Last Updated: 2022.01.13

Results Summary for FY2022 1Q (Three Months to November 2021)

FAST RETAILING CO., LTD.![]() (197KB)

(197KB)

to Japanese page

to Chinese page

Consolidated Business Performance

Performance by Group Operation

FY2022 1Q Main Points

■Fast Retailing Group reports first-quarter revenue and profit gains that far outstrip plan

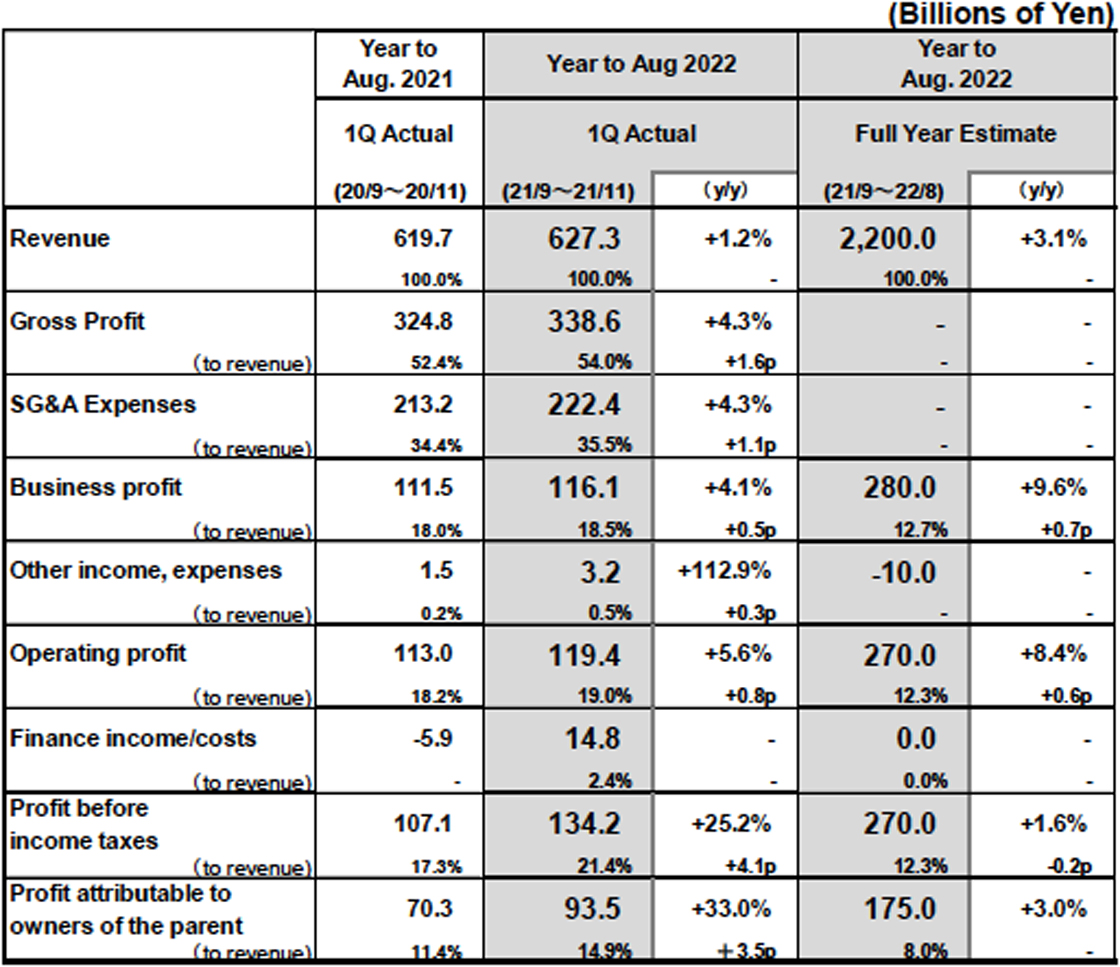

- Consolidated revenue and profit both increased in the first quarter of FY2022. Revenue: 627.3 billion yen (+1.2% year-on-year), operating profit: 119.4 billion yen (+5.6%).

- UNIQLO operations in the South Asia, Southeast Asia & Oceania, North America, and Europe regions all recorded strong performances by reporting considerable increases in revenue and profit. While revenue and profit from UNIQLO operations in Japan and the Greater China region and from our GU operation declined, first-quarter consolidated sales and consolidated operating profit both outstripped our initial expectations by a considerable margin thanks to the growing diversification of our various earnings pillars.

- Recorded a 14.8 billion yen gain from foreign exchange gains and other items under finance income net of costs. As a result, profit attributable to owners of the parent increased 33.0% to 93.5 billion yen.

■UNIQLO Japan:Outperforms plan despite large fall in revenue and profit

- Revenue and profit declined considerably. Revenue: 226.4 billion yen (−10.8%), operating profit: 48.7 billion yen (−18.8%).

- First-quarter same-store sales contracted 7.7% compared to a strong previous year and after persistently warm weather through mid-October continued to stifle sales of Fall Winter ranges.

- Gross profit margin improved 0.5 points on lower discounting. SG&A ratio increased 2.6 points in line with the decline in overall sales.

■UNIQLO International:Large revenue, profit gains on strong S/SE Asia & Oceania, North America and Europe sales

- Revenue: 299.7 billion yen (+15.0%). Operating profit: 59.9 billion yen (+44.6%).

- Strong sales in S/SE Asia & Oceania, North America, and Europe helped generate considerable increases in both revenue and profit in the first quarter. Meanwhile, revenue declined slightly and profits fell sharply in the Greater China region.

- Overall, UNIQLO International was able to report a record first-quarter result thanks to the growing diversification of our earnings pillars.

■GU:Revenue declines and profit falls sharply. Roughly in line with plan

- GU revenue declined and profits contracted sharply in the first quarter. Revenue: 69.8 billion yen (−8.7%), operating profit 8.9 billion yen (−34.5%).

- First-quarter same-stores sales declined year-on-year after persistently warm temperatures stifled sales of Fall items and production and distribution delays resulted in a later launch of Winter ranges.

■Global Brands:Revenue increase and move into the black roughly to plan

- Global Brands reported increased revenue and a move into the black in the first quarter. Revenue: 30.7 billion yen (+9.5%), operating profit: 2.5 billion yen.

- Compared to the previous year when the United States and Europe were hit hard by COVID-19, all stores were able to operate regular openings hours, which resulted in large revenue and profit gains for Theory and a large revenue gain and an operating profit from our France-based Comptoir des Cotonniers operation.

■FY2022 estimates unchanged from initial plan

- We have maintained our initial estimates for FY2022 business performance, which include predicted consolidated revenue of 2.2000 trillion yen (+3.1%), consolidated operating profit of 270.0 billion yen (+8.4%), and profit attributable to owners of the parent of 175.0 billion yen (+3.0%).

- We expect to pay an annual dividend per share of 520 yen, split equally into interim and year-end dividends of 260 yen.

FY2022 1Q Performance in Focus

■UNIQLO Japan:Outperforms plan despite large fall in revenue and profit

UNIQLO Japan reported significant declines in revenue and profit in the first quarter of fiscal 2022, with revenue totaling 226.4 billion yen (−10.8%) and operating profit totaling 48.7 billion yen (−18.8%). First-quarter same-store sales declined by 7.7% year-on-year. This performance was being compared to a strong result in the previous year when stay-at home demand and sales of AIRism masks were particularly buoyant. In addition, the large number of persistently warm days from September through to the middle of October stifled sales of Fall Winter ranges. Sales of outerwear and thermal innerwear did strengthen once the weather turned colder from the middle of October and sales exceeded previous year levels during our UNIQLO anniversary sale in November, but, despite that, revenue for the first-quarter as a whole still declined year-on-year.

E-commerce sales declined slightly compared to the first quarter of fiscal 2021 with online sales totaling 36.6 billion yen (−0.2%). However, this figure represented an approximate 50% increase compared to the first quarter of fiscal 2020, so e-commerce is still trending on a favorable expansion track. UNIQLO Japan's gross profit margin improved by 0.5 point as our determination to restrict any tendency to offer excessive discounts improved discounting rates. The selling, general and administrative expense ratio increased by 2.6 points following the decline in sales.

■UNIQLO International:Large revenue, profit gains on strong S/SE Asia & Oceania, North America and Europe sales

UNIQLO International reported a significant increase in both revenue and profit in the first quarter of fiscal 2022, with revenue rising to 299.7 billion yen (+15.0%) and operating profit expanding to 59.9 billion yen (+44.6%). This impressive UNIQLO International performance was fueled primarily by strong sales and large increases in both revenue and profit at UNIQLO operations in the S/SE Asia & Oceania, North America, and Europe regions. Meanwhile, first-quarter revenue declined marginally and first-quarter profit declined significantly for the Greater China region. Overall, UNIQLO International generated a record performance in the first quarter as the segment's earning pillars continued to diversify.

Breaking down the UNIQLO International performance into individual regions and markets, revenue declined and profit contracted significantly in the Mainland China market. This was due to a weaker consumer appetite for apparel following the continued implementation of tough restrictions to control rising COVID-19 infections, and the fact that the operation was being compared to a strong sales performance in the previous year. Meanwhile, the Hong Kong and Taiwan markets generated significant increases in both revenue and profit and UNIQLO South Korea reported a rise in both revenue and profit. S/SE Asia & Oceania reported significantly higher revenue and profit as the region recovered the level of performance it had enjoyed two years ago prior to COVID-19. UNIQLO USA generated a significant rise in revenue and moved into the black in the first quarter. Sales were strong thanks to a partial recovery in travel demand and our concerted efforts to convey information and product news to strengthen UNIQLO branding. UNIQLO Europe achieved significant increases in both revenue and profit as falling temperatures and a rising consumer appetite for shopping created a buoyant sales environment and an increase in the number of registered e-commerce app members helped strengthen customer support for the UNIQLO brand.

■GU:Revenue declines and profit falls sharply. Roughly in line with plan

The GU business segment reported a decline in revenue and a considerable contraction in profit in the first quarter of fiscal 2022, with revenue falling to 69.8 billion yen (−8.7%) and operating profit contracting to 8.9 billion yen (−34.5%). First-quarter same-store sales declined as persistently warm weather stifled sales of Fall items and delays in production and distribution also delayed the launch of Winter ranges. GU's gross profit margin declined by 1.7 points after we strengthened discount sales to help rundown Fall inventory and as the sharp rises in raw materials prices and shipping costs resulted in a slightly higher cost of sales. GU's selling, general and administrative expense ratio increased by 3.2 points. However, this was due to a temporary increase in distribution costs linked to the launch of automated warehousing in Western Japan to help expand e-commerce operations as well as stronger marketing to boost our brand recognition.

■Global Brands:Revenue increase and move into the black roughly to plan

The Global Brands segment reported a rise in revenue and a move back into the black in the first quarter of fiscal 2022. The segment generated revenue of 30.7 billion yen (+9.5%) and an operating profit of 2.5 billion yen (compared to a 0.2 billion yen loss recorded in the first quarter of fiscal 2021). Our Theory operation generated strong increases in both revenue and profit, thanks primarily to a recovery in performance and a move back into the black for Theory in the United States. PLST reported a decline in both revenue and profit as that operation struggled to attract customers during the COVID-19-related state of emergency in Japan. Our France-based Comptoir des Cotonniers operation reported higher revenue and a move back into the black after we were able to avoid temporarily closing any stores due to COVID-19. Meanwhile, the permanent closure of unprofitable stores and other structural reforms improved cost efficiencies.

■FY2022 estimates unchanged from initial plan

We have decided to maintain our initial estimates for FY2022 business performance, which we announced in October 2021. Those estimates predict full-year consolidated revenue of 2.2000 trillion yen (+3.1%), consolidated operating profit of 270.0 billion yen (+8.4%), and profit attributable to owners of the parent of 175.0 billion yen (+3.0%). We expect to achieve our initial estimates though we have difficulties involved in attempting to predict the future situation due to the global spread of COVID-19.

We expect UNIQLO International will exceed our expectations for the first half of FY2022 and generate considerable increases in both revenue and profit. Looking at regional operations within the UNIQLO International segment, we expect the S/SE Asia & Oceania and Europe regions will report large rises in both revenue and profit, while North America is forecast to achieve a large rise in revenue and to move into the black in terms of operating profit. The Greater China region is expected to report a decline in revenue and a large decline in profit, while UNIQLO South Korea is seen reporting increased revenue and profit. While UNIQLO Japan is forecast to report lower revenue and a large decline in profits in the first half, we do expect the segment could attain a slightly higher performance than initially predicted. Our GU business segment is expected to report a decline in revenue and a large drop in profits in the first half that are roughly in line with our initial forecasts. Meanwhile, Global Brands is expected to perform roughly as planned by reporting a large increase in revenue and moving move into the black in the first half of FY2022.

Finally, our forecasted annual dividend per share for FY2022 remains unchanged from our original estimate of ¥520, split equally between interim and year-end dividends of ¥260.

Fast Retailing Co., Ltd. discloses business results data and offers a variety of press releases on its IR website https://www.fastretailing.com/eng/ir/.