Last Updated: 2024.04.11

to Chinese page

to Japanese page

Below is the summary announced on April 11 of Results Summary for FY2024 2Q (Three Months to February 2024).

FY2024 1H Highlights

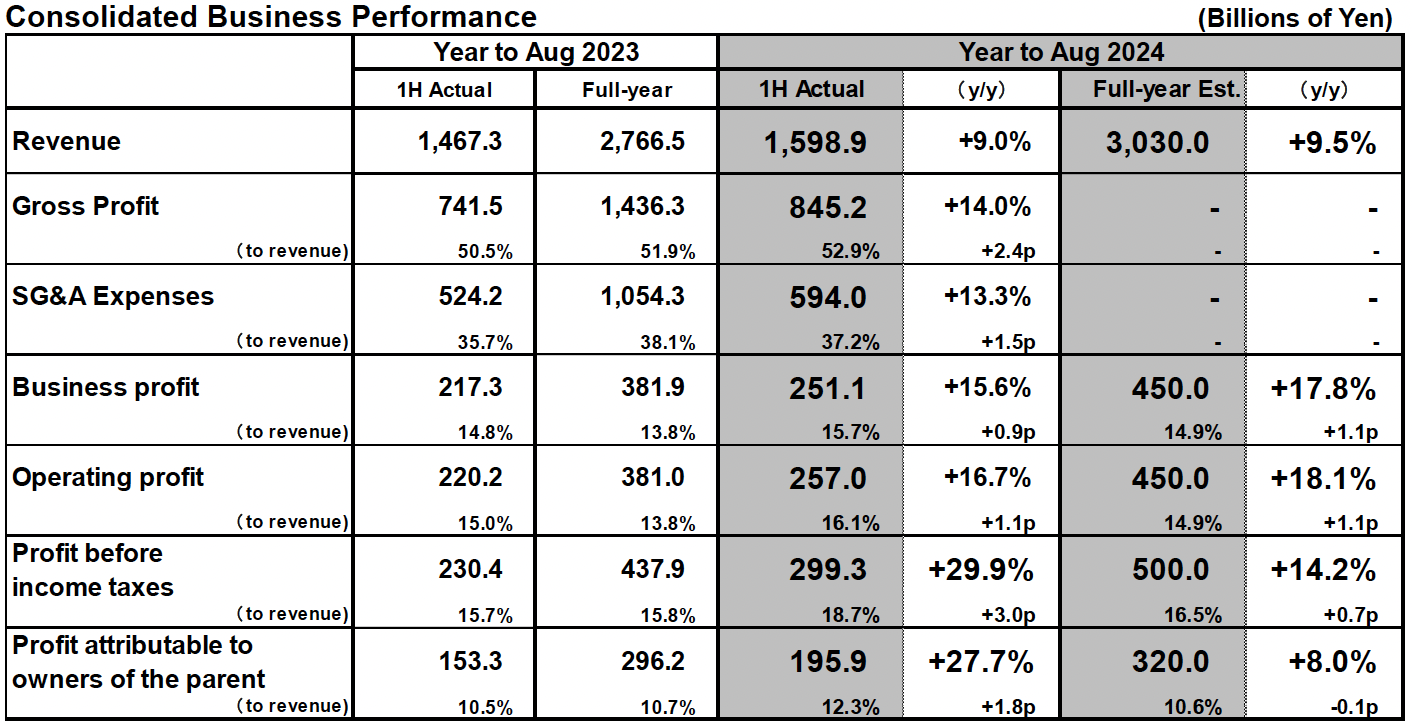

■Consolidated results: Fast Retailing reports record first-half results on higher revenue and a sharp jump in profits

- In the first half of FY2024, consolidated revenue rose to 1.5989 trillion yen (+9.0% year-on-year) and operating profit increased to 257.0 billion yen (+16.7%).

- Strong performances from UNIQLO operations in North America, Europe, and Southeast Asia, as well as GU drove the Group's overall operational expansion.

- Profit attributable to owners of the parent rose 27.7% to 195.9 billion yen. We expect the annual dividend per share to increase by 60 yen year-on-year to 350 yen, including an interim dividend of 175 yen.

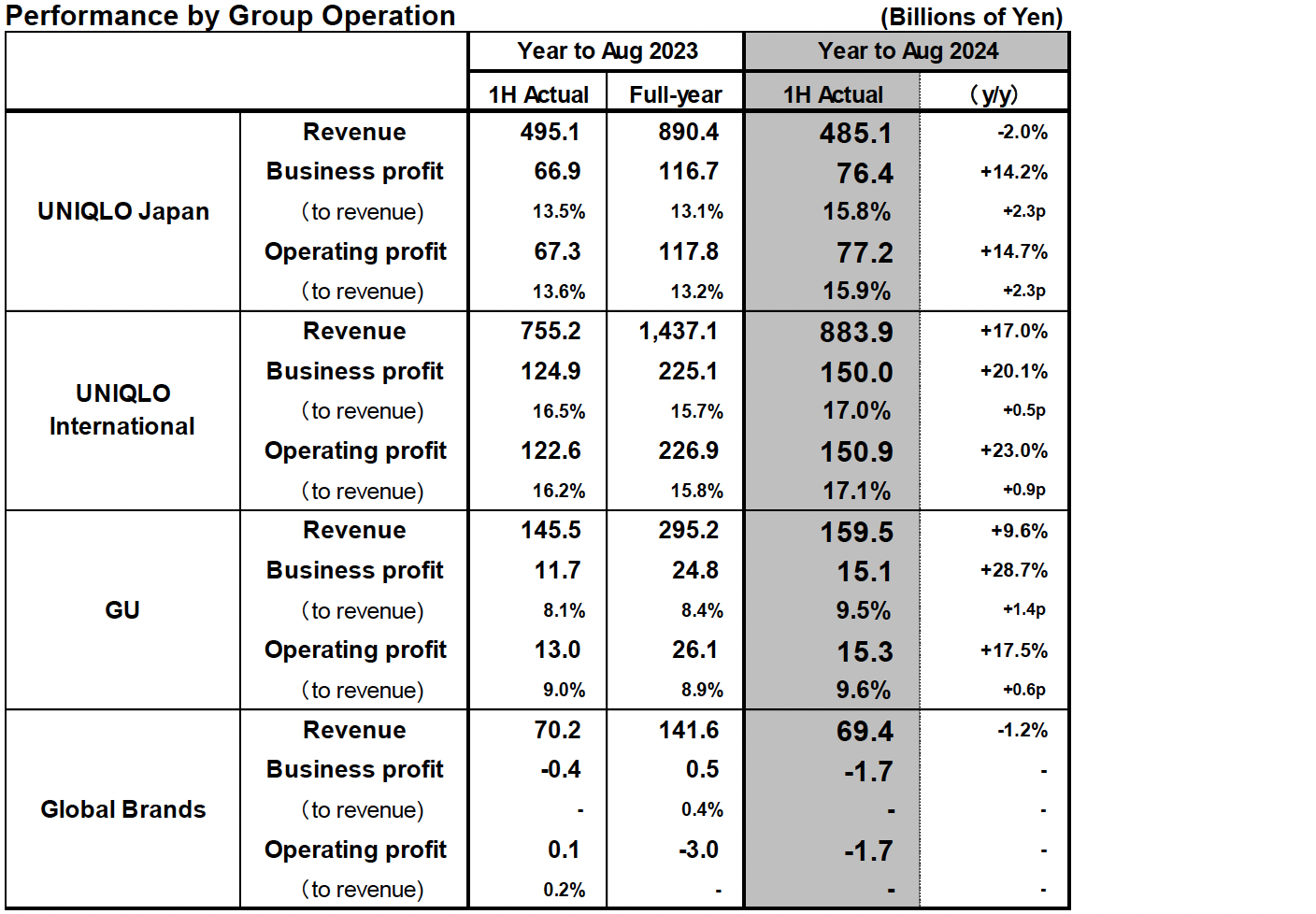

■UNIQLO Japan:Profits rise sharply on improved gross profit margin despite dip in revenue

- Revenue: 485.1 billion yen (−2.0%), operating profit: 77.2 billion yen (+14.7%).

- Same-store sales contracted by 3.4% due to an insufficient lineup of products suited to warm winter weather and poor communication of product-related information.

- Gross profit margin improved by an impressive 3.6p year-on-year. Impact of yen spot rates used for additional production orders eased thanks to more accurate ordering, resulting in a large improvement in cost of sales.

■UNIQLO International:Large profit and revenue gains. U.S. and Europe enter a virtuous growth cycle

- Revenue: 883.9 billion yen (+17.0%), operating profit: 150.9 billion yen (+23.0%).

- North America and Europe reported significant revenue and profit gains on the back of a continued expansion in new customer bases and growing customer affinity toward LifeWear.

- Southeast Asia, India & Australia reported significantly higher revenue and profit. South Korea reported revenue and profit gains.

- The Greater China region reported an increase in revenue but operating profit came in flat year-on-year. Warm winter weather and a general slowdown of consumer appetite weighed on sales.

■GU:Reports higher revenue and sharply higher profits

- Revenue: 159.5 billion yen (+9.6%), operating profit: 15.3 billion yen (+17.5%).

- Strong performance after we prepared ample stock of products that captured mass fashion trends and took measures to strengthen sales.

■Global Brands:Reports lower revenue and an operating loss

- Revenue: 69.4 billion yen (−1.2%), operating loss: 1.7 billion yen.

- Theory operation: While revenue expanded, profit declined due to an increase in the selling, general and administrative expense ratio. PLST and Comptoir des Cotonniers brands: Revenue declined following a reduction in the total number of stores, while operating losses were similar to the previous year's levels.

■FY2024 Estimates:Predicting a record performance and a 60 yen YoY increase in the annual dividend

- We expect to achieve full-year consolidated revenue of 3.03 trillion yen (+9.5%), consolidated operating profit of 450.0 billion yen (+18.1%), and profit attributable to owners of the parent of 320.0 billion yen (+8.0%).

- We have revised down our full-year revenue forecast by 20.0 billion yen to reflect the unexpected shortfall in first-half performance. We have revised up our forecast for profit attributable to owners of the parent by 10.0 billion yen to reflect revised expected totals for interest income and expenses.

- We forecast an annual dividend per share in FY2024 of 350 yen, including an interim dividend of 175 yen. This is anticipated to result in an increase of 60 yen in the annual dividend for FY2024 compared with FY2023.

FY2024 Performance in Focus

■UNIQLO Japan:Profits rise sharply on improved gross profit margin despite dip in revenue

UNIQLO Japan reported a decline in revenue but a significant increase in profit in the first half of fiscal 2024, with revenue contracting to 485.1 billion yen (−2.0% year-on-year) and operating profit rising to 77.2 billion yen (+14.7% year-on-year). First-half same-store sales declined by 3.4% year-on-year. This was due to warmer-than-usual temperatures that stifled demand for Fall Winter ranges at the beginning of the season in September, October and then again during the bumper sales period of December, and due to our inability to compile a suitable product lineup for the warm winter weather or convey sufficient product-related information. The gross profit margin improved by a considerable 3.6 points year-on-year thanks primarily to an improvement in cost of sales. In the first half of fiscal 2023, cost of sales deteriorated following the sharp weakening in yen spot rates used for additional production orders. However, in the first half of fiscal 2024, greater control over orders reduced the amount of additional production, lessening the impact of spot exchange rates and greatly improving first-half cost of sales. The selling, general and administrative expense ratio increased by 1.3 points year-on-year due primarily to lower sales and higher personnel costs and depreciation and amortization ratios.

■UNIQLO International:Large profit and revenue gains. U.S. and Europe enter a virtuous growth cycle

UNIQLO International reported significant increases in revenue and profit in the first half of fiscal 2024, with revenue rising to 883.9 billion yen (+17.0% year-on-year) and operating profit expanding to 150.9 billion yen (+23.0% year-on-year). UNIQLO operations in North America and Europe performed particularly well, with operational growth entering a virtuous cycle on the back of growing customer affinity toward LifeWear, an expanding customer base, and an accelerated opening of new stores.

Breaking down the UNIQLO International performance into individual regions and markets and viewing performance on a local currency basis, the Mainland China market reported a rise in revenue but a slight contraction in profit in the first half. However, if you exclude the impact caused by the changes in the timing of recording year-end bonuses, profit did actually increase slightly year-on-year. Same-store sales in the Mainland China market increased by approximately 20% year-on-year in the first quarter from September to November 2023 thanks to strong sales of Winter ranges, which resulted in an increase in same-store sales for the first half overall. In the second quarter from December 2023 to February 2024, same-store sales contracted slightly on the back of a general slowdown of consumer appetite and our own inability to offer ranges that matched demand in the face of warm winter weather and volatile temperatures. First-half revenue and profits from the Hong Kong market rose, while the Taiwan market generated higher revenue and a flat operating profit result. UNIQLO South Korea reported higher revenue and profit in the first half by successfully coinciding the launch of Winter ranges with the onset of colder weather. Revenue and profit rose considerably in the Southeast Asia, India & Australia region thanks to strong sales of Winter items and subsequent Spring Summer ranges, which were put on display earlier than usual in local stores. Meanwhile, UNIQLO North America and UNIQLO Europe both reported significant increases in first-half revenue and profit, with extremely strong performances being buoyed by continued growth in new customer bases and growing support for LifeWear among local customers.

■GU:Reports higher revenue and sharply higher profits

The GU business segment reported higher revenue and a significant increase in profit in the first half of fiscal 2024, with revenue rising to 159.5 billion yen (+9.6% year-on-year) and operating profit totaling 15.3 billion yen (+17.5% year-on-year). Thanks to efforts to prepare ample volumes of products that captured mass fashion trends and to strengthen sales, GU generated strong sales of Heavy Weight Sweat Shirts, Heat Padded outerwear, Cargo Pants, Wide Jeans, and other products, contributing to an increase in first-half same-store sales. Furthermore, the GU operating profit margin improved by 0.6 points year-on-year as improvements in production efficiency and other factors helped improve cost of sales and the gross profit margin.

■Global Brands:Reports lower revenue and an operating loss

The Global Brands segment reported a decline in revenue to 69.4 billion (−1.2% year-on-year) in the first half of fiscal 2024 and an operating loss of 1.7 billion yen (compared with a profit of 0.1 billion yen in the first half of fiscal 2023). While our Theory brand generated higher revenue thanks to strong sales in Japan and Asia, profit declined on the back of higher personnel costs resulting from salary increases and a rise in the selling, general and administrative expense ratio. Our PLST brand reported a decline in revenue as efforts to reform business operations resulted in an approximate 60% reduction in store numbers. The brand also reported a slight operating loss of similar level to the previous year. Finally, our France-based Comptoir des Cotonniers brand reported a decline in revenue as structural reforms reduced the store network by approximately 10% compared with the previous year and shortages of key Winter ranges made it difficult to attract customers. The first-half operating loss reported by Comptoir des Cotonniers was similar to that of the previous year.

■FY2024 consolidated estimates:Predicting a record performance and a 60 yen YoY increase in the annual dividend

In fiscal 2024, the Fast Retailing Group expects to achieve a record performance, with consolidated revenue totaling 3.03 trillion yen (+9.5% year-on-year), business profit reaching 450.0 billion yen (+17.8%), operating profit rising to 450.0 billion yen (+18.1% year-on-year), and profit attributable to owners of the parent totaling 320.0 billion yen (+8.0% year-on-year). This includes a downward revision in revenue of 20.0 billion yen to reflect the shortfall in first-half performance compared with our latest estimates issued in January. First-half operating profit was roughly in line with plan, so we have made no revisions to this measure. However, we did revise up our forecasts for profit attributable to owners of the parent by 10.0 billion yen following revisions to the expected full-year totals for interest income and expenses.

In the second half of fiscal 2024, we will continue to strengthen our initiatives in relation to the following five priority areas in order to accelerate the diversification of earning pillars for the Fast Retailing Group.

- (1) Pursuing global optimum product development and enhance branding globally

- (2) Strengthening the opening of high-quality stores

- (3) Implementing management that focuses on SKU and the needs of individual stores

- (4) Strengthening all brands by leveraging UNIQLO experience

- (5) Transforming our management to operate from a global perspective

Looking at the future outlook for individual business segments in fiscal 2024, we expect UNIQLO International will generate large increases in revenue and profit in both the second half of fiscal 2024 and the full business year. UNIQLO operations in North America, Europe, Southeast Asia, India & Australia in particular are expected to continue to drive the Group's overall expansion by reporting significant increases in revenue and profit in both the second half and for the full business year. We anticipate the Greater China region will report higher revenue and a slight increase in profit in both the second half and full business year. UNIQLO South Korea is predicted to report higher second-half and full-year revenue and profit. UNIQLO Japan is predicted to generate an increase in second-half revenue, along with a significant rise in second-half operating profit on the back of improvements in both the gross profit margin and the selling, general and administrative expense ratio. For the full business year, we forecast UNIQLO Japan will achieve a slight increase in revenue and a significant increase in profit. Meanwhile, we expect our GU segment will achieve higher revenue and a significant increase in profit in both the second half of fiscal 2024 and for the full business year, while the Global Brands segment is expected to report a slight increase in second-half and full-year revenue and to move into the black.

We have revised up our forecast for the fiscal 2024 annual dividend per share by 20 yen compared with our most recent estimates to 350 yen (comprising interim and year-end dividends of 175 yen each). That represents an increase of 60 yen in the full-year dividend per share compared with the previous year.

Fast Retailing Co., Ltd. discloses business results data and offers a variety of press releases on its IR website https://www.fastretailing.com/eng/ir/.