Last Updated: 2023.04.13

Results Summary for FY2023 First Half (Six Months to February 2023)

FAST RETAILING CO., LTD.![]() (181KB)

(181KB)

to Japanese page

to Chinese page

FY2023 1H Highlights

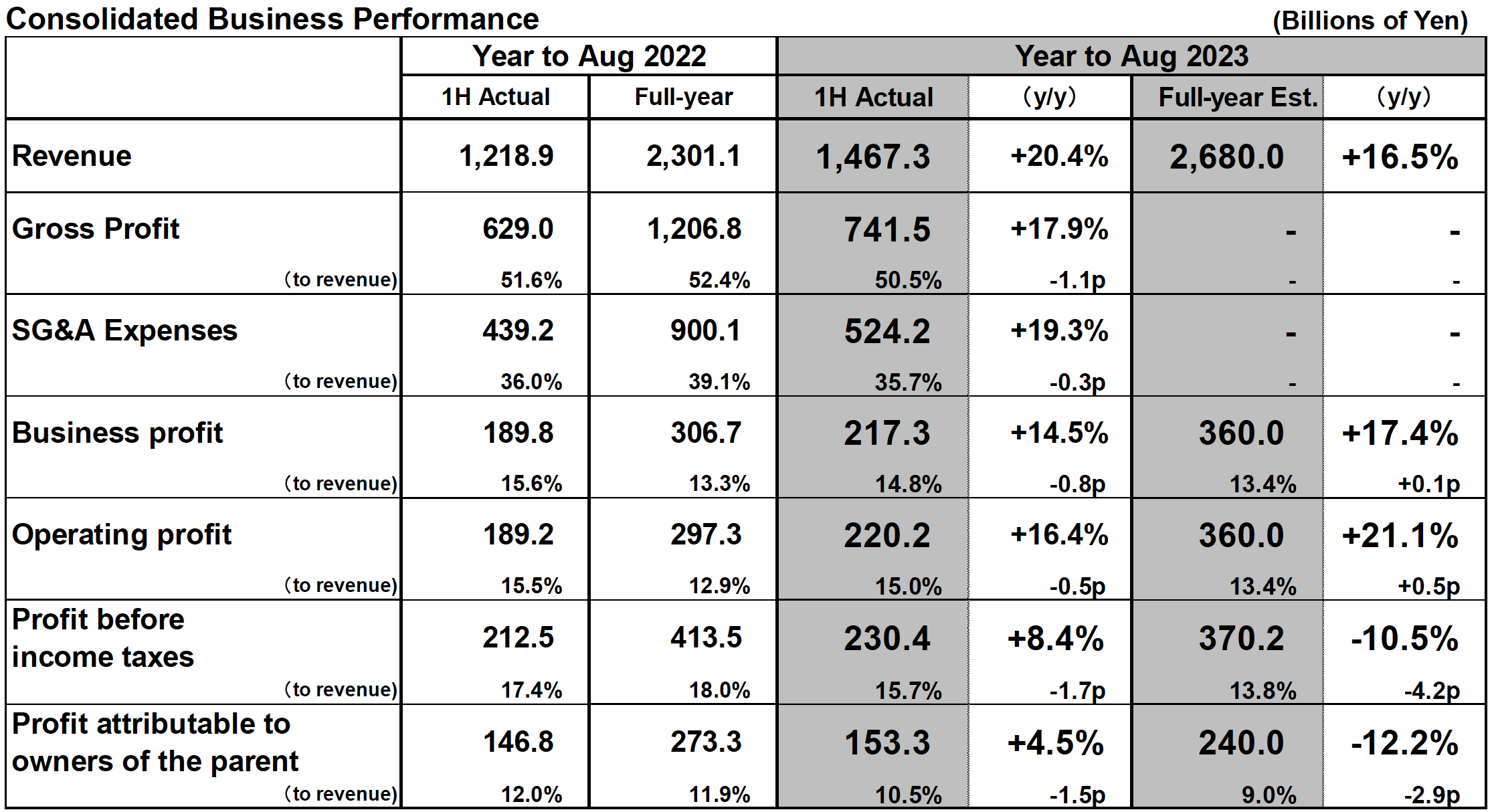

■Consolidated results:Fast Retailing first-half revenue and profit rise considerably to generate a higher-than-expected, record result

- Revenue: 1.4672 trillion yen (+20.4% year-on-year), operating profit: 220.2 billion yen (+16.4%).

- Strong performances from UNIQLO operations in Southeast Asia, India & Australia, North America, and Europe regions, and from GU, which all generated significant increases in both revenue and profit.

- Higher interest income and some other factors helped generate 10.2 billion yen under net finance income. As a result, profit attributable to owners of the parent rose 4.5% to 153.3 billion yen.

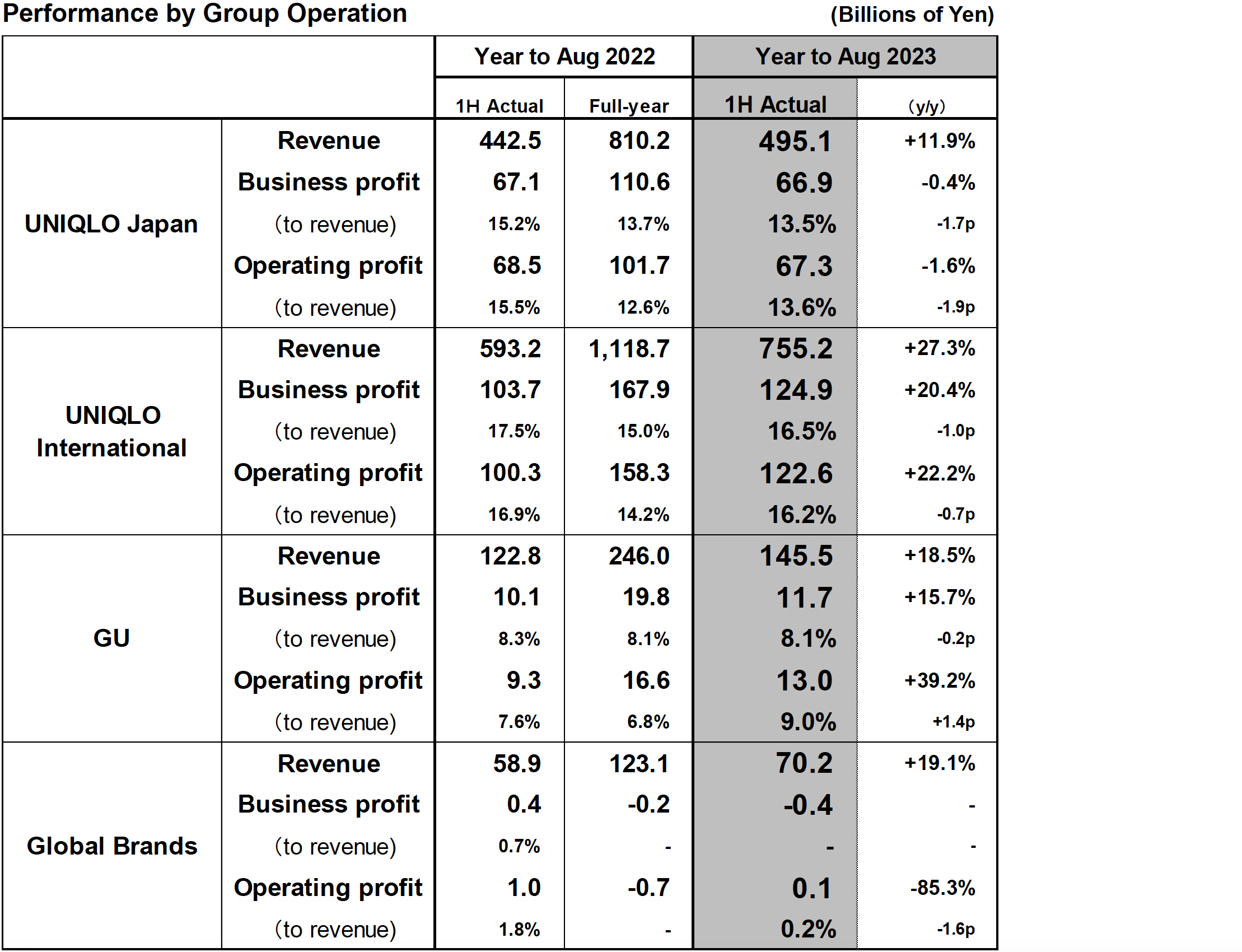

■UNIQLO Japan:Significantly higher revenue, but slight decline in profits

- Revenue: 495.1 billion yen (+11.9%), operating profit: 67.3 billion yen (−1.6%).

- Same-store sales rose 10.0% on the back of particularly strong sales of Winter products in the second quarter from December 2022 to February 2023.

- Profit declined slightly after the sharp depreciation in the Japanese yen resulted in higher procurement costs, which, in turn, led to a 2.2 point decline in the gross profit margin year-on-year.

■UNIQLO International:Large revenue and profit gains, growing needs for LifeWear worldwide

- Revenue: 755.2 billion yen (+27.3%), operating profit: 122.6 billion yen (+22.2%).

- Southeast Asia, India & Australia, North America, and Europe (ex. Russia) reported significant revenue and profit gains as they enter a full-fledged growth phase.

- The Greater China region reported a decline in first-half revenue and profit due to the heavy impact of COVID-19 in the first quarter. However, performance has since started to recover, with the region generating strong sales from January and a rise in second-quarter profit.

■GU:Large revenue and profit gains

- Revenue: 145.5 billion yen (+18.5%), operating profit: 13.0 billion yen (+39.2%).

- Same-store sales rose sharply after we tightened the number of product items on offer and prepared sufficient supply of products that captured mass fashion trends right through until the second half of the season.

■Global Brands:Revenue increases but profit declines sharply

- Revenue: 70.2 billion yen (+19.1%), operating profit: 0.1 billion yen (−85.3%).

- Theory operation reported a large increase in revenue but a decline in profits. Comptoir des Cotonniers reported a decline in revenue and a wider operating loss.

■FY2023 Estimates:Revised up our latest estimates. Predict a 43.3 yen increase in FY2023 annual dividend

- In light of the strong first-half performance, we have revised up our latest estimates by 30.0 billion yen for FY2023 consolidated revenue and by 10.0 billion yen for our consolidated profit measures.

- We now expect to achieve full-year consolidated revenue of 2.6800 trillion yen (+16.5%), consolidated operating profit of 360.0 billion yen (+21.1%), and profit attributable to owners of the Parent of 240.0 billion yen (−12.2%).

- We forecast an annual dividend per share in FY2023 of 250 yen, split equally between interim and year-end dividends of 125 yen each. This is expected to result in an increase of 43.3 yen in the annual dividend for FY2023 compared to FY2022.

FY2023 Performance in Focus

■UNIQLO Japan:Significantly higher revenue, but slight decline in profits

UNIQLO Japan reported a considerable increase in revenue in the first half of fiscal 2023. However, profits declined as the depreciation in the Japanese yen resulted in higher cost of sales. As a result, first-half revenue totaled 495.1 billion yen (+11.9% year-on-year) and first-half operating profit totaled 67.3 billion yen (−1.6% year-on-year). First-half same-store sales increased by 10.0% year-on-year. The strong revenue performance was due to firm sales of Fall Winter items and thermal Winter products such as HEATTECH innerwear. Strong sales of Spring items, such as our Wide-fit pleated pants, as well as products that satisfied new everyday needs, such as AirSense jacket, AirSense pants and shirts also boosted the first-half results. However, on the profit front, the gross profit margin declined by 2.2 points year-on-year as procurement costs on additional product orders rose considerably on the back of the sharp depreciation in the Japanese yen during the six-month period. The selling, general and administrative expense ratio decreased by 0.5 point year-on-year as cost ratios primarily in the areas of store rents, personnel, and distribution improved on the back the extremely strong sales performance during the second quarter from December 2022 to February 2023.

■UNIQLO International:Large revenue and profit gains, growing needs for LifeWear worldwide

UNIQLO International reported a significant increase in both revenue and profit in the first half of fiscal 2023, with revenue rising to 755.2 billion yen (+27.3% year-on-year) and operating profit expanding to 122.6 billion yen (+22.2% year-on-year). We saw large increases in both revenue and profit at UNIQLO operations in the Southeast Asia, India & Australia, North America, and Europe (ex. Russia), as these regions start to enter a genuine growth phase. The strong overall performance by UNIQLO International can be attributed to the fact that rapid changes in clothing demand over the past few years in the face of the COVID-19 pandemic and rising inflation have fueled consumer appetite for LifeWear, our high-quality and long-lasting basic everyday clothing. Our aggressive efforts to consistently expand business by strengthening our branding and pursuing community-based commercial operations also supported the segment's strong first-half results. Breaking down the UNIQLO International performance into individual regions and markets (in local-currency terms), the Greater China region reported a dip in revenue and a sharp fall in profits in the first half of fiscal 2023. This was due to a large decline in revenue and profit in the Mainland China market caused by the heavy impact of COVID-19 in the first quarter. However, sales did start to recover in January, resulting in a slight decline in second-quarter revenue and a sharp increase in second-quarter profit, so overall performance is now on a recovery track. UNIQLO South Korea reported higher revenue and profit in the first half of fiscal 2023. Meanwhile, revenue and profit both rose considerably in Southeast Asia, India & Australia as we successfully and consistently conveyed information primarily about our core products and expanded our customer base. UNIQLO North America reported significantly higher revenue and profit in the first half. Strong marketing of core Winter items and the timely conveyance of information to coincide with seasonal sales helped fuel significant increases in same-store sales throughout the six-month period. Europe (ex. Russia) reported much higher revenue and profit in the first half as our consistent efforts to appeal the superior functionality and value of our products proved to be successful and helped expand our customer base.

■GU:Large revenue and profit gains

The GU business segment reported large increases in both revenue and profit in the first half of fiscal 2023, with revenue rising to 145.5 billion yen (+18.5% year-on-year) and operating profit totaling 13.0 billion yen (+39.2% year-on-year). GU same-store sales rose significantly in the first half as we pursued some bold strategies that involved successfully narrowing down the number of product numbers on offer and ensuring a sufficient supply of mass-trend products. Sales of heat padded outerwear, super wide cargo pants, and baggy slacks proved especially strong. While the GU gross profit margin did decline 1.8 points year-on-year, this was due primarily to the rapid depreciation of the Japanese yen over the first half, which resulted in sharply higher procurement costs on additional product orders and an increase in cost of sales. Meanwhile, the selling, general and administrative expense ratio improved by 1.5 points year-on-year on the back of strong overall sales and appropriate control of business costs.

■Global Brands:Revenue increases but profit declines sharply

The Global Brands segment reported a large rise in revenue but a decline in profit in the first half of fiscal 2023, with revenue rising to 70.2 billion (+19.1% year-on-year) and an operating profit contracting to 0.1 billion yen (−85.3% year-on-year). While our Theory brand generated much higher revenue, it also reported a decline in first-half profit. This was due primarily to a decline in the gross profit margin at Theory's United States operation after we prioritized selling inventory at a reduced price as well as a fall in profits from Theory's Asian operation, which is concentrated primarily in Greater China, due to COVID-19. Theory Japan, however, reported a large rise in both revenue and profit as department-store customer visits recovered and our decision to strategically build up stocks of strong-selling items proved successful. Meanwhile, our PLST brand generated slightly higher revenue and a marginally smaller loss, and our France-based Comptoir des Cotonniers brand reported a decline in revenue and a slightly higher operating loss over the six-month period.

■FY2023 consolidated estimates:Revised up our latest estimates. Predict a 43.3 yen increase in FY2023 annual dividend

In light of the strong first-half performance, we have revised up our latest full-year business estimates announced in January by 30.0 billion yen for sales, and 10.0 billion yen for business profit, operating profit and profit attributable to owners of the Parent. We now expect to achieve full-year consolidated revenue of 2.6800 trillion yen (+16.5% year-on-year), consolidated operating profit of 360.0 billion yen (+21.1% year-on-year), and profit attributable to owners of the Parent of 240.0 billion yen (−12.2% year-on-year). If we strip out the boost to corporate performance resulting from yen depreciation, revenue is expected to increase by approximately 13% year-on-year, operating profit by approximately 18% year-on-year, and profit attributable to owners of the Parent by approximately 17% year-on-year.

Looking at each business segment in turn, we predict UNIQLO International will achieve significantly higher revenue and profit in the second half of fiscal 2023 and the full business year. We expect Southeast Asia, India & Australia, North America, and Europe (ex. Russia) to generate considerable increases in second-half and full-year revenue and profit and to continue to drive overall performance. The Greater China region is expected to report significant increases in second-half revenue and profit as the Mainland China market gets back onto a recovery track, and Greater China revenue and profit are also expected to rise year-on-year for the full fiscal year. UNIQLO South Korea is predicted to generate higher second-half and fiscal 2023 revenue and profit. Our GU business segment is expected to continue to generate strong sales and generate significant increases in second-half and full-year profit. UNIQLO Japan is expected to report slightly higher revenue and profit in the second half and for the full fiscal year, while our Global Brands segment is predicted to achieve a rise in revenue and a slight profit in the second half and full fiscal year. In terms of store numbers, we predict our total network will expand to 3,674 stores by the end of August 2023, comprising 809 UNIQLO Japan stores (including franchise stores), 1,690 UNIQLO International stores, 469 GU stores, and 706 Global Brands stores.

We have positioned 2023 as the company's "4th Frontier" in which we aim to become a trusted brand among a wide range of customers worldwide and an essential brand for everyday life. We also aim to expand sales to 5 trillion yen within about five years. To that end, we will be focusing on various pillar strategies, including (1) Further evolve our digital consumer retailing business, (2) Shift to managing business with a global perspective, (3) Pursue a business model in which the very development of our business operations contributes to sustainability, (4) Expand group brands such as GU, Theory and so on, and (5) Focus on organizational management that maximizes human resource potential on a global scale and ensure the personal growth of each and every employee.

Finally, we have revised up our latest forecast for the fiscal 2023 annual dividend per share by 20 yen and are now predicting a fiscal 2023 dividend of 250 yen, split equally between interim and year-end dividends of 125 yen each. We expect this will result in an increase of 43.3 yen in the annual dividend for fiscal 2023 compared to fiscal 2022.

Fast Retailing Co., Ltd. discloses business results data and offers a variety of press releases on its IR website https://www.fastretailing.com/eng/ir/.