Last Updated: 2011.01.13

Results summary three months to November 2010

FAST RETAILING CO., LTD.![]() ( 55KB )

( 55KB )

to Japanese page

Consolidated results

【Summary】 Sales and Operating Income Fall in First Quarter of Fiscal 2011

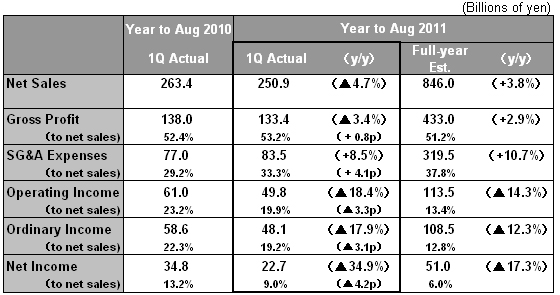

Fast Retailing Co., Ltd. experienced a dip in both sales and operating income in the three months through November 2010, the first quarter of fiscal 2011. Consolidated sales contracted 4.7% year on year to ¥ 250.9bln, operating income fell 18.4% year on year to ¥ 49.8bln and net income fell 34.9% year on year to ¥ 22.7bln. The primary cause of the overall contraction was a fall in sales and operating income at UNIQLO Japan. UNIQLO Japan same-store sales suffered a double-digit contraction of 12.3% year on year in the first quarter resulting in large part from lingering summer weather and results overshadowed in comparison with the extremely strong sales of the previous year. Nevertheless, operating income came in ¥ 5.0bln higher than our initial business forecast, buoyed by sales that exceeded our initial estimates for the quarter by ¥ 5.0bln and SG&A expenses finishing ¥ 2.0bln lower than initially forecast. In addition, the opening of our first global flagship store in Japan, the UNIQLO Shinsaibashi Store, in October proved a great success.

UNIQLO International performed to plan, generating an impressive 52.5% increase in operating income as UNIQLO operations expanded favorably in Asia, as well as in Europe and the United States. Our first UNIQLO stores opened in Taiwan, in October, and in Malaysia, in November, both of which also enjoyed strong sales. The Global Brands segment fulfilled initial targets thanks to a strong performance by our Theory operation.

We estimate profits at UNIQLO Japan will expand in the second half of the business year from March to August 2011. Same-store sales are seen improving to record an increase of 3.0% year on year with various business cost-cutting initiatives also anticipated to boost profitability further. UNIQLO International's contribution to the overall Fast Retailing Group increases each year, with the segment forecast to attain sales of ¥ 100bln (up 37.4% year on year) for the business year ending August 2011.

We have revised downward ¥ 10.0bln our estimate for UNIQLO Japan sales, bringing our estimate for consolidated sales to ¥ 846.0bln (up 3.8% year on year). However, we expect cost-cutting benefits to bolster profitability, and therefore we have made no changes to our profit forecasts. The fiscal 2011 forecast remains unchanged with operating income expected to total ¥ 113.5bln (down 14.3% year on year), ordinary income ¥ 108.5bln (down 12.3%), and net income ¥ 51.0bln (down 17.3%). We predict profit per share of 501.06 yen, and an annual dividend per share of 170 yen: an interim dividend of 85 yen and a year-end dividend of 85 yen.

■ UNIQLO Japan

UNIQLO Japan, which currently constitutes 75% of consolidated sales, suffered a drop in both sales and operating income in the first quarter from September to November 2010. Net sales contracted 9.6% year on year to ¥ 189.7bln, and operating income shrank 24.2% year on year to ¥ 42.0bln. However, both net sales and operating income exceeded our initial estimate by approximately ¥ 5.0bln.

The operation experienced a double-digit fall in same-store sales of 12.3% year on year. Prolonged hot summer weather continued through September, stifling sales of fall items. Comparative figures for the quarter were further exacerbated by virtue of being compared to the extremely robust performance of the previous year, when same-store sales soared 20.8% year on year. As a result, customer numbers in the three months from September to November 2010 shrank 6.6% year on year and the average customer spending fell 6.0% over the same period.

UNIQLO Japan's gross profit margin fell 1.8 points year on year using the same accounting comparison. However, we had incorporated a fall in gross profit margin over the first half, September 2010 to February 2011, into our initial business estimate, meaning that in actuality the first quarter gross profit margin fared slightly better than our initial estimate. The hot weather in September hampered sales of fall items and necessitated greater-than-anticipated discounting of fall products while the number of HEATTECH limited-offer sales increased compared to the previous year when product shortages had restricted such promotions. On the other hand, SG&A expenses came in ¥ 2.0bln below our initial estimate thanks to cost cutting efforts.

Following the December sales results, which showed same-store sales falling a unexpected15.5% year on year, we decided to revise downward our first-half forecast for UNIQLO Japan sales by ¥ 10.0bln. However, we still expect to achieve the ¥ 5.0bln reduction in SG&A expenses over the first half in line with our initial estimate, and therefore we have made no change to our operating income forecast of ¥ 66.0bln (down 28.6%) for the first half of the business year through February 2011.

We expect same-store sales to rise 3.0% year on year and operating income to increase in the second half from March through August 2011. Taking the predicted rise in same-store sales forecast first, the second half figure will be compared to double-digit falls in sales in March and April 2010 and a 6.3% contraction in same-store sales in the six months from March to August 2010. In addition, we expect to boost sales through various marketing strategies, and our current product strategy drive to strengthen a solid range of core basic items. Looking next at gross profit margin, the increased cost of cotton and other raw materials and the need to offload inventory is expected to nudge lower the second-half gross margin 2.4 points year on year when compared under the same accounting procedure, and 0.7 point compared to our initial estimate. However, we now expect to be able to reduce SG&A expenses ¥ 2.0bln below our initial forecast, and therefore we maintain our original forecast for a 12.3% year-on-year rise in operating income to ¥ 39.5bln in the second half through August 2011.

As a result of these data, we have revised downward our initial full-year estimate for UNIQLO Japan sales by ¥ 10.0bln. We now expect UNIQLO Japan will generate sales for the business year of ¥ 618.0bln (up 0.5% year on year). However, our initial full-year forecast for operating income remains unchanged at ¥ 105.5bln (down 17.4%).

New store openings at UNIQLO Japan proceeded smoothly, adding a net 31 stores to bring the total of direct-run and franchise outlets at the end of November 2010 to 823 stores. We are pushing ahead with plans to increase openings of large-scale stores, those with shop floor space in excess of 1,650 square meters, and we expect to expand the number of large-scale stores to 132 and the overall store total to 844 stores by end August 2011.

■ UNIQLO International

UNIQLO International achieved significant gains in both sales and operating income as planned over the three months from September to November 2010. Sales rose 29.3% year on year to ¥ 26.8bln and operating income surged an impressive 52.5% to ¥ 4.8bln. In Asia, in the first quarter we opened 11 new stores including our first store in Taiwan, opened on October 7, and in Malaysia, opened on November 11, both of which have performed well. In fact, the first Taiwanese store, located in Taipei's Uni-President Hankyu Department Store, has shown unprecedented sales strength. The Asian market (excluding Japan) currently constitutes over 70% of UNIQLO International sales, and sales from the region are expected to exceed ¥ 70.0bln for the business year ending August 2011.

Europe and the United States performed in line with expectation in the first quarter, generating gains in both sales and operating income after excluding rental obligations on the New York Fifth Avenue property for the new global flagship store. The new fall and winter +J collection was well received, helping drive the New York Soho global flagship store to a new daily sales record when it launched on October 15, 2010. The Paris global flagship store continues to generate strong sales and improve profitability. Same-store sales also continued to rise at UNIQLO in the U.K. The second UNIQLO store in Russia opened its doors in November 2010. Full-year forecasts for UNIQLO International remain unchanged, with sales expected to rise 37.4% year on year to ¥ 100.0bln and operating income to rise 33.5% to ¥ 8.5bln.

■ Global Brands

The Global Brands segment generated increases in both sales and operating income in the first quarter from September through November 2010 with sales rising 4.1% year on year to ¥ 33.7bln and operating income rising 13.4% to ¥ 3.9bln.

The Theory operation proved especially strong as Theory in the U.S. enjoyed further double-digit gains in same-store sales, boosting the total profit well beyond our initial estimate. Same-store sales also continued to rise at Theory in Japan and profits increased as planned there. Sales and operating income fell short of target at our French women's fashion label Comptoir des Cotonniers as same-store sales contracted. Revenue from our French lingerie brand Princesse tam.tam declined as the wholesale arm of the business was reduced. However, Princesse tam.tam income held flat year on year performing to plan.

While the prolonged hot summer stifled sales in September, a recovery in sales from late October enabled our low-priced g.u. casual brand to achieve the planned increase in revenue over the quarter as a whole. On the income side, g.u.'s profit level held flat year on year performing essentially in line with our estimate as the operation absorbed the cost of the Shinsaibashi flagship store opening on October 23, 2010.

Our forecasts for the Global Brands category for the business year through August 21011 remain unchanged with sales expected to contract 0.2% year on year to ¥ 125.0bln and operating income to increase 8.3% to ¥ 8.5bln.

■ Consolidated Operating Income Forecast Unchanged for FY2011

We have revised downward ¥ 10.0bln our estimate for UNIQLO Japan sales, bringing our estimate for consolidated sales to ¥ 846.0bln (up 3.8% year on year). However, we expect cost-cutting benefits to bolster profitability, and therefore we have made no changes to our profit forecasts. The fiscal 2011 forecast remains unchanged with operating income expected to total ¥ 113.5bln (down 14.3% year on year), ordinary income ¥ 108.5bln (down 12.3%), and net income ¥ 51.0bln (down 17.3%). We predict profit per share of 501.06 yen, and an annual dividend per share of 170 yen: an interim dividend of 85 yen and a year-end dividend of 85 yen.