Last Updated: 2010.01.08

Results summary three months to November 2009

FAST RETAILING CO., LTD.![]() ( 127KB )

( 127KB )

to Japanese page

Consolidated results

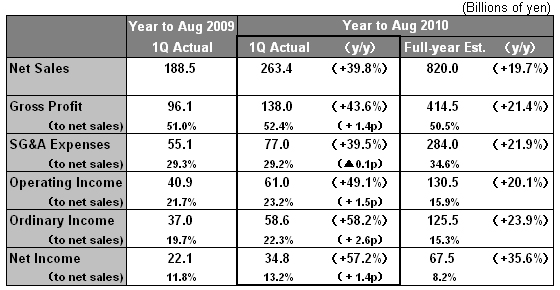

【Summary】 Three months to November 2009: Net sales up 39.8%, OP rises 49.1%

Both revenue and income increased significantly at FAST RETAILING during the first quarter from September to November 2009. Net sales rose 39.8% year on year to ¥263.4bln, operating income rose 49.1% year on year to ¥61.0bln, and net income increased by 57.2% to ¥34.8bln. Underlying this strong performance were considerable gains in both revenue and profit at our mainstay UNIQLO Japan operation and also expanded profits at UNIQLO International.

UNIQLO Japan same store sales increased by a strong 20.8% year on year, tipping net sales ¥20.0bln and operating income ¥10.0bln above the initial estimate for the quarter. New products including outerwear such as neo-leather jackets proved strong right from the autumn season launch. UNIQLO was often in the news with the opening of the Paris global flagship store, and the launch of the +J collection with fashion design Ms. Sander. This boosted customer numbers considerably during the quarter. Large year-on-year increases in sales of HEATTECH functional wear also contributed to the quarter's strong revenue performance.

UNIQLO International generated a significant increase in revenue over the first quarter with the success of the Paris global flagship store opened October 1 and the launch of the +J collection helping to boost same store sales in each national market. Although GOV RETAILING performed to plan, profit at our Japan Apparel segment fell overall on the back of a downturn in performance at women's fashion developer CABIN. Both revenue and income rose at our Global Brands segment as the newly consolidated theory brand made a strong contribution, and our COMPTOIR DES COTONNIERS brand performed to plan.

We have revised up our initial consolidated business estimates for the year to August 2010. We now predict consolidated net sales for the full year of ¥820.0bln (up 19.7% y/y), operating income of ¥130.5bln (up 20.1% y/y) and ordinary income of ¥125.5bln (up 23.9% y/y). We forecast a profit per share of 663.16 yen. We are scheduling an annual dividend per share of 200 yen that includes an interim dividend payout of 100 yen.

■ UNIQLO Japan

We achieved significant gains in both revenue and profit at our mainstay UNIQLO Japan operation which accounts for approximately 80% of consolidated net sales. Net sales for the first quarter rose 30.2% year on year to ¥204.9bln and operating income rose 42.9% to ¥56.2bln. Compared to our initial target, net sales outperformed by ¥20.0bln and operating income by ¥10.0bln. We achieved extremely strong same store sales growth of 20.8% year on year during the first quarter. New products including outerwear such as neo-leather jackets proved strong from the autumn season launch. UNIQLO was often in the news with the opening of the Paris global flagship store, the launch of the +J collection with fashion design Ms. Sander, and the grand opening of our expanded, refurbished Ginza store - all of which helped boost customer numbers during the quarter. Then, thanks to our campaign to mark FAST RETAILING's 60th anniversary, we were even able to further extend sales in November, a month which had already seen a large increase in year-on-year sales last year. An increase in sales of HEATTECH functional wear also contributed to the strong performance at UNIQLO Japan with the number of units sold rising considerably year on year.

On the profit front, gross margin improved 1.1 points, and the SG&A to net sales ratio also improved 1.3 points year on year. The improvement in gross margin can be attributed to several factors including strong sales of new Autumn items early on in the season, strong sales of HEATTECH items, and an early launch of new seasonal goods after bringing forward the offloading of summer inventory within the previous business year to August 2009. Strong sales also generated improvement in business cost ratios.

The strong sales trend continued in December with sales of HEATTECH items and down jackets buoyant, generating same store sales growth of 11.5% year on year. However, we expect some shortages of winter stock in January, and therefore we included only the strong first quarter sales performance from September through November upon revising our full-year forcasts for UNIQLO Japan. As a result, we have revised up our prediction for net sales for the year through August 2010 to ¥615.0bln (up 14.3% y/y) and operating income to ¥130.0bln (up 17.4% y/y).

New store openings proceeded as planned in the first quarter adding a net 25 stores to bring the total number of direct-run stores to 772 at end November 2009 (792 stores including franchises). At end November 2009, we had 81 large-format stores of 1650sqm or more.

■ Japan Apparel

Overall net sales at the Japan Apparel operation during the three months from September to November 2009 rose 6.2% year on year to ¥14.4bln, while operating income shrank year on year to near zero. GOV RETAILING performed to plan, but a downturn at CABIN dragged the overall Japan Apparel segment below our initial estimate. Sales at our low-cost casual g.u. brand took off following the launch of the ¥990 Jeans series in March 2009. A continued strong trend saw g.u. sales exceed initial forecast in the first quarter generating significant gains in both revenue and income. Losses increased somewhat at our footwear operation with closing down sales at FOOTPARK stores continuing to impact. Performance at CABIN dipped below target with same store sales continuing to fall below previous year levels in a generally depressed fashion apparel industry environment.

We have revised down our forecasts for the Japan Apparel segment for the year to August 2010 owing to the continued decline in same store sales at CABIN. We now predict the Japan Apparel segment will generate net sales of ¥47.0bln (down 8.8% y/y) and an operating loss of ¥0.7bln.

■ Global Brands

Our Global Brands operation fueled a 189.4% year-on-year increase in net sales to ¥22.8bln and a 167.4% increase in operating income to ¥2.6bln. The new incorporation of theory as a consolidated subsidiary contributed greatly to this large increase in both revenue and income. Sales from the theory operation came in on plan, but the operation outperformed on profitability thanks to stronger control over inventory, and lower procurement costs as the yen strengthened. COMPTOIR DES COTONNIERS and PRINCESSE TAM.TAM performed as expected. Our full-year forecast for the Global Brands segment remains unchanged from the initial estimate of net sales ¥85.0bln (up 52.9% y/y) and operating income of ¥4.5bln (up 2.7% y/y).

■ Revisions to consolidated business forecasts for year to August 2010

Having revised upwards our full-year forecasts at UNIQLO Japan and UNIQLO International and revised down our Japan Apparel segment, we have also made some revisions to our consolidated business forecasts for the full year to August 2010. We have revised up the full-year consolidated net sales forecast from ¥798.0bln to ¥820.0bln (up 19.7% y/y), the operating income forecast from ¥120.0bln to 130.5bln (up 20.1% y/y), and the ordinary income estimate from ¥115.0bln to ¥125.5bln (23.9% y/y). Consequently, we now envisage profit per share of 663.16 yen, and we are scheduling an annual dividend per share of 200 yen including a 100-yen per share interim payment.