Last Updated: 2025.01.09

Results Summary for FY2025 1Q (Three Months to November 2024)

FAST RETAILING CO., LTD.![]() (171KB)

(171KB)

to Japanese page

to Chinese page

【Highlights】

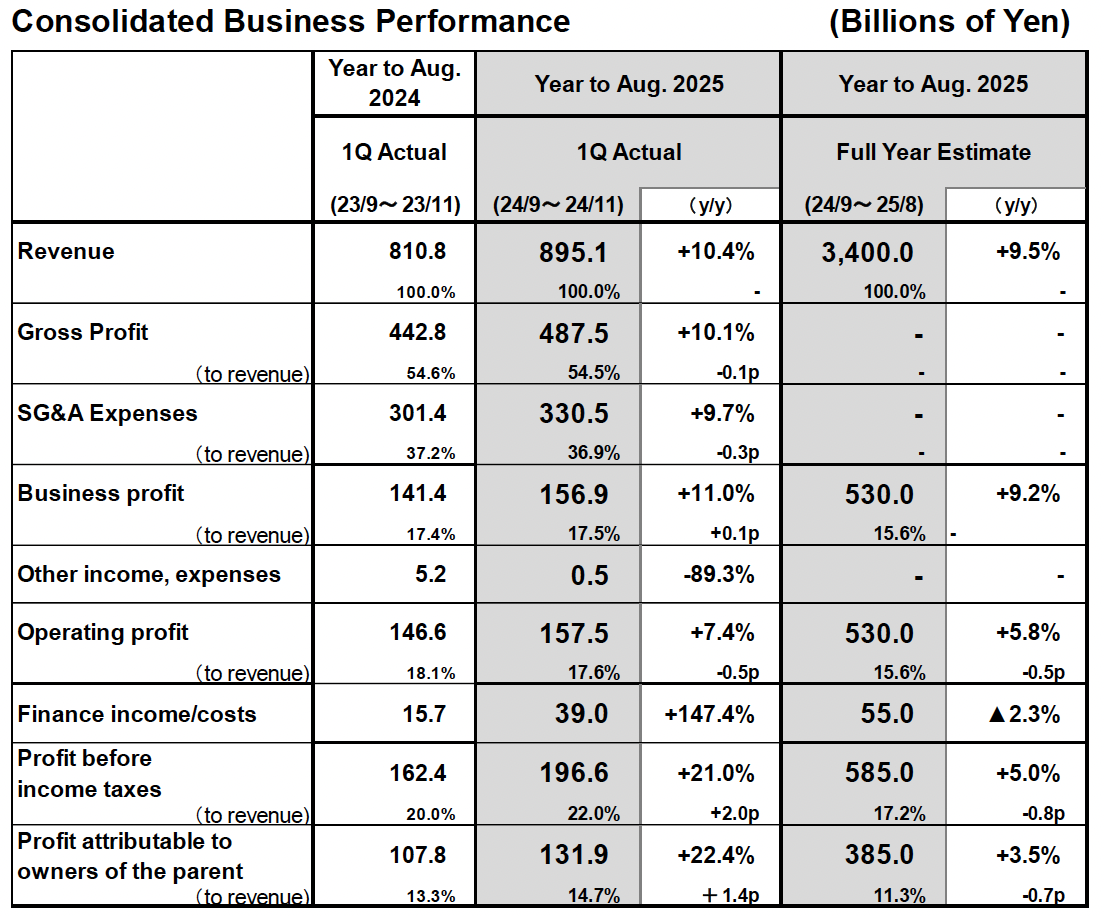

■FY2025 1Q consolidated results: Fast Retailing reports significant revenue and profit gains

- In the first quarter of FY2025, consolidated revenue rose to 895.1 billion yen (+10.4% year-on-year) and business profit, which is calculated by subtracting cost of sales and SG&A expenses from revenue and thus serves as a true reading of business profitability, increased to 156.9 billion yen (+11.0%).

- Operating profit increased by a lesser extent than business profit due to foreign exchange factors, rising 7.4% to 157.5 billion yen.

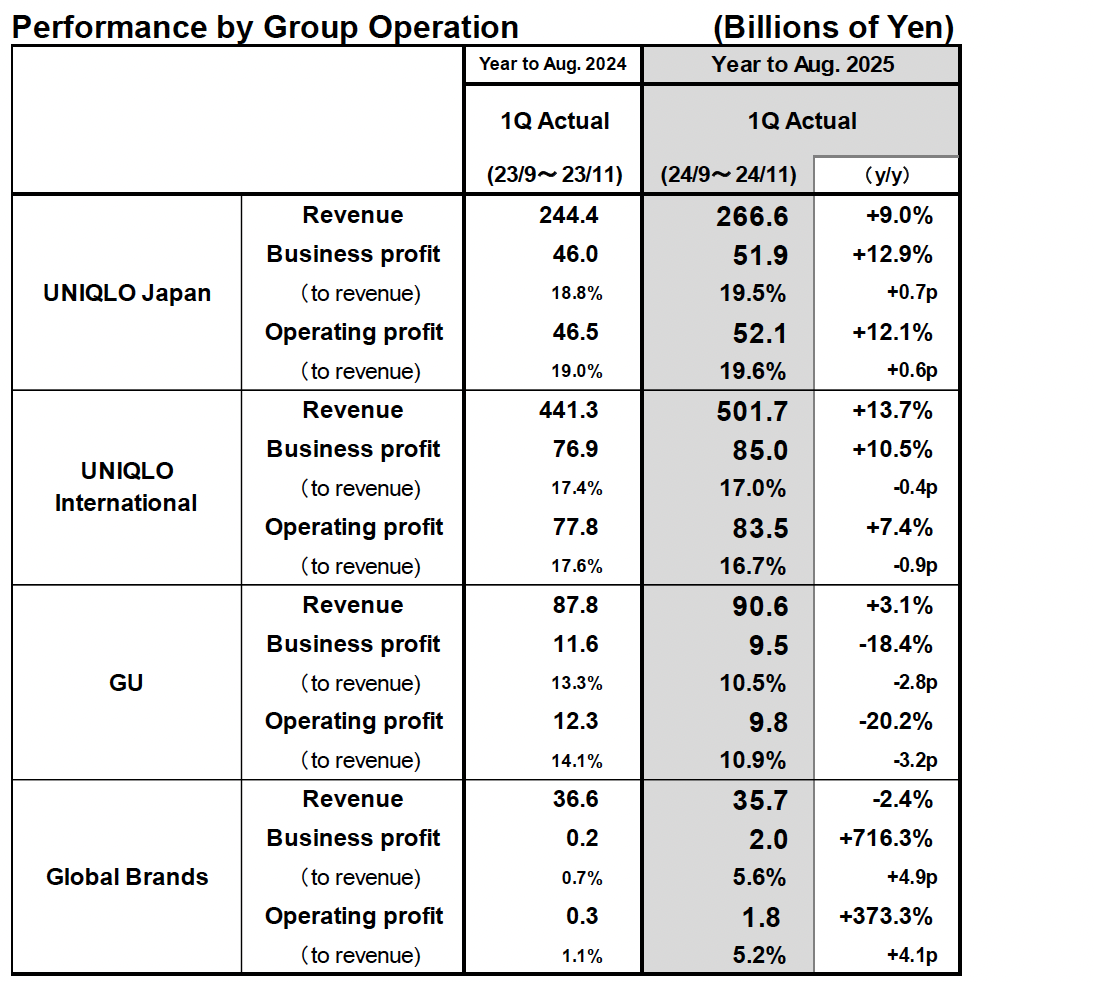

- UNIQLO operations in Japan, Southeast Asia, India & Australia, North America, and Europe all continued to perform strongly.

■UNIQLO Japan: Higher revenue, large profit gain. Gradually establishing a commercial business that is more resilient to changing weather patterns

- Revenue: 266.6 billion yen (+9.0%), operating profit: 52.1 billion yen (+12.1%).

- Same-store sales expanded 7.3%. Generated strong sales in September after compiling suitable product mixes for warm prevailing temperatures and marketing accordingly. November sales were also strong thanks to colder weather and a buoyant 40th UNIQLO Thank You Festival.

- Gross profit margin contracted by 0.2p on slightly higher discounting. SG&A ratio decreased 0.9p on improved personnel costs and store rent component ratios.

■UNIQLO International: Large revenue gain. Operating profit rises. Europe, the US, Southeast Asia, India & Australia all strong

- Revenue: 501.7 billion yen (+13.7%), operating profit: 83.5 billion yen (+7.4%).

- Greater China reported a decline in revenue and a sharp contraction in profits. The Mainland China market reported a decline in revenue and considerable drop in profits after failing to compile sufficient product mixes suited to warm winter weather or develop a sufficiently detailed response to the minute needs of individual regions.

- UNIQLO operations in the Southeast Asia, India & Australia reported a large increase in revenue and profit.

- UNIQLO North America reported considerably expanded revenue and an increase in profit. UNIQLO North America generated strong sales and opened stores in new areas, including the state of Texas, confirming further growth potential.

- UNIQLO Europe reported strong revenue and profit gains. UNIQLO brand visibility continues to improve and the customer base continues to expand as store coverage area increases.

■GU: Revenue increases but profit dips sharply

- Revenue: 90.6 billion yen (+3.1%), operating profit: 9.8 billion yen (−20.2%).

- Same-store sales flat year-on-year due to insufficient development of hit products that capture mass fashion trends and are not influenced by changing temperatures, as well as shortages of strong-selling items.

- Profits declined significantly on lower gross profit margin and higher SG&A ratio.

■Global Brands: Revenue dips but profit increases

- Revenue: 35.7 billion yen (−2.4%), operating profit: 1.8 billion yen (+373.3%).

- Revenue declined on the back of sluggish Theory sales, but profit increased on improved SG&A ratios at Theory and all other labels.

■FY2025 consolidated business forecasts: Unchanged from initial forecasts. Expect record full-year performance

- We have maintained our initial estimates for FY2025 consolidated revenue of 3.4 trillion yen (+9.5%), consolidated operating profit of 530.0 billion yen (+5.8%), and profit attributable to owners of the Parent of 385.0 billion yen (+3.5%).

- We forecast an annual dividend per share in FY2025 of 450 yen, split equally between interim and year-end dividends of 225 yen each.

FY2025 1Q Performance in Focus

■UNIQLO Japan: Higher revenue, large profit gain. Gradually establishing a commercial business that is more resilient to changing weather patterns

UNIQLO Japan reported higher revenue and a significant increase in profit in the first quarter of fiscal 2025, with revenue totaling 266.6 billion yen (+9.0% year-on-year) and operating profit totaling 52.1 billion yen (+12.1% year-on-year). First-quarter same-store sales (including e-commerce) increased by 7.3% year-on-year on the back of strong sales performances in September and November. In September, sales of T-shirts, Bra Tops, and other items proved strong as we maintained sufficient inventory and strengthened the promotion of summer ranges. In November, HEATTECH innerwear, cashmere knitwear, and other warm winter clothing sold well and our 40th UNIQLO Thank You Festival also attracted a large number of customers. The gross profit margin contracted by 0.2 point year-on-year on slightly higher discounting. The selling, general and administrative expense ratio improved by 0.9 point year-on-year thanks to a decline in the cost ratios for personnel and store rent.

■UNIQLO International: Large revenue gain. Operating profit rises. Europe, the US, Southeast Asia, India & Australia all strong

UNIQLO International reported a significant increase in revenue and an expansion in operating profit in the first quarter of fiscal 2025, with revenue rising to 501.7 billion yen (+13.7% year-on-year) and operating profit expanding to 83.5 billion yen (+7.4% year-on-year). Southeast Asia, India & Australia, North America, and Europe reported large revenue and profit gains and continue to perform strongly.

Breaking down the UNIQLO International performance into individual regions and markets and viewing the results in local currency terms, within Greater China, revenue declined and profit contracted sharply in the Mainland China market due to persistently warm weather throughout the three-month period, insufficient product mixes tailored for warm winter weather, and an insufficient response to minute needs of individual regions. Revenue declined slightly and profits dipped sharply in the Hong Kong market and the Taiwan market. UNIQLO South Korea reported higher revenue and profit in the first quarter thanks to strong sales of casual shirts, sweatshirts, and other staple year-round ranges that are not easily impacted by changes in the weather. The Southeast Asia, India & Australia region reported a large increase in revenue and profit in the first quarter. Same-store sales rose on the back of strong sales of T-shirts, short pants, Bra Tops and other core summer items as well as strong sales of our newly released short-sleeved cable knitwear items. UNIQLO North America reported a large increase in revenue and a rise in operating profit. Same-store sales increased on the back of strong sales of cashmere, PUFFTECH, and other items. In the first quarter, we also opened multiple stores in new areas such as the state of Texas for the first time, which all generated stronger-than-expected sales. This development enabled us to confirm the potential for further growth in the North America market by expanding into new areas. UNIQLO Europe reported large increases in both revenue and profit. Same-store sales rose markedly in the first quarter after our decision to launch Winter ranges early resulted in strong sales of seamless down, cashmere, and other winter ranges. Sales from new stores including our first store in Poland, which we opened in September proved extremely strong. UNIQLO's brand visibility and customer base continue to expand as we open more stores in new areas.

■GU: Revenue increases but profit dips sharply

The GU business segment reported an increase in revenue but a large decline in profit in the first quarter of fiscal 2025, with revenue rising to 90.6 billion yen (+3.1% year-on-year) and operating profit declining to 9.8 billion yen (−20.2% year-on-year). While sales of the new Barrel Leg Jeans launched in Fall Winter 2024 proved strong, first-quarter GU same-store sales remained close to previous year levels after the operation failed to generate enough hit products reflecting mass fashion trends that are not influenced by changing temperatures, and shortages of strong-selling items emerged. On the profit front, the gross profit margin declined and the selling, general and administrative expense ratio increased, resulting in a large decline in overall profits. The fact that GU has not yet established a solid brand position for itself either inside or outside of Japan is a key issue. We will reinvigorate GU Japan as a priority by working to strengthen the development of products that reflect mass fashion trends by fortifying global R&D functions, create more accurate numerical plans and sales plans for staple year-round products, reduce shortages of strong-selling items, strengthen the communication of information that illustrates GU's worldview, and improve the quality of individual store management.

■Global Brands: Revenue dips but profit increases

The Global Brands segment reported a decline in revenue but an increase in profit in the first quarter of fiscal 2025, with revenue contracting to 35.7 billion (−2.4% year-on-year) and operating profit expanding to 1.8 billion yen (+373.3% year-on-year). While sluggish sales from our Theory operation were primarily responsible for the decline in revenue, improved gross profit margins at Theory and all other labels helped boost overall profits.

Theory reported a decline in revenue but an increase in profit in the first quarter. On the revenue front, in addition to the failure to develop sufficient product mixes that satisfied customer needs, depressed consumer appetite for apparel in Asia also contributed to the decline in overall sales. Operating profit increased mainly due to an improvement in the selling, general and administrative expense ratio at Theory USA. Meanwhile, our PLST brand reported a large increase in revenue thanks to efforts to determine products for strategic marketing, conduct sufficient marketing, and prepare sufficient inventory. Those efforts also helped move the operating profit figure into the black. Finally, Comptoir des Cotonniers reported a decline in revenue on the back of a one-third reduction in store numbers. However, the label generated double-digit growth in same-store sales thanks to buoyant sales of items that are now marketed in a more affordable price range. This resulted in a contraction in overall losses.

■FY2025 consolidated business forecasts: Unchanged from initial forecasts. Expect record full-year performance

We have made no change to the initial forecasts for fiscal 2025 consolidated performance announced in October 2024. We still expect to achieve consolidated revenue of 3.4 trillion yen (+9.5% year-on-year), consolidated operating profit of 530.0 billion yen (+5.8% year-on-year), and profit attributable to owners of the Parent of 385.0 billion yen (+3.5% year-on-year). While revenue for the first quarter and month of December came in slightly below plan, operating profit is tracking roughly in line with our forecasts.

Given the strong performances from Southeast Asia, India & Australia, Europe, and North America, we predict UNIQLO International will achieve significantly higher revenue and profit in the first half of fiscal 2025. However, segment performance is expected to fall short of expectations given the fact that performance in Greater China is currently tracking below plan. Breaking the UNIQLO International forecasts down by geographical location, we predict Greater China will fall short of plan in the first half and report a decline in both revenue and profit. South Korea is expected to generate revenue and profit gains that are roughly in line with expectations, while Southeast Asia, India & Australia, North America and Europe are expected to perform largely to plan and generate significantly higher revenue and profit. UNIQLO Japan continues to generate strong sales illustrated most recently by another large increase in same-store sales in December. This segment is expected to exceed expectations and report a rise in first-half revenue and a large increase in first-half profit. Our GU segment is expected to report higher revenue in the first half. However, first-half operating profit is expected to contract on the recording of store opening expenses relating to the first GU USA store opening. This result would be lower than originally anticipated. Finally, our Global Brands segment is predicted to generate similar revenue to the previous year and a positive operating profit in the first half. While revenue is underperforming, operating profit is performing largely to plan.

We forecast an annual dividend per share in fiscal 2025 of 450 yen, split equally between interim and year-end dividends of 225 yen each. That represents a year-on-year increase of 50 yen in the annual dividend.

Fast Retailing Co., Ltd. discloses business results data and offers a variety of press releases on its IR website https://www.fastretailing.com/eng/ir/.