Last Updated: 2010.07.22

Amalgamation of Subsidiaries and Restructuring of the CABIN business

FAST RETAILING CO., LTD.![]() ( 89KB )

( 89KB )

to Japanese page

FAST RETAILING CO., LTD. has decided to amalgamate two fully owned subsidiaries, CABIN CO., LTD. and LINK THEORY JAPAN CO., LTD. and to restructure the businesses managed by CABIN CO., LTD. The details of this decision are laid out below.

1. Aim of the Amalgamation

Since December 2007, when CABIN CO., LTD., which operates brands such as "ZAZIE" and "enraciné," (henceforth referred to as "CABIN") became a wholly owned subsidiary of FAST RETAILING CO., LTD. through tender offers, FAST RETAILING Group's management has been working to grow CABIN to become one of the FR Group's core women's wear businesses. However, the current business climate in the women's wear retail industry continues to be unfavorable, due to the changing lifestyles and tastes of the young female consumers that CABIN targets as its main customers.

Therefore, we have decided to merge CABIN with another wholly owned subsidiary, LINK THEORY JAPAN CO., LTD., (henceforth referred to as "LTJ") in order in order to optimize FR Group's brand portfolio and to grow its businesses by sharing store networks, personnel and management expertise in the women's wear sector.

2. Restructuring of the CABIN Business

After merging with LTJ, FR Group will cease to operate brands currently managed by CABIN, such as "ZAZIE" and "enraciné," in early 2011. We will talk to related parties and carefully reassess the FR Group's women's wear operations in CABIN's current stores, including the possibility of switching them with other brands managed by our group.

3. Details of the Companies Involved in the Consolidation

(1) Date of effect

September 1, 2010

(2) Type of amalgamation

By absorption method, leaving LTJ as the surviving company

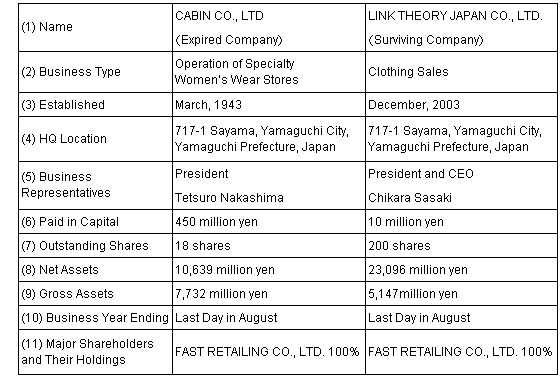

(3) Details of the companies involved in the amalgamation (as of June 1, 2010)

(4) Future Outlook

This amalgamation is expected to cause 3 billion yen of extraordinary losses in the consolidated results for the business year ending August 2010.