Last Updated: 2014.10.09

Results Summary for the Year to August 31, 2014

FAST RETAILING CO., LTD.![]() ( 269KB )

( 269KB )

to Japanese page

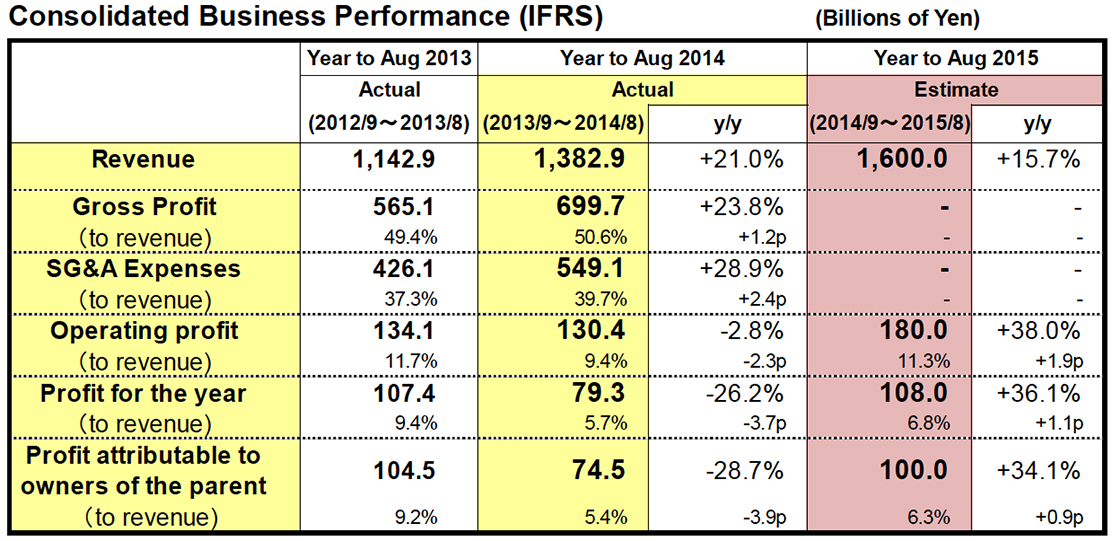

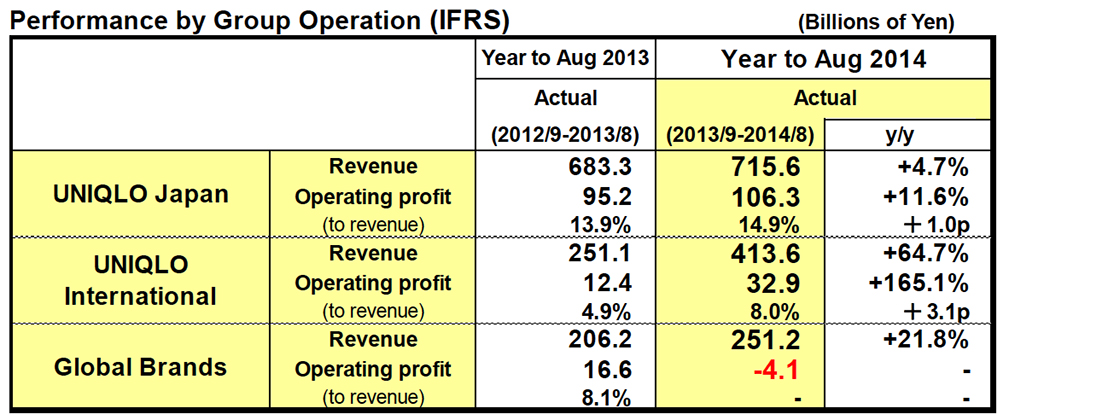

The Fast Retailing Group decided to switch from the Japanese generally accepted accounting principles (JGAAP), which it had been using to date, to the International Financial Reporting Standards (IFRS), starting from the year to August 31, 2014. Data for the year to August 31, 2013 have been recalculated using the IFRS standard in order to facilitate comparative analysis of Group performance and financial conditions.

Our results announcement flash statement only discloses IFRS data. However, to ensure consistency with past data and to enable easy comparisons with the business estimates already announced, this results summary mainly discusses the data as calculated using JGAAP standards.

FY2014 Highlights: Fast Retailing Achieves Gains in Sales and Income

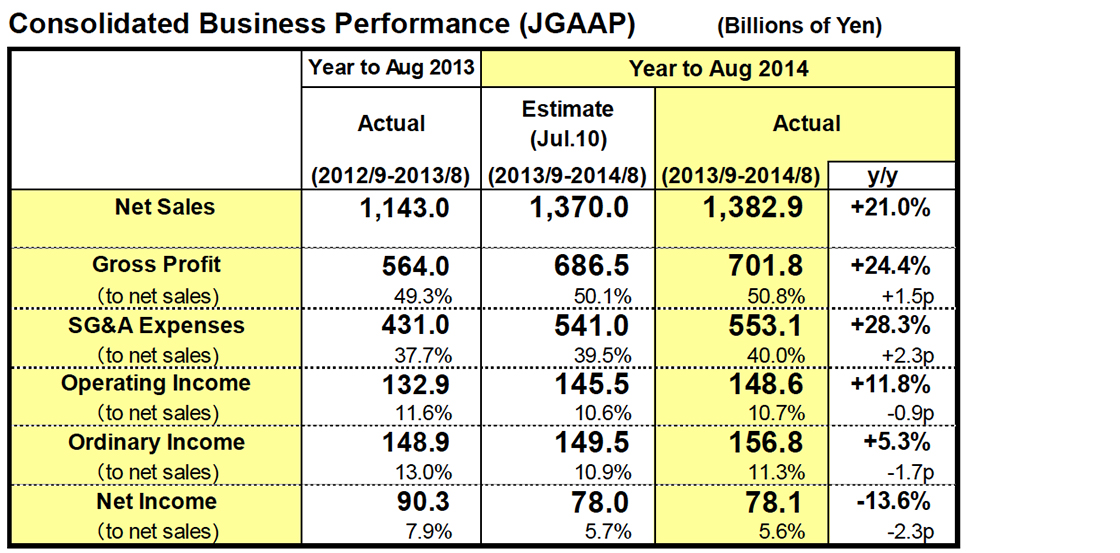

■FY2014 Group performance (JGAAP)

The Fast Retailing Group achieved gains in both sales and income in fiscal 2014, or the year ended August

31, 2014. Net sales rose 21.0% year on year to JP¥1.3829 trillion, and operating income expanded 11.8%

to ¥148.6 billion. UNIQLO Japan reported gains in sales and income, thanks to growth in same-store sales

and an improved gross profit margin. UNIQLO International achieved significant gains in sales and income

on the back of mass new store openings. Meanwhile, the Global Brands segment reported a rise in sales

but a contraction in income, on the back of rising sales but falling income at both its GU and Theory

operations. Foreign exchange gains, recorded as non-operating income, shrank by ¥7.3 billion compared

to the previous year. As a result, ordinary income expanded 5.3% to ¥156.8 billion. Net income contracted

13.6%, following the recording of impairment losses at J Brand. We estimate an annual dividend per share

in fiscal 2014 of ¥300, split evenly into interim and year-end dividend of ¥150 each.

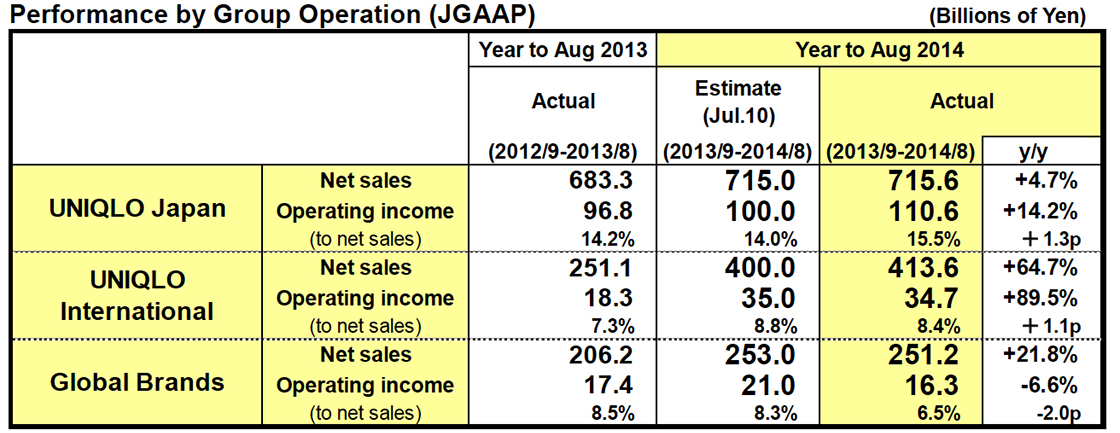

■UNIQLO Japan: Improved gross profit margin boosts sales and income (JGAAP)

Sales of core products continued strong throughout the year. Same-store sales rose 1.9% year on year.

Those strong sales, along with an improved gross margin, boosted operating income by 14.2%.

■UNIQLO International: Sales and income rise. Greater China, Korea, and Europe strong

(JGAAP)

Achieved the expected strong gains in sales and income. Particularly strong same-store sales growth in

Greater China (Mainland China, Hong Kong, and Taiwan), South Korea, and Europe generated

higher-than-expected gains in both sales and income for those regions. UNIQLO Greater China generated

sales of ¥208.1 billion, a 66.5% increase year on year, and operating income of ¥24.8 billion, an

83.0% increase year on year.

■Global Brands: Sales rise but income falls on impairment losses at J Brand (JGAAP)

Operating income fell short of target, reporting a contraction in fiscal 2014. GU reported a 28.4% rise in sales to ¥107.5 billion and a 10.8% fall in operating income to ¥6.8 billion. J Brand was forced to report an impairment loss following persistent operating losses.

■Group operating income: The differences between JGAAP and IFRS calculations

Operating income under JGAAP standards totaled ¥148.6 billion. That was ¥18.2 billion higher than the ¥130.4 figure recorded under IFRS standards. Various factors contributed to the differing results. Under JGAAP rules, the ¥12.7 billion impairment loss at J Brand and the ¥4.6 billion impairment loss on stores were reported as a special loss, whereas, under IFRS standards, those figures were subtracted from the operating income total. In addition, under IFRS standards, the ¥6.6 billion in J Brand goodwill, which had already been amortized under JGAAP, and intangible assets, were recorded as an additional impairment loss, and consequently also subtracted from the operating income total. Conversely, a ¥3.9 billion portion of the foreign exchange gains reported as non-operating income under JGAAP was added to the operating income total under IFRS. The removal of the ¥5.9 billion in depreciation of goodwill recorded under JGAAP also boosted the IFRS operating income total. All this taken together, operating income for the Fast Retailing Group rose year on year using JGAAP standards, but contracted year on year using IFRS standards.

■FY2015 consolidated estimates (IFRS)

Group revenue: ¥1.600 trillion (+15.7%), operating profit: ¥180.0 billion (+38.0%), profit before income taxes: ¥180.0 billion (+32.9%), profit for the year: ¥108.0bln (+36.1%), earnings per share: ¥981.18, annual dividend forecast: ¥320 per share (interim dividend: ¥160, year-end dividend: ¥160).

FY2014 Performance in Focus

■UNIQLO Japan: Increased sales and income (JGAAP)

UNIQLO Japan is the mainstay operation of the Fast Retailing Group, accounting for 51.7% of consolidated sales and 74.4% of consolidated operating income.

UNIQLO Japan generated gains in both sales and income in fiscal 2014, or the year to August 31, 2014. Net sales increased 4.7% year on year to ¥715.6 billion and operating income rose 14.2% to ¥110.6 billion. This strong performance was due in part to a 1.9% rise in same-store sales, and in part to a rise in total sales per store. The latter was achieved through our "scrap and build" strategy of gradually increasing the size of our sales floor by replacing smaller, less efficient stores with large-scale outlets.

Throughout the business year, sales of key core items such as HEATTECH, knitwear, jeans, Ultra Light Down, sweatshirts and pants, and AIRism proved strong. In addition, new ranges of skirts, dresses, and bras also sold well. Thanks to the strong overall sales trend, UNIQLO Japan's gross profit margin improved 3.0 points year on year to 49.5%. On the other hand, the business costs to net sales ratio also rose 1.7 points year on year. This was due mainly to a rise in the personnel to net sales ratio which was fuelled by higher in-store personnel costs, and also due to higher distribution costs.

The total UNIQLO Japan network decreased by one store to 852 stores (including franchise outlets) at the end of August 2014.

■UNIQLO International: Sales and income rise. Greater China, Korea, and Europe continue strong (JGAAP)

As expected, UNIQLO International reported significant gains in both sales and income in fiscal 2014. Sales expanded to ¥413.6 billion (+64.7%), and operating income rose to an impressive ¥34.7 billion (+89.5%). UNIQLO Greater China (Mainland China, Hong Kong, and Taiwan), South Korea, and Europe reported strong gains in sales and income that were well above target, thanks to continued buoyant growth in same-store sales. Sales and income increased significantly at UNIQLO Greater China, with sales rising 66.5% to ¥208.1 billion and operating income expanding 83.0% to ¥24.8 billion. The total number of UNIQLO stores in the Greater China region expanded to 374 at the end of August 2014.

Thanks to strong gains in same-store sales, UNIQLO South Korea also outstripped company estimates to report a healthy rise in sales and income. By the end of August 2014, UNIQLO South Korea had boosted its store total to 133 stores. UNIQLO Southeast Asia and Oceania which incorporates Singapore, Malaysia, Thailand, the Philippines, Indonesia, and Australia also reported rising sales and income. However, these gains fell slightly short of target following weaker-than-expected sales of Summer items. UNIQLO opened its first store in Australia, in Melbourne, in April 2014. Sales from this store have already outstripped our forecasts. UNIQLO added 41 stores in the Southeast Asia and Oceania region in fiscal 2014, bringing the total number of stores there to 80 at the end of August 2014.

UNIQLO USA generated a strong performance in the first half of the business year from September 2013 through February 2014. However, the cool Summer had an adverse impact on sales in the second half from March through August 2014. Taking that into account, along with some additional costs incurred in relation to the early opening of new stores, the US operation was unable to reduce its operating loss significantly from the previous year's level. UNIQLO USA boasted 25 stores at the end of August 2014, up 18 stores compared to the end of August 2013.

UNIQLO Europe, which covers the United Kingdom, France, Russia, and Germany, reported higher-than-expected gains in both sales and income in fiscal 2014. The first UNIQLO outlet in Germany opened in Berlin in April 2014, as a global flagship store. We believe the store's presence and strong performance is helping to build awareness of the UNIQLO brand in Europe.

The total number of UNIQLO International stores expanded by 187 to 633 stores at the end of August 2014.

■Global Brands: Sales rise but income falls on impairment losses at J Brand (JGAAP)

Global Brands reported a rise in sales, but a decrease in profit, in fiscal 2014. Sales expanded 21.8% year on year to ¥251.2 billion, while operating income contracted 6.6%, to ¥16.3 billion. Our low-priced GU casualwear brand reported a 28.4% rise in sales to ¥107.5 billion. However, GU income contracted 10.8% year on year to ¥6.8 billion. A strong performance from GU in the first half boosted the operation's sales and income, but income started to come under pressure in early Spring, when sluggish sales forced GU to discount more heavily to offload leftover inventory. Our Theory fashion brand also reported a slight contraction in income. Our French women's fashion brand, Comptoir des Cotonniers, reported rising sales and income in fiscal 2014, while our French corsetry, homewear, and swimwear brand, Princesse tam.tam, reported a fall in income, after a cool Summer dampened swimwear sales. Continued losses at J Brand obliged the segment to record impairment losses at the end of fiscal 2014.

■Group operating income: The differences between JGAAP and IFRS calculations

Operating income under JGAAP standards totaled ¥148.6 billion. That was ¥18.2 billion higher than the ¥130.4 billion figure recorded under IFRS standards. Various factors contributed to this differential. Under JGAAP rules, the ¥12.7 billion impairment loss at J Brand and the ¥4.6 billion impairment loss on stores were reported as a special loss, whereas, under IFRS standards, those figures were subtracted from the operating income total. In addition, under IFRS standards, the ¥6.6 billion in J Brand goodwill, which had already been amortized under JGAAP, and intangible assets, were recorded as an additional impairment loss, and consequently also subtracted from the operating income total. Conversely, a ¥3.9 billion portion of the foreign exchange gains reported as non-operating income under JGAAP was added to the operating income total under IFRS. The removal of the ¥5.9 billion in depreciation of goodwill recorded under JGAAP also boosted the IFRS operating income total. All this taken together, operating income for the Fast Retailing Group rose year on year using JGAAP standards, but contracted year on year using IFRS standards.

■FY2015 consolidated estimates (IFRS)

Regarding our consolidated business estimates for the year ending August 31, 2015, we expect revenue will increase by 15.7% to ¥1.600 trillion and operating profit will expand by 38.0% to ¥180.0 billion. Profit before income taxes are forecast to expand 32.9% to ¥180.0 billion, while profit for the year is expected to expand by 36.1% to ¥108.0 billion. Profit attributable to owners of the parent is expected to rise 34.1% to ¥100.0 billion. Basic earnings per share are estimated at ¥981.18.

We expect all three business segments to generate gains in both sales and income.

We forecast the total store network for the Fast Retailing Group will expand by 262, to 3,015 stores, in fiscal 2015. This estimates breaks down into 844 stores, including franchise outlets, for UNIQLO Japan (a net decrease of 8 stores versus the previous year), 818 stores for UNIQLO International (a net increase of 185 stores), and 1,353 stores for Global Brands (a net increase of 85 stores).

We estimate we will be able to deliver an annual dividend per share in fiscal 2015 of ¥320, split evenly into interim and year-end dividends of ¥160 each.

Fast Retailing Co., Ltd. discloses business results data and offers a variety of press releases on its IR website https://www.fastretailing.com/eng/ir/.