Last Updated: 2013.01.10

Results Summary for the Three Months to November 2012

FAST RETAILING CO., LTD.![]() ( 160KB )

( 160KB )

to Japanese page

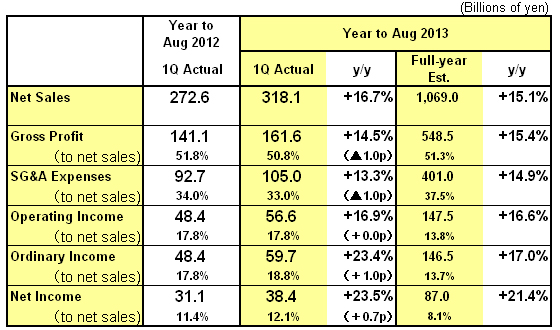

Consolidated Business Performance

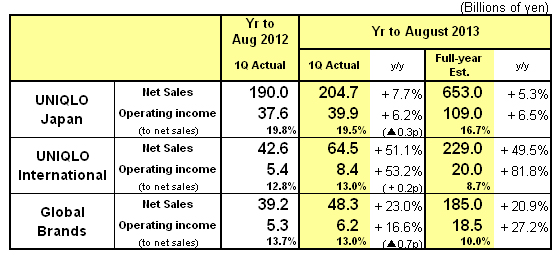

Performance by Group Operation

FY2013 First Quarter Highlights: Sales and Income Gains Across the Board

■Group Performance:

The Fast Retailing Group reported considerable gains in both sales and income in the first quarter of fiscal 2013 with all three business segments providing positive results. In the three months from September through November 2012, consolidated sales rose 16.7% year on year to ¥ 318.1bln, operating income expanded 16.9% to ¥ 56.6bln, ordinary income increased 23.4% to ¥ 59.7bln and net income expanded 23.5% to ¥ 38.4bln.

■UNIQLO Japan:

Sales and income expanded at UNIQLO Japan with sales reaching ¥ 204.7bln (+7.7% year on year) and operating income ¥ 39.9bln (+6.2%). Sales of items promoted in our advertising campaigns such as Ultra Light Down, HEATTECH, fleece and danpan warm pants picked up sharply after the weather turned cold in November. As a result, same-store sales expanded by 5.0% year on year, generating a profit gain in the first quarter.

■UNIQLO International:

This segment reported gains in both sales and income of over 50% year on year in the first quarter with sales expanding to ¥ 64.5bln (+51.1%) and operating income ¥ 8.4bln (+53.2%). Performance was especially strong in Asia, outstripping our first-quarter targets. Admittedly, we had issued relatively conservative forecasts in China and South Korea in light of the economic slowdown. However, given that we expect UNIQLO International will be able to boost profits further over the current period, we have decided to revise up our fiscal 2013 estimates for this segment. We now estimate UNIQLO International will achieve sales of ¥ 229.0bln (+49.5% year on year) and operating income of ¥ 20.0bln (+81.8%) in the year ending August 31, 2013. The total number of UNIQLO International stores is expected to expand to 439 stores by the end of August 2013.

■g.u.:

Performed strongly as expected, generating a rise of over 20% year on year in same-store sales.

■Theory:

Performed to plan with Theory Japan and PLST proving particularly strong.

■Fiscal 2013 Consolidated Estimates:

Consolidated sales are forecast to top one trillion yen for the first time, with sales of ¥ 1.069.0trln (+15.1% year on year), operating income ¥ 147.5bln (+16.6%), ordinary income ¥ 146.5bln (+17.0%) and net income ¥ 87.0bln (+21.4%).

■Dividend:

Fast Retailing plans an annual dividend payment for fiscal 2013 of 280 yen per share, split into interim and year-end dividends of 140 yen each.

■ UNIQLO Japan

UNIQLO Japan currently constitutes 64.4% of consolidated sales and 70.5% of consolidated operating income. In the three months to November 2012, UNIQLO Japan generated gains in both sales and income with sales increasing 7.7% year on year to ¥ 204.7bln and operating income 6.2% to ¥ 39.9bln. The segment exceeded our initial estimates by ¥ 5.0bln in terms of sales and ¥ 0.8bln in terms operating income. Sales were initially dampened by the lingering hot weather in September through early October. But once the weather turned colder, sales of our advertised ranges such as Ultra Light Down, HEATTECH, fleece, danpan warm pants and other core fall/winter items picked up strongly. As a result, same-store sales increased 5.0% year on year in the first quarter. We also increased the average size of our store stock over the quarter by opening new large-format stores and closing regular or small-sized outlets. At the end of November 2012, UNIQLO Japan boasted 832 stores (excluding 19 franchise stores), a net year-on-year increase of 3 stores.

On the income side, the gross profit margin contracted 0.8 point year on year in the first quarter. This was due to greater discounting from October when we increased the number of days for limited-period sales in order to attract customers. Despite this fall in the gross margin, operating income still expanded in the first quarter thanks to strong sales and firm control over business expenses.

In 2012 fall/winter, we conducted advertising campaigns for a number of garment ranges: Easy Leggings Pants, Ultra Stretch Jeans, Ultra Light Down, HEATTECH, knitwear, fleece, danpan warm pants and Micro Fleece Lounge Wear Sets. Our mainstay HEATTECH functional innerwear continues to sell well. To meet this season's global HEATTECH sales target of 130 million units, we increased the number of colors and patterns on offer and also expanded the range of legwear and other thermal goods.

Our forecasts for UNIQLO Japan for the full fiscal year through end August 2013 remain unchanged with sales expected to reach ¥ 653.0bln (+5.3% year on year) and operating income ¥ 109.0bln (+6.5%).

■ UNIQLO International:

UNIQLO International outperformed our initial target for the first quarter to generate gains in both sales and income of over 50% year on year. Sales expanded an impressive 51.1% year on year to ¥ 64.5bln and operating income expanded 53.2% to ¥ 8.4bln. Over the three months to November, an increase of 55 stores were recorded mainly in Asia, bringing the total number of UNIQLO International stores to 347 at the end of November, 2012.

Looking at individual UNIQLO International operations in more detail, UNIQLO China and UNIQLO South Korea exceeded our initial estimates while UNIQLO's other Asian operations in Hong Kong, Taiwan, Singapore, Malaysia, Thailand and the Philippines also reported strong results. Revenue at UNIQLO USA expanded considerably in the first quarter due to a number of factors. Sales at the global flagship New York Fifth Avenue Store, opened in October 2011, increased favorably. We also opened a 3,300sqm large-format store in the leading Garden State Plaza shopping mall in New Jersey in September 2012 and our first UNIQLO store on the West Coast of the United States, the San Francisco Union Square Store, in October 2012. As a result, we were able to reduce the operating loss reported by UNIQLO USA as planned. UNIQLO Europe (U.K., France and Russia) reported gains in both sales and income in the first quarter.

In light of this strong performance in the first quarter, we have decided to revise our initial fiscal 2013 forecasts for UNIQLO International. We have revised the full-year sales estimate up by ¥ 13.0bln to ¥ 229.0bln (+49.5% year on year) and the full-year operating income estimate by ¥ 4.0bln to ¥ 20.0bln (+81.8%). Our relatively conservative initial estimates reflected the slowdown in economic conditions in China and South Korea at the beginning of the fiscal year. However, subsequently, performance in China, South Korea and across Asia has consistently outstripped those targets and this persuaded us to revise up our forecasts for the UNIQLO International segment as a whole. In the United States, we are planning to open two new stores in suburban New York shopping malls (Palisades Center and Ridge Hill Shopping Center) in spring 2013, so we have revised up our year-end forecast for UNIQLO USA store numbers from 5 to 7 stores.

■ Global Brands

Global Brands generated the expected gains in sales and income in the first quarter with sales expanding 23.0% year on year to ¥ 48.3bln and operating income rising 16.6% to ¥ 6.2bln. Our low-priced g.u. casualwear brand performed strongly and to plan, reporting an impressive gain in same-store sales of over 20% year on year. Our Theory women's fashion also performed to plan with Theory Japan and the PLST label doing especially well. Our France-based labels, women's fashion brand, Comptoir des Cotonniers, and corsetry, lounge wear and swimwear label, Princesse tam.tam, reported a flat year-on-year result for the first quarter as expected.

Our estimates for the Global Brands segment for fiscal 2013 remain unchanged with sales expected to rise by 20.9% to ¥ 185.0bn and operating income to expand 27.2% to ¥ 18.5bln.

■ Fiscal 2013 Consolidated Forecasts: Upward Revisions on UNIQLO International

In light of the upward revision to our forecasts for UNIQLO International, we have revised up our consolidated business estimates for the fiscal year ending August 31, 2013 as follows: Sales ¥ 1.069.0trln (+15.1% year on year), operating income ¥ 147.5bln (+16.6%), ordinary income ¥ 146.5bln (+17.0%) and net income ¥ 87.0bln (+21.4%). Consolidated sales are forecast to top one trillion yen for the first time. This would generate earnings per share of 854.14 yen. Fast Retailing is planning to offer an annual dividend payment for fiscal 2013 of 280 yen per share, split into interim and year-end dividends of 140 yen each.