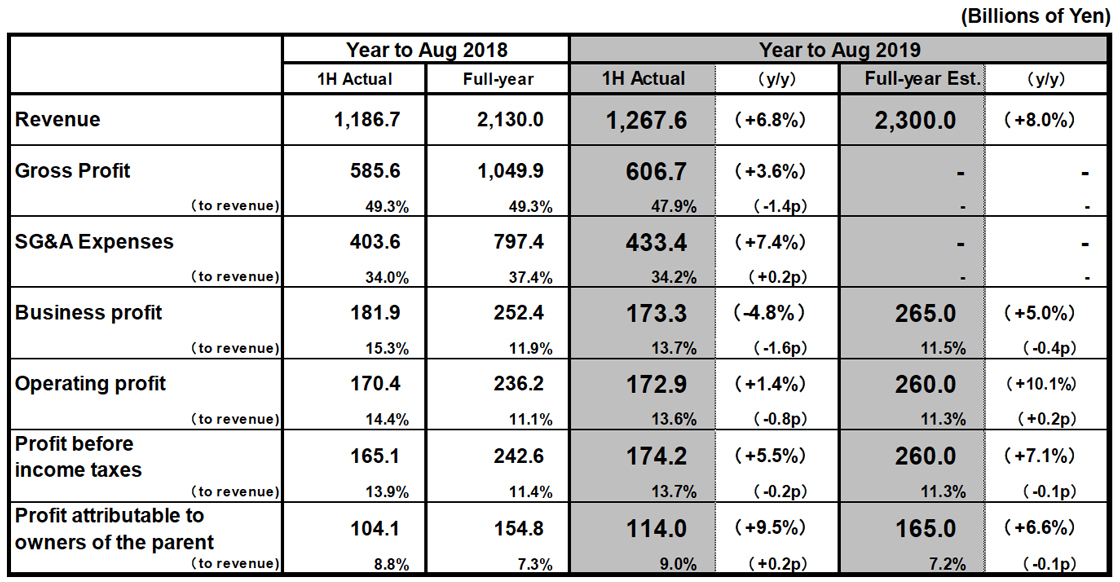

Consolidated Business Performance

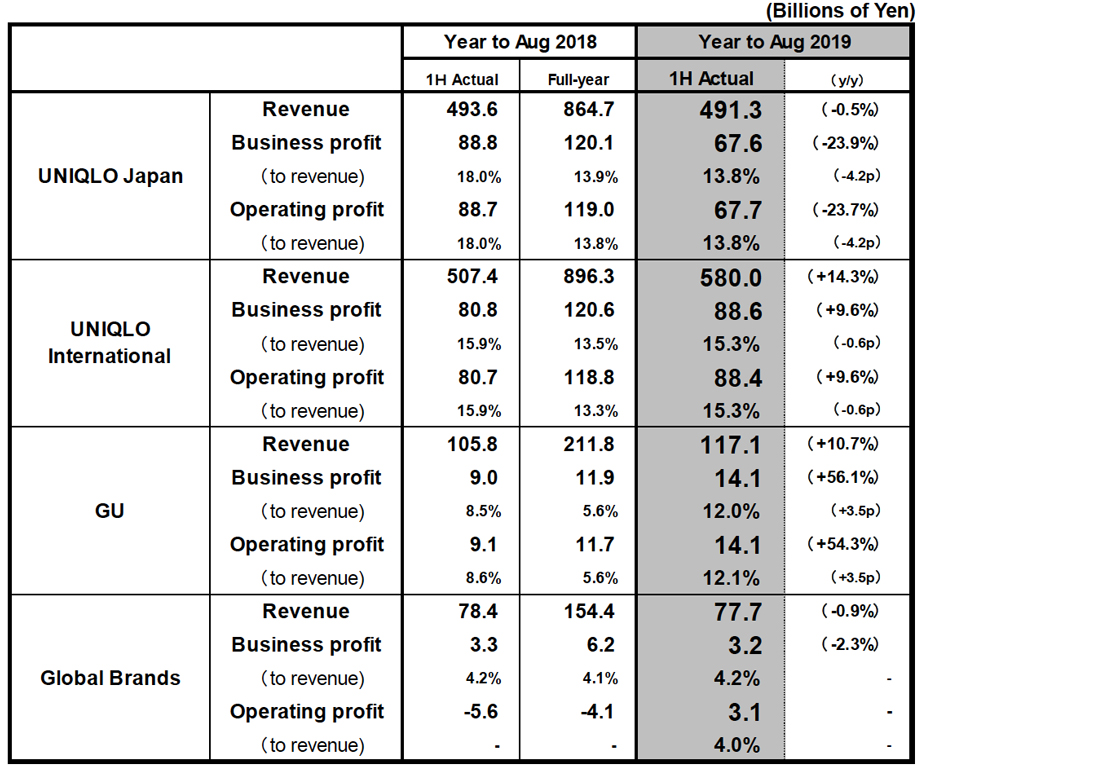

Performance by Group Operation

FY2019 1H Main Points

■Fast Retailing Group 1H revenue and profit rise to new record levels

・Consolidated 1H revenue: 1.2676 trillion yen (+6.8% year on year), operating profit: 172.9 billion yen (+1.4%), profit before income taxes: 174.2 billion yen (+5.5%), profit attributable to owners of the parent: 114.0 billion yen (+9.5%).

・1H revenue, operating profit, profit before income taxes, and profit attributable to owners of the parent all reached new record highs.

■UNIQLO Japan: Revenue, profit down on warm winter effect

・1H revenue and profit both decline. Revenue: 491.3 billion yen (-0.5%), operating profit: 67.7 billion yen (-23.7%).

・Same-store sales down 0.9% in 1H on warm winter effect. However, same-store sales did recover to rise 2.8% year on year in the second quarter after the temperature turned colder from December onwards. Online sales continued their strong expansion, rising 30.3% year on year and raising the e-commerce proportion of total sales from 7.5% to 9.9%.

・On the profit front, the 1H gross profit margin contracted 3.3 points as a result of stronger 2Q discounting. Despite an improvement in the personnel cost ratio, the 1H SG&A-to-net-sales ratio rose 1.0 point y/y.

■UNIQLO International: Continued strong performance, revenue and profit rise

・Revenue and profit both rose. Revenue: 580.0 billion yen (+14.3%), operating profit: 88.4 billion yen (+9.6%).

・Looking at individual markets, Mainland China continued to report especially strong results, which helped UNIQLO Greater China (Mainland China, Hong Kong, Taiwan) achieve double-digit growth in both revenue and profit. UNIQLO Southeast Asia & Oceania also reported significant revenue and profit gains. UNIQLO South Korea reported rising revenue and profit. UNIQLO USA turned a profit in the first half. UNIQLO Europe reported a flat result.

■GU: Performance continues to recover, achieves large revenue and profit gains

・GU achieved significant 1H gains in both revenue and profit. Revenue: 117.1 billion yen (+10.7%), operating profit :14.1 billion yen (+54.3%).

・Same-stores sales recovered on the back of a solid focus on mass trend-oriented clothing and some successful marketing and expert coordination of TV and online advertising.

■Global Brands: Revenue down, profit up. Theory strong

・Revenue: 77.7 billion yen (-0.9%), operating profit: 3.1 billion yen (+8.7 billion yen).

・Theory achieved a significant rise in profit on a strong performance in the United States.

・Comptoir des Cotonniers operation reported a wider loss on continued sluggish sales.

■FY2019 business estimates revised down to reflect 1H shortfall, but still expecting record full-year performance

・To reflect the below-plan first-half performance, we have revised down our full-year forecasts for the business year through August 2019 for both business profit and operating profit by 10.0 billion yen each. However, we still expect to achieve another record full-year performance for the third year in a row.

・Our FY2019 are now as follows: Consolidated revenue: 2.3000 trillion yen (+8.0%), consolidated business profit: 265.0 billion (+5.0%), operating profit: 260.0 billion yen (+10.1%), and profit attributable to owners of the parent: 165.0 billion yen (+6.6%).

・We forecast an annual dividend per share in FY2019 of 480 yen, which includes an interim dividend of 240 yen.

FY2019 First Half Performance in Focus

■UNIQLO Japan: Revenue, profit down on warm winter effect

UNIQLO Japan reported declines in both revenue and profit in the first half of fiscal 2019, with revenue totaling 491.3 billion yen (-0.5% year-on-year) and operating profit totaling 67.7 billion yen (-23.7% year-on-year). First-half same-store sales, including online sales, declined 0.9% year-on-year. While sales of core Winter items struggled overall in the face of especially warm winter in October and November, sales of Winter ranges such as HEATTECH, down, and fleece picked up strongly once the weather turned colder in December and January, and Spring ranges such as sweat wear, legging pants, and BLOCKTECH got off to a favorable start in February. Meanwhile, online sales continued to rise strongly, expanding by an impressive 30.3% year-on-year in the first half, and expanding their proportion of total sales from 7.5% to 9.9% of total sales. On the profit front, the continued rise in cost of sales due to a weakening in internal yen exchange rates, along with stronger discounting of Winter items, resulted in a 3.3 point year-on-year decline in the gross profit margin. In addition, the selling, general and administrative expense ratio increased by 1.0 points year-on-year. While new IC tags (radio frequency identification) helped increase productivity and reduce the personnel-to-net-sales ratio, the distribution-to-net-sales ratio rose on the back of expanding online sales, and the other expenses-to-net-sale ratio rose on the back of higher IT investment relating to our ongoing transformative Ariake Project. In October 2018, the Ariake distribution center started operating as a fully automated dedicated online sales warehouse.

■UNIQLO International: Continued strong performance, revenue and profit rise

UNIQLO International revenue and profit rose in the first half of fiscal 2019, with revenue expanding to 580.0 billion yen (+14.3% year-on-year) and operating profit increasing to 88.4 billion yen (+9.6% year-on-year). In terms of individual markets, UNIQLO Greater China generated double-digit growth in both revenue and profit in the first half of the financial year despite the dampening effect of the mild winter weather. Within that region, our operation in Mainland China continued to report strong growth in revenue and profit of approximately 20% year-on-year. UNIQLO South Korea also reported increases in both revenue and profit. UNIQLO Southeast Asia & Oceania generated significant rises in both revenue and profit thanks to strong increases in same-store sales in every single one of the region's markets. UNIQLO USA generated an operating profit in the first half. UNIQLO Europe reported a steady first-half performance. In terms of new-store activity, UNIQLO International opened its first store in the Netherlands in Amsterdam in September 2018, and its biggest Southeast Asian global flagship store in Manila, the Philippines in October 2018.

■GU: Performance continues to recover, achieves large revenue and profit gains

The GU business segment achieved significantly higher revenue and profit in the first half of fiscal 2019, with revenue climbing to 117.1 billion yen (+10.7% year-on-year) and operating profit rising to 14.1 billion yen (+54.3% year-on-year). GU same-store sales rose as determined action to create mass-trend focused product mixes and pursue complementary TV and web marketing helped put the operation on a firm recovery track. The GU gross profit margin increased by 3.0 points year-on-year thanks to strong sales, strict control over discounting, and lower cost of sales resulting from aggregate purchasing of raw materials. This and a 0.5point year-on-year improvement in the selling, general and administrative expense ratio helped generate the impressive rise in operating profit.

■Global Brands: Revenue down, profit up. Theory strong

Global Brands revenue declined while profit rose in the first half of fiscal 2019, with revenue totaling 77.7 billion yen (-0.9% year-on-year) and operating profit standing at 3.1 billion yen (compared to a 5.6 billion yen loss in the first half of fiscal 2018). The Theory fashion operation reported a considerable increase in profit, thanks to strong sales at the Theory operation in the United States. Meanwhile, the France-based Comptoir des Cotonniers fashion brand reported another loss on the back of continued sluggish sales.

■FY2019 business estimates revised down to reflect 1H shortfall, but still expecting record full-year performance

In recognition of the fact that areas of Group performance fell short of plan in the first half, we have revised down our FY2019 full-year forecasts for both consolidated business profit and consolidated operating profit by 10.0 billion yen each. However, we still expect to attain another record full-year performance for the third year in a row, with consolidated revenue forecast to reach 2.3000 trillion yen (+8.0%), business profit 265.0 billion (+5.0%), operating profit 260.0 billion yen (+10.1%), profit before income taxes 260.0 billion yen (+7.1%), and profit attributable to owners of the parent 165.0 billion yen (+6.6%). While we have revised down some of our full-year FY2019 forecasts, we have made no change to our consolidated business estimates for second-half performance from March through August 2019. Having said that, in light of recent sales trends, we have made some changes to our 2H revenue and operating forecasts at the operational segment level, revising up our estimates for GU and revising down our estimates for Global Brands. Our second-half estimates for UNIQLO Japan and UNIQLO International remain unchanged.

In the second half, we expect UNIQLO Japan will report a strong rise in profit as lower cost of sales helps improve the gross profit margin, and higher store productivity improves the SG&A ratio. However, given the significant decline in first-half profit, we are forecasting a rise in revenue but a fall in profit for UNIQLO Japan for the full business year. We expect UNIQLO International will generate strong gains in both revenue and profit in FY2019. We predict that strong performances from Greater China, and Southeast Asia & Oceania will continue to drive growth in the second half, and that UNIQLO USA will move into the black in the full business year. We expect GU will exhibit a similar strong recovery in performance in the second half, leading to us to predict a rise in GU revenue and a sharp increase in profit for the full business year. Global Brands is forecast to achieve higher full-year revenue and profit, supported by buoyant Theory and PLST operations. At the end of August 2019, we expect to have a total number of 3,639 stores, made up of 827 UNIQLO Japan stores (including franchise outlets), 1,407 UNIQLO International stores, 423 GU stores, and 982 Global Brands stores.

Finally, our forecast for the annual dividend per share for FY2019 remains unchanged at 480 yen. This will be split evenly into interim and year-end dividends of 240 yen each, and represents a 40 yen increase in the annual dividend compared to the previous year.

Fast Retailing Co., Ltd. discloses business results data and offers a variety of press releases on its IR website https://www.fastretailing.com/eng/ir/.