Last Updated: 2010.04.08

Results summary for the six months to February 2010

FAST RETAILING CO., LTD.![]() ( 24KB )

( 24KB )

to Japanese page

Consolidated results

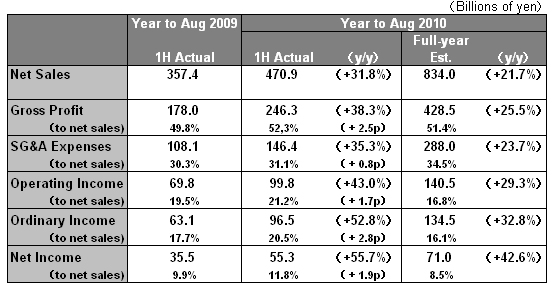

【Summary】 Interim first-half operating income was up 43.0% year on year and the full year operating income forecast was revised upward to ¥ 140.5bln (+29.3%) with a ¥ 70 annual dividend increase expected for a total dividend of ¥ 230.

FAST RETAILING achieved a significant increase in both revenue and income in the six months from September 2009 to February 2010 with consolidated net sales totaling ¥ 470.9bln (up 31.8% y/y), operating income totaling ¥ 99.8bln (up 43.0% y/y) and net income ¥ 55.3bln (up 55.7% y/y). Underlying this strong performance were consolidated gains in both revenue and profit at our mainstay UNIQLO Japan operations and also at UNIQLO international operations.

UNIQLO Japan's same-store sales increased by a strong 13.1% year on year. Buoyed both by strong new product lines and increased sales of HEATTECH products, customer traffic also jumped considerably spurred by media attention focused on the success of the Paris global flagship store and the launch of the +J collection with fashion designer Jil Sander. In addition, improved gross margins and an improved cost ratio contributed to the significant gains in profit. UNIQLO international also generated a significant increase in both revenue and profit fueled by the successful launch of new stores in Asia and strong performance from global flagship stores. In the Japan Apparel segment, although G.U. continued to see increases in revenue and profit, our footwear operations and CABIN ended in the red. Both revenue and income rose at our Global Brands segment with the newly consolidated Theory making a significant contribution. Sales for Theory and COMPTOIR DES COTONNIERS in Japan, Europe and the U.S. have bottomed out and profitability is in an uptrend.

We have revised upward our most recent consolidated business forecasts, which were announced on January 8, for the year to August 2010. We now predict consolidated net sales for the full year of ¥ 834.0bln (up 21.7% y/y), operating income of ¥ 140.5bln (up 29.3% y/y) and ordinary income of ¥ 134.5bln (up 32.8% y/y). We forecast earnings per share of ¥ 697.55. At our April 8 board meeting we decided to increase the interim dividend payout from ¥ 100 to ¥ 115. The annual dividend per share has been revised upward from ¥ 200 to ¥ 230, ¥ 70 higher than the year before.

■ UNIQLO Japan

UNIQLO Japan accounts for 76% of consolidated net sales and the segment performed extremely well in the sixth months through February 2010 generating a large increase in both revenue and income. Net sales for the six-month period totaled ¥ 360.2bln (up 21.6% y/y) and operating income totaled ¥ 93.7bln (up 36.3% y/y). Compared to the most recent forecasts announced on January 8, net sales at UNIQLO Japan and also operating income outperformed, both beating the forecast by ¥ 7.2bln. Same-store sales in the sixth-month period increased 13.1% year on year. New products for the fall and winter seasons, such as the synthetic leather jacket and premium down ultra light jacket lines, contributed to this jump in sales. The successful opening of the Paris global flagship store and the global launch of the +J collection, the grand opening of our expanded, refurbished Ginza store and FAST RETAILING's 60th anniversary campaign in November helped greatly to boost customer traffic. Furthermore, the increase in domestic sales of HEATTECH, from 27 million pieces last year to 47 million pieces this year, contributed to increased revenue. As of the end of February 2010, our directly owned stores increased in number to 771 (791 including franchised stores), up 25 year on year, and this increase also contributed to the revenue gains.

On the profit front, gross margin improved 2.3 points and the SG&A to net sales ratio also improved 0.6 points year on year. The improvement in gross margin can be attributed to strong sales of new fall and winter items, the resulting reduction in discount sales and the continued strong sales of the ever-popular HEATTECH line, which sold out by the middle of January. Meanwhile, inventory at UNIQLO Japan at the end of February 2010 has increased to ¥ 50.1 billion, up ¥ 8.6 billion year on year. This is due to the 25-store increase, the increase of large-format stores and early orders of spring and summer items.

So far, in the second six months of the fiscal year, same-store sales for March decreased significantly, falling 16.4% year on year. We believe the decrease to be due primarily to unseasonably cold weather. In the first week of April 2010, same-store sales were up year on year and nearly in line with our forecast. From April onward, we will further expand our sales of functional innerwear, such as SILKY DRY, and SARAFINE. We will also launch new women's products and a new "Relax and Comfort" product group while strengthening UNIQLO's core product groups, including UT (printed T-shirts) and the +J line. By doing so, we forecast our same-store sales for the last six months of the fiscal year to be on par with those of the year before.

We have revised upward our full-year consolidated business forecast to August 2010 to reflect the upturn in business in the first six months of this year. We now expect net sales of ¥ 624.0bln (up 15.9% y/y) and operating income of ¥ 137.5bln (up 24.1% y/y). By proceeding to open large-format stores, the number of our directly owned stores as of the end of February 2010 is expected to be 789 (102 large-format stores), up 39 year on year.

■ UNIQLO International

Our UNIQLO International operations outperformed with significant gains in both revenue and income by doubling revenue and more than tripling operating income with net sales totaling ¥ 40.5bln (up 117.0% y/y) and operating income totaling ¥ 5.8bln (up 267.2% y/y). In the six months to February 2010, we were able to move into the black in all countries achieving a level surpassing our initial forecast. Especially in Asian markets, such as those of China, Hong Kong, Korea and Singapore, we were able to achieve significant increases in revenue and income by adding 32 stores and achieving double-digit increases in same-store sales. In the U.S. and Europe, our brand recognition has increased with the launch of +J and the success of our Paris flagship store. As a result, same-store sales have increased in a range of 30% to 50% year on year.

We have revised upward our forecast for UNIQLO International for the year to August 2010, increasing our net sales forecast to ¥ 74.0bln (up 95.8% y/y) and operating income to ¥ 7.5bln (up 363.0% y/y). Our international business operations are set to expand, with our first Russian store in Moscow off to a good start after opening its doors on April 2, and the opening of our Shanghai global flagship store scheduled for May 15.

■ Japan Apparel

Japan Apparel Operations performed almost in line with the initial forecast with net sales totaling ¥ 24.2bln (down 0.8% y/y) and operating income minus ¥ 1.0bln during the first six months to February 2010. After it's successful "990 yen jeans" campaign, the G.U. business continued to release a series of affordably priced items, including "490 yen T-shirts," and is establishing a new business model in the low-priced market segment. In the first six months to February 2010, G.U.'s performance exceeded our initial forecast by recording both increases in revenue and income. In our footwear operations, losses increased due to store-closing sales at FOOTPARK stores. Affected by deteriorating demand in the overall fashion apparel industry, same-store sales for CABIN continued to fall, driving performance into the red and yielding results below our forecast. Our forecast remains unchanged, with the Japan Apparel segment expected to generate net sales of ¥ 47.0bln (down 8.8% y/y) and an operating loss of ¥ 0.7bln.

■ Global Brands

Our Global Brand Operations produced net sales of \45.5bln (up 168.7% y/y) and operating income of \4.3bln (up 76.4% y/y) in the first six months to February 2010. We achieved significant increase in revenue and income following the consolidation of Theory, effective March 1, 2009. Theory's same-store sales have bottomed out in both Japan and the U.S. In terms of profit, a stronger yen helped to reduce procurement costs, consequently boosting the profits of Theory operations in Japan.

The fall and winter collection of COMPTOIR DES COTONNIER was extremely well received, fueling a rise in revenue and a rebound in same-store sales. PRINCESSE TAM.TAM is scaling back the size of its wholesale business. As a result of these developments, we have revised upward slightly the consolidated business forecast of Global Brand Operations to net sales of ¥ 86.0bln (up 54.7% y/y) and operating income of ¥ 5.5bln (up 50.0% y/y).

■ Revisions to consolidated business forecast for the year to August 2010

Since our most recent forecast, announced on January 8, we have revised upward our consolidated business forecast for the year to August 2010 with net sales of ¥ 834.0bln (up 21.7% y/y), an operating income of ¥ 140.5bln (up 29.3% y/y) and with ordinary income of ¥ 134.5bln (up 32.8% y/y). Earnings per share are expected to be ¥ 697.55. On our dividend policy, we decided to increase the interim dividend payment per share from the initial ¥ 100 to ¥ 115 at the executive board meeting, held on April 8. Our year-end dividend is also revised upward from initial ¥ 100 to ¥ 115 and the annual dividend is planned to increase from the initial ¥ 200 to ¥ 230, offering an increase of ¥ 70 from last year.