Last Updated: 2013.10.10

Results Summary for the Twelve Months to August 2013

FAST RETAILING CO., LTD.![]() ( 170KB )

( 170KB )

to Japanese page

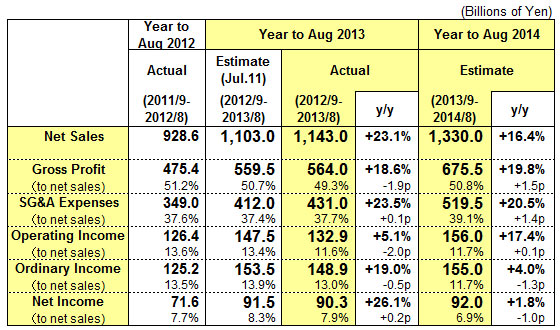

Consolidated Business Performance

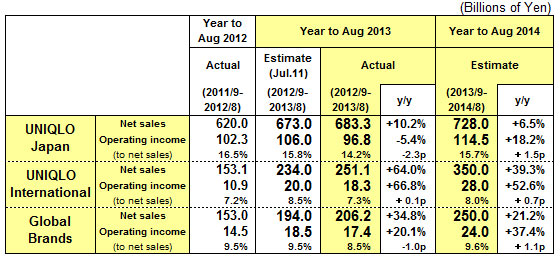

Performance by Group Operation

Fiscal 2013 Highlights: Fast Retailing achieves growth in sales and income

■Group Performance:

Sales topped one trillion yen for the first time and operating income hit a new record high in fiscal 2013. Ordinary income expanded by an impressive 19.0% year on year due largely to the reporting of a ¥ 15.5bln foreign exchange gain related to the weakening of the Japanese currency. We intend to increase our annual dividend per share from 260 yen in fiscal 2012 to 290 yen in fiscal 2013, split between a revised year-end dividend of ¥ 150 and an interim dividend of ¥ 140.

■UNIQLO Japan:

Net sales expanded 10.2% year on year supported by a 7.3% increase in same-store sales. However, a fall in the gross profit margin and an increase in business cost ratios led to a decline in operating income of 5.4% year on year.

■UNIQLO International:

Achieved considerable gains in both sales and profit thanks to continued strong performances in the Asian region. UNIQLO operations in China, Hong Kong and Taiwan generated combined sales of ¥ 125.0bln and operating income of ¥ 13.5bln. UNIQLO USA and UNIQLO South Korea fell short of target in fiscal 2013, with the operating loss in the United States hovering close to the previous year's level.

■Global Brands:

Generated significant growth in both sales and profit thanks to strong performances from the GU and Theory operations. Both GU and Theory posted record profits in fiscal 2013. Conversely, Comptoir des Cotonniers fell short of target, reporting a decline in profits.

■Fiscal 2014 Consolidated Estimates:

Group sales: ¥ 1.330trln (+16.4% year on year), operating income: ¥ 156.0bln (+17.4%), ordinary income: ¥ 155.0bln (+4.0%), earnings per share: ¥ 902.88, annual dividend forecast: ¥ 300 per share.

■ UNIQLO Japan

UNIQLO Japan, which constitutes 59.8% of consolidated and 72.9% of operating income, generated a significant 10.2% year-on-year gain in net sales to ¥ 683.3bln in fiscal 2013. However, operating income contracted 5.4% year on year to ¥ 96.8bln.

One of our recent business focuses has been to boost the number of customer visits to our stores. In fiscal 2013, we successfully boosted customer numbers by an impressive 12% year on year by aggressively increasing the number of TV commercials featuring core ranges such as HEATTECH winter innerwear, Ultra Light Down, Ultra Stretch Jeans, AIRism summer innerwear, Steteco and Relaco light-weight clothing, and also by expanding the distribution of paper fliers. The increase in the number of customers visiting our stores helped boost same-store sales by 7.3% year on year in fiscal 2013.

However, on the income side, our aggressive promotional drive ultimately led to a deterioration in the gross profit margin because so many customers were attracted by the featured discounted ranges. This, along with the traditional season-end discounting of excess stock, resulted in a 1.8-point decline in the gross margin at UNIQLO Japan in fiscal 2013. UNIQLO Japan's SG&A to net sales ratio increased 0.6 point year on year, due in part to increased expenditure on fixtures and fittings linked to the upgrade of in-store displays and to the decision to introduce a new system for store manager allowances from April. This decline in the gross margin along with the increased business cost ratios led to an overall contraction in operating income of 5.4% year on year in fiscal 2013.

At the end of August 2013, the total number of directly operated UNIQLO Japan stores (excluding the 19 franchise stores) stood at 834 stores, a net increase of 10 stores compared to end August 2012.

Our estimates for UNIQLO Japan performance during the year ending August 31, 2014 include a 6.5% rise in net sales to ¥ 728.0bln and an 18.2% increase in operating income to ¥ 114.5bln. We forecast same-store sales will expand by 1.6% year on year, and the total number of directly operated stores will increase by a net 10 stores to 844 stores. We expect to be able to boost operating income through strict control of discounting and determined cost-cutting efforts. Spring 2014 will be an exciting time for UNIQLO Japan with global flagship stores scheduled to open in Tokyo's thriving commercial districts of Ikebukuro and Ueno.

■ UNIQLO International

UNIQLO International generated considerable gains in both revenue and income in fiscal 2013 with sales rising 64.0% year on year to ¥ 251.1bln and operating income expanding by 66.8% to ¥ 18.3bln. The UNIQLO International store network expanded by 154 stores over the business year, reaching a total of 446 stores at end August 2013. The Asian region encompassing China, Hong Kong and Taiwan performed especially well with 102 new stores opening for business, sales expanding to ¥ 125.0bln and operating income swelling to ¥ 13.5bln in fiscal 2013. Conversely, while our UNIQLO operation in South Korea reported growth in both sales and income in fiscal 2013, unseasonal weather and a slowdown in economic conditions knocked that operation below target and negatively impacted profitability in the second half from March through August 2013. Our UNIQLO operations in Southeast Asia, which currently span Singapore, Malaysia, Thailand, the Philippines and Indonesia, performed strongly and exceeded our expectations in fiscal 2013. During the business year, we opened 22 new stores in Southeast Asia, including our first UNIQLO store in Indonesia in June.

At our other global UNIQLO operations, UNIQLO Europe (United Kingdom, France and Russia) broke roughly even in fiscal 2013 as expected. Sales at UNIQLO USA expanded with the opening of a further four new stores in prominent malls during fiscal 2013. However, operating income fell short of target with the current operating loss hovering stubbornly close to the previous year's level. There were several reasons why we were unable to reduce the operating loss at UNIQLO USA, including unseasonal weather in the second half, some advance business expenses related to the opening of 10 new stores in fall 2013, and the fact that the operating loss appeared higher in yen terms following the weakening of the Japanese currency.

Our estimates for UNIQLO International performance during the year ending August 31, 2014 include a 39.3% rise in net sales to ¥ 350.0bln and a 52.6% increase in operating income to ¥ 28.0bln. We plan to continue our strategy of opening multiple new stores in the Asian region, and we expect to boost sales in the China-Hong Kong-Taiwan region by over 30% year on year in fiscal 2014. Our store opening plans for fiscal 2014 include: 98 new stores in China, Hong Kong and Taiwan combined, 30 stores in South Korea, 50 stores in other parts of Asia, 15 stores in the United States and 5 stores in Europe. During fiscal 2014, we plan to open our first UNIQLO stores in the new markets of Germany and Australia. The new global flagship store opened in Shanghai on September 30 is already enjoying an enthusiastic reception among local customers. This new UNIQLO store also houses other Group brands including GU, PLST, Comptoir des Cotonniers and Princesse tam.tam.

■ Global Brands

Our Global Brands segment generated sales of ¥ 206.2bln in fiscal 2013, up 34.8% year on year, and operating income of ¥ 17.4bln, up 20.1% year on year. Our low-priced GU casualwear brand performed especially well, reporting gains in both sales and income. Double-digit growth in same-store sales and the brisk opening of new stores during the business year helped boost GU sales from ¥ 58.0bln in fiscal 2012 to ¥ 83.7bln in fiscal 2013, while operating income expanded from ¥ 5.0bln in fiscal 2012 to ¥ 7.6bln in fiscal 2013. Our Theory fashion label reported another record performance in fiscal 2013 with strong gains in both sales and income. Our French fashion labels, Comptoir des Cotonniers (women's fashion) fell short of target and reported a decline in operating income. Newly consolidated in December 2012, our J Brand premium denim label generated the expected level of sales but fell short of target in terms of operating income.

Our estimates for the Global Brands segment for the year ending August 31, 2014 include a 21.2% rise in net sales to ¥ 250.0bln and a 37.4% increase in operating income to ¥ 24.0bln. We are aiming to boost GU sales beyond ¥ 100.0bln and also improve the brand's profitability. We forecast our Theory operation will generate another record performance in terms of profit. Meanwhile, we expect a steady performance from Comptoir des Cotonniers roughly in line with that of fiscal 2013. We will be looking to expand our J Brand premium denim label with the opening of the first directly operated store in Japan in October 2013 in the popular Osaka Hankyu Umeda Main Store, a focal point for consumers in Osaka's vibrant shopping district of Umeda.

■ Fiscal 2014 Consolidated Forecasts

We estimate Group sales will expand by 16.4% year on year to ¥1.330trln in fiscal 2014, or the year ending August 31, 2014. We forecast operating income will expand by 17.4% to ¥156.0bln, ordinary income will increase by 4.0% to ¥155.0bln and net income will rise 1.8% to ¥92.0bln in the same period. This translates into expected earnings per share of ¥902.88. In addition, we forecast an annual dividend per share for fiscal 2014 of ¥300, split equally between an interim dividend of ¥150 and a year-end dividend of ¥150.