Last Updated: 2023.10.12

Results Summary for Fiscal 2023 (Year to August 31, 2023)

FAST RETAILING CO., LTD.![]() (174KB)

(174KB)

to Japanese page

to Chinese page

【Financial Highlights】

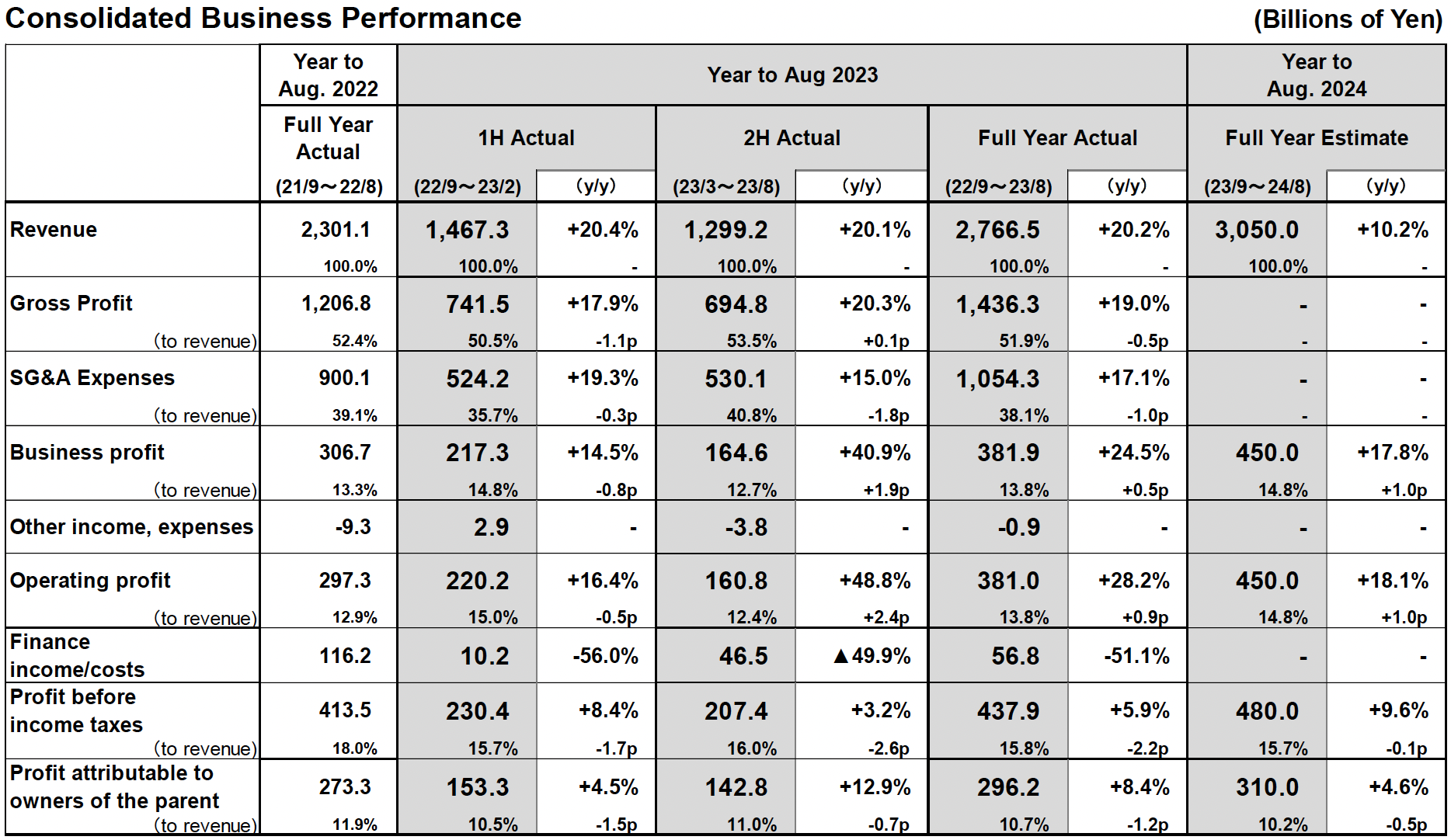

■FY2023 consolidated results: Fast Retailing achieves third consecutive record annual performance on significantly higher full-year revenue and profit

- FY2023 revenue: 2.7665 trillion yen (+20.2% year-on-year), operating profit: 381.0 billion yen (+28.2% year-on-year), and profit attributable to owners of the parent: 296.2 billion yen (+8.4% year-on-year).

- UNIQLO International revenue surpassed 50% of total consolidated revenue for the first time, and UNIQLO International operating profit accounted for roughly 60% of consolidated profit. UNIQLO International generated strong rises in both revenue and profit in all markets and we saw a clear diversification of our earnings pillars.

- Scheduled to offer a year-end dividend of 165 yen per share. When added to the 125 yen interim dividend, that would generate a scheduled annual dividend of 290 yen for FY2023, an increase of 83 yen compared to the previous year.

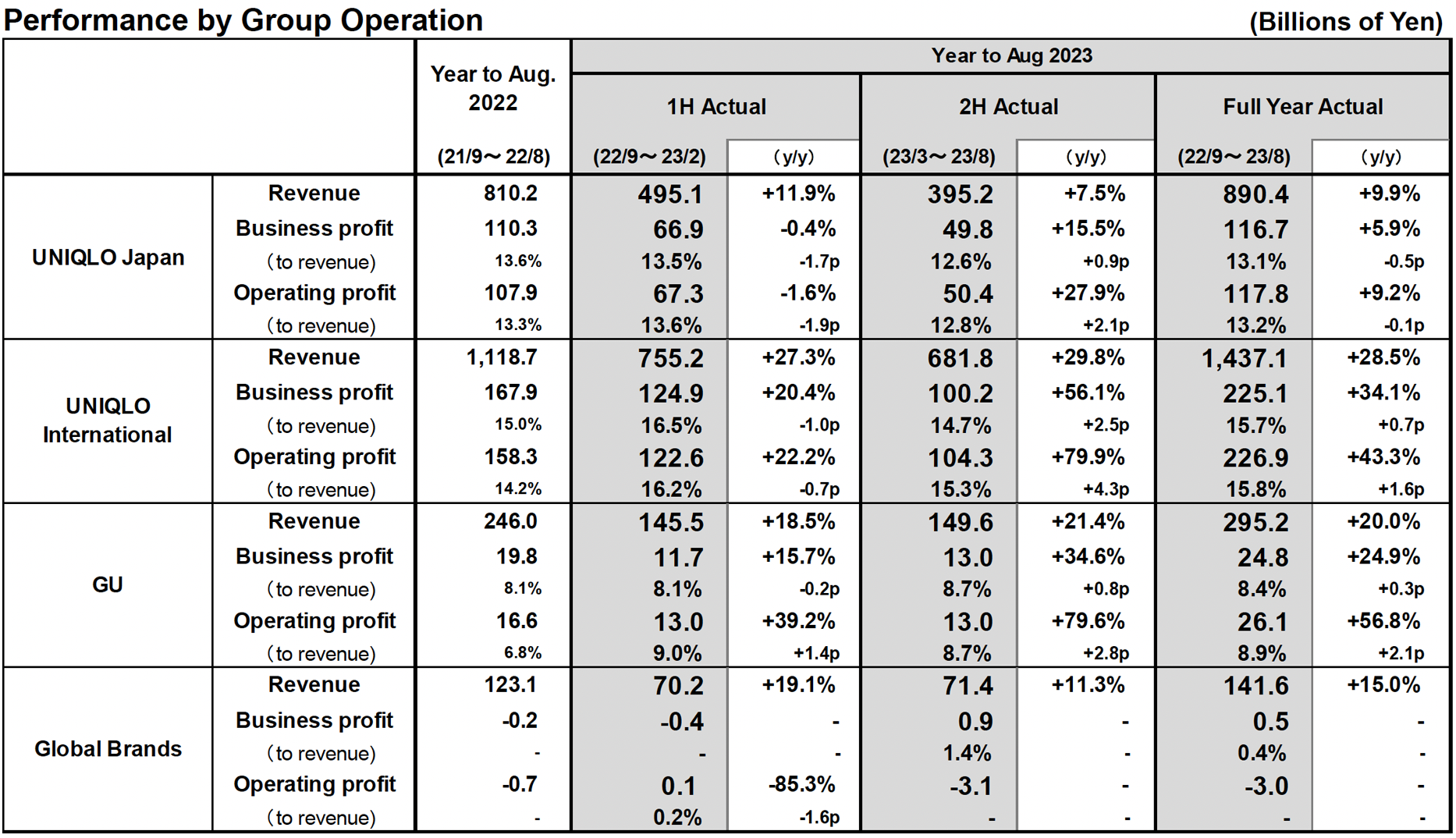

■UNIQLO Japan: Full-year revenue and profit gains help generate a record performance

- FY2023 revenue: 890.4 billion yen (+9.9% year-on-year), operating profit: 117.8 billion yen (+9.2% year-on-year).

- FY2023 same-store sales increased 7.6% year-on-year. First-half same-stores sales rose 10.0% year-on-year on the back of strong sales of Winter items. Second-half same-store sales rose 4.7% on strong sales of AIRism innerwear, AirSense (Ultra Light) jackets, and other products.

- The full-year gross profit margin declined by 1.0 point year-on-year following a 2.2 point decline in the first-half margin. However, the second-half gross profit margin improved 0.4 point year-on-year on the back of improvements in discounting rates and cost of sales. The full-year selling, general and administrative expense ratio improved by 0.6 point.

■UNIQLO International: Large full-year revenue and profit increases. Strong overall performance with significant revenue and profit gains in all markets

- FY2023 revenue: 1.4371 trillion yen (+28.5% year-on-year), operating profit: 226.9 billion yen (+43.3% year-on-year). Achieved a record performance.

- Greater China region achieved a record full-year performance by generating significant increases in both revenue and profit. While sales struggled in the first-half due to COVID-19, second-half performance recovered by a greater extent than we had expected.

- South Korea reported higher revenue and profit. Southeast Asia, India & Australia reported significantly higher revenue and profit, with sales proving strong throughout the period. However, second-half operating profit contracted slightly as the impact of safeguards in Indonesia knocked the gross profit margin lower.

- The North America and Europe regions achieved large increases in revenue and profit. The deepening affinity for our LifeWear concept helped generate a strong performance.

■GU: Significant increases in FY2023 revenue and profit

- FY2023 revenue: 295.2 billion yen (+20.0% year-on-year), operating profit: 26.1 billion yen (+56.8% year-on-year).

- Sales proved strong throughout the period as we successfully narrowed the number of product items and strategically prepared ample volumes of products that captured the mass fashion trends.

- The selling, general and administrative expense ratio improved, and the operating profit margin increased by 1.2 points year-on-year.

■Global Brands: Large increase in full-year revenue but operating loss widens on recording of impairment and other losses

- FY2023 revenue: 141.6 billion yen (+15.0% year-on-year), business profit: 0.5 billion yen. The segment's FY2023 operating loss expanded to 3.0 billion yen (compared to a 0.7 billion yen loss in FY2022). This was due to the recording of impairment losses relating to the closure of unprofitable stores and costs relating to operational restructuring at the Comptoir des Cotonniers label.

- Our Theory label generated large increases in revenue and profit. PLST reported higher revenue and a smaller loss. Comptoir des Cotonniers reported a decline in revenue and a wider loss.

■FY2024 consolidated business estimates: Expect significant rises in revenue and profit, with revenue seen surpassing 3 trillion yen

- FY2024 consolidated revenue:3.0500 trillion yen (+10.2% year-on-year), consolidated operating profit: 450.0 billion yen (+18.1% year-on-year), profit attributable to owners of the parent: 310.0 billion yen (+4.6% year-on-year).

- We forecast an annual dividend per share in FY2024 of 330 yen, split equally between interim and year-end dividends of 165 yen each. That represents an increase in the full-year dividend of 40 yen per share.

FY2023 Performance in Focus

■UNIQLO Japan: Full-year revenue and profit increases help generate a record performance

UNIQLO Japan reported increases in both revenue and profit in fiscal 2023, with revenue totaling 890.4 billion yen (+9.9% year-on-year) and operating profit totaling 117.8 billion yen (+9.2% year-on-year). Full-year same-store sales (including e-commerce) expanded by 7.6% year-on-year. In the first half from 1 September 2022 through 28 February 2023, same-store sales expanded by a considerable 10.0% year-on-year thanks to strong sales of HEATTECH innerwear and other Winter items as the weather remained cold. Same-store sales subsequently increased by 4.7% year-on-year in the second half from 1 March through 31 August 2023 on strong sales of AIRism innerwear, AirSense Jacket (Ultra Light Jacket), and Pleated Pants. Meanwhile, full-year e-commerce sales expanded by 2.3% year-on-year in fiscal 2023 to 133.8 billion yen, constituting 15.0% of total revenue.

The UNIQLO Japan gross profit margin contracted by 1.0 point year-on-year in fiscal 2023. This was due to a 2.2 point year-on-year contraction in the first-half gross profit margin following a considerable weakening in the yen spot exchange rates used for additional production orders. Meanwhile, the second-half gross profit margin improved by 0.4 point year-on-year on the back of improved discounting rates and cost of sales in the fourth quarter from June to August 2023. The selling, general and administrative expense ratio improved by 0.6 point in fiscal 2023 as strong sales helped improve component cost ratios such as store rents and distribution.

■UNIQLO International: Large full-year revenue and profit increases. Strong performance with significant revenue and profit gains in all markets

UNIQLO International reported a record high performance in fiscal 2023 on the back of significant increases in both revenue and profit, with revenue rising to 1.4371 trillion yen (+28.5% year-on-year) and operating profit expanding to 226.9 billion yen (+43.3% year-on-year).

Breaking down the UNIQLO International performance into individual regions and markets, the Greater China region reported significant increases in both revenue and profit, with revenue rising to 620.2 billion yen (+15.2% year-on-year) and operating profit totaling 104.3 billion yen (+25.0% year-on-year). While sales in the region struggled in the first half due to COVID-19, performance recovered to a greater degree than expected in the second half, which resulted in a record full-year performance. UNIQLO South Korea and UNIQLO Southeast Asia, India & Australia reported significantly higher revenue and profits, with revenue for those markets rising to 449.8 billion yen (+46.1% year-on-year) and operating profit totaling 78.2 billion yen (+36.4% year-on-year). Revenue and profit at UNIQLO South Korea increased after the operation successfully strengthened communication of pertinent information about core products. UNIQLO Southeast Asia, India & Australia reported considerable rises in both revenue and profit. First-half revenue and profit rose significantly on the back of strong sales primarily of core products that were generated by an expansion in the operation's customer base and a recovery in travel-related demand. While the region reported a large increase in second-half revenue, second-half operating profit contracted slightly on the back of a decline in the gross profit margin. This decline was due to our decision to conduct a certain amount of discount sales in the second half of fiscal 2023 compared to the second half of fiscal 2022 when supply disruptions resulted in insufficient inventory, making it impossible to conduct special sales promotions. The second-half gross profit margin was also adversely impacted by safeguard measures in Indonesia. UNIQLO North America achieved a large increase in revenue and profit in fiscal 2023, with revenue totaling 163.9 billion yen (+43.7% year-on-year) and operating profit totaling 21.1 billion yen (+91.9% year-on-year). The operation managed to maintain strong sales throughout the period by holding sufficient volumes of products targeted for strategic sales and enhancing the communication of pertinent product information. UNIQLO Europe achieved large increases in revenue and profit in fiscal 2023, with revenue totaling 191.3 billion yen (+49.1% year-on-year) and operating profit coming in at 27.3 billion yen (+82.5% year-on-year) as European customers developed an even deeper affinity for our LifeWear concept and the region's customer base expanded as a result.

■GU: Significant increases in FY2023 revenue and profit

Our GU segment reported large increases in both revenue and profit in fiscal 2023, with revenue totaling 295.2 billion yen (+20.0% year-on-year) and operating profit totaling 26.1 billion yen (+56.8% year-on-year). GU was able to generate strong sales throughout the period by successfully narrowing down the number of product items on offer and strategically preparing a sufficient supply of products that captured mass fashion trends. Sales of Heavy Weight Sweat wear, Super Wide Cargo Pants, Pull-on Pants, and other products proved especially strong. GU's selling, general and administrative expense ratio also improved on the large rise in sales and stronger cost controls, which led to a 2.1 point improvement in the operating profit margin.

■Global Brands: Large increase in full-year revenue but operating loss widens on recording of impairment and other losses

In fiscal 2023, the Global Brands segment reported a rise in revenue to 141.6 billion yen (+15.0% year-on-year) and a move back into the black after posting a business profit of 0.5 billion yen (compared to a loss of 0.2 billion yen in fiscal 2022). The segment's operating loss expanded to 3.0 billion yen (compared to a loss of 0.7 billion yen in fiscal 2022) but that was due to the recording of impairment losses relating to the closure of unprofitable stores and the cost of structural reforms at the Comptoir des Cotonniers label. Our Theory label reported significant increases in both revenue and profit, which were fueled by strong performances from the label's Asian and Japanese operations. Sales of jackets, pants, dresses, and other "going-out" attires proved particularly strong after we focused primarily on appealing the value of the brand's core ranges. Our PLST label reported an increase in revenue and a smaller operating loss in fiscal 2023. Finally, our Comptoir des Cotonniers brand reported a decline in revenue and a wider operating loss for the year.

■FY2024 consolidated business estimates: Expect significant rises in revenue and profit, with revenue seen surpassing 3 trillion yen

In fiscal 2024, the Fast Retailing Group expects to achieve consolidated revenue of 3.0500 trillion yen (+10.2% year-on-year), operating profit of 450.0 billion yen (+18.1% year-on-year), profit before income taxes of 480.0 billion (+9.6% year-on-year), and profit attributable to owners of the parent of 310.0 billion yen (+4.6% year-on-year).

During the year ending 31 August, 2024, we will adopt an aggressive stance by accelerating growth on a global scale, while simultaneously going back to basics and focusing on thoroughly implementing our business principles and strengthening our management platforms. We will also scale up our efforts to address the following five priority issues.

- (1) Pursue global optimum product development and enhance branding globally

- (2) Strengthen the opening of high-quality stores

- (3) Implement management that focuses on SKU units and the needs of individual stores

- (4) Strengthen Group brands

- (5) Transform our management to operate from a global perspective

Looking at the future outlook for individual business segments in fiscal 2024, we expect UNIQLO Japan will generate higher revenue and profit, and UNIQLO International will generate large increases in both revenue and profit and continue to expand its operations around the globe. We expect our GU segment will achieve higher revenue and profit, while the Global Brands segment is expected to report higher revenue and a move into the black.

We plan to strengthen the opening of high-quality stores primarily at our UNIQLO International operation. In terms of store numbers, we predict our store network will total 3,660 stores by the end of August 2024, comprising 800 UNIQLO Japan stores (including franchise stores), 1,744 UNIQLO International stores, 480 GU stores, and 636 Global Brands stores.

We forecast an annual dividend per share in FY2024 of 330 yen (interim and year-end dividends of 165 yen each). That represents an increase in the full-year dividend of 40 yen per share compared to the previous year.

Fast Retailing Co., Ltd. discloses business results data and offers a variety of press releases on its IR website https://www.fastretailing.com/eng/ir/.