Last Updated: 2009.04.09

Results for six months to February 2009

FAST RETAILING CO., LTD.![]() ( 27KB )

( 27KB )

to Japanese page

Consolidated results

【Summary】 FAST RETAILING revenue and income soar in the six months to Feb 2009

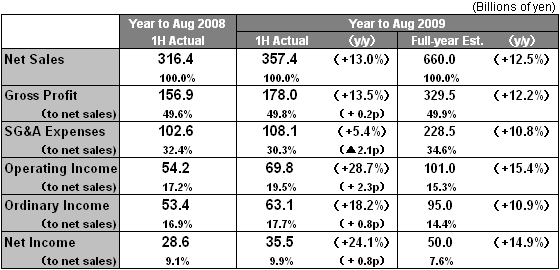

FAST RETAILING achieved a significant increase in both revenue and income in the six months from September 2008 through February 2009 with consolidated net sales totaling ¥ 357.4bln (up 13.0% y/y), operating income totaling ¥ 69.8bln (up 28.7% y/y) and net income totaling ¥ 35.5bln (up 24.1% y/y).

At our mainstay UNIQLO Japan operation, existing store revenue rose an impressive 12.9% generating a large increase in operating income. UNIQLO International produced a higher than anticipated operating income for the first half as business continued to expand favorably in the Asian region including China, Hong Kong and South Korea, and our UNIQLO operation in the UK managed to reduce its operating loss. Although one component, GOV RETAILING, did perform to target, the Japan Apparel segment overall suffered an operating loss as sales at women's fashion chain developer CABIN fell short of target generating an operating loss there. Our Global Brands segment suffered a significant reduction in both revenue and income on the back of the slowdown in the European economy and the weakening Euro.

We have made various revisions to our consolidated business estimates for the full year to August 2009. We have revised up estimates for our UNIQLO Japan and UNIQLO International operations. We have revised down estimates for the Japan Apparel operation and have also had to take into account the additional impact of the consolidation of LINK THEORY HOLDINGS CO., LTD. as an FAST RETAILING subsidiary from the second half. Taken overall, our full-year estimate for consolidated net sales has been revised up to ¥ 660.0bln (up 12.5% y/y), and the estimate for operating income revised up to ¥ 101.0bln (up 15.4% y/y). On the other hand, we suffered an exchange rate loss of ¥ 5.3bln over the six months to February, and we also incurred an equity-method investment loss of ¥ 1.3bln. That led us to maintain our initial full-year estimate for ordinary income at ¥ 95.0bln (up 10.9% y/y), and our net income forecast at ¥ 50.0bln (up 14.9% y/y). We are predicting a profit per share of ¥ 490.92. Our dividend policy remains unchanged. We determined an interim dividend payout of 75 yen per share. And there is no change to our original forecast for a 150-yen annual dividend per share payout for the year to end August 2009.

■ UNIQLO Japan

UNIQLO Japan accounts for approximately 80% of consolidated net sales, and the segment performed extremely well in the first half to February 2009 generating a large increase in both revenue and income. Net sales for the first half at UNIQLO Japan totaled ¥ 296.2bln (up 17.0% y/y), and operating income totaled ¥ 68.8bln (up 36.1% y/y). Compared to the most recent forecast announced January 9, net sales at UNIQLO Japan outperformed by approximately ¥ 11.2bln and operating income by approximately ¥ 4.8bln. One of the key factors underlying this strong performance was the significant increase in existing store revenue, up 12.9% year on year. We continued to develop aggressive sales promotions and advertising campaigns in the second quarter as we had done in the first. And this resulted in a greater of customer visits to our stores. We conducted two more campaigns over the six-month period than we did in the same period last year, namely the Micro Fleece Room Set campaign in December 2008 and the PARKA campaign in February 2009.

Two key factors underlying the strong leap in income at UNIQLO Japan in the first half to February 2009 were the 0.9 points improvement in gross margin, and the 2.4 points improvement in cost ratios. The improvement in gross margin can be explained by our continued success in controlling discount sales and the early launch of autumn, winter and spring ranges. The segment's overall cost to net sales ratio improved as personnel ratios improved on the back of operational efficiency gains particularly at our large-format stores. Another contributing factor here was the improvement in the store rent ratios at roadside stores that enjoy fixed rents but also generated higher sales over the period.

We have revised up our full-year estimates for UNIQLO Japan. We now expect net sales of ¥ 521.0bln (up 12.7% y/y) and operating income of ¥ 105.0bln (up 21.5% y/y). To reflect the upturn in business in the first six months to February, we have revised up our estimated increase in existing store sales in the second half through August from 1.0% to 2.3%.

New store openings have proceeded to plan with a year-on-year net increase of 8 stores producing a total 746 stores at the end of February 2009 (766 including franchises). We are continuing our strategy to open large-format stores with 1600sqm in sales space. We are planning to open 21 large-format stores over the full year to August 2009 bringing the total number of such stores to 71 by end August. The Japanese consumer environment is predicted to worsen further going forward. And against that background, we intend to continue to develop revolutionary, unique products, and to further strengthen our advertising campaigns and other sales promotion activities.

■ UNIQLO International

Net sales at UNIQLO International totaled ¥ 18.6bln (up 17.9% y/y) in the six months to February 2009. The first-half operating loss at UNIQLO International shrank by ¥ 0.9bln year on year to ¥ 1.6bln thanks to the favorable expansion of UNIQLO operations in the Asian region of China, Hong Kong and South Korea, and a reduction in losses at our UNIQLO operation in the UK.

Taking the exchange rate impact into account, we have revised down our full-year estimate for net sales at UNIQLO International by ¥4.0bln to ¥37.0bln (up 26.1% y/y). However on the other hand, we are now predicting a full-year operating income of ¥1.5bln to reflect the upswing in the first half. That is ¥1.2bln better than the ¥0.3bln generated in the previous year. We will continue to open new stores aggressively in the Asian region, with store numbers there expected to double to 76 by end August 2009. We are also set to open our global flagship store in L'Opera, Paris in Autumn 2009. .

■ Japan Apparel

Net sales at the Japan Apparel segment in the six months to February 2009 totaled ¥ 24.4bln (up 7.3% y/y) and operating income was largely flat at ¥ 1.1bln. GOV RETAILING performed to expectations. However, women's fashion retailer CABIN fell short of its target on sales and suffered an operating loss over the six months to February 2009. That, in turn, tipped the Japan Apparel segment overall into an operating loss for the period. Existing store sales at G.U. improved with business proceeding favorably and profitability improving. Net sales at our footwear retailers FOOTPARK and VIEW fell slightly short of target.

We have revised down our full-year estimates for the Japan Apparel segment compared to the most recent forecast issued January 9. We are now predicting net sales of ¥ 48.0bln (down 3.0% y/y), and an operating loss of ¥ 2.0bln (compared to an operating loss of ¥ 2.8bln in the previous year). This downward revision is largely a reaction to sluggish conditions at CABIN. CABIN is planning to boost efficiency by consolidating its products around the two mainstay ZAZIE and enraciné brands. Following the launch of its ¥ 990 Jeans, G.U. is planning to introduce more and more new low-priced items into it stores. We are aiming to boost profitability at our ONEZONE and VIEW footwear operations by further strengthening product development of in-house designed shoes and closing down unprofitable stores.

■ Global Brands

Our Global Brands operation produced net sales of ¥ 16.0bln (down 29.6% y/y) and an operating income of ¥ 2.4bln (down 52.7% y/y) in the six months to February 2009. Given the slowdown in the European economy and the impact of exchange rate movements at the time, we had already revised down our expectations of performance on January 9 when we announced the first quarter performance through November 2008. And the second quarter (the three months to February 2009) generated a performance in line with those reduced expectations. In fact, if you view the performance in the six maonths to February 2009 in Euro terms, then net sales actually rose by a marginal amount and operating income fell by approximately 30% year on year.

LINK THEORY HOLDINGS CO., LTD. is to become an FAST RETAILING consolidated subsidiary from the third quarter beginning March 2009 based as a result of the take over bid concluded on March 12. This will influence the full-year performance of the Global Brands operation and so we have revised our estimates for the segment for the year ending August 2009. We now expect net sales of ¥ 51.3bln (down 17.3% y/y), and operating income of ¥ 2.4bln (down 69.1% y/y). Finally, we have generated goodwill in relation to the additional LINK THEORY HOLDINGS stock purchase of ¥ 14.5bln. On a depreciation period of six years, we foresee the increased goodwill amortization having a ¥ 1.2bln impact on consolidated business performance for the year to end August 2009.

■ Revisions to consolidated business estimates for year to end August 2009

We have made several revisions to our consolidated estimates for the full year to end August 2009. We have revised up expectations for UNIQLO Japan and UNIQLO International. On the other hand, we have revised down our estimates for the Japan Apparel segment. We have also incorporated the expected impact of the new consolidation of our former equity-method affiliate LINK THEORY HOLDINGS as a consolidated subsidiary from the second half onwards.

Bringing all of these elements together, we have revised up our estimates for consolidated net sales for the full year ending August to ¥ 660.0bln (up 12.5% y/y) and operating income to ¥ 101.0bln (up 15.4% y/y). At the same time, we have maintained our original estimate for ordinary income at ¥ 95.0bln (up 10.9% y/y) and net income at ¥ 50.0bln (up 14.9% y/y). This decision takes into account the cumulative exchange rate loss of ¥ 5.3bln suffered in the first half to February and the generation of a ¥ 1.3bln equity-method investment loss.

On our dividend policy, we determined the interim dividend payment at 75 yen per share, and there is no change to our initial forecast of an annual dividend payout of 150 yen per share.