Last Updated: 2025.03.04

to Japanese page

Aiming for World No. 1

UNIQLO's 40th Anniversary: Looking to the Future

The first UNIQLO store was opened in Hiroshima in June 1984. Forty years on, UNIQLO boasts roughly 800 stores in Japan and 1,700 stores in 25 markets worldwide.

At the start of my career, I vowed to develop a world-class casual wear brand. Among my publications is the book One Win Nine Losses, but the journey has actually felt more like one win and 99 losses. We have picked ourselves up after every failure and kept pushing toward where we are today. These 40 years have gone by in a flash.

-

UNIQLO began enjoying greater visibility as a brand during the 1998 fleece boom. I wanted to show that UNIQLO was a new company offering great quality casual wear for everyone. At the time, fleece garments were expensive, so we chose to draw attention to our contemporary cutting-edge fleece. The aim was to sell products that were as good as those of our competitors--or better--at affordable prices for everyone in Japan.

We then expanded beyond Japan's borders because I felt we could create a world-class business and even become the top global brand. We have always been and always will be dedicated to the planning, preparation, and execution of this goal.

-

The 1998 fleece boom at the UNIQLO Harajuku store

LifeWear: The World's Most Advanced Clothing

We work to make people's lives better, and to do that, we constantly refine not only our clothes, but the very idea of a company that makes clothes. LifeWear is the epitome of these values. "The Art and Science of LifeWear," a special event held in the global fashion capital Paris, commemorated UNIQLO's 40th anniversary by seeking to broaden and deepen understanding of LifeWear as a new type of clothing that transcends traditional fashion and apparel concepts.

I feel that the values that LifeWear represents resonate with European customers. Values have changed dramatically worldwide, and the emphasis now is on long-lasting clothes, as well as recycling and reusing items to the extent possible. The need for LifeWear will continue to expand as this mindset becomes increasingly mainstream.

Our strategic partnership with Toray Industries is vital for realizing LifeWear value. Since forming this partnership in 2006, we have created new clothes that changed conventional wisdom, including HEATTECH, AIRism, Ultra Light Down, and PUFFTECH. Our starting points in business were very different, but now we share information and collaborate on all processes, from raw materials development to production and product improvement. A successful partnership of this kind is extremely rare, and we will continue to work together to keep LifeWear at the world's cutting edge.

In October 2024, a large-scale interactive event was held near Place Vendôme in Paris to mark UNIQLO's 40th anniversary. "The Art and Science of LifeWear. What Makes Life Better?" featured unique exhibits and installations that showcased LifeWear concepts at the core of UNIQLO apparel.

As a Truly Global Brand

UNIQLO Princes Street store (UK)

A Growing Affinity for LifeWear: North America & Europe Poised for Dramatic Growth

LifeWear seeks to improve people's lives. With increasing support from customers worldwide, who see our commitment to society as we grow, our business continues to expand.

UNIQLO Europe and North America are entering a stage of undeniable growth. Both regions achieved record performances in FY2024. The first signs of dramatic growth in Europe are highly significant because they indicate that UNIQLO has earned the support of discerning customers in the birthplace of modern fashion. I think UNIQLO's global visibility will only strengthen going forward. People see UNIQLO as a new, innovative brand offering affordable clothing that is well designed, high quality, and easily pairs with clothing from other labels. One factor underpinning UNIQLO's success is the opening of global flagship stores, which achieve the perfect blend of local history, culture, and UNIQLO values in prime urban locations. Sales are proving extremely strong in the markets we entered in 2024: Edinburgh, Scotland; Rome, Italy; Warsaw, Poland; and Texas, the USA. The European and North American apparel market is worth ¥120 trillion. Our target is to achieve revenue of ¥1 trillion in each of these regions and then eventually grow total sales to ¥3 trillion.

Asia: Strengthen Local Store Management, On to the Next Stage

With their large populations, Greater China and the Southeast Asia, India & Australia markets harbor great potential, and we must strengthen local store management to promote further growth.

The Mainland China market covers a vast landmass with differing climates, cultures, and customs. We are responding with community-based store operations that combine the best elements of global and local management. Mirroring our successful strategy in Europe, we will contribute to local communities by opening global flagship stores in major cities and developing regionally tailored product mixes. Each store will be transformed into an indispensable location for local customers.

Southeast Asia product ranges are being fundamentally reshaped by our swift creation of product mixes for perpetual summer weather, which include more items for year-round sale and regionally customized product lineups.

India is growing rapidly, and the first stores we opened this year in the bustling commercial hub of Mumbai are performing extremely well. Indeed, growth potential in India is greater than originally anticipated. I think we will be able to develop ¥100 billion businesses in India and each Southeast Asian market in the near future. As economic growth progresses, I believe these markets will become pillar operations of similar magnitude to UNIQLO Mainland China.

GU Strengthens Management Team, Aims for Rapid Growth

-

By clearly defining GU's brand value and embodying it in GU products, sales floors, and human resources, GU will have the potential to grow as large as UNIQLO. We must first establish the foundations for developing a reasonably priced brand with global reach. Going forward, management resources drawn from throughout the Fast Retailing Group will support GU. The most important task is to cultivate managers and nurture talented employees. As we do so, we will also strengthen the GU management team.

In September 2024, we opened GU's first global flagship store outside Japan, the GU NY SOHO, together with an online store. Opening day was a great success thanks to proactive advertising in UNIQLO stores and on social media, with the help of UNIQLO USA. Success in trendsetting New York will be a first step in GU's global journey.

By leveraging Fast Retailing's platforms as well as UNIQLO's proven expertise and experience, I think GU could grow even faster than UNIQLO did. Going forward, we intend to accelerate GU growth in Japan and establish GU business foundations in Greater China and the USA. Then we plan to accelerate expansion around the world, including in Southeast Asia.

-

GU NY SOHO (USA)

Borderless Team Management

New Workstyles Driven by Talented Teams

Our real global battle is yet to come. All employees must fully review what they should be doing for customers, and then act. By encouraging independent individuals to work as a team, leveraging strength and minimizing weaknesses, we make our organization strong. We always seek to exceed customer expectations and increase corporate profits. We provide growth opportunities to world-class talent and incentivize work of the highest global standard. Fast Retailing boasts a wealth of next-generation talent with excellent capabilities in all our markets and functions. We will accelerate efforts to discover and effectively assign standout management candidates. Indeed, current executive officers and local managers are responsibly establishing local training-related frameworks for that very purpose.

Furthermore, we are transforming management frameworks and encouraging senior managers from global headquarters to visit local sites to identify issues and work with local management teams to deliver solutions based on real circumstances.

We will deploy select teams of managers to implement new workstyles. Cutting-edge hardware and software will connect cross-border teams and transform global management.

Consistent, Balanced Management

Fast Retailing cultivates managers who embrace our company philosophy and contribute to growth, like President and COO of UNIQLO Co., Ltd. Daisuke Tsukagoshi. Training management successors is not about mastery of theory; successful habits are nurtured in the real world every day through practical on-site challenges that engage management principles and good judgment.

Two members of the founding family, Kazumi Yanai and Koji Yanai, oversee corporate governance. They ensure Fast Retailing conducts proper management and plays a positive role in society.

I am especially proud of our consistent long-term growth. We have pursued management that stresses overall profitability and a long-term perspective, all the while considering what is right for society. This has facilitated sustainable growth. The crucial task going forward will be maintaining proper management and continuing long-term growth.

Fast Retailing combines the best elements of a family business and a public company. I want us to keep this balance in our management well into the future.

The morning meeting on what proved to be a very successful opening day for the UNIQLO Koningsplein store in Amsterdam, October 2024

For a Better Tomorrow

Increasing Long-term Value

I believe only companies that contribute to society will last. For many years, we have concentrated on management that enhances the intrinsic value of our business. It is only natural for companies to pursue profits. But it is also important to prosper in tandem with society, and strive to be a company valuing business expansion that contributes to society.

Our business is centered primarily around individual store management, so contributing to local communities is vital. We have always fiercely defended our approach of working together with local communities to generate maximum benefits for everyone. We only partner with companies that share our vision so as to ensure our business is conducted responsibly from end to end. We will continue to pursue thorough management, building a network that allows us to visualize all processes, from materials procurement to fabric production and garment sewing. We will also strengthen relationships with partner factories that adhere to shared values and standards.

Technological innovations enable us to form partnerships on a global scale, promote mutual growth, and develop even stronger win-win relationships--a great source of strength for us. We will continue to undertake business activities that increase long-term value.

Investing in a Better Future

-

The LifeWear concept is premised on creating clothing MADE FOR ALL and realizing PEACE FOR ALL around the world. Our ultimate desire is a peaceful society. Without peace, our business would not survive, and our PEACE FOR ALL project is designed to take action for world peace. As part of the project, UNIQLO sells charity T-shirts and donates all the profits (equivalent to 20% of the retail price for each T-shirt) to support emergency humanitarian assistance and other international aid activities.

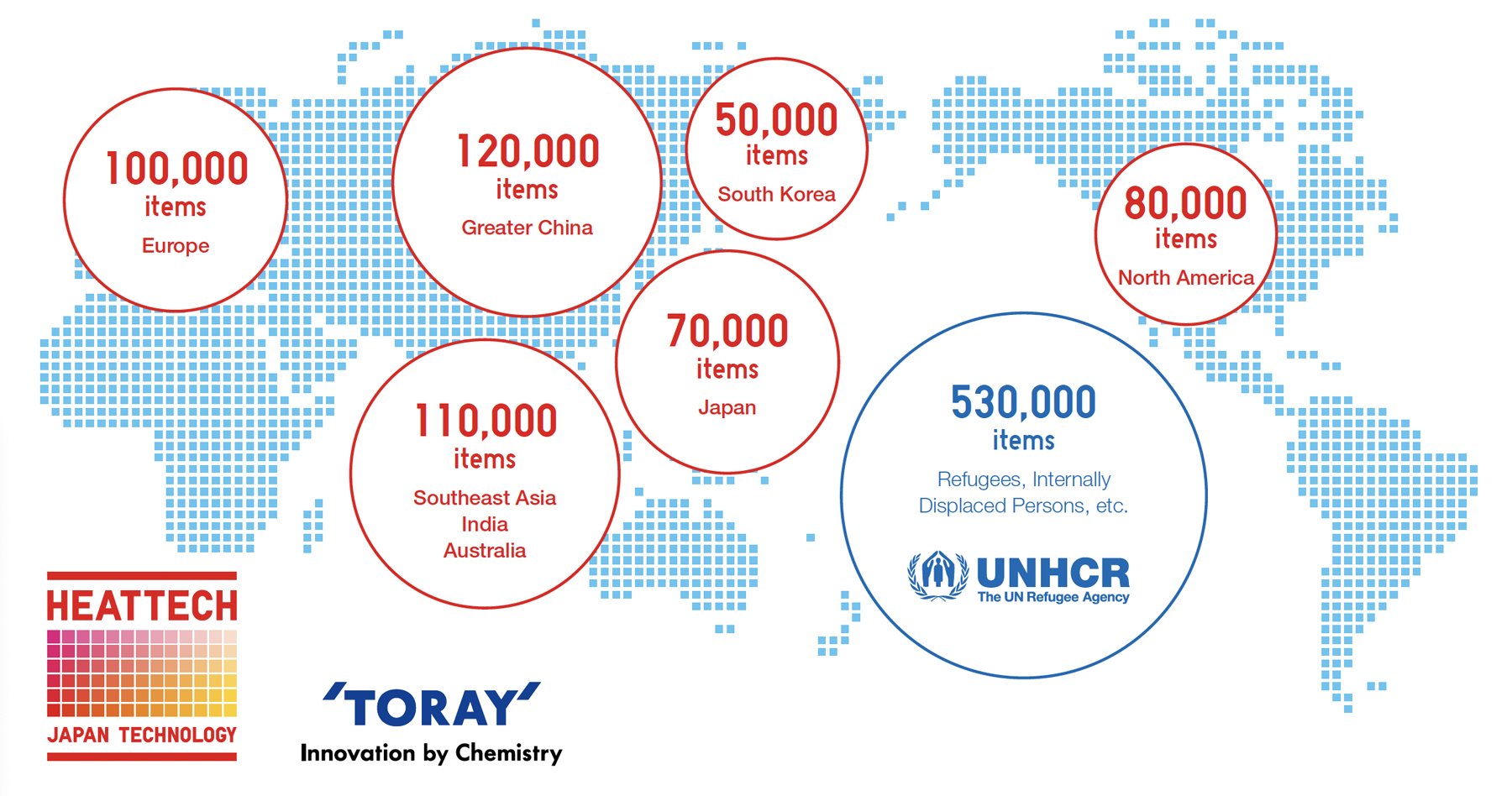

Through The Heart of LifeWear, a worldwide initiative launched in winter 2024, we have been working to donate one million new clothing items, primarily HEATTECH. In October 2024, we delivered HEATTECH to Ukrainian refugees in Moldova. Meanwhile, UNIQLO Japan delivered 70,000 HEATTECH garments to those affected by the 2024 Noto Peninsula earthquake (through the NGO Japan Platform) and also to children in orphanages across Japan (through the Mirai Kodomo Foundation). Everything we do is in pursuit of our corporate statement--Changing clothes. Changing conventional wisdom. Change the world. We will continue to develop Fast Retailing into the world's most trusted company.

-

UNIQLO launched The Heart of LifeWear, an initiative to donate one million new HEATTECH items to people in need around the world. UNIQLO is being assisted by its Global Brand Ambassadors as well as the Toray Group, the leading Japanese materials manufacturer and joint developer of HEATTECH.

Donations in The Heart of LifeWear Initiative

* Planned figures as of December 31, 2024. Includes HEATTECH and AIRism items depending on the climate of the donation region.