Last Updated: 2023.01.12

Results Summary for FY2023 1Q (Three Months to November 2022)

FAST RETAILING CO., LTD.![]() (170KB)

(170KB)

to Japanese page

to Chinese page

【Highlights】

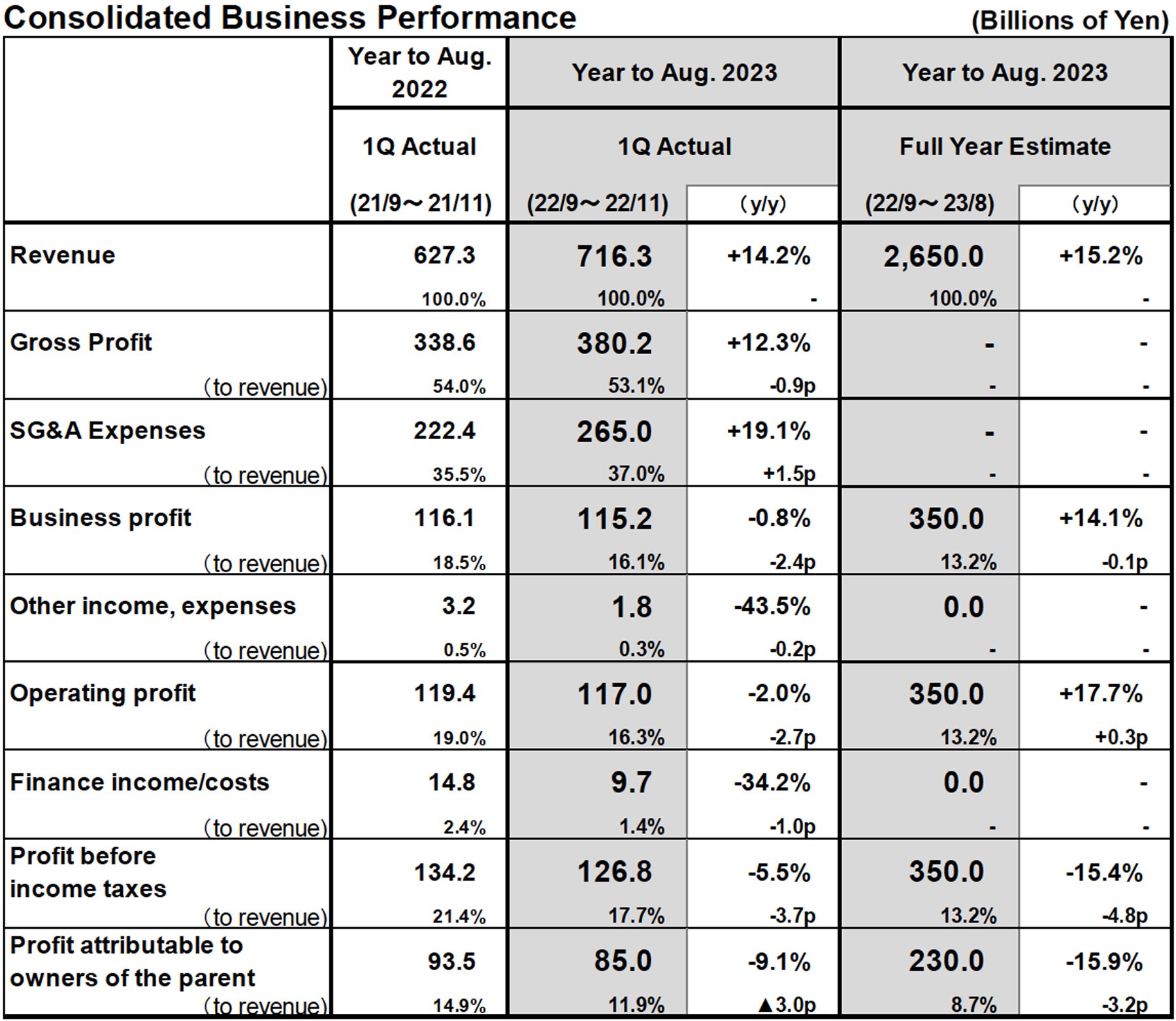

■FY2023 1Q consolidated results: Fast Retailing reports only a slight decline in profits as earnings pillars continue to diversify

- In the first quarter of FY2023, consolidated revenue rose to 716.3 billion yen (+14.2% year-on-year), while operating profit declined to 117.0 billion yen (−2.0%).

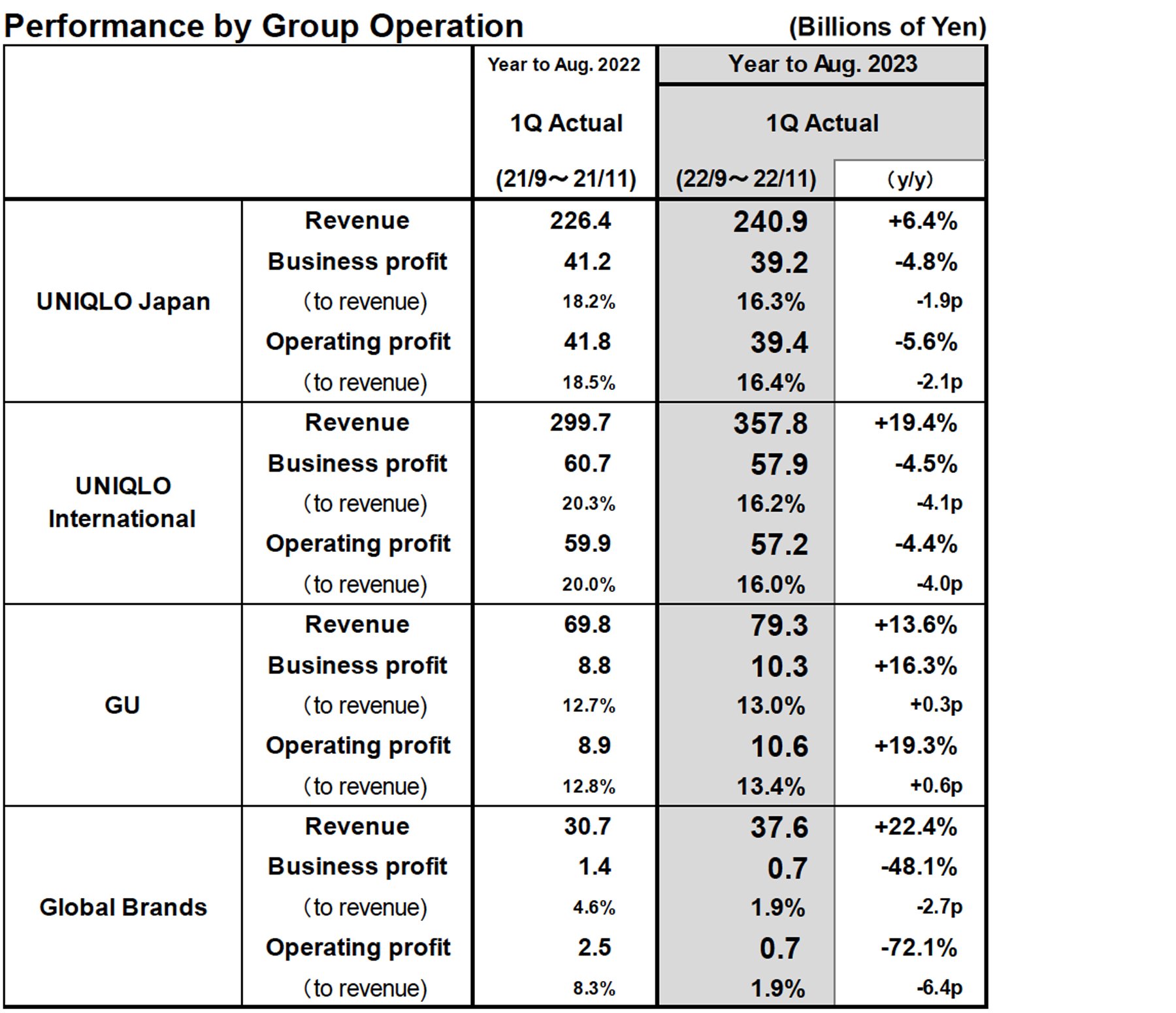

- While UNIQLO operations in the Greater China region and Japan both reported a contraction in profits, all other UNIQLO operations generated strong results and significant increases in both revenue and profit. Southeast Asia, North America, and Europe in particular reported record performances. GU also generated considerably higher revenue and profit, and is moving back onto a steady growth track.

- While first-quarter performance fell short of our consolidated business estimates, we have enjoyed strong sales since December, and so we do expect to be able to achieve both our first-half and full-year business forecasts.

■UNIQLO Japan: Revenue rises but profit falls. Profit declined on struggling sales in November but recovered in December

- Revenue increased while profit declined. Revenue: 240.9 billion yen (+6.4%), operating profit: 39.4 billion yen (−5.6%).

- The gross profit margin declined by 1.1 points year-on-year after warm temperatures stifled sales in November and the rapid depreciation in the yen boosted cost of sales. Profit also declined as a result.

- December same-store sales rose by a strong 16.9% year-on-year. In fact, if we take the four months together, revenue and profit both increased year-on-year.

■UNIQLO International: Revenue increases sharply, but profit declines. S/SE Asia & Oceania, N. America, and Europe (ex. Russia) report record high results

- Revenue: 357.8 billion yen (+19.4%), operating profit: 57.2 billion yen (−4.4%).

- Segment profit declined after the Mainland China market reported a large decline in profits due to COVID-19 restrictions on movement and Russia reported a loss due to the suspension of operations in that market.

- South Asia, Southeast Asia, & Oceania, North America, and Europe (ex. Russia) achieved record high performances, reporting large increases in both revenue and profit that outstripped our initial plan.

■GU: Generates considerably higher revenue and profit, and returns to a growth track

- Revenue: 79.3 billion yen (+13.6%), operating profit: 10.6 billion yen (+19.3%).

- Sales proved strong after we tightened the number of product items on offer and conducted business with a sufficient supply of products that captured mass fashion trends.

■Global Brands: Revenue rises but profit falls

- Revenue: 37.6 billion yen (+22.4%), operating profit: 0.7 billion yen (−72.1%).

- Theory operation reported a large increase in revenue but a decline in profits. Comptoir des Cotonniers reported a decline in revenue and a slight expansion in operating losses.

■FY2023 consolidated business forecasts: Unchanged from initial estimates

- We have maintained our initial estimates for FY2023 consolidated revenue of 2.6500 trillion yen (+15.2%), consolidated operating profit of 350.0 billion yen (+17.7%), and profit attributable to owners of the Parent of 230.0 billion yen (−15.9%).

- We forecast an annual dividend per share in FY2023 of 230 yen, split equally between interim and year-end dividends of 115 yen each. These dividend totals have been adjusted to reflect our decision announced on December 15, 2022 to conduct a three-for-one stock split.

FY2022 1Q Performance in Focus

■UNIQLO Japan: Revenue rises but profit falls

UNIQLO Japan reported higher revenue but lower profit in the first quarter of fiscal 2023, with revenue totaling 240.9 billion yen (+6.4% year-on-year) and operating profit totaling 39.4 billion yen (−5.6% year-on-year). First-quarter same-store sales increased by 4.7% year-on-year. Cooler-than-usual temperatures in September and October helped generate strong sales of Fall Winter items, such as jackets, souffle yarn knitwear, cashmere, and HEATTECH items. Sales of on-trend items such as our tucked wide-leg pants also sold well. However, on the profit front, the gross profit margin declined by 1.1 points year-on-year as procurement costs rose on the back of the sharp depreciation in the Japanese yen. The selling, general and administrative expense ratio increased by 0.8 point year-on-year as personnel costs rose on the back of higher wages for part-time and temporary workers and we decided to strategically increase outlays for advertising and promotion.

■UNIQLO International: Revenue increases sharply, but profit declines. S/SE Asia & Oceania, N. America, and Europe (ex. Russia) report record high results

UNIQLO International reported a significant increase in revenue but a decline in profit in the first quarter of fiscal 2023, with revenue rising to 357.8 billion yen (+19.4% year-on-year) and operating profit contracting to 57.2 billion yen (−4.4% year-on-year). The two factors that sparked the decline in first-quarter profit were the impact of COVID-19 restrictions on movement in Mainland China, which resulted in a large contraction in profit there, and the temporary suspension of operations in Russia, which resulted in a first-quarter loss. However, the South Asia, Southeast Asia & Oceania region, North America, and Europe (ex. Russia) all achieved record first-quarter performances, generating impressively strong increases in revenue and profits that outstripped our expectations.

Breaking down the UNIQLO International performance into individual regions and markets (in local-currency terms), the Mainland China market was heavily impacted by COVID-19 restrictions on movement and a decline in consumer appetite. At the same time, a maximum of 247 stores were forced to temporarily close their doors over the period, all of which resulted in a large decline in both revenue and profit in the Mainland China market. The weather was warmer than usual in the normally bumper month of November in the Hong Kong and Taiwan markets, which resulted in a fall in revenue and a large decline in profits. UNIQLO South Korea reported higher revenue and profit in the first quarter, thanks to particularly strong sales of casualwear items and knitwear. Meanwhile, revenue and profit both rose considerably in S/SE Asia & Oceania, where we witnessed a recovery in consumer appetite and travel demand. Customer support for UNIQLO products had also grown even stronger following our efforts to continuously convey pertinent information about our core items. UNIQLO North America reported significantly higher revenue and profit in the first quarter, with sales proving strong after we conveyed information to improve our branding and strengthened our marketing of core Winter items. Europe (ex. Russia) reported much higher revenue in the first quarter and profit also increased, with sales proving especially strong in September after the weather turned sharply colder.

■GU: Generates considerably higher revenue and profit

The GU business segment reported large increases in both revenue and profit in the first quarter of fiscal 2023, with revenue rising to 79.3 billion yen (+13.6% year-on-year) and operating profit totaling 10.6 billion yen (+19.3% year-on-year). GU was able to generate strong first-quarter sales by narrowing down the number of product numbers on offer and ensuring a sufficient supply of mass-trend products. The return of more normal distribution operations, an increased ability to respond flexibly to requirements for additional production of strong-selling items, and falling temperatures in October all helped boost GU performance. Sales of heavyweight sweatshirts, wide pants, and heat padded outerwear proved especially strong.

■Global Brands: Revenue rises but profit falls

The Global Brands segment reported a large rise in revenue but a decline in profit in the first quarter of fiscal 2023, with revenue rising to 37.6 billion (+22.4% year-on-year) and an operating profit contracting to 0.7 billion yen (−72.1% year-on-year). While our Theory brand generated much higher revenue, it also reported a decline in first-quarter profit. This was due to a decline in profitability and a consequent contraction in profits at Theory's United States operation following a decision to strengthen discount sales and also to falling profits from Theory's Asian operation, which is concentrated primarily in Greater China, due to COVID-19. Meanwhile, our PLST brand generated slightly higher revenue and profit in the first quarter on the back of strong sales of lightweight haori jackets and stick pants. Finally, our France-based Comptoir des Cotonniers brand reported a decline in revenue on the back of the warmer weather in Europe from October onwards as well as declining consumer appetite in an inflationary environment, and, as a result, the brand recorded a slightly larger operating loss than in the previous year.

■FY2023 consolidated business forecasts: Unchanged from initial estimates

We have made no change to the initial forecasts for fiscal 2023 consolidated performance announced in October 2022. We still expect to achieve consolidated revenue of 2.6500 trillion yen (+15.2% year-on-year), operating profit of 350.0 billion yen (+17.7% year-on-year), and profit attributable to owners of the Parent of ¥230.0 billion (−15.9% year-on-year). We expect revenue and profit to increase in the first half of fiscal 2023 as initially expected. While performance in the Mainland China market remains fluid due to COVID-19, we do expect to be able to achieve our business estimates for the second half of fiscal 2023 as well as this stage.

We predict UNIQLO International will achieve higher revenue and profit in the first half of fiscal 2023 that will prove roughly in line with our expectations. Breaking those forecasts down by geographical location, we expect S/SE Asia & Oceania, North America, and Europe (ex. Russia) to generate higher-than-expected significant increases in first-half revenue and profit. The Greater China region is expected to fall short of expectations by reporting a considerable decline in both revenue and profit on the back of continued sluggish performance in the Mainland China market. UNIQLO Japan is expected to report slightly lower-than-expected first-half results, with revenue rising but operating profit remaining roughly flat year-on-year. We expect the GU segment will exceed expectations by reporting considerable increases in first-half revenue and profit, and our Global Brands segment to fall short of expectations by reporting an increase in revenue but a decline in profit in the first half of fiscal 2023.

Reflecting our decision announced on December 15, 2022 to conduct a stock split, we are now predicting an annual dividend per share for fiscal 2023 of 230 yen, split equally between interim and year-end dividends of 115 yen each. If we calculate the same dividend per share using pre-stock split parameters, that would translate into interim and year-end dividends of 345 yen each and an annual dividend of 690 yen, which represents a 10-yen increase in the annual dividend per share compared to the estimated dividend announced back in October 2022.

Fast Retailing Co., Ltd. discloses business results data and offers a variety of press releases on its IR website https://www.fastretailing.com/eng/ir/.