Last Updated: 2012.07.06

Results Summary for the Nine Months to May 2012

FAST RETAILING CO., LTD.![]() ( 165KB )

( 165KB )

to Japanese page

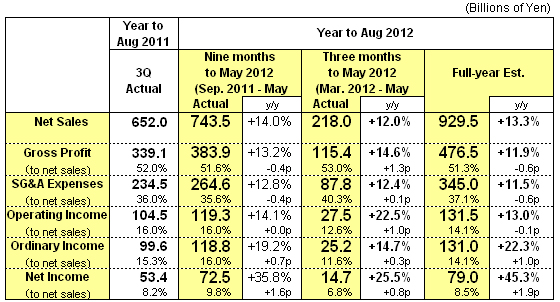

Consolidated Business Performance

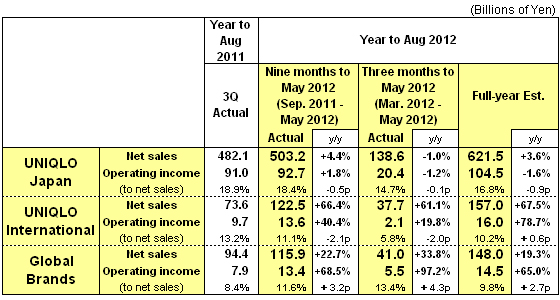

Performance by Group Operation

FY2012 Third Quarter Highlights

■Group Performance:

The Fast Retailing Group generated significant gains in both sales and income in the third quarter of fiscal 2012, or the nine months from September 2011 through May 2012. Consolidated sales increased 14.0% to ¥ 743.5bln, while operating income expanded 14.1% to ¥ 119.3bln and net income expanded an impressive 35.8% to ¥ 72.5bln..

■UNIQLO Japan:

Both sales and income contracted in the three months from March to May 2012 with sales totaling ¥ 138.6bln (-1.0% y/y) and operating income ¥ 20.4bln (-1.2%). Same-store sales at UNIQLO Japan contracted 5.4% year on year in the third quarter due to our strong focus on spring inventory which, with hindsight, probably detracted from sales of inter-season garments. In addition, the weather remained fairly cool during the March to May quarter and this dampened sales of summer clothing. On the income side, the gross profit margin improved year on year but operating income dipped slightly.

■UNIQLO International:

The UNIQLO International segment generated gains in both sales and income in the March to May quarter with sales totaling ¥ 37.7bln (+61.1% y/y) and operating income ¥ 2.1bln (+19.8%). While profits continue to expand strongly in Asia, losses at UNIQLO USA expanded as sales at the New York 34th Street megastore and the New York Soho global flagship fell short of target.

■Theory:

The rising trend in same-store sales and income continued through the third quarter in both Japan and the United States.

■g.u.:

The opening of the g.u. Ginza flagship store on March 30 boosted the brand's profile and same-store sales have expanded by over 40% since then. The g.u. sales target for the year through August 2012 of ¥50.0bln was surpassed on July 1, and we now expect to achieve operating income of ¥ 5.0bln in fiscal 2012.

■Fiscal 2012 Consolidated Estimates:

We expect consolidated sales to increase by 13.3% to ¥929.5bln, consolidated operating income to increase by 13.0% to ¥131.5bln, and net income to expand 45.3% to ¥79.0bln. That would generate earnings per share of 775.65 yen.

■Fiscal 2012 Dividend Payment:

In addition to the elevated interim dividend of 130 yen which has already been paid out, we plan to offer a year-end dividend of 130 yen, bringing the scheduled annual dividend to 260 yen per share.

■ UNIQLO Japan

UNIQLO Japan, which constitutes 67.7% of consolidated net sales, generated gains in both sales and income in the nine months from September 2011 through May 2012. Sales totaled ¥503.2bln (+4.4% y/y) and operating income totaled ¥92.7bln (+1.8%). However, both sales and income contracted in the third quarter from March to May 2012, with sales totaling ¥138.6bln (-1.0% y/y) and operating income ¥20.4bln (-1.2%). UNIQLO Japan sales fell ¥10.0bln short and operating income ¥3.0bln short of our most recent estimates for the third quarter announced on April 12.

In the first half from September 2011 through February 2012, same-store sales expanded 2.3% year on year thanks to the strong performance of core winter garment ranges such as HEATTECH, Ultra Light Down and warm pants. However, same-store sales contracted 5.4% year on year in the third quarter from March to May 2012 as our determined focus on spring inventory probably detracted from sales of inter-season garments and cool weather throughout the quarter dampened sales of summer clothing. The gross profit margin expanded 1.5 points year on year in the third quarter with the cost of sales ratio improving now that the recent rise in cotton and other raw material costs has run its course and also thanks to comparative benefits from the stronger yen.

On new store openings, we continued our policy of closing smaller stores and replacing them with large-format stores. In the nine months to May 2012, we opened 24 new stores and closed 18 existing stores, bringing the total number of stores to 849 (including 21 franchise stores) at the end of May 2012.

Over the 2012 spring/summer season, Sarafine bra tops for women and the Silky Dry Steteco (long trunks) garments for men have proved the top sellers within our AIRism global brand of functional summer innerwear. This year we have expanded the set of colors for Steteco garments to 80 and the range is proving extremely popular as innerwear and lounge wear offering cool, light comfort however hot and sticky the climate. In addition, our Easy Leggings Pants are proving popular among customers of all ages, combining the comfort of leggings with the look and design of pants.

We have revised down our fiscal 2012 estimates for UNIQLO Japan by ¥12.0bln in terms of sales and ¥6.5bln in terms of operating income to reflect the shortfall in performance in the March to May quarter and also the dip in retail sales in the month of June. As a result, we now expect sales for UNIQLO Japan for the full year through end August 2012 to rise 3.6% year on year to ¥621.5bln and operating income to contract 1.6% to ¥104.5bln.

■ UNIQLO International

The UNIQLO International operations achieved significant gains in both sales and income in the nine months to May 2012 with sales rising an impressive 66.4% year on year to ¥122.5bln and operating income expanding 40.4% to ¥13.6bln. Having accelerated the pace of new store openings mainly in China, Taiwan and South Korea, UNIQLO International opened 98 new stores and closed four stores over the nine months, bringing the total number of UNIQLO International stores to 275 at the end of May 2012.

UNIQLO International also generated gains in sales and income in the three months from March through May 2012 with sales rising 61.1% year on year to ¥37.7bln and operating income expanding 19.8% to ¥2.1bln. On the sales front, the operation continues to generate considerable gains fueled mainly by consistent strong growth in same-store sales from stores located in Asia and also to our persistent drive to open multiple new stores in the Asian sub-region of China, Taiwan and South Korea. On the income side, while profits continue to rise firmly in Asia, losses at UNIQLO USA expanded as sales at the New York 34th Street megastore and the New York Soho global flagship fell short of target.

For the full year through end August 2012, we expect sales from the UNIQLO International operation will increase by 67.5% year on year to ¥157.0bln and operating income will expand an impressive 78.7% to ¥16.0bln.

■ Global Brands

Our Global Brands segment generated significant gains in both sales and income in the nine months through May 2012 with sales expanding 22.7% year on year to ¥115.9bln and operating income rising 68.5% to ¥13.4bln. The third quarter performance from March to May was particularly strong with sales increasing by 33.8% year on year to ¥41.0bln and operating income rising an impressive 97.2% to ¥5.5bln.

Our Theory label exceeded our profit target for the third quarter thanks to continued strong growth in same-store sales in both Japan and the United States. Our low-priced g.u. casualwear brand is also performing extremely well. The opening of the g.u. Ginza flagship store on March 30 boosted the brand's profile and same-store sales have expanded by as much as 40% since then. Our ambitious g.u. sales target of ¥50bln for the year through August 2012 was already surpassed on July 1. Profitability is also improving as sales per store increase and we are now predicting operating income will rise to ¥ 5.0bln in fiscal 2012. Going forward, we expect the g.u. brand will blossom into a future mainstay operation for the Global Brands segment offering strong growth potential.

Performance at our France-based labels was mixed, with women's fashion brand Comptoir des Cotonniers generating the expected gain in both sales and income while corsetry brand Princesse tam.tam fell short of target, posting a dip in both sales and income.

For the full fiscal year through the end of August 2012, we expect sales from the Global Brands operations to increase by 19.3% year on year to ¥148.0bln and operating income to expand by 65.0% to ¥14.5bln.

■ Fast Retailing forecasts earnings per share of 775.65 yen and an annual dividend of 260 yen

We expect consolidated sales to increase by 13.3% to ¥929.5bln, operating income to increase by 13.0% to ¥131.5bln, ordinary income to expand 22.3% to ¥131.0bln and net income to expand 45.3% to ¥79.0bln.That would generate earnings per share of 775.65 yen. In addition to the elevated interim dividend of 130 yen which has already been paid out, we plan to offer a year-end dividend of 130 yen, bringing the scheduled annual dividend to 260 yen per share.