Last Updated: 2013.04.11

Results Summary for the Six Months to February 2013

FAST RETAILING CO., LTD.![]() ( 247KB )

( 247KB )

to Japanese page

Consolidated Business Performance

Performance by Group Operation

FY2013 Highlights: First-half Sales and Income Rise, Full-Year Sales Expected to Top ¥ 1 Trillion for the First Time

■Group Performance:

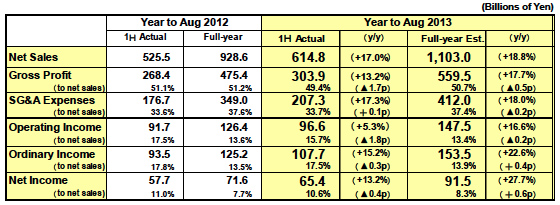

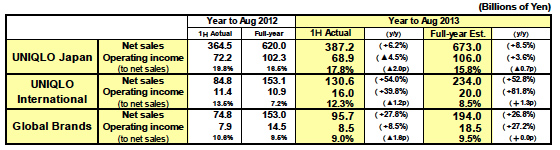

The Fast Retailing Group achieved considerable gains in both sales and income in the first half of fiscal 2013, or the six months from September 2012 through February 2013. Sales rose 17.0% year on year to ¥ 614.8bln, operating income increased by 5.3% to ¥ 96.6bln, ordinary income rose 15.2% to ¥ 107.7bln and net income expanded by 13.8% to ¥ 65.4bln. UNIQLO International and Global Brands reported gains in both sales and income in the first half, while UNIQLO Japan reported a rise in sales but a fall in profit over the six-month period.

■UNIQLO Japan:

Sales increased while profit contracted in the first half, with sales rising 6.2% year on year to ¥ 387.2bln and operating income contracting by 4.5% to ¥ 69.8bln. While same-store sales expanded by 3.6% year on year, a contraction in the gross profit margin led to the fall in first half profits at UNIQLO Japan. As a result, we have revised our full-year forecasts for UNIQLO Japan. We have revised up the fiscal 2013 sales estimate by ¥ 20.0bln to ¥ 673.0bln (+8.5% y/y). By strengthening control over our gross profit to sales margin, we do expect to generate a profit gain in fiscal 2013. But, in light of the ¥ 3.0bln shortfall in operating income in the first half, we have adjusted our full-year operating income estimate to ¥ 106.0bln (+3.6% y/y).

■UNIQLO International:

This segment reported significant gains in sales and income in the first half, with sales rising 54.0% to ¥ 130.6bln and operating income expanding by 39.8% to ¥ 16.0bln. China and Hong Kong, Taiwan, South Korea and other parts of Asia generated especially strong gains in both sales and income. UNIQLO USA and UNIQLO Europe performed to plan in the first half. After sales outstripped our January estimate by ¥ 5.0bln in the first half, we have revised up our full-year forecasts for UNIQLO International. We now predict sales will increase by 52.8% year on year to ¥ 234.0bln and operating income by an impressive 81.8% to ¥ 20.0bln. We expect the total number of UNIQLO stores outside of Japan to rise rapidly to 441 stores by the end of August 2013, an increase of 149 stores from the end of August 2012.

■Global Brands:

GU generated double-digit growth in both sales and income as expected in the six months to February 2013. Theory also performed to plan, but rising business expenses in the United States dampened profits marginally. We have revised our full-year forecasts for the Global Brands segment to incorporate performance estimates for the newly consolidated premium denim label, J Brand. We now expect Global Brands will generate sales of ¥ 194.0bln (+26.8% y/y) and operating income of ¥ 18.5bln (+27.2%) in fiscal 2013.

■Fiscal 2013 Consolidated Estimates:

We forecast Group sales will top ¥ 1trln for the first time, and operating income will reach a new record high for the first time in three years. In fiscal 2013, we estimate Group sales will reach ¥ 1,103.0trln (+18.8% y/y), operating income ¥ 147.5bln (+16.6%), ordinary income ¥ 153.5bln (+22.6%) and net income ¥ 91.5bln (+27.7%). These forecasts translate into earnings per share of ¥ 898.09.

■Dividend:

We forecast an annual dividend of ¥ 280 per share for the year to end August 2013, split equally between an interim dividend of ¥ 140 and a year-end dividend of ¥ 140.

■ UNIQLO Japan: First-half Income Contracts but Full-year Income Expected to Rise

UNIQLO Japan constitutes 63.0% of Group sales and 71.4% of Group income. In the six months to February 2013, UNIQLO Japan generated sales of ¥ 387.2bln (+6.2% y/y) and operating income of ¥ 68.9bln (-4.5%). Several factors contributed to the rise in first-half sales at UNIQLO Japan, including a 3.6% year-on-year increase in same-store sales. Our "scrap and build" strategy of replacing smaller-sized stores with large-format stores also boosted sales per store. Breaking down the 3.6% increase in same-store sales, customer numbers expanded by 6.3% year on year in the first half, but the average purchase price per customer contracted 2.5%. Through fiscal 2012, the company had to address the pressing issue of falling customer visits. But, in the first half of fiscal 2013, our determined marketing strategy helped generate strong sales of Ultra Light Down, HEATTECH, danpan warm pants and other core items, and triggered a successful recovery in customer numbers. The total number of UNIQLO stores held steady at 828 stores (excluding 19 franchise stores) at end February 2013.

The fall in operating income at UNIQLO Japan in the six months from September 2012 through February 2013 was due to a 1.5-point contraction in the gross margin to 46.7%. The gross margin was squeezed by greater discounting, following a decision taken in October to attract more customers by extending the length and range of limited-period sales. The subsequent rundown of winter inventory also weighed on the gross margin.

In light of the strong sales performance in the first half (¥ 8.7bln above target) and subsequent strong sales data in March, we have revised up our fiscal 2013 sales forecast for UNIQLO Japan to ¥ 673.0bln (+8.5% y/y). We also expect to generate a 3.6% year-on-year gain in operating income to ¥ 106.0bln for the full fiscal year, primarily by maintaining strong control over the gross margin in the second half, spanning March through August 2013.

■ UNIQLO International: Impressive Gains in First-half Sales and Income

UNIQLO International achieved significant gains in both sales and income in the six months through February 2013, with sales rising an impressive 54.0% to ¥ 130.6bln and operating income 39.8% to ¥ 16.0bln. Performance was especially strong in China and Hong Kong, Taiwan, South Korea and other parts of Asia. In addition, UNIQLO USA and UNIQLO Europe fulfilled their targets. We pursued particularly aggressive new store openings in the Asian region, including China and Hong Kong, South Korea and Taiwan. UNIQLO opened 70 new stores outside of Japan in the first half and closed 3 existing stores, bringing the total number of UNIQLO International stores to 359 at the end of February 2013.

■ Breaking down the first-half performance by region:

UNIQLO China reported strong gains in both sales and income. Sales of core winter ranges such as Ultra Light Down and HEATTECH picked up sharply from late October, generating near double-digit growth in same-store sales for the first half as a whole. UNIQLO Hong Kong reported significant gains in both sales and income on the back of continued double-digit growth in same-store sales. UNIQLO Taiwan performed strongly and to target, with 10 new stores opening for business in the first half. UNIQLO South Korea also reported gains in sales and income as planned. However, the first-quarter boom in UNIQLO fleece and HEATTECH sales resulted in some stock shortages. Consequently, this led to a slowdown in sales from December, and a slight contraction in same-store sales in the second quarter from December 2012 through February 2013. UNIQLO operations in Singapore, Malaysia, Thailand and the Philippines all performed to plan, with six new stores contributing to the strong performance. UNIQLO USA reported an operating loss in the first half but this was well within our expectations. Thanks to the opening of two large-format stores in fall 2012 - the UNIQLO San Francisco Union Square Store and the UNIQLO Garden State Plaza Store in New Jersey - UNIQLO USA enjoyed a sharp rise in total sales in the first half, and the operating loss was kept in check. UNIQLO Europe (U.K., France, Russia) generated the planned gain in both sales and income, with one new store opening for business in Paris.

In fiscal 2013, we forecast UNIQLO International will produce an extremely strong performance on both sales and income, with sales seen rising 52.8% year on year to ¥ 234.0bln and operating income expected to expand by 81.8% to ¥ 20.0bln. The total number of UNIQLO stores outside of Japan is expected to expand rapidly to 441 stores by end August 2013.

■ Global Brands: GU Continues Strong

The Global Brands segment generated gains in both sales and income in the first half as planned, with sales expanding by 27.8% year on year to ¥ 95.7bln and operating income increasing by 8.5% to ¥ 8.5bln. Same-store sales for our low-priced GU casualwear brand continued to grow strongly, but the profit gain in the second quarter was not as impressive as in the first quarter due to some offloading of excess winter stock. Our women's fashion Theory label performed to plan, but higher marketing and personnel expenses in the United States knocked profits marginally lower in the first half. Our France-based labels, women's fashion brand Comptoir des Cotonniers, and corsetry, lounge wear and swimwear label Princesse tam.tam, reported a flat year-on-year result for the first half as expected. A new addition to the Fast Retailing Group from December 2012, the J Brand premium denim label contributed approximately two months of performance to the Group's first-half results: sales of ¥ 2.5bln and an operating loss of ¥ 0.2bln.

We have revised up our fiscal 2013 forecasts for Global Brands to incorporate an estimated ¥ 9.0bln sales contribution from J Brand. We now predict Global Brands will generate sales of ¥ 194.0bln (+26.8% y/y) and operating income of ¥ 18.5bln (+27.2%).

■ Fiscal 2013 Consolidated Forecasts: Sales to Top ¥ 1 Trillion, Profit to Hit a New Record

We estimate Group sales will top ¥ 1trln for the first time. In addition, we predict operating income will surpass the record high recorded three years ago to attain new heights. We forecast fiscal 2013 sales will reach ¥ 1,103.0trln (+18.8% y/y), operating income ¥ 147.5bln (+16.6%), ordinary income ¥ 153.5bln (+22.6%), net income ¥ 91.5bln (+27.7%), generating earnings per share of ¥ 898.09. The total number of Group stores is expected to reach 2,456 at the end of August 2013, comprising 854 UNIQLO Japan stores (including franchise stores), 441 UNIQLO International stores and 1,161 Global Brands stores (including 216 GU stores).

We forecast an annual dividend of ¥ 280 per share for the year to end August 2013, split equally between an interim dividend of ¥ 140 and a year-end dividend of ¥ 140.