Last Updated: 2011.10.12

Results Summary for Year to August 2011

FAST RETAILING CO., LTD.![]() ( 175KB )

( 175KB )

to Japanese page

Consolidated results

【Summary】 Fast Retailing Forecasts Increased Sales and Income in Fiscal 2012. UNIQLO International, Seen as the Driving Force, Generating Continued Strong Growth with Multiple New Store Openings and Four New Global Flagship Stores

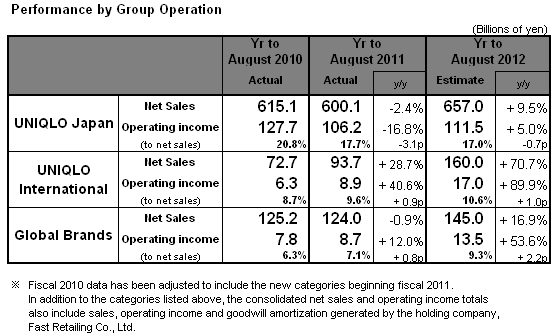

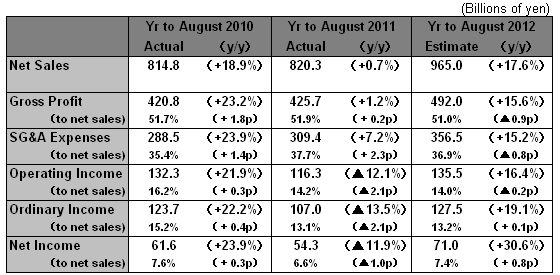

The Fast Retailing Group reported an increase in sales but a fall in profit in fiscal 2011, the business year through August 2011, with consolidated sales rising 0.7% year on year to ¥ 820.3bln while operating income contracted 12.1% to ¥ 116.3bln and net income fell 11.9% to ¥ 54.3bln. The main factor underlying this result was a decline in operating income at UNIQLO Japan. Same-store sales at UNIQLO Japan did improve in the second half, the six months from March through August 2011, and operating income recovered to generate positive year-on-year growth in the second half. However, this improvement was not sufficient to offset the weak performance in the first half from September 2010 to February 2011. On the other hand, UNIQLO International performed extremely well in fiscal 2011, generating considerable gains in both sales and income, and our Global Brands segment also reported an increase in profits thanks mainly to the strong performance of our Theory brand operation.

Fast Retailing is deeply committed to expanding UNIQLO operations, particularly outside Japan, and is currently working to strengthen its operational base by opening even more stores in the Asian region, including China and Hong Kong, South Korea, Singapore, Taiwan, Malaysia, Thailand, and the Philippines, and also by opening global flagship stores in New York and other major cities around the world. In fiscal 2012, the year through August 2012, Fast Retailing is planning to open an additional 107 new UNIQLO stores outside of Japan, and also to open four global flagship stores on New York's Fifth Avenue, in Taipei, Seoul and Tokyo's Ginza shopping district.

Fast Retailing predicts both sales and income will increase in fiscal 2012, with UNIQLO International continuing to generate strong gains in both sales and income, and profits improving at UNIQLO Japan. In fiscal 2012, consolidated sales are estimated to rise 17.6% year on year to ¥ 965.0bln, operating income is seen increasing 16.4% to ¥ 135.5bln and net income is expected to expand 30.6% to ¥ 71.0bln. This translates into earnings per share of 697.34 yen and enables us to schedule an annual dividend of 230 yen, including an interim dividend of 115 yen.

■ UNIQLO Japan

As our current mainstay operation, UNIQLO Japan constitutes 73% of consolidated sales. UNIQLO Japan reported a fall in both sales and income in fiscal 2011, with sales contracting 2.4% year on year to ¥ 600.1bln and operating income contracting 16.8% year on year to ¥ 106.2bln. Same-store sales in the first six months to February 2011 fell 9.9% year on year as a delay in the launch of fall items and a warm winter knocked income lower during the season's peak months of November and December, and sales of some popular core items suffered from shortages in supply. As a result, operating income contracted considerably in the first half. Same-store sales recovered to post a 0.4% year-on-year increase in the second half from March to August 2011 and operating income also rose by 1.7% in the same six-month period. However, UNIQLO Japan also suffered from a worsening in the overall business environment in the second half as the sharp rise in raw cotton prices globally nudged the cost of sales ratio higher and knocked the gross profit margin lower. In the end, the pickup in income in the second half was not sufficient to offset the fall in the first half, and, as a consequence, the segment reported a decline in income for the full business year through August 2011.

Regarding new store openings at UNIQLO Japan, the opening of the first global flagship store in Japan, the UNIQLO Shinsaibashi Store, in October 2010 was a great success, and new large-scale stores were opened in major urban areas, including Tokyo and Osaka. We also opened more new stores within prime department store locations including the UNIQLO Daimaru Umeda Store in March and the UNIQLO Tachikawa Takashimaya Store in April. By the end of August 2011, our total store network, including 21 franchises stores, had expanded to 843 stores, and 129 of that total were large-scale stores. In fiscal 2011, we opened 61 new stores, and closed 27 stores as part of our drive to make our stores larger.

In terms of new product development at UNIQLO, we continue to strengthen the product development framework that we have with materials' manufacturers to ensure we respond in a timely fashion. We are creating new demand through the development and refinement of our highly functional ranges such as HEATTECH and Ultra Light Down items for the fall/winter season, and Sarafine (Dry Luxe), Silky Dry, Bra Tops, Style Up innerwear and Easy Exercise innerwear for the spring/summer season. Sales of these summer functional innerwear (Sarafine, Silky Dry and Style Up lines) doubled to 36 million units in fiscal 2011. HEATTECH sales around the world increased to 80 million units in fiscal 2011 from the previous year's 50 million units.

Looking ahead to fiscal 2012, we expect UNIQLO Japan to generate gains in both sales and income in the year to August 2012. We estimate sales will expand 9.5% year on year to ¥ 657.0bln and operating income will rise 5.0% year on year to ¥ 111.5bln. We also estimate same-store sales growth of 5.0% in fiscal 2012. We expect to add a net 24 new stores over the year, bringing the total number of stores, including franchise stores, to 868 by end August 2012. As part of our increasingly aggressive drive to open more global flagship stores and large-scale stores in Japan, we are planning to open the Ginza global flagship store (provisional name) with a shop floor of 5,000 square meters in March 2012, and the Shinjuku global flagship store (provisional name) with a floor space of 4,100 square meters in fall 2012. We plan to press ahead with the development of global flagship stores in key areas of the Japanese capital such as Shibuya, Harajuku, Ueno and Ikebukuro. On the profit front, we predict that the cost of sales ratio will continue to rise on the back of sharp increases in the price of cotton and other raw materials, and increased factory processing charges. However, we still expect to successfully expand operating income at UNIQLO Japan in fiscal 2012 by further strengthening controls on product discounting and overall business expenses.

■ UNIQLO International

UNIQLO International generated considerable gains in both sales and income in fiscal 2011 with sales expanding 28.7% year on year to ¥ 93.7bln and operating income increasing 40.6% year on year to ¥ 8.9bln. However, owing to the adverse impact of the strengthening of the yen, this performance was actually slightly below target.

The pace of new store openings was particularly strong in Asia, with 43 new stores opening across China and Hong Kong, South Korea and Taiwan, bringing the total store network in Asia to 181 stores by the end of August 2011. In addition, each individual Asian nation continued to generate double-digit growth in same-store sales and significant gains in both revenue and income. We achieved great success with the opening of our first store in Taiwan in October 2010. Sales at the first Taiwanese store far exceeded our initial target as the UNIQLO brand proved extremely popular with local shoppers and the operation was able to turn a profit in its first year of operation. In addition, we opened our first store in Malaysia in November 2010 and successfully expanded our store network in Singapore and Malaysia to a total of 7 stores by the end of August 2011.

In the United States, the New York Soho Store continued to generate double-digit growth in sales. We are now pressing ahead with final preparations for the opening of our global flagship store, UNIQLO New York Fifth Avenue Store, on Friday, October 14 (floor space: 4,600 square meters) and our megastore, UNIQLO New York 34th Street Store, one week later on Friday, October 21 (floor space: 4,300 square meters). In Europe, the Paris Opera Store in France continued, as expected, to improve on an already strong performance. Meanwhile, UNIQLO operations in both the U.K. and Russia fell short of targets, reporting operating losses in the year to August 2011.

For the full year to August 2012, we expect UNIQLO International to generate considerable gains in both sales and income. We estimate the scheduled acceleration in new store openings, mainly in Asia, will help boost sales for the segment by an impressive 70.7% year on year to ¥ 160.0bln, and increase operating income by 89.9% to ¥ 17.0bln. We are scheduled to add a net 107 new stores over the business year, bringing the total number of UNIQLO International stores to 288 by end August 2012. We are pressing ahead with our strategy to open global flagship stores in major cities around the world and are already preparing to open global flagship stores in Beijing and on New York's prestigious Fifth Avenue in October 2011 and in Seoul the following month.

■ Global Brands

In fiscal 2011, sales at our Global Brands segment dipped 0.9% year on year to ¥ 124.0bln but operating income increased by 12.0% to ¥ 8.7bln. The discontinuation of brands formerly operated by Cabin shaved ¥ 10.0bln off the revenue total which was also adversely affected by the strengthening of the yen. Our Theory brand operation in the U.S. reported a strong rise in income on the back of consistent double-digit growth in same-store sales. Our Theory operation in Japan also achieved gains in both sales and income across the full business year despite the temporary slump in sales recorded in the wake of the March 11 earthquake and tsunami. Our French-born women's fashion label, Comptoir des Cotonniers, fell short of target, posting a fall in income, while our French lingerie brand, Princesse tam.tam, performed to plan.

Same-store sales at our low-priced g.u. casualwear operation began rising in the second half of the business year, with brand awareness boosted by the opening of two flagship stores: the g.u. Shinsaibashi Store in November 2010 and the g.u. Ikebukuro East Entrance Store in April 2011. However, operating income at g.u. contracted over the full business year as the operation absorbed expenses associated with the opening of the two flagship stores.

In fiscal 2012, we estimate the Global Brands segment will generate a 16.9% increase in sales to ¥ 145.0bln and a 53.6% increase in operating income to ¥ 13.5bln. Sales of the g.u. brand are expected to top ¥ 50.0bln, and we predict sales and profit will rise at our Theory operations in both Japan and the United States.

■ Consolidated Sales and Income Predicted to Rise in Fiscal 2012

Fast Retailing predicts both sales and income will increase in fiscal 2012, with UNIQLO International continuing to generate strong gains in both sales and income, and profits improving at UNIQLO Japan. For the full business year through August 2012, consolidated sales are estimated to rise 17.6% year on year to ¥ 965.0bln, operating income is forecast to increase 16.4% to ¥ 135.5bln and net income is expected to expand 30.6% to ¥ 71.0bln. This would translate into earnings per share of 697.34 yen and enable us to schedule an annual dividend of 230 yen, including an interim dividend of 115 yen.