Last Updated: 2025.07.10

Results Summary for FY2025 Third Quarter (Nine Months to May 2025)

FAST RETAILING CO., LTD.![]() (176KB)

(176KB)

to Japanese page

to Chinese page

FY2025 3Q Highlights

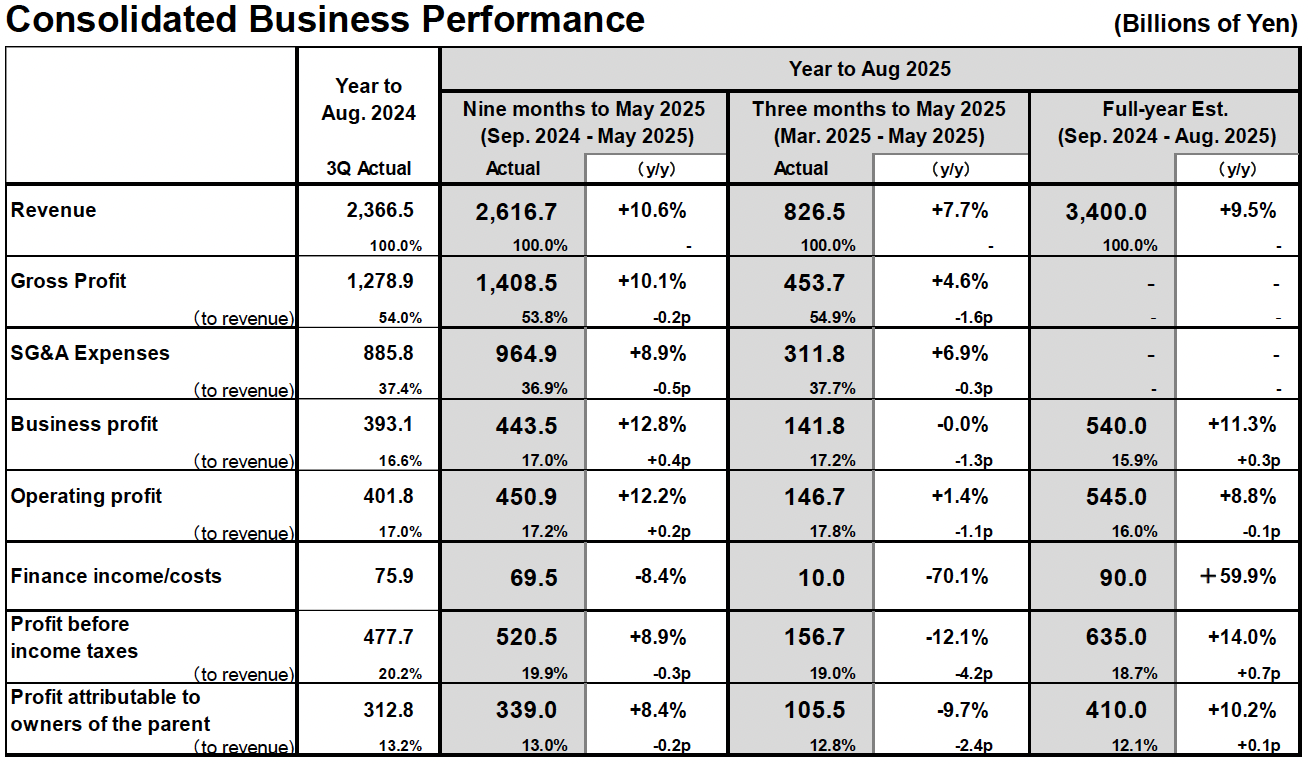

■Consolidated Results: Fast Retailing reports higher revenue and profit for the first nine months, achieves a new record performance

- In the nine months to May 31, 2025, consolidated revenue totaled 2.6167 trillion yen (+10.6% year on year), operating profit rose to 450.9 billion yen (+12.2%), and profit attributable to owners of the parent increased to 339.0 billion yen (+8.4%).

- In the third quarter from March to May 2025, strong performances from UNIQLO operations in Japan, Europe, North America, the Southeast Asia, India & Australia region, and South Korea helped drive overall performance.

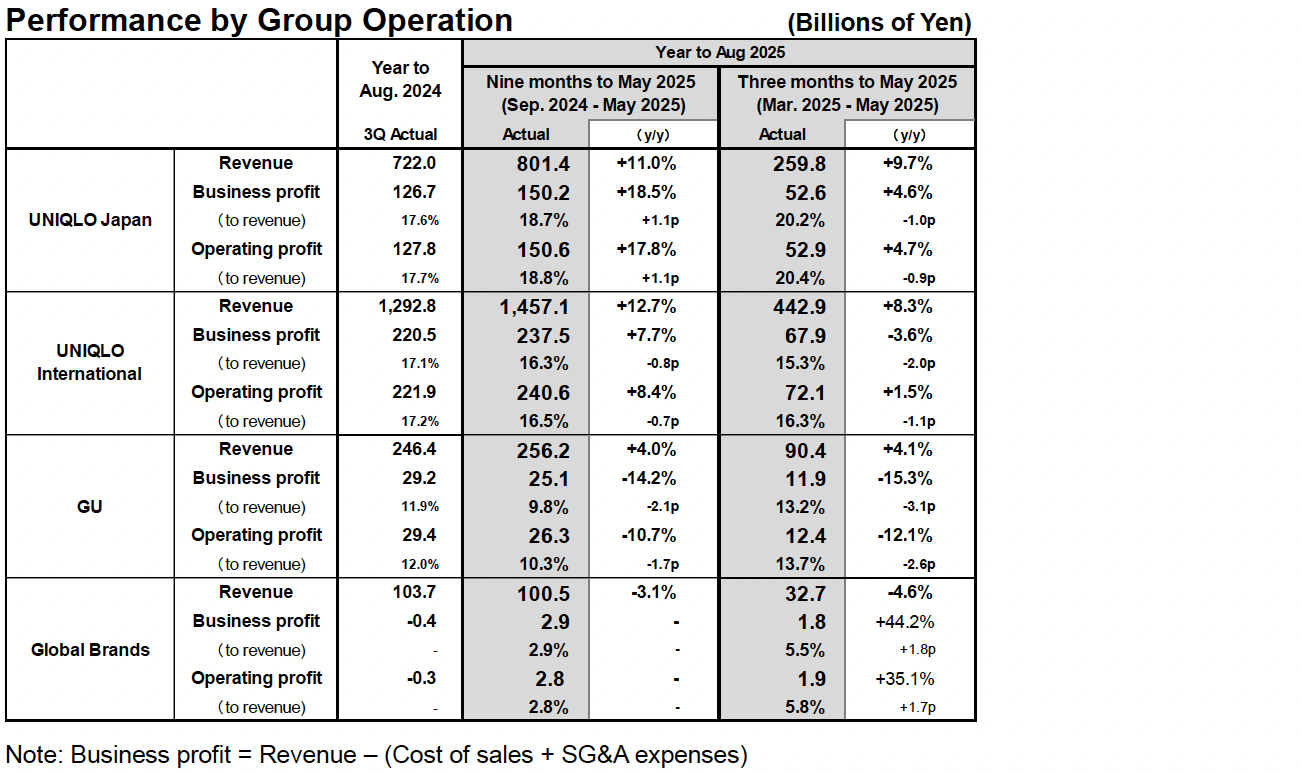

■UNIQLO Japan: Reports 3Q revenue and profit gains

- In the three months through May 2025, revenue rose to 259.8 billion yen (+9.7%) and operating profit expanded to 52.9 billion yen (+4.7%).

- Same-store sales increased by 7.5%. Core Summer items and year-round products sold well. Sales held during our Thank You Festival and the Golden Week holiday were also strong.

- The gross profit margin decreased by 2.1 points on higher cost of sales and discounting rates. The selling, general and administrative expense ratio improved by 1.2 points.

- In the nine months through May 2025, revenue rose 11.0% to 801.4 billion yen, and operating profit expanded by 17.8% to 150.6 billion yen.

■UNIQLO International: Reports 3Q revenue and profit gains

- In the three months through May 2025, revenue rose to 442.9 billion yen (+8.3%) and operating profit increased to 72.1 billion yen (+1.5%). In local currency terms, revenue increased by approximately 14% and operating profit by approximately 7%.

- UNIQLO operations in South Korea, the Southeast Asia, India & Australia region, North America, and Europe all reported higher revenue and profit. The strong performance in those markets was driven partly by robust sales of strongly marketed core Summer ranges along with the continued opening of high-quality stores that successfully convey LifeWear brand value.

- Greater China markets reported an overall decline in revenue and profit. In the Mainland China market, revenue and profits contracted due to a general decline in overall consumer appetite and a dampening in actual demand caused by persistently cool temperatures until early May.

- In the nine months through May 2025, revenue totaled 1.4571 trillion yen (+12.7%) and operating profit totaled 240.6 billion yen (+8.4%).

■GU: Reports higher revenue, but significantly lower profit in 3Q

- In the three months through May 2025, revenue rose to 90.4 billion yen (+4.1%) while operating profit decreased to 12.4 billion yen (−12.1%).

- Despite strong sales of GU's range of Barrel Leg Pants, Sweat Look T-shirts, DRY T-shirts, and other items, same-store sales increased only slightly year-on-year due insufficient volumes and marketing of potentially promising products such as haori-style jackets and long T-shirts.

- For the nine months through May 2025, revenue totaled 256.2 billion yen (+4.0%) and operating profit totaled 26.3 billion yen (−10.7%).

■Global Brands: 3Q revenue declines, but profit increases

- In the three months through May 2025, revenue declined to 32.7 billion yen (−4.6%) while operating profit increased to 1.9 billion yen (+35.1%).

- Revenue declined on the back of lacklustre sales at the Theory label, while overall profit increased due to a contraction in losses at the Comptoir des Cotonniers label.

- In the nine months through May 2025, the segment reported a decline in revenue to 100.5 billion (−3.1%) and moved into the black, reporting an operating profit of 2.8 billion yen.

■FY2025 consolidated estimates: No changes to latest estimates. Still expect to achieve a record performance and increase annual dividend by 80 yen

- No change in latest estimates for FY2025 consolidated performance or annual dividend per share.

- Expect full-year consolidated revenue to total 3.4000 trillion yen (+9.5%), operating profit to rise to 545.0 billion yen (+8.8%), and profit attributable to owners of the parent to total 410.0 billion yen (+10.2%).

- Forecast an annual dividend per share in FY2025 of 480 yen, split into an interim dividend of 240 yen and a year-end dividend of 240 yen. This represents an increase of 80 yen in the annual dividend for FY2025 compared with FY2024.

Fiscal 2025 3Q Performance in Focus

■UNIQLO Japan: Reports 3Q revenue and profit gains

UNIQLO Japan reported large increases in revenue and profit in the first nine months of fiscal 2025, with revenue totaling 801.4 billion yen (+11.0% year on year) and operating profit reaching 150.6 billion yen (+17.8%).

The segment also generated revenue and profit gains in the three months from March to May. Same-store sales expanded by 7.5% in that three-month period, driven by strong sales of year-round items and sales of core Summer ranges during our Thank You Festival and the Golden Week holiday. The gross profit margin contracted by 2.1 points. This was due to the impact of a weaker yen on forward contract rates used for materials procurement, which resulted in higher cost of sales, and a higher discounting rate resulting from swift discount sales primarily of Spring ranges to offload excess inventory. Finally, the selling, general and administrative expense ratio improved by 1.2 points as the higher revenue performance resulted in a decline in personnel, store rents, and advertising and promotion cost ratios.

■UNIQLO International: Reports 3Q revenue and profit gains

UNIQLO International reported a significant increase in revenue and an expansion in profits in the first nine months of fiscal 2025, with revenue rising to 1.4571 trillion yen (+12.7%) and operating profit expanding to 240.6 billion yen (+8.4%). The strong performance was underpinned by growing support for our core products and the continued successful opening of high-quality stores that successfully conveyed the brand value presented by LifeWear in each region.

Breaking the UNIQLO International third-quarter performance from March to May down into individual regions and markets and viewing performance on a local currency basis, the Mainland China market reported a roughly 5% decline in revenue and an approximately 3% decline in profit. This was due to the general decline in overall consumer appetite and a dampening in actual demand caused by persistently cool temperatures until the early May. Revenue in the Hong Kong and Taiwan markets increased but profits contracted significantly as higher cost of sales weighed on the gross profit margin and the selling, general and administrative expense ratio also increased. UNIQLO South Korea reported considerable increases in revenue and profit thanks to the strategic preparation of Spring products and year-round product stock, which helped generate strong sales over the transitional inter-season period, as well as a successful marketing strategy. UNIQLO operations in Southeast Asia, India & Australia reported a large increase in revenue and growing profits. Same-store sales in the region increased on the back of strong sales primarily of Summer ranges. Our operations in North America and Europe continued to perform strongly, with UNIQLO North America reporting significant increases in both revenue and profit, and UNIQLO Europe reporting considerably higher revenue and a rise in profits. Strategic marketing efforts resulted in strong sales, particularly for core items. Sales at new stores opened during the third quarter also proved strong, helping secure new customers and further boosting brand visibility.

■GU: Reports higher revenue, but significantly lower profit in 3Q

The GU business segment reported an increase in revenue but a large decline in profits in the first nine months of fiscal 2025, with revenue rising to 256.2 billion yen (+4.0%) and operating profit contracting to 26.3 billion yen (−10.7%).

In the three months from March to May, GU also recorded an increase in revenue but a large contraction in profits. While same-store sales increased slightly on the back of strong sales of GU's range of Barrel Leg Pants, Sweat Look T-shirts, DRY T-shirts, and other items, insufficient preparation of potentially promising products such as haori-style jackets and long T-shirts, along with insufficient marketing, resulted in lower-than-expected sales levels. The gross profit margin declined as yen weakness pushed up cost of sales. The selling, general and administrative expense ratio increased as the expansion in sales proved not large enough to offset increases in salary levels, resulting in higher personnel cost and head office cost ratios.

■Global Brands: 3Q revenue declines, but profit increases

In the first nine months of fiscal 2025, the Global Brands segment reported a decline in revenue to 100.5 billion (−3.1%) and an operating profit of 2.8 billion yen (compared to an operating loss of 0.3 billion yen in the previous year).

In the three months from March to May, the Theory operation reported declines in both sales and profits. Both Theory Japan and Theory Asia reported lower revenue and profit levels on the back of struggling department store sales and declining consumer appetite for apparel, respectively. Meanwhile, PLST reported sharply higher revenue and profit on the back of strong sales of new products and overall strong sales, buoyed by successful product launches at the Thank You Festival. Finally, while revenue at Comptoir des Cotonniers declined because store numbers had been reduced, same-store sales increased and operating losses contracted on the back of buoyant sales of items that are now marketed in a more affordable price range, and strong sales at newly refurbished stores.

■FY2025 consolidated estimates: No changes to latest estimates. Still expect to achieve a record performance and increase annual dividend by 80 yen

There has been no change to the latest estimates for fiscal 2025 performance announced in April, with the Fast Retailing Group still expected to achieve a record performance. The Group is expected to generate consolidated revenue totaling 3.4000 trillion yen (+9.5%), business profit reaching 540.0 billion yen (+11.3%), operating profit rising to 545.0 billion yen (+8.8%), and profit attributable to owners of the parent totaling 410.0 billion yen (+10.2%). We expect the impact of the reciprocal and additional tariffs announced by the U.S. government on second-half consolidated business profit will be roughly 1%. The impact will be limited in fiscal 2025 because we already have a considerable volume of products in our warehouses in the United States.

Looking at the future outlook for individual business segments in fiscal 2025, we expect UNIQLO International will generate a large increase in revenue and a rise in operating profit in local currency terms in both the second half and the full business year. Looking at individual regions, the Greater China markets are expected to report a decline in revenue and an approximately 10% decline in profit in both the second half and full business year. UNIQLO South Korea is predicted to generate considerable revenue and profit gains in both the second half and full business year. The Southeast Asia, India & Australia region is expected to record a large increase in revenue in the second half. Operating profit is also expected to rise strongly, after stripping out the impact of higher royalty expenses. For the full business year, this region is predicted to achieve considerable revenue and profit gains. UNIQLO North America and UNIQLO Europe are expected to report considerably higher revenue and profit in the second half and full business year. Meanwhile, UNIQLO Japan is predicted to report a rise in revenue and profit in the second half of fiscal 2025, and a rise in revenue and a large increase in profit for the full business year. The GU operation is expected to generate an increase in revenue but a decline in profits in both the second half and the full business year. Finally, for both the second half and full business year, the Global Brands segment is expected to report a decline in revenue and to report a slight operating loss due to the recording of approximately 4.0 billion yen in impairment losses associated with business restructuring at Comptoir des Cotonniers and Princesse tam.tam.

There has been no change in our latest estimates for a year-end dividend of 240 yen per share. Coupled with the interim dividend of 240 yen that has already been paid out, we therefore expect to generate an annual dividend of 480 yen per share, which represents an increase of 80 yen in the full-year dividend per share compared to the previous year.

Fast Retailing Co., Ltd. discloses business results data and offers a variety of press releases on its IR website https://www.fastretailing.com/eng/ir/.