Last Updated: 2010.10.08

Results Summary for Year to August 2010

FAST RETAILING CO., LTD.![]() ( 30KB )

( 30KB )

to Japanese page

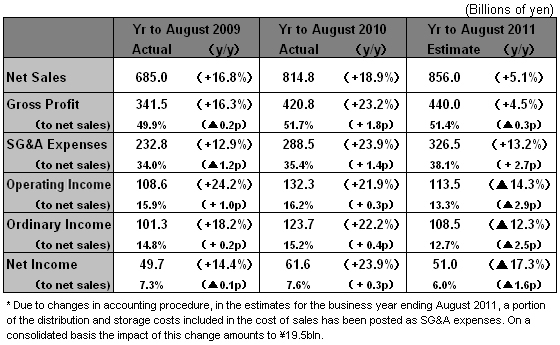

Consolidated results

【Summary】 Summary:FR Achieves Gains in Sales and Operating Income for Year to August 2010

FAST RETAILING CO., LTD. achieved double-digit gains in both consolidated sales and operating income for the business year through August 2010. While operating income enjoyed significant gains in the first half (September 2009-February 2010), operating income fell in the second half (March-August 2010) year on year.

Our mainstay UNIQLO Japan operation posted considerable gains in both sales and operating income in the first half thanks to strong sales of our hit HEATTECH line and other new products. However, operating income at UNIQLO Japan fell in the second half as same-store sales shrank and gross margin tipped lower. This was due to a number of factors, including unseasonably cool temperatures in early spring, delayed demand for fall clothing resulting from an August heat wave and shortages in inventory of staple UNIQLO core items.

Our current estimate is for a continued drop in income at UNIQLO Japan during the first six months of fiscal 2011 to February 2011, followed by a pick-up in sales and operating income in the second half through August 2011. For the full year to August 2011, we estimate operating income will contract as the gross profit margin falls, with the second-half rebound failing to offset the first-half contraction. We are actively moving ahead with our global flagship strategy having opened our fifth global flagship store, the UNIQLO Shinsaibashi Store, in the Shinsaibashi commercial district of Osaka, Western Japan on October 1, 2010.

Operating income at UNIQLO International rose nearly fourfold in the year to August 2010. We will be looking to continue this favorable expansion during the current business year, to achieve our estimate of a 33% increase in operating income for the year to August 2011. We were able to further enhance UNIQLO's brand image worldwide during the year to August 2010 through further successful openings of global flagship stores in Paris and Shanghai. The +J collection, developed in conjunction with fashion designer Ms. Jil Sander, also helped to boost UNIQLO brand awareness.

We expect to expand UNIQLO International's sales in fiscal 2011 to ¥ 100.0bln, and operating income to ¥ 8.5bln. We plan to expand into new locations, opening stores s in Taiwan in October and Malaysia in November 2010. We are also pressing ahead with preparations to open in fall 2011 a new US global flagship store on New York's Fifth Avenue.

Our Global Brands segment recorded a significant gain in operating income for the year through August 2010 thanks to expanding income at our Theory operation. We expect Theory to continue to post favorable results for the year to August 2011. We predict favorable growth in both sales and operating income for the overall segment, with continued growth at Theory, and multiple openings of new stores for our low-priced g.u. casual brand, which has been repositioned in the Global Brands segment from fiscal 2011.

■ UNIQLO Japan

UNIQLO Japan, which constituted 74% of FR's consolidated net sales for the year to August 2010, achieved considerable increases in both sales and operating income for the year. UNIQLO Japan net sales rose 12.5% year on year to ¥ 605.5bln, and operating income increased by 17.0% year on year to ¥ 129.5bln. This was due primarily to extremely strong gains in sales and income in the first half, through February 2010, with unit sales of HEATTECH items during the fall/winter season soaring from 20 million units to 47 million units year on year. New fall/winter products, such as our premium down ultra-light jacket line, also sold well over the same period. However, same-store sales contracted in the second half, from March through August 2010, due to unseasonably cool temperatures in early spring impacting sales, the August heat wave delaying demand and sales for fall clothing and shortages in inventory of staple UNIQLO core items. As a result, operating income at UNIQLO Japan fell year on year in the second half to August 2010.

New store openings proceeded favorably throughout the business year, with 78 new directly-operated stores opening and 40 stores closing in a scrap-and-build drive to expand floor space per store. As a result, store numbers expanded by a net 38 stores, bringing the total for Japan to 808 stores through August 2010 (including 20 franchise stores). Store floor space at directly-operated stores expanded 10.1% year on year.

For the year ending August 2011, we estimate overall net sales at UNIQLO Japan will expand 2.1% year on year to ¥ 628.0bln, and operating income will decrease 17.4% year on year to ¥ 105.5bln. We predict a 9.8% year-on-year fall in same-store sales during the first six months, as stores struggle to match the strong first-half results of fiscal 2010, with revenue also expected to suffer from the delay in fall clothing sales, followed by a 3.0% rise in same-store sales in the second half. However, we do not expect the rise in second-half operating income to offset the contraction in the first half, as the gross profit margin falls and the SG&A expense to sales ratio increases. Therefore, we estimate operating income will contract for the business year ending in August 2011.

Regarding new store openings during fiscal 2011, we expect to open 60 new directly-operated stores and close 24, for a net increase of 36. We opened our fifth global flagship store, the UNIQLO Shinsaibashi Store, in the Shinsaibashi commercial district of Osaka, Western Japan on October 1, 2010. We plan to open more large-format stores in prime urban locations, including department stores, throughout the business year.

■ UNIQLO International

Operating income expanded nearly fourfold at our UNIQLO International segment during the year through August 2010. Net sales rose 92.6% year on year to ¥ 72.7bln, and operating income rose 293.0% to ¥ 6.3bln. During the year, we opened 44 new stores outside of Japan, expanding the UNIQLO International network to 136 stores as of the end of August 2010. Of this total, 118 stores are located in Asia. Our business expansion in Asia has been particularly prominent, and we are accelerating new store openings in China and South Korea. Our business in the Asian region continued to perform well throughout the business year, with consistent double-digit gains in same-store sales in every Asian market. Our fourth global flagship store, the Shanghai West Nanjing Road Store, opened in May 2010 and has proven a success.

Profitability also improved at UNIQLO operations in the US and Europe. In the US, sales remain extremely buoyant at our SOHO New York global flagship store. We continue to expand our operations in the US. In May 2010, we signed a lease for the property that will be home to our future global flagship store on New York's Fifth Avenue. In Europe, we are expanding our operational base on the continent following the opening of our Paris global flagship, the Paris Opera Store, in October 2009. The success of the Paris flagship store, and the launch of the +J collection in collaboration with designer Ms. Jil Sander dramatically raised the profile of the UNIQLO brand in Europe. This also helped to boost sales per store and profitability in the UK. In addition, we also opened our first store in Russia in April 2010.

We predict that UNIQLO International sales will reach ¥ 100.0bln, an increase of 37.4% year on year, in the year through August 2011. We estimate the segment's operating income will reach ¥ 8.5bln, for a rise of 33.2% year on year, even after absorbing the pre-opening costs of the New York Fifth Avenue global flagship store. In our aim to become the overwhelming number one in Asia, we plan to actively continue opening new stores with an emphasis on the Chinese market, where growth is most prominent. We plan to expand our UNIQLO International store network to 180 stores over the year to August 2011, including 23 new stores in China. This expansion includes launching in locations in new markets, with our first store opened in Taiwan in October 2010, and to open in Malaysia in November 2010.

■ Japan Apparel

Net sales at our Japan Apparel segment fell 12.5% year on year to ¥ 45.0bln during the year to August 2010, with operating losses expanding to ¥ 1.5bln. While our low-priced g.u. casual wear brand recorded large increases in sales and operating income, our footwear operation, and women's fashion label CABIN both posted larger losses. The expansion of g.u. stores proceeded smoothly with 43 new stores opening during the business year, bringing the total to 115 stores through August 2010. Same-store sales at our footwear operation continued to fall, with operating losses expanding. In April 2010, we merged our footwear operation with UNIQLO CO., LTD., and from September merged our specialty stores under the CANDISH brand. CABIN has been hit by the consumption downturn in the fashion apparel industry and the continued difficult business environment. As a result, we decided to amalgamate CABIN CO., LTD. with LINK THEORY JAPAN CO., LTD. effective September 2010. All brands currently operated by CABIN, such as enraciné and ZAZIE, will be discontinued in early 2011.

■ Global Brands

In the year to August 2010, net sales at our Global Brands segment rose 61.6% year on year to ¥ 89.9bln, and operating income rose 104.0% to ¥ 7.4bln. Our US Theory operation posted a strong gains in sales and operating income. Same-store sales at directly-operated stores enjoyed robust increases, and the operation's wholesale section performed well. The Theory operation in Japan also posted a strong gain in operating income, as sales remained favorable and profitability was significantly buoyed by lower procurements costs resulting from the stronger yen. Our French-based women's fashion label, COMPTOIR DES COTONNIERS, recorded flat operating income, in line with our projection. Our French-based lingerie label, PRINCESSE TAM.TAM, posted a fall in both sales and income as the operation's wholesale business was further reduced.

For the year to August 2011, we estimate net sales at the Global Brands segment will reach ¥ 125.0bln, and operating income ¥ 8.5bln. We expect the overall Theory operation to generate increased income, with the US Theory operation projected to continue to perform well. We expect increased sales and operating income for the year at COMPTOIR DES COTONNIERS. While the continued reduction in PRINCESSE TAM.TAM's wholesale business will likely reduce sales, we estimate cost-cutting efforts will generate increased income for the year. Beginning in fiscal 2011, g.u. will be included in our Global Brands operational segment and g.u. sales and operating income are both expected to increase during the business year spurred by the significant number of new stores coming on line.

■ Business estimates for full year to August 2011

We estimate FR consolidated net sales in the year to August 2011 will rise 5.1% year on year to ¥ 856.0bln, operating income will fall 14.3% year on year to ¥ 113.5bln, ordinary income will fall 12.3% year on year to ¥ 108.5bln, and net income will fall 17.3% year on year to ¥ 51.0bln. This would represent earnings per share of 501.06 yen. We predict an annual dividend per share of 170 yen: an 85-yen interim dividend and an 85-yen year-end dividend.