Last Updated: 2011.04.07

Results Summary for Fiscal 2011 First Half (Six Months through Feb. 2011)

FAST RETAILING CO., LTD.![]() ( 55KB )

( 55KB )

to Japanese page

Consolidated Business Performance

【Summary】

Sales and Operating Income Fall in the First Half of Fiscal 2011

Fast Retailing Co., Ltd. experienced a dip in both sales and operating income in the six months to February 2011, the first half of fiscal 2011, caused primarily by sluggish performance at its mainstay UNIQLO Japan operation. Same-store sales at UNIQLO Japan contracted 9.9% year on year and operating income declined in the six months through February 2011 with results overshadowed by comparisons with the extremely strong sales of the previous year and impacted by unseasonably warm weather in December 2010 that dampened sales of fall and winter products.

UNIQLO International produced an impressive 33.9% increase in operating income with new stores opening and same-store sales expanding rapidly in Asia, in particular in the markets of China, Hong Kong and South Korea. Our Global Brands segment also generated a 10.3% rise in operating income thanks to a strong performance by Theory operations in both Japan and the United States.

Sales and Operating Income Expected to Rebound in the Second Half of Fiscal 2011

We estimate that both sales and operating income at UNIQLO Japan will expand in the second half of the fiscal year, from March through August 2011. However, due to the negative impact on sales from stores unable to operate following the devastating March 11 earthquake and tsunami that hit northeastern Japan as well as the impact of the reduction in the number of new store openings in the first half, we have revised down our latest UNIQLO Japan sales estimate in the second half by ¥ 8.0bln. However, our most recent estimate for same-store sales at UNIQLO Japan remains unchanged at a 3.0% increase year on year. Following the March 11 earthquake, same-store sales fell further below the previous year's level in March, contracting 10.5% year on year. However, subsequently sales have been gradually recovering and we expect same-store sales to increase from April. We estimate our gross profit margin will dip 1.8 points year on year in the six months through August 2011 on the back of rising cost of sales, but also expect increased revenue and cost-cutting measures to nudge operating income higher in the second half. In addition, UNIQLO International and Global Brands are expected to generate continued increases in income through the second half of fiscal 2011.

Interim Dividend for Fiscal 2011 increased 10 Yen

Given the larger-than-forecast rise in net income in the six months through February 2011, we have decided to increase our interim dividend by 10 yen from 85 yen to 95 yen per share. Combined with our estimated 85-yen year-end dividend, this would generate a higher full-year dividend of 180 yen per share.

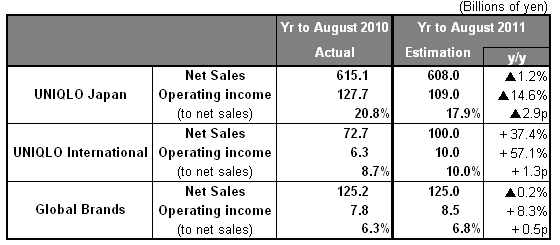

■ UNIQLO Japan

UNIQLO Japan, which currently constitutes 74.8% of consolidated sales, experienced a drop in both sales and operating income in the first half of fiscal 2011 in the six months through February 2011. Net sales contracted 6.8% to ¥ 342.1bln and operating income fell 23.9% year on year to ¥ 70.3bln. However, the operating income did exceed our most recent estimate by more than ¥ 4.0bln.

Same-store sales at UNIQLO Japan contracted 9.9% year on year in the six months through February 2011, but the result was being compared with the extremely robust performance for the same period of the previous year during which same-store sales rose 13.1% year on year. Unseasonably warm December weather also served to stifle the sales of fall and winter items. As a result, customer numbers in the second half shrank 5.0% year on year and the average customer spending fell 5.2% for the same period.

UNIQLO Japan's gross profit margin fell 3.4 points year on year when compared using the same accounting procedure. We conducted more discounting to liquidate inventory of fall items, and increased production of HEATTECH items resulted in more limited-offer sales than in the previous year when production levels were tight. SG&A expenses rose 1.1 points year on year in the six months through February 2011, however, solid control enabled a reduction in costs for personnel, advertising and distribution, resulting in the SG&A expense total for the first half coming in ¥ 8.4bln below our initial estimate.

We expect UNIQLO Japan to generate increases in both sales and operating income in the second half of the business year through August 2011, with sales seen rising 7.1% year on year to ¥ 265.8bln, and operating income forecast to rise 9.5% to ¥ 38.6bln over the same period. We have revised downward our second-half estimate for UNIQLO Japan sales by ¥ 8.0bln in the wake of the March 11 earthquake. Stores forced to close due to the disaster are expected to detract ¥ 3.0bln from total sales with the impact of the reduced number of new store openings estimated at ¥ 2.0bln. Nonetheless, our most recent estimate of a 3.0% year-on-year increase in same-store sales at UNIQLO Japan in the second half remains unchanged. Following the March 11 earthquake, same-store sales fell even further below the previous year's level in March, contracting 10.5% year on year, but subsequently sales have begun to rebound gradually and we expect same-store sales to increase from April onward. We estimate the gross profit margin will dip 1.8 points year on year in the six months to August 2011 on the back of increased cost of sales, but we also expect increased revenue and cost-cutting measures to nudge operating income higher in the same period.

We added a net 16 stores in the first half to bring the total of directly-run and franchise outlets at the end of February 2011 to 824 stores. We expect to expand the number of large-scale stores, locations with a retail space in excess of 1,600 square meters, to 129 and the overall store total to 836 by the end of August 2011.

■ UNIQLO International

UNIQLO International achieved significant gains in both sales and operating income in the first half of fiscal 2011 with sales rising 24.0% to ¥ 50.2bln and operating income jumping 33.9% to ¥ 7.8bln, surpassing our most recent estimate by approximately ¥ 1.5bln.

Sales and profits soared in the Asian market (excluding Japan), notably in the markets of China, Hong Kong and South Korea, with same-store sales continuing to post strong growth and more new stores opening their doors. Our first Taiwan store, which opened in October 2010, achieved sales well in excess of our initial plan, while business continues to expand favorably in Singapore. Our first Malaysia store, which opened in November 2010, is also generating favorable sales.

In the United States, the New York Soho global flagship store continued to generate double-digit growth in sales, boosting operating income for the UNIQLO operation in America after excluding rental obligations on the New York Fifth Avenue property for the new global flagship store and the New York 34th Street property. Our UNIQLO operation in France posted the predicted rise in both sales and operating income while operations in the U.K. and Russia came in marginally below their respective targets.

Having outperformed our most recent estimate in the first half, we have revised upward our forecast at UNIQLO International for the fiscal year through August 2011. We expect sales to expand 37.4% year on year to ¥ 100.0bln with operating income now seen soaring 57.1% year on year to ¥ 10.0bln. We plan to add a net 46 stores year on year to bring the number of UNIQLO International stores to 182 by the end of August 2011.

Moving forward, we plan to aggressively open flagship stores and megastores in major cities around the world. A global flagship store is scheduled to open on New York's Fifth Avenue in fall 2011, followed by a megastore on New York's 34th Street, with global flagship stores also scheduled for Seoul and Taipei, and a megastore planned for Bangkok.

■ Global Brands

The Global Brands segment generated a year-on-year increase of 1.2% in sales, which rose to ¥ 63.7bln in the six months through February 2011. Operating income rose 10.3% to ¥ 5.1bln during the same period. The Theory operation continued to both Japan and the United States with operating income posting both a strong year-on-year gain, outpacing our initial estimate. Same-store sales at our French women's fashion label Comptoir des Cotonniers contracted marginally in the first half with operating income falling slightly short of target and slightly below the previous year's level. Sales at our French lingerie brand Princesse tam.tam contracted as the wholesale arm of the business was scaled back, with the decline in operating income generally in line with expectations. Business expanded favorably at our low-priced g.u. casual brand operation in the first half with operating income declining as the operation absorbed costs associated with the October 2010 opening of the Shinsaibashi flagship store.

Our forecasts for the Global Brands segment for the full business year through August 2011 remain unchanged with sales expected to contract 0.2% year on year to ¥ 125.0bln and operating income to increase 8.3% to ¥ 8.5bln.

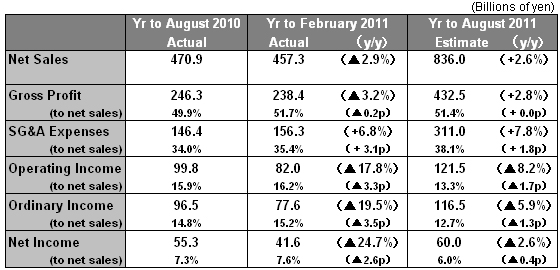

■ Consolidated Forecasts for Fiscal 2011 Revised

Our consolidated estimates for the fiscal year through August 2011 now stand as follows: net sales are expected to rise 2.6% year on year to ¥ 836.0bln; operating income is forecast to decline 8.2% to ¥ 121.5bln; ordinary income is seen contracting 5.9% to ¥ 116.5bln; and, net income is expected to shrink 2.6% to ¥ 60.0bln. Compared to our January estimates, these new forecasts incorporate a downward revision of ¥ 10.0bln for consolidated sales, an upward revision of ¥ 8.0bln for operating income and an upward revision of ¥ 9.0bln for net income.

Given the larger-than-forecast rise in net income in the six months through February 2011, we have decided to increase our interim dividend by 10 yen from 85 yen to 95 yen per share. Combined with our estimated 85-yen year-end dividend, this will generate a higher full-year dividend of 180 yen per share.

Fiscal 2011 Forecasts by Group Operation