Last Updated: 2007.10.11

Results summary for the year to August 31, 2007

FAST RETAILING CO., LTD.![]() ( 23KB )

( 23KB )

to Japanese page

Consolidated Results

【Summary】 Revenue rises but profit slips in year to August 2007

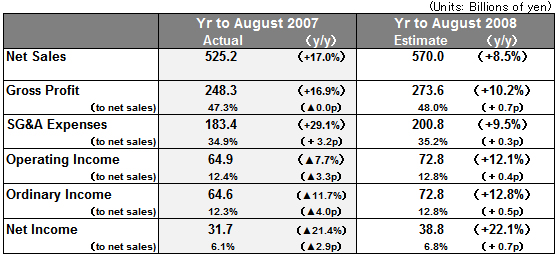

For the year through end August 2007, FAST RETAILING experienced a rise in revenue but a fall in profit. Overall net sales rose 17.0% year on year to ¥ 525.2bln, while operating income fell 7.7% to ¥64.9bln, and net income fell 21.4% year on year to ¥ 31.7bln.

Our mainstay domestic UNIQLO operation experienced an increase in revenue on the back of an increase in total store numbers and existing store sales. However, gross margin fell year on year due the need to offload inventory in the first half following some unseasonable weather. And a rise in personnel costs and promotional expenses to fuel operational growth resulted in a fall in overall profits.

Taken as a whole, our international UNIQLO operation posted a reduced loss during the year thanks to the growing success of our large-format stores and flagship stores now open in New York and Shanghai. In fact, our Chinese, Hong Kong and South Korean operations all posted a profit.

Domestic apparel-related companies - women's fashion retailer CABIN CO., LTD., our low-cost g.u. brand clothing, and footwear retailer ONEZONE CORPORATION - all posted a loss for the year.

FR global brands COMPTOIR DES COTONNIERS and PRINCESSE TAM.TAM continued their strong performance.

We are predicting an annual dividend of 130 yen per share. This incorporates a year-end dividend of 60 yen per share.

For the coming year through end August 2008, we estimate overall net sales of ¥ 570.0bln (up 8.5% year on year), and operating income of ¥ 72.8bln (up 12.1% year on year). That represents a profit of 380.95 yen per share. We are predicting an annual dividend of 130 yen per share.

■ Domestic UNIQLO operation

Revenue at UNIQLO CO., LTD., our domestic UNIQLO operation that constitutes roughly 81% of total consolidated sales, rose 7.9% in the year to August 2007. However, operating income slipped 7.1% year on year to ¥64.0bln. A 1.4% increase in existing store sales, and an additional 27 direct-run UNIQLO stores contributed to the rise in overall net sales. The total number of direct-run UNIQLO stores stood at 730 at end August 2007, or 748 stores including franchises. However, gross margin to net sales fell 2 points year on year in the six months to February 2007 as the warm winter forced us to offload more winter stock at discounted prices. Despite greater control implemented in the second half, gross margin for the six months to August 2007 remained in line with the previous year's levels. That generated a 1.1 point fall in the gross margin for the full business year to August 31, 2007. On the income side, profits were squeezed by increased personnel costs on the back of expanded hiring for future growth, and increased advertising and promotion costs aimed at strengthening our branding.

We are expecting to add 37 new direct-run stores to our domestic UNIQLO store total during the year to August 2008 through scrap and build. This reflects our strategic positioning of 1,600sqm class large-format stores as a key growth driver, and our commitment to open 40 such stores during the year. At the same time, we will also be looking to improve our gross profit to net sales ratio through a further refinement of our operating plan, more flexible production adjustments to reflect predicted demand and immediate sales trends, and better control over discounts. We will also continue to promote cost-effective, low-cost management.

For the year to August 2008 we are predicting a rise in both revenue and income at UNIQLO CO., LTD. We estimate net sales of ¥ 448.0bln (up 5.5% year on year), and operating income of ¥ 71.0bln (up 10.9% year on year).

■ Overseas UNIQLO operation

Net sales at our overseas UNIQLO operation nearly doubled in the year to August 2007 to ¥ 16.9bln. While our US and UK operations are running at a loss due to the cost of opening global flagship stores in those markets, net sales have expanded favorably in Asia (China, Hong Kong, South Korea) taking that operation in the black.

At our overseas UNIQLO operation, we are implementing a "flagship store strategy" in order to increase the visibility of the UNIQLO brand and strengthen our branding power. Our global flagship New York store opened in November 2006 with its 3,300sqm floor space is proving successful. And we are now planning to open a global flagship store on London's Oxford Street in November 2007. We are also scheduled to open our first antenna shop in La Defense, Paris in December this year, while at the same time beginning to prepare for the opening of a global flagship store in Paris as well. Net sales for our overseas UNIQLO operation for the year to August 2008 are expected to reach ¥ 30.0bln, and the operating loss is seen shrinking to ¥ 0.4bln.

■ Domestic apparel-related operations

Net sales rose to ¥ 46.0bln following the addition of CABIN and G.U. to the domestic apparel-related operation during the year to August 2007. But we also experienced a larger loss. CABIN posted a small loss following tough competition on summer fashions. And, although we opened 50 stores at our new, low-cost g.u. clothing operation, customer numbers failed to rise sufficiently and the operation continues to post a loss. Amid a very tough competitive environment at our footwear retailer ONEZONE, we have continued to standardize store operation, and strengthen in-house design products. But we have still not managed to generate a recovery in sales and the operation continues to post a loss. In November 2006, we undertook an allocation of new shares to a third party at VIEWCOMPANY CO., LTD. (JASDAQ listed), a developer of women's footwear specialty stores, and we have now made that company an equity-method affiliate of the FR group.

For the year to August 2008, we expect net sales at our domestic apparel-related operation to total ¥ 47.0bln and the operating loss to shrink. We are aiming to bring CABIN CO., LTD. into the black from this business year, pressing ahead with drastic reform including a complete brand consolidation. We plan to improve sales per store at both g.u. and ONEZONE, and, at the same time, we are looking to cut the operating loss in half by downsizing the head office to cut costs.

■ Global brand operations

As for our global brand operations in the year to August 2007, the French casual brand COMPTOIR DES COTONNIERS in Europe, and the quintessentially French lingerie brand PRINCESSE TAM.TAM both continued to perform favorably, posting net sales of ¥ 36.7bln and an operating profit of ¥ 7.2bln.

For the year to August 2008, we expect to see a continued increase in both revenue and profit. We plan to continue our aggressive store opening plans for COMPTOIR DES COTONNIERS in other parts of Europe. And we will be looking to strengthen PRINCESSE TAM.TAM's base in the French market.

■ FR consolidated estimates for year to August 2008

For the year to end August 2008, we estimate consolidated net sales will rise 8.5% year on year to ¥ 570.0bln and operating income will rise 12.1% year on year to ¥ 72.8bln, or a profit per share of 380.95 yen. We are predicting an annual dividend per share of 130 yen.

Note: FAST RETAILING CO., LTD. discloses data on its business results and offers a variety of press releases on its IR website https://www.fastretailing.com/eng/ir/.