Last Updated: 2008.10.09

Results summary for year to August 2008

FAST RETAILING CO., LTD.![]() ( 22KB )

( 22KB )

to Japanese page

Consolidated results

【Summary】 FR profits leap in the year to August 2008

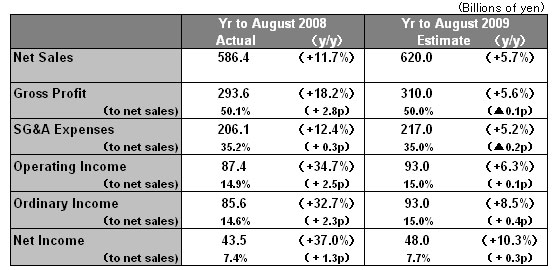

FAST RETAILING CO., LTD. enjoyed an impressive rise in both revenue and profit in the year ending August 31, 2008. Net sales rose 11.7% year on year to ¥ 586.4bln, operating income rose 34.7% year on year to ¥ 87.4bln and net profit rose 37.0% year on year to ¥ 43.5bln.

We enjoyed a very large increase in revenue at our mainstay UNIQLO Japan operation. Our gross profit margin improved on the back of favorable sales and strong control over discounting. Expenses ratio also improved due to business overheads. UNIQLO operations in the Asian region including China, Hong Kong and South Korea continued to expand favorably. In addition, profitability at UNIQLO USA improved winning us the first full business year in the black for UNIQLO International as a whole. CABIN CO., LTD., one of our Japan Apparel subsidiaries achieved an operating profit for the year. However, our Global Brands operation (including brands such as COMPTOIR DES COTONNIERS, and PRINCESSE TAM.TAM) suffered a business correction during the six months from February on account of the worsening European economic climate. We are planning a year-end dividend of 65 yen per share, bringing the full-year dividend per share to 130 yen for the year to August 2008.

For the coming business year through end August 2009, we are forecasting consolidated net sales of ¥ 620.0bln (up 5.7% year on year), operating income of ¥ 93.0bln (up 6.3% year on year), and a profit per share of 471.28 yen. We predict further rises for the year in both revenue and profit based firstly upon an expected continued strong performance at UNIQLO Japan, further growth in profit at UNIQLO International, and a reduction in losses at the Japan Apparel operation. We are planning to increase our dividend for the year ending August 2009 to 150 yen per share including an interim dividend of 75 yen.

■ UNIQLO Japan

Our UNIQLO Japan operation, which constitutes a 79% share of consolidated net sales, enjoyed an 8.9% increase in overall net sales for the year to end August 2008 and an impressive 35.0% year-on-year increase in operating income to ¥ 86.4bln. A favorable 2.9% increase in existing store sales and the net addition of 10 new UNIQLO stores contributed to this strong rise in revenue. The number of UNIQLO stores totaled 740 at the end of August 2008, or 749 stores including franchises. Our gross profit margin improved considerably over the year, rising 3.1 points to 48.5%. We gained a firm control over discounting with all those involved in sales, merchandising and inventory control committed to maximizing profits. Favorable sales throughout the business year reduced the need to offload inventory, and an early launch of new season ranges helped boost our gross profit margin.

We also saw considerable efficiencies gained and savings made on the cost front. We were able to improve our personnel to net sales ratio by 0.5 points thanks to more efficient in-store management, and less time-consuming staff recruitment and training following the introduction of our regional employee system. We successfully boosted customer numbers through our campaign promotions including the Bottoms Campaign and the Bra Top Campaign while at the same time shaving 0.3 point off of our advertising and promotion costs to net sales ratio.

We expect to open large-scale stores (floor space around 1,600sqm) during the year to August 2009. Our plan is to open 24 new large-scale stores and boost total UNIQLO Japan stores by 19 by the end of the year. At the same time, we expect to be able to maintain gross profit to net sales ratio roughly at the 2008 business year level by continuing to make flexible production volume adjustments and control discounting. The Japanese consumer environment is likely to prove tough during the coming year. With this in mind, we plan to forge ahead with our development of revolutionary products, and further strengthen our campaign-focused sales prowess. We estimate a rise in both revenue and profit for the year ending August 2009 at UNIQLO Japan with net sales forecast to 4.3% year on year to ¥ 482.0bln, and operating income to rise 4.2% to ¥ 90.0bln.

■ UNIQLO International

Net sales at UNIQLO International rose roughly 72.6% year on year in the year ending August 2008 to ¥ 29.3bln and the overall operation enjoyed its first annual operating profit. The cost of opening our global flagship store on London's Oxford Street in November 2007 generated a loss in the UK. However, net sales expanded favorably in Asia (China, Hong Kong and South Korea) and profitably improved markedly at UNIQLO USA. Sales continued to expand at our New York SOHO global flagship store opened in November 2006, bringing the UNIQLO USA operation close to the black for the year.

During the year to end August 2009 at UNIQLO International, we plan to forge ahead with aggressive store openings in the Asian markets of China, Hong Kong and South Korea. We expect to open our first store in Singapore in Spring 2009, and are looking to double the number of UNIQLO stores in Asia to 78 by the end of the year. With the predicted improvement in profitably at our UK global flagship store, we estimate net sales for UNIQLO International of ¥ 41.0bln and an operating income of ¥ 1.0bln for the year ending August 2009. Autumn 2009 will see the opening of our global flagship store in Opera, central Paris.

■ Japan Apparel

Business results for the Japan Apparel segment came in roughly in line with expectations for the year ending August 2008. Improvements in business operations instituted at CABIN helped generate an operating profit there over the full fiscal year. Our low-cost casual brand G.U. performed as expected. Losses at footwear retailer ONEZONE CORPORATION were reduced as more unprofitable stores were closed. However, fellow footwear retailer VIEWCOMPANY (newly incorporated as a consolidated subsidiary from the second half) under performed.

In the year to August 2009, we expect the Japan Apparel segment to generate net sales of ¥ 50.0bln. This is turn should help us reduce the segment's operating loss to ¥ 1.0bln. We will be looking to boost profits at CABIN by continuing to focus management resources on refining and promoting core brands such as ZAZIE and enracine. Management restructuring of the segment will continue following the merger of G.U., ONEZONE and VIEWCOMPANY business operations and the launch of GOV RETAILING CO., LTD. on September 1, 2008. More concretely, we are looking to reduce unit costs and half the operating loss generated by these three operations. We plan to do this by merging the three companies' formerly separate head office functions and by unifying production and procurement under the FR group umbrella.

■ Global Brands

Our Global Brands operation entered a correction phase in the six months from February through August 2008 as the European economic climate worsened. The segment generated overall net sales of ¥ 43.7bln and an operating income of ¥ 7.7bln. Our COMPTOIR DES COTONNIERS brand missed its target and suffered a fall in profits. PRINCESSE TAM.TAM profits were in line with expectations.

In view of the slowdown in European economic conditions, we are planning to sustain both new store openings and overheads in the year through end August 2009. We expect revenue to increase but income to shrink somewhat over the year for the Global Brands segment as a whole.

■ Business forecasts for the year to August 2009

Consolidated business forecasts for the year to end August 2009 include a 5.7% year-on-year increase in overall net sales to ¥ 620.0bln, a 6.3% rise in operating income to ¥ 93.0bln and a profit per share of 471.28 yen. Further increases in revenue and income at our mainstay UNIQLO Japan operation, an expanded profit at UNIQLO International, and reduced losses at our Japan Apparel operation are all expected to contribute to rising consolidated revenue and rising consolidated income for the year. We are expecting to increase our shareholder dividend to 150 yen per share for the year to end August 2009 that includes an interim dividend of 75 yen.