Last Updated: 2008.04.10

Business results summary for the six months to February 2008

FAST RETAILING CO., LTD.![]() ( 93KB )

( 93KB )

to Japanese page

Consolidated results

【Summary】 Profits leap in first half to February 08

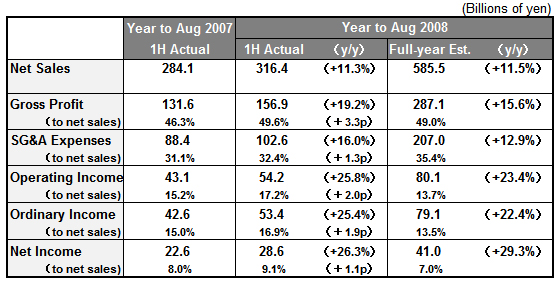

FAST RETAILING achieved a significant increase in profit in its interim results for the six months from September 2007 through February 2008. Net sales increased 11.3% year on year to¥ 316.4bln, operating income increased 25.8% to¥ 54.2bln and net income increased 26.3% to¥ 28.6bln.

We enjoyed an increase in both income and profit at our mainstay UNIQLO Japan operation with net sales and operating income both exceeding forecasts. The strong performance by core winter products such as HEAT TECH inner wear, cashmere sweaters and down jackets greatly reduced the need for later discounting. UNIQLO International posted its first interim profit thanks to firm results from our UNIQLO New York global flagship store, and our continued favorable business expansion in China, Hong Kong and South Korea. While our Japan Apparel operation slightly under performed versus target, our Global Brands operation continues to fulfill expectations.

We have decided to revise up our consolidated forecasts for the full business year to end August 2008 to reflect the significant out performance by UNIQLO Japan in the first half coupled with the revised forecasts for our Japan Apparel segment. Our revised consolidated full year forecasts are for net sales to increase 11.5% year on year to¥ 585.5bln and operating income to increase 23.4% year on year to¥ 80.1bln. We are predicting a profit per share of¥ 403.33. We expect to pay an interim dividend per share of 65 yen with the full year dividend in line with last year at 130 yen.

■ UNIQLO Japan

UNIQLO Japan constitutes 80% of total consolidated interim net sales. Net sales at UNIQLO Japan rose 8.1% year on year during the six months to February 2008 while operating income enjoyed a 24.1% increase. Interim results at UNIQLO Japan outperformed thanks to strong sales and an improvement in gross margins.

Firstly, a 1.5% year-on-year increase in existing store sales helped UNIQLO Japan achieve a higher than expected level of net sales in the first half. The warm weather back in September delayed the launch of our autumn garments dampening customer numbers and income during that month. However, sales of winter garments such as cashmere and fleece products picked up from mid October onwards once the cold weather set in. Our extremely successful promotion of HEAT TECH inner wear and down jackets during the peak winter season of November and December drew in a large number of customers and helped boost income significantly. Our HEAT TECH inner wear products proved a huge hit. Our HEAT TECH inner wear campaign promoting UNIQLO's strengths in the use of "functional materials" was a great success with 20 million HEAT TECH items sold during the winter season.

New store openings proceeded roughly to plan in the first half with an additional 10 large-scale with about 1,600 square meters of sales space stores opening for business during the period. Total store numbers at end February reached 738 stores (757 including franchises). That represents an increase of 25 stores compared to the previous year.

On the income side, the strong performance by our core products reduced the need for discounting during the season. This in turn helped boost gross profit margins beyond expectations, with an improvement of 3.1 points over the previous year. From a cost perspective, our SG&A expense to net sales ratio rose 0.6 point year on year. Personnel costs increased on the back of expanded hires and recruitment of regional employees. Store rents rose as the number of new stores opening in more prestigious shopping centers increased.

We have already revised forecasts for UNIQLO Japan new store openings in the second half to August 2008 due to the delay in the opening of new shopping centers affected by revisions to the Japanese building code. However, we have revised up our expectations for second half existing store sales from an initial increase of 0.2% year on year to a 1.9% increase year on year. This reflects the favorable launch of spring garments and the 8.1% increase in existing store sales already recorded for March. As a result, we have revised up our full year forecasts for UNIQLO Japan to net sales of¥ 459.2bln (up 8.1% year on year), and operating income of¥ 79.2bln (up 23.9% year on year).

■ UNIQLO International

Our UNIQLO International operation turned last year's interim loss into its first interim profit this time. This was due to improved finances at UNIQLO USA where we opened our global flagship store in November 2006, and our continued favorable business expansion in China, Hong Kong and South Korea.

Following the opening of our New York global flagship store, we then opened a global flagship store on London's Oxford Street in November 2007. We are currently planning the opening of our third global flagship store in Paris's Opera in Autumn 2009. We are already enjoying enthusiastic support from Parisian customers at our first French UNIQLO store opened in the Parisian suburb of La Defense in December 2007.

We are predicting overall net sales for UNIQLO International for the full year to end August to increase 76.5% year on year to¥ 30.0bln, and the operating loss to shrink to¥ 0.4bln.

■ Japan Apparel

CABIN CO., LTD. and G.U. CO., LTD. performed in line with expectations during the first half, but the competitive environment for footwear developer ONEZONE CORPORATION was tough and the subsidiary under performed as a result.

Focuses here for the second half include achieving a full year profit at CABIN by boosting efficiency and concentrating on core brands. In addition, we are looking to strengthen the women's fashion component at our low-cost casual G.U. brand and to expand sales per store and boost overall profitability. Consolidated subsidiary VIEWCOMPANY will be incorporated into the FR accounts from the second half following the tender offer completed in February 2008. As a result, we have revised the full-year net sales estimate for our Japan Apparel segment to¥ 50.8bln. Given the slight delay on our initial plan to reduce operating losses and improving performance at ONEZONE and G.U., we have revised our full-year operating loss forecast for the Japan Apparel operation to¥ 2.7bln (The actual operating loss for the previous year to August 2007 was¥ 3.5bln). G.U., ONEZONE and VIEWCOMPANY signed an agreement dated April 1 to begin discussions for a possible reorganization of operations and merger of management functions.

■ Global Brands

Our Global Brands segment performed as expected over the six months to February 2008. Customer visits to our French casual brand developer Comptoir Des Contonniers were adversely impacted by the strikes in Paris, but sales of the brand in other parts of Europe such as Spain and Italy proved strong. French lingerie brand developer PRINCESSE TAM.TAM also continues to perform favorably.

Going forward in the second half, we will continue our aggressive opening of new Comptoir Des Cotonniers stores in other parts of Europe outside France while also looking to consolidate the French market base for our PRINCESSE TAM.TAM operation. We are predicting full year net sales for our Global Brands operation of¥ 43.0bln and operating income of¥ 7.4bln.

■ Business forecasts for the year to August 2008

We have revised up our full year consolidated business forecasts for the FAST RETAILING group given the significant out performance at UNIQLO Japan in the first half, coupled with revised performance expectations at our Japan Apparel operation. We are now forecasting full year overall net sales to increase 11.5% year on year to¥ 585.5bln, and operating income to rise 23.4% year on year to¥ 80.1bln. We predict profit per share to total ¥ 403.33. We are planning an interim dividend of 65 yen and an annual dividend in line with last year at 130 yen.